The shift to wash power is triggering rising considerations concerning the sustainability, resilience, and integration of the facility sector’s complicated provide chains. Listed below are 5 traits to look at.

The ability sector’s provide chain has been in turmoil for a number of years. Whereas it confronted vulnerabilities earlier than the pandemic, pushed by the geographic focus of part manufacturing and minerals mining, COVID lockdowns and Russia’s invasion of Ukraine launched logistics bottlenecks and labor shortages. The hastening tempo of the power transition has triggered additional complexities and launched new uncertainties, together with a precarious scarcity of uncooked supplies and elements. At CERAweek by S&P International in March, a number of trade leaders famous extra shifts are happening as firms put extra emphasis on sustainability. Following are 5 dynamic elements which are affecting the sector’s provide chain, serving to or hindering its safety and resilience.

1. A Looming Shortage of Uncooked Supplies

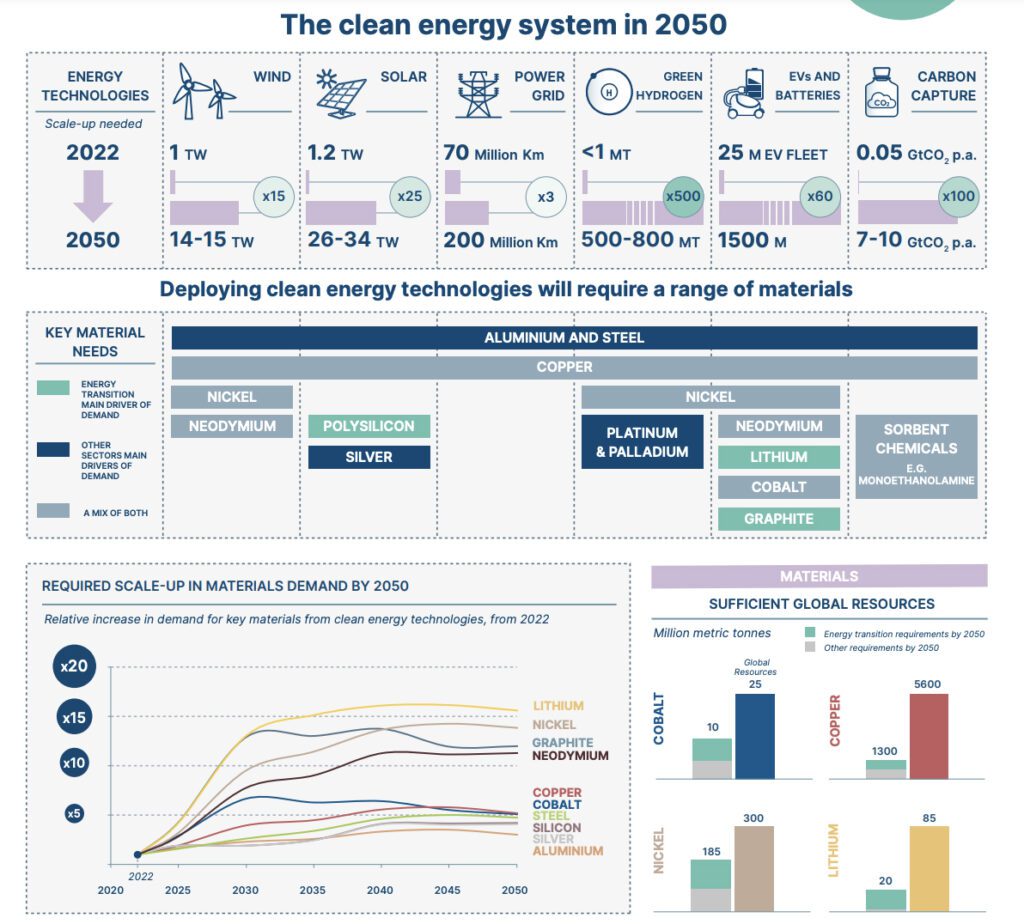

A number of discussions at CERAweek had been devoted to constructing out part manufacturing, boosting mining and manufacturing of important minerals and supplies, and committing to future demand to incentivize international funding. At one session, Jeremy Weir, government chairman and CEO of provide chain administration agency Trafigura, urged the trade to heed wildcard progress from digitalization, together with synthetic intelligence (AI) and as much as 16 GW (for now) projected from information heart progress by 2026. “That’s simply pure copper, and we’re going to see vital deficits because of that,” he predicted.

Expertise corporations are taking be aware. “What we see for cleantech, the demand for minerals goes to develop 3.5 occasions to 2030,” stated Tim Holt, government board member at Siemens Power. Siemens Power, which manufactures wind generators, gasoline generators, hydrogen and grid gear, and storage, is intently watching international markets for nickel, which seems to have normalized after disruptions as a result of Ukraine Struggle, and copper, which is “extra important,” he stated. “I did a fast back-of-the-envelope calculation, and we at Siemens Power purchase 0.2% of the output of copper … and we’re going quickly into applied sciences which are utilizing copper for wind and grid,” he stated.

Competitors for lithium can also be ramping up, although 90% is spearheaded by the automotive trade, Holt famous. One other much-watched mineral is iridium, which shall be wanted as a catalyst for proton change membrane (PEM) electrolyzers. “Simply to provide you a way, for two GW of electrolyzer capability to supply inexperienced hydrogen, we want about 1 tonne of iridium. The annual manufacturing of iridium is 8 tonnes,” he stated. “And the final one is uncommon earths, which we use in our wind generators, particularly on offshore,” he stated.

In line with consulting agency Deloitte, new incentives just like the Inflation Discount Act (IRA) may additional drive up demand for important minerals. “By 2035, this demand is anticipated to rise 15% and 13% increased than pre-IRA numbers for lithium and cobalt, respectively, that are wanted for storage; 14% for nickel, which is in storage, wind, and hydrogen provide chains; and 12% for the copper wanted throughout all power transition applied sciences,” it stated.

A key concern is that home and free-trade-agreement-country provides that might qualify for IRA incentives are restricted. China refines about half of worldwide copper manufacturing, two-thirds of lithium, three-quarters of copper, and four-fifths of nickel. Underinvestment in mining “amid at present low costs, mixed with lengthy lead occasions for brand new initiatives that may stretch over a decade, may yield yawning provide gaps. Shortages starting from 10% to 40% throughout these minerals are anticipated by 2030,” Deloitte warned.

2. Approaches to Provide Chain Administration Are Shifting

To this point, the crunch is already affecting each facet of the facility trade. However whereas it’s exacerbating competitors for supplies and expertise, collaboration can also be rising as a pivotal new attribute to successfully deal with constraints.

As Anthony Allard, Hitachi Power’s government vp and head of North America, instructed POWER in March, the mandatory build-out of extra environment friendly transmission strains, together with high-voltage direct-current (HVDC) methods, depends closely on specialised long-lead elements, comparable to transformers and valves. “We’re clearly investing actually around the globe in each single one of many [top bottlenecks],” he stated. “However nonetheless, that’s not sufficient. We see that the hole between provide and demand stays, and that’s why we have to speak to our clients as an trade when it comes to: ‘We now have a restricted provide, however how can we optimize using it?’ ”

Allard instructed one resolution to beat materials shortages whereas accelerating infrastructure initiatives may come from creating extra standardized and repeatable processes for giant infrastructure initiatives. By constructing extra initiatives concurrently in a extra streamlined trend, in addition to making certain a safe provide of important elements by strategic partnerships and agreements, the trade can extra effectively scale up its challenge execution capabilities, he instructed.

GE Vernova, a significant international unique gear producer (OEM), additionally cites collaboration as a key attribute because it meets heightened demand for elements. The corporate’s technique emphasizes steady enchancment and problem-solving underneath a “lean” tradition. “I believe the one fixed within the provide chain is that it’s continuously altering,” Dan Garceau, GE Vernova’s chief provide chain officer, stated through the firm’s inaugural investor day in March. “We’ve form of taken the method, let’s management what we are able to management, which is our end-to-end provide chain, together with our companions, our suppliers, our provide base.”

For the gasoline part aspect of its enterprise, for instance, it has labored with one in all its suppliers to deal with provide indicators, which has enabled the provider to arrange “lean manufacturing cells” that help GE Vernova’s wants, Garceau stated. “So we’ve improved our service ranges from the suppliers and decreased operational prices, each inside GE Vernova in addition to the provision base. On this particular instance, they diminished lead time by over 50%. And on the identical time, we took about 50% of the stock out of the system. And now we have this stabilized achievement now.”

The stakes are maybe increased for engineering, procurement, and building (EPC) firms. The worldwide provide chain “just isn’t as unhealthy because it was for the previous few years, however it’s nonetheless not as predictable because it was stepping into 2018–2019,” Paul Marsden, president of Bechtel Power, famous at CERAweek. “Because the world electrifies, there’s nonetheless plenty of misery within the electrical provide chain, and based mostly on the capability obtainable to make what everyone desires, it’s nonetheless choked over. That’s nonetheless a problem for an EPC, an integrator of those amenities, to face in entrance of the entire provide chain.”

How the trade will maintain progress additionally stays a vital concern, he instructed. “I believe the IRA definitely creates an incentive that stimulates innovation, however the problem we nonetheless see is subsidy on a long-term foundation just isn’t sustainable.” Marsden instructed the trade will must be “progressive with how we share the chance as this local weather continues,” which may go on for an additional three to 5 years. “If one other international degree disruptor occurs throughout that timeframe, we’d be but once more stepping again, and it’ll get difficult as soon as once more,” he stated.

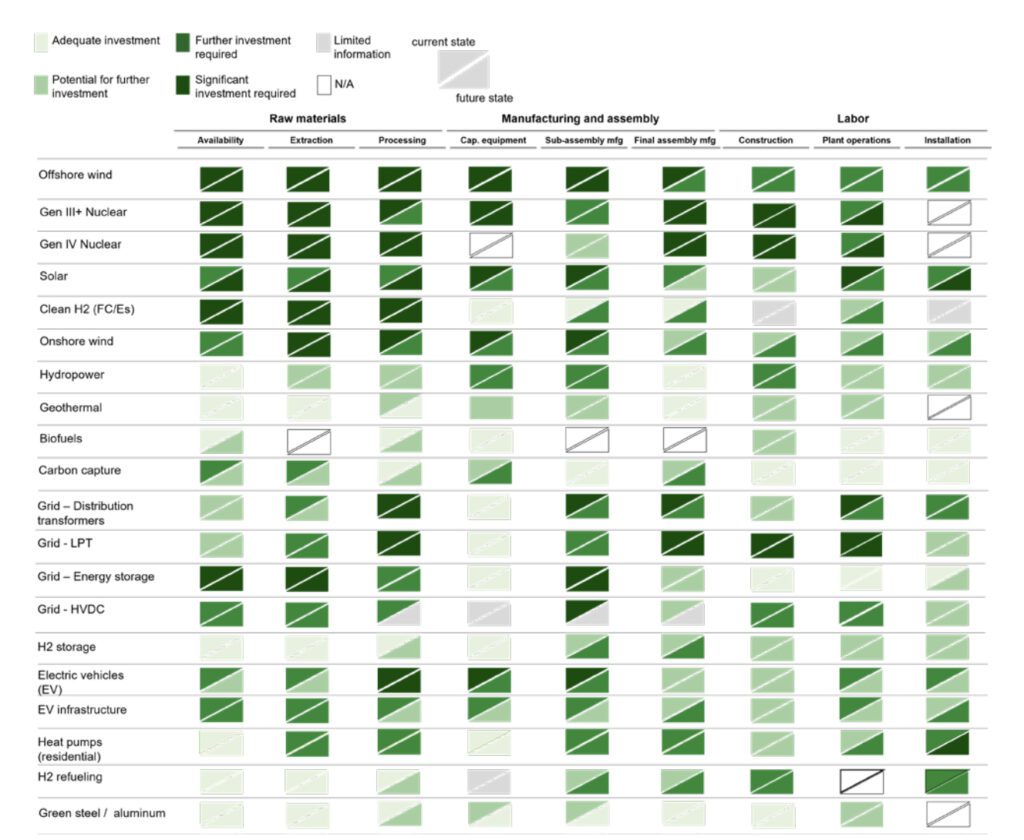

For now, no less than, incentives, like these from the IRA, seem poised to reinforce provide chain resilience within the photo voltaic and storage sectors. That’s regardless of challenges, comparable to overcapacity and regulatory changes, affecting imports and home content material qualification. The outlook is dimmer for offshore wind, owing to part materials prices and inflation which have despatched offshore wind funding prices surging, prompting some turmoil within the sector. Efforts, nevertheless, are underway to ramp up manufacturing amenities, devoted vessels, and ports. One other rising development that Deloitte identified in January is that renewable firms are pursuing “strategic reshoring joint ventures to safe a stake within the rising home provide chain.”

In the meantime, given the urgency for brand new, dependable, and decarbonized capability, the nuclear trade can also be working to ramp up a sturdy, aggressive, and doubtlessly adaptive provide chain for supplies, elements, and gas. A key precedence for the nuclear sector, in response to the World Nuclear Affiliation, is to acquire market indicators for brand new initiatives—together with superior reactors—and simplify procurement fashions to provide suppliers a higher line of sight of tenders.

One other goal has been to research current nuclear plant building initiatives to develop a stronger and extra agile provide chain, together with by greatest practices. The extremely regulated trade, nevertheless, can also be pushing to streamline licensing processes and harmonize technical laws and provider necessities. All these elements will rely closely on collaboration to fill gaps and mitigate bottlenecks throughout initiatives and suppliers.

Nonetheless, the OECD Nuclear Power Company (NEA) at a current nuclear provide chain workshop it hosted alongside the World Nuclear Affiliation in March instructed reviving nuclear deployment faces steep challenges. Outstanding gaps embody a declining variety of nuclear-grade suppliers and a lack of abilities in some areas. Provide chain improvement, significantly for superior nuclear, would require a powerful emphasis on high quality supply, which would require strengthened administration of superior manufacturing and commercial-grade procurement. It’s going to additionally require a eager consciousness of continued dangers “related to counterfeit and fraudulent actions and potential strategies to mitigate dangers in a continuously altering setting,” it stated.

Different gaps embody securing important minerals and supplies for superior fuels. Enough gas procurement stays a key precedence and it has been not too long ago boosted by authorities efforts. For instance, whereas the prevailing U.S. fleet runs on uranium gas enriched as much as 5% with uranium-235 (U-235), the Division of Power (DOE) has ramped up efforts—furnished with $700 million from the IRA_to construct out a home provide of high-assay, low-enriched uranium (HALEU). HALEU improvement is underway within the UK, too. Lastly, over the long run, the nuclear trade might want to handle gaps associated to nuclear waste disposal and the simultaneous decommissioning of many U.S. nuclear crops.

3. The Concentrate on Environmental Sustainability Is Rising

One other obvious new requirement voiced repeatedly at CERAweek pertains to energy entity environmental, social, and governance (ESG) initiatives. The occasion in Houston was notably held simply days after the U.S. Securities and Alternate Fee (SEC) adopted remaining guidelines designed to reinforce public firm disclosures associated to dangers and impacts of climate-related issues. (The ultimate rule was was formally placed on pause on April 8 given a number of lawsuits difficult the local weather disclosure necessities have been consolidated in a federal appeals courtroom). Whereas the ultimate rule eradicated its proposed reporting of Scope 3 greenhouse gasoline (GHG) emissions (together with from an organization’s provide chain), it requires giant accelerated and accelerated filers to reveal, beginning in 2025, their Scope 1 (direct emissions) and Scope 2 (oblique emissions induced by power consumption).

Elements of the facility trade, like investor-owned utilities, have embraced ESG initiatives, and a few are already creating capabilities to construct a round economic system. In line with the Sustainable Provide Chain Alliance (SSCA)—a company of utilities and suppliers that work collectively to advance sustainable provide chain practices—ESG is “outlined by the rising significance of procurement practices and selections, consolidation of associated disclosure requirements and laws, and growing curiosity of stakeholders in provide chain sustainability.”

The group pointed to Dominion Power’s 2023-deployed Provider Sustainability Index (SSI) software as only one instance of how utilities are leveraging ESG information to higher inform engagement methods and threat evaluation capabilities. Extra firms could observe swimsuit, the group predicted. “The SSCA is witnessing a noticeable shift within the standards utilized by members transitioning from a give attention to understanding ESG subjects in a broad sense to a powerful inclination towards sensible instruments and assets for successfully implementing and addressing ESG issues in worth chain design and decision-making.”

One motive for this, it notes, is as a result of “within the face of unprecedented ranges of provide chain disruption, utilities are more and more acknowledging the important nexus between ESG rules and the efficient mitigation of potential vulnerabilities.”

A Strong New Function Is Rising for the ‘Worth Chain’As power calls for evolve and industries around the globe urgently rework their operational fashions to prioritize sustainability, a hanging focus is being positioned on constructing out the “worth chain” over the normal “provide chain.” In contrast to provide chains, which focus totally on the logistics of manufacturing and supply, worth chains embody the complete lifecycle of a product—from design by manufacturing to consumption and reuse—making certain that every step provides worth. “A price chain represents a sequence of values. As an illustration, think about the large-scale improvement of renewable power, ammonia manufacturing, and transportation from ports by way of tankers. Should you solely take a look at one phase at a time, it’s primarily a provide chain,” defined Masato Otaki, government officer, senior working officer of Japanese technology big JERA’s Optimization Division, in a current interview. “We imagine that by getting concerned in every of those segments, we are able to create a price chain that has the potential to complement society extra broadly than simply specializing in a single area.” The prospect applies to different essential end-use supplies, comparable to liquefied pure gasoline (LNG), a gas on which Japan is closely reliant however should import. “If we solely have a receiving terminal and await the oil majors to ship the LNG to us for energy technology, we will be unable to know the price construction and provide capability, and we could find yourself counting on others to acquire LNG in an economically environment friendly and steady method,” Otaki stated. “Extra importantly, that method wouldn’t develop our enterprise attain, nor wouldn’t it foster innovation. The scope of the worth we may supply society would develop into exceedingly slender.” Past resiliency and sustainability, worth chains assist increase collaboration throughout a number of sectors, effecting a “ripple impact” that fosters financial progress at every stage of the manufacturing course of. The U.S. Division of Power’s (DOE’s) Industrial Effectivity and Decarbonization Workplace (IEDO), for instance, is actively working to create worth chains that combine numerous phases of the chemical compounds worth chain in an effort to enhance present processes in addition to pioneer new strategies that might revolutionize how industrial chemical compounds are produced, dealt with, and used. The chemical compounds trade at present converts uncooked supplies into greater than 70,000 totally different merchandise, the DOE famous in March. “Because of [their] complicated provide chain, decreasing emissions from the manufacturing of high-volume chemical compounds can solely handle a portion of our bigger decarbonization resolution,” it stated. “Connections should even be made at a number of steps down the worth chain to construct pathways from feedstocks to remaining merchandise like specialty chemical compounds, thermoplastics, and textiles. For instance, adjustments to upstream chemical compounds from sustainable feedstocks or from superior manufacturing strategies, comparable to electrochemical and membrane reactors, should be suitable with downstream processes.” |

4. Digitalization’s Potential Impression

The final decade, in the meantime, has ushered in additional digitalization of the sector’s provide chain. Use instances are nonetheless overwhelmingly centered on automation, together with the gathering, communication, and remedy of data. Nevertheless, extra firms are additionally utilizing digital twin expertise and synthetic intelligence (AI) as predictive analytics instruments, for instance, to trace and order stock extra effectively, handle upkeep points, and assess pricing information to enhance provide chain threat administration. Rising applied sciences like blockchain, in the meantime, promise overhauls for conventional provide chain ache factors, like real-time monitoring, traceability, and useful resource allocation.

Skilled providers agency PwC, in a 2023 survey, discovered that the power sector is usually captivated with provide chain digitalization. Though budget-constrained, the sector stories “increased ranges of funding and adoption of provide chain applied sciences than different industries,” it stated. Key focus areas deliberate over the subsequent two years embody cloud-based frequent information platforms—“doubtless the results of trade efforts to maneuver giant enterprise useful resource planning and enterprise asset administration methods to cloud—in addition to blockchain pilots and AI-enabled “management towers” that mix conventional provide chain planning information with real-time visibility updates from carriers and suppliers, the agency stated.

To this point, nevertheless, almost 98% of trade respondents stated expertise investments aren’t absolutely delivering the anticipated outcomes, the agency reported. One motive is likely to be that “On this trade, processes may be deeply ingrained—and infrequently for good motive,” it stated. “Nevertheless, as expertise adjustments, these tried and true practices might have to vary as properly.”

The ability sector, in the meantime, is acutely cautious that digitalization can pose a brand new set of dangers, given that each new digital hyperlink within the provide chain poses cybersecurity vulnerabilities. The ability sector has sought to ramp up its personal protections by collaborations. Within the U.S., it has, for instance, championed Software program Payments of Supplies (SBOMs), which are primarily an data expertise checklist of components in software program, Alex Santos, co-founder and CEO of Fortress Info Safety, not too long ago defined to POWER.

5. An Rising however Critical Threat: Labor Shortages

Lastly, labor points are rising as a compelling sticking level for the facility and manufacturing industries. Workforce shortages requiring specialised abilities can severely have an effect on the manufacturing and logistics sectors, inflicting delays in manufacturing, distribution, and supply. High quality and productiveness are additionally key considerations.

For the facility sector, the urgency to domesticate a sizeable workforce is particularly amplified, given new incentives that promise to develop the market. The College of Massachusetts Amherst Political Economic system Analysis Institute (PERI) has discovered investments within the three main financial coverage legal guidelines enacted between 2021 and 2022—the IRA, the Bipartisan Infrastructure Regulation, and the Creating Useful Incentives to Produce Semiconductors (CHIPS) Act—will generate, in whole, a mean of almost 3 million jobs per yr. Nevertheless, the group has additionally recognized stringent labor shortages, significantly concentrated within the building and manufacturing sectors.

Labor shortages have solely grown extra profound. A examine performed by the Nationwide Affiliation of Producers (NAM) and Deloitte discovered that the manufacturing abilities hole within the U.S. may lead to 2.1 million unfilled jobs by 2030. One key discovery from the examine was that “discovering the suitable expertise is now 36% more durable than it was in 2018, although the unemployment charge has almost doubled the provision of obtainable employees.” And whereas discovering and retaining expert employees for specialised roles has been troublesome, executives famous challenges in filling even higher-paying entry-level manufacturing positions. That boils all the way down to a long-term problem: “77% of producers say they may have ongoing difficulties in attracting and retaining employees in 2021 and past,” NAM stated.

The DOE suggests the mismatch in labor demand and provide may be pinned to a number of elements. These embody a “ big selection of social, financial, technological, and demographic elements that embody declining wages within the manufacturing sector, growing precarity of jobs, an absence of funding in employee talent improvement, an getting older workforce, and adjustments in workforce preferences,” it stated.

For now, each the non-public and public sectors are working to deal with the mismatch. It notes the three payments are designed to advertise workforce improvement. The company itself has a number of program places of work which are centered on constructing a clear power workforce.

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).