Earlier than the passage of the Inflation Discount Act (IRA) over a 12 months in the past, tax credit for photo voltaic tasks have been out there solely to taxable entities. That meant that whereas tax-exempt and authorities entities — reminiscent of nonprofits, church buildings, faculties and tribes — may go photo voltaic by way of a lease or PPA, they couldn’t straight reap the benefits of the Funding Tax Credit score (ITC).

Fortunately, the IRA modified this limitation with its direct pay provision, also referred to as “elective pay.” Direct pay permits nonprofits to obtain a cost that’s equal to the total worth of tax credit after they construct qualifying clear vitality tasks.

Direct pay is undoubtedly a boon for nonprofit entities and will spur far more photo voltaic improvement on this sector. However a pair lesser-known provisions within the laws may trigger snags for nonprofits that aren’t conscious of them, in addition to for photo voltaic builders working with nonprofits.

1. Avoiding the “extreme profit” pitfall

The “extreme profit” provision will not be a part of the IRA invoice textual content itself, however it’s within the laws from the Dept. of the Treasury, which was approved within the IRA to offer interpretive steering and implementation guidelines. The supply is meant to make sure that tax-exempt entities don’t obtain funding in extra of their mission’s value by combining direct pay with a grant or donation.

Below this provision, in case your nonprofit funds all or a portion of your photo voltaic mission with grants or charitable donations which might be particularly earmarked for photo voltaic functions, your direct pay advantages may probably be decreased and even utterly eradicated. Your potential to assert direct pay can be decreased to the extent that the grants earmarked for photo voltaic plus the direct pay quantities exceed the acquisition value of the photo voltaic system. Basic grants and donations not earmarked for photo voltaic tasks is not going to have an effect on direct pay for a mission.

For funds to be thought of earmarked for a photo voltaic mission, the grant or donation would want to go towards “buying, establishing, reconstructing, erecting or in any other case buying” the photo voltaic mission.

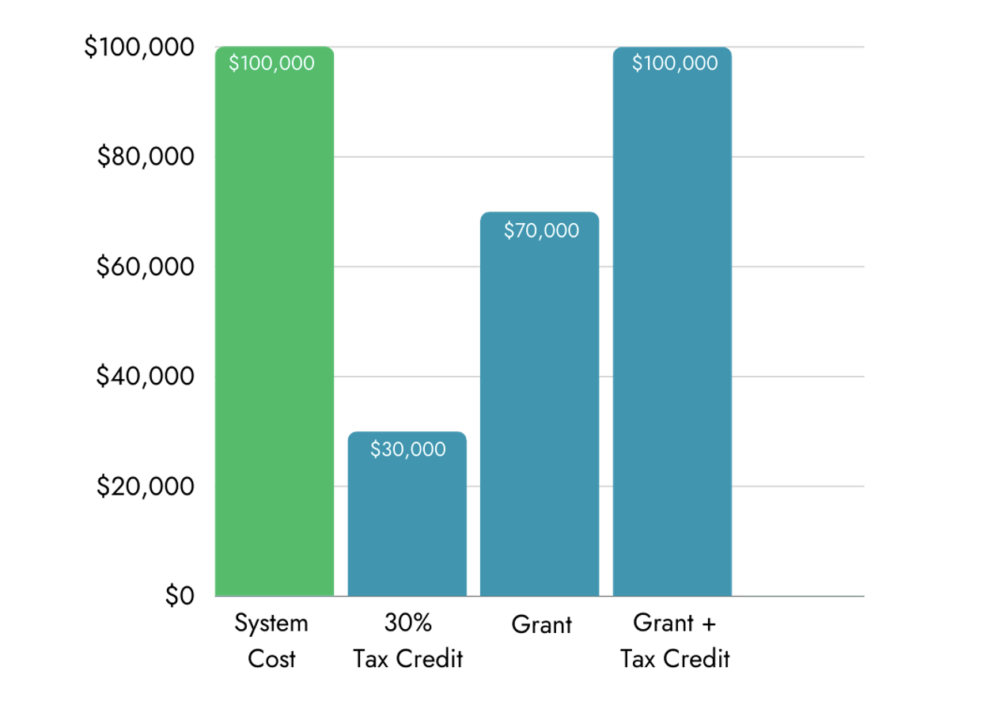

To see how this works, let’s use the instance of a mission that prices $100,000 and is claiming the bottom 30% tax credit score. If the mission can be getting a grant of $70,000, it may get the total 30% credit score as a result of the tax credit score plus the grant doesn’t exceed the price of the mission.

Then again, if the nonprofit receives a grant of $80,000 earmarked for the $100,000 mission, it may obtain solely a part of the 30% tax credit score — on this case, $20,000, as a result of any extra would exceed the price of the mission.

Figuring out about this provision can assist your nonprofit tailor your fundraising to permit for full receipt of any tax credit your mission is eligible for.

Figuring out about this provision can assist your nonprofit tailor your fundraising to permit for full receipt of any tax credit your mission is eligible for.

How will the IRS know the place your mission’s funding got here from? Nonprofits can be requested this query within the pre-filing registration portal that’s required to be accomplished when using direct pay.

2. Avoiding timing points

As a result of many nonprofits have fiscal years ending on June 30, their tax 12 months will not be the identical because the calendar 12 months, so that may have an effect on after they can apply for and obtain direct pay. A nonprofit can declare direct pay just for tasks that have been positioned in service throughout their tax 12 months and just for tasks positioned in service after January 1, 2023.

To say direct pay, even a tax-exempt group that doesn’t usually file tax types should file a 990T kind 5 months plus 15 days after the top of their tax 12 months. For a nonprofit with a year-end of June 30, that submitting date is November 15. Not solely is that arising very quickly, however the portal for the pre-filing registration has not but opened. To obtain direct pay to your mission, you’re required to finish the pre-filing registration, and you can’t do this after the due date of your tax return plus extensions; you’ve got just one likelihood to finish this step. Treasury doesn’t enable going again to a previous 12 months to assert direct pay, nor does it enable carrying a mission ahead.

For these causes, it’s advisable that in case your nonprofit desires to obtain direct pay for a mission within the tax 12 months ending on June 30, you file for a six-month extension. This is applicable solely to tasks positioned in service between January 1, 2023, the primary eligible date, and June 30, 2023, the top of the tax 12 months. Initiatives positioned in service after June 30 this 12 months can anticipate subsequent 12 months’s submitting timeframe.

That brings us to a different timing concern for nonprofits to concentrate on, each time your tax 12 months ends: As soon as the types have been submitted to use for direct pay, there can be a ready interval earlier than the refund is obtained. As a result of direct pay is new, we don’t but understand how lengthy that ready interval can be. What we do know is that the purposes is not going to be thought of till the date when the tax submitting is due, so even in the event you file early, you’ll have to anticipate the refund to be processed. This may create hole financing challenges to your nonprofit.

When you’ve got the flexibleness to position your photo voltaic mission in service near the top of your nonprofit’s tax 12 months, that may lower the funding hole.

Checking for the newest laws

As of mid-November, Treasury has launched steering and proposed laws on direct pay. Be sure you examine again for the ultimate laws in the event you’re studying this at a later date and plan to file for direct pay.

For extra on direct pay and the pitfalls to keep away from, see CollectiveSun’s current direct pay webinar and Extreme Profit Reality Sheet.

Disclaimer: This info doesn’t represent authorized or tax recommendation and shouldn’t be relied upon for any goal. Please seek the advice of your authorized counsel and tax advisor.