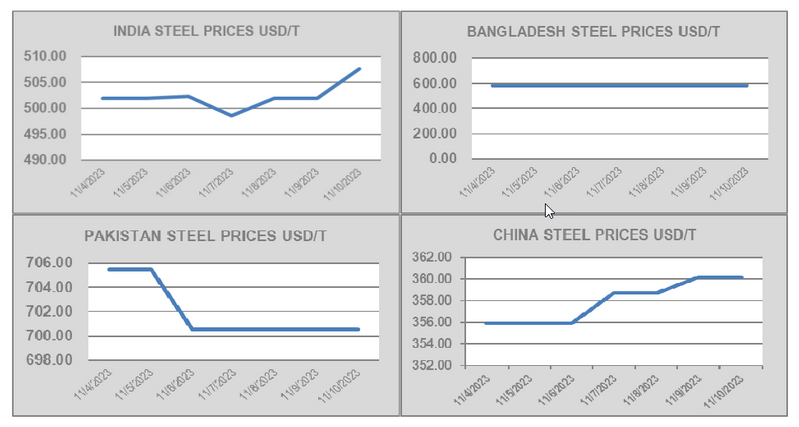

Markets stay precariously poised as Diwali holidays occupy the sub-continent markets and the trade heads into the ultimate months of the 2023, says money purchaser GMS. Though a number of gross sales have reportedly registered into India at some spectacular ranges, sentiments and pricing right here stays muted general.

“On the Jap finish and within the lead as much as the Bangladeshi elections due in mid-January 2024 – disruptions, protests, and even strikes have embattled the nation and as such, it’s anticipated to turn out to be much more difficult to get traces of credit score open and deliveries accomplished into Chattogram, particularly as the continued unrest persists.”

Pakistan is beginning to see some shopping for curiosity reemerge, because the foreign money continues to depreciate as soon as once more. As vessels get more and more costly, native metal plate costs will finally must agency with a view to preserve native enterprise viable, and that is maybe lending native recyclers some forward-thinking encouragement on doubtlessly promoting their product at workable ranges within the close to future / 2024.

The Turkish market stories much more enhancements as each native and import metal costs registered enhancements this week, with even value indications seeming to agency about by about US$ 10/MT, says GMS.

“Total, with international metal costs now gaining some first rate floor over the previous weeks (together with Turkey and notably even in China this week), there’s the lingering hope that these enhancements might filter by way of to the opposite recycling markets within the weeks forward, particularly upon the conclusion of Diwali holidays.

“And amidst the shaky hopes that markets do certainly rise to increased ranges, there actually have been a handful of money consumers who proceed to be playing on vessels with a ahead supply, all whereas immediate vessels are going through comparative reductions to these with an extended / ahead laycan.”

Classic container ships and dry bulk vessels proceed to dominate the recycling lanes, however they’re nonetheless lacking the volumes that many had anticipated, particularly as constitution charges and second-hand values are but to sink and compel shipowner’s to recycle their models.

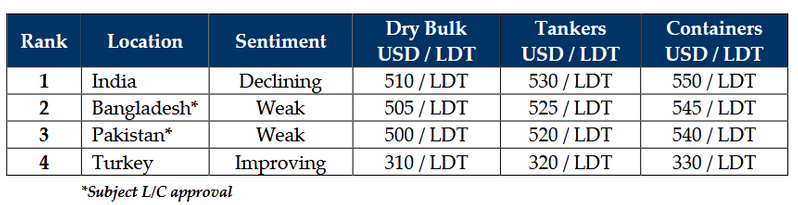

For week 45 of 2023, GMS demo rankings / pricing for the week are: