Through the weekdays of the third week of November, costs in the primary European electrical energy markets registered an upward development. Nonetheless, over the weekend, the mix of decrease demand and excessive renewable power manufacturing helped to carry costs down. On the 19th, Spain registered the photo voltaic photovoltaic power manufacturing document for a month of November and in Germany, on the 14th, wind power manufacturing was the very best for a month of November.

Photo voltaic photovoltaic, photo voltaic thermoelectric and wind power manufacturing

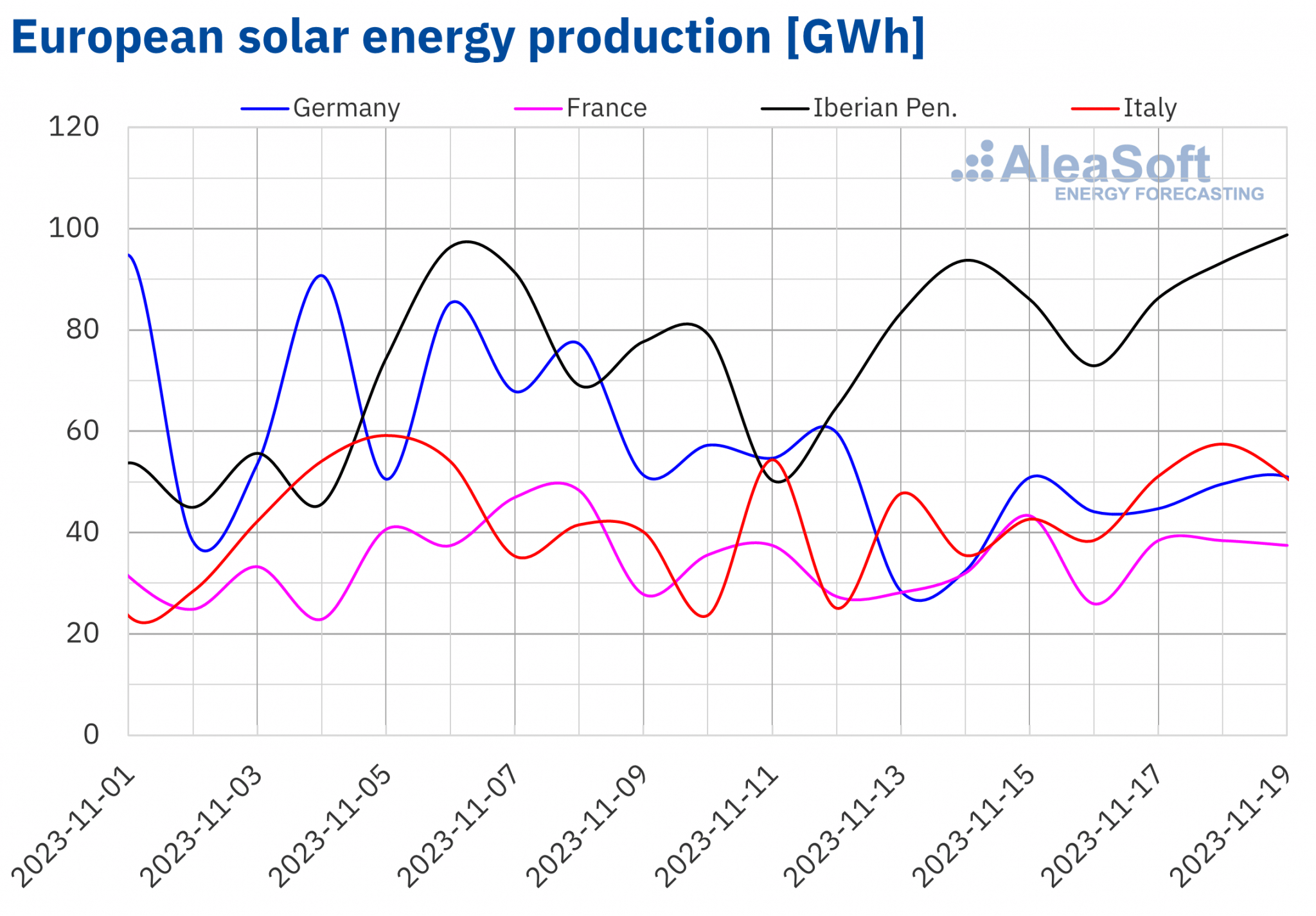

Within the week of November 13, modifications in photo voltaic power manufacturing in the primary European electrical energy markets in comparison with the earlier week didn’t present a homogeneous development. Photo voltaic power manufacturing elevated by 19% in Portugal, 18% in Italy and 16% in Spain. The other conduct occurred within the German and French markets, the place photo voltaic power manufacturing fell by 34% and 6.6%, respectively.

On November 19, the Spanish market produced 84 GWh utilizing photo voltaic photovoltaic power, the very best worth since October 21 when it generated 89 GWh. On November 19, manufacturing was additionally the very best in historical past for a month of November.

For the week of November 20, based on AleaSoft Vitality Forecasting’s photo voltaic power manufacturing forecasts, it can improve in Germany and Spain, however it can lower in Italy.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

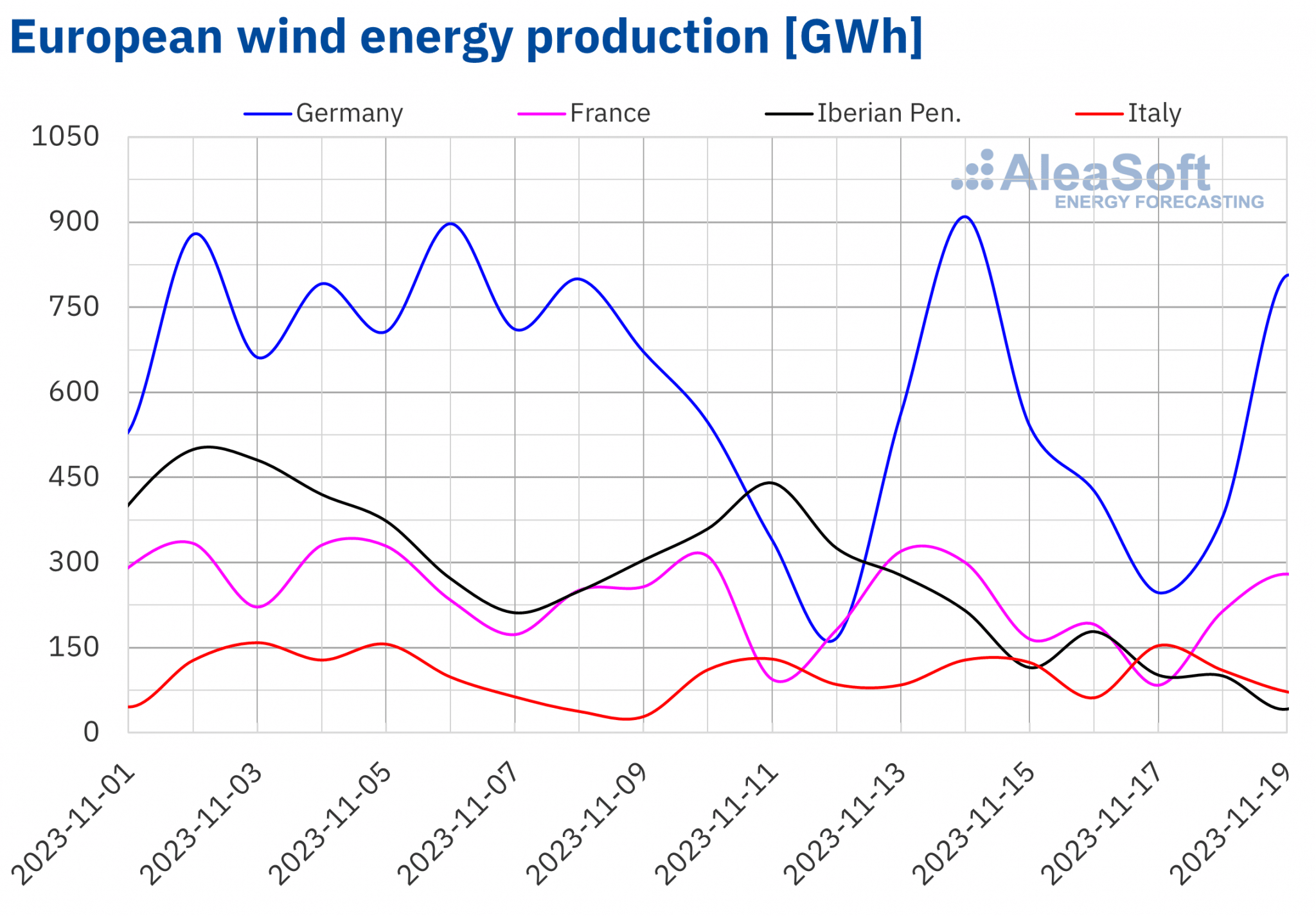

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

Through the week of November 13, wind power manufacturing decreased in a lot of the analyzed European markets in comparison with the earlier week. The lower ranged from 68% within the Portuguese market to six.3% within the German market. On the similar time, the Italian and French markets registered a rise in wind power era of 33% and three.5% respectively.

Regardless of the inter?week decline, on November 14 the German market produced 910 GWh utilizing wind power, the very best worth since mid?March. This worth additionally represents the historic document of day by day wind power manufacturing in a month of November on this market.

For the week of November 20, AleaSoft Vitality Forecasting’s wind power manufacturing forecasts point out that manufacturing utilizing this expertise will improve within the Iberian Peninsula, however it can lower in the remainder of the markets.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

Electrical energy demand

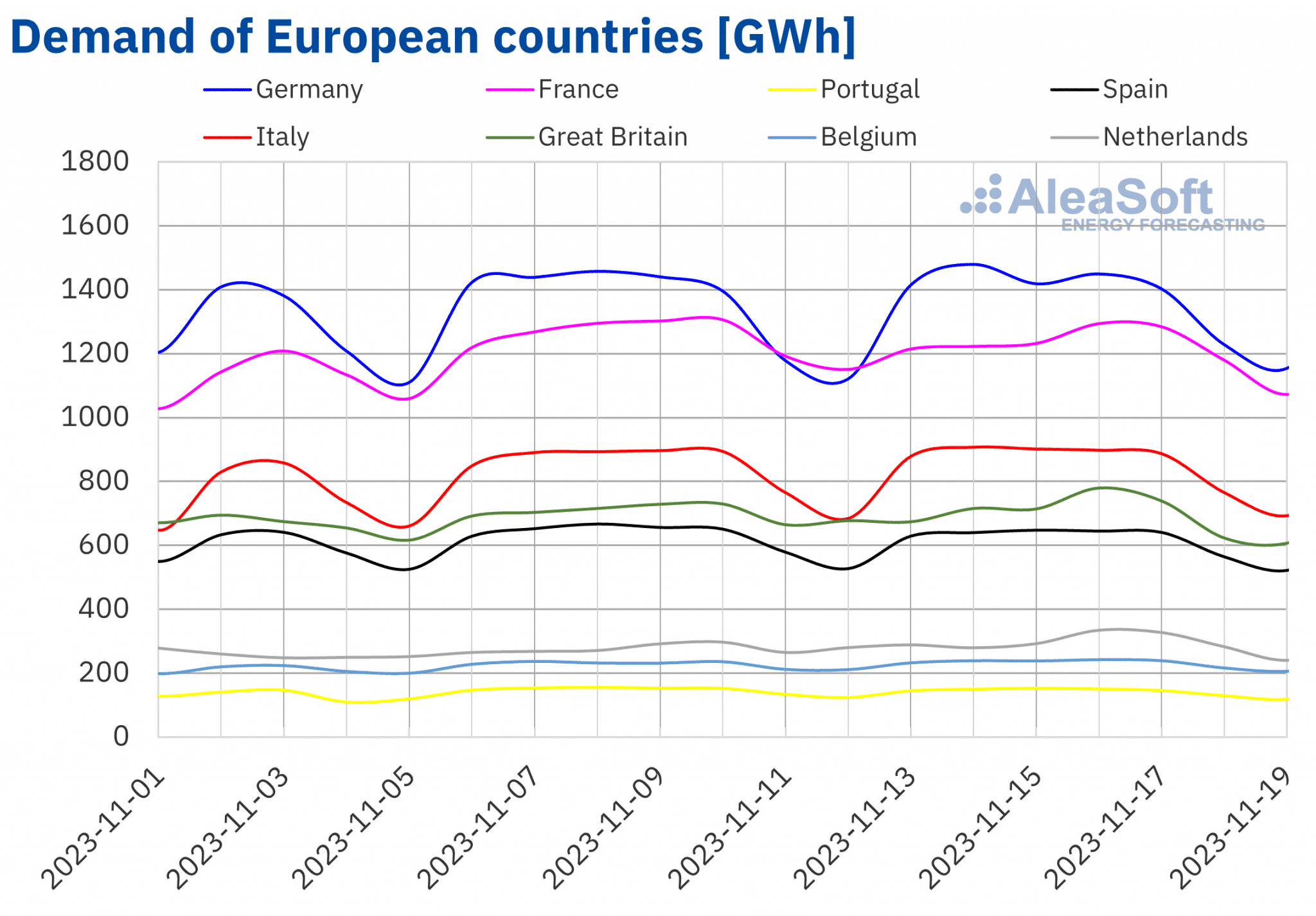

Within the week of November 13, the primary European markets registered modifications in electrical energy demand that didn’t present a uniform development with respect to the earlier week. In Germany and Italy, electrical energy demand elevated by 1.0%, in Belgium by 1.6%, and within the Netherlands by 5.5%. In different markets, demand fell, starting from 2.7% in France and Portugal to 1.2% in Nice Britain.

Within the third week of November, a lot of the analyzed markets registered a rise in common temperatures in comparison with the week of November 6. Will increase ranged from 0.5 °C within the Netherlands to 1.9 °C in Spain. In Italy, common temperatures remained much like these of the earlier week. Then again, common temperatures decreased by 0.4 °C in Germany, the one market with decreases.

AleaSoft Vitality Forecasting’s demand forecasts point out that electrical energy demand will improve in a lot of the analyzed markets within the week of November 20. Solely the German and Dutch markets will register decrease demand.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ENTSO-E, RTE, REN, REE, TERNA, Nationwide Grid and ELIA.

European electrical energy markets

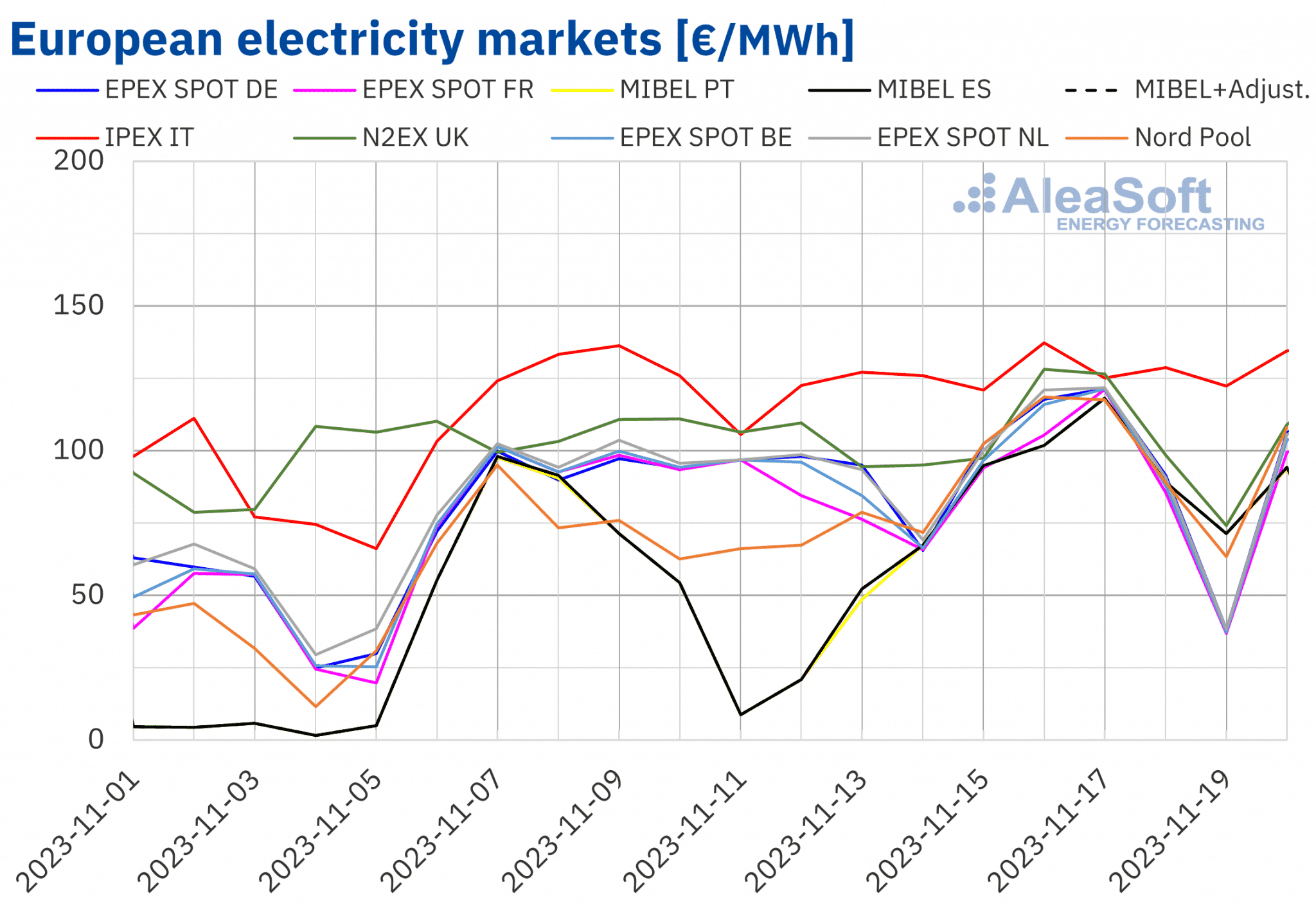

Through the week of November 13, day by day costs in the primary European electrical energy markets progressively elevated. On Friday, November 17, costs exceeded €115/MWh in all markets analyzed at AleaSoft Vitality Forecasting. Nonetheless, over the weekend, costs dropped once more. In consequence, the weekly common in some markets was decrease than the earlier week. In distinction, within the IPEX market of Italy, the Nord Pool market of the Nordic international locations and the MIBEL market of Portugal and Spain, averages elevated by 4.3%, 26%, 48% and 49%, respectively. Within the remaining markets, costs declined between 2.5% within the EPEX SPOT market of Germany and eight.8% within the EPEX SPOT market of France.

Within the third week of November, weekly averages have been under €95/MWh in a lot of the analyzed European electrical energy markets. The exceptions have been the N2EX market of the UK and the Italian market, the place costs have been €101.97/MWh and €126.73/MWh, respectively. In distinction, the French market registered the bottom common value, €83.48/MWh. In the remainder of the analyzed markets, costs ranged from €84.35/MWh within the Portuguese market to €91.51/MWh within the Nordic market.

Exactly the Nordic market reached a value of €180.01/MWh on Thursday, November 16, from 17:00 to 18:00. This value was the very best for the reason that first half of March on this market. Then again, the German, Belgian, French and Dutch markets registered hourly costs under €2/MWh on November 14 and 19. Within the case of the German market, on Tuesday, November 14, there have been three hours with damaging costs.

Through the week of November 13, the rise within the common value of gasoline and CO2 emission rights had an upward affect on European market costs. Over the weekend, the mix of decrease demand and excessive renewable power manufacturing helped costs to fall in most markets. Within the case of the French market, wind power manufacturing elevated and demand fell for the week as a complete. This contributed to this market registering the bottom weekly common.

AleaSoft Vitality Forecasting’s value forecasts point out that within the fourth week of November costs in most European electrical energy markets would possibly improve. Declining wind power manufacturing and rising demand in most markets would possibly contribute to this conduct. Nonetheless, the rise in wind power manufacturing within the Iberian Peninsula would possibly result in decrease costs within the MIBEL market.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from OMIE, EPEX SPOT, Nord Pool and GME.

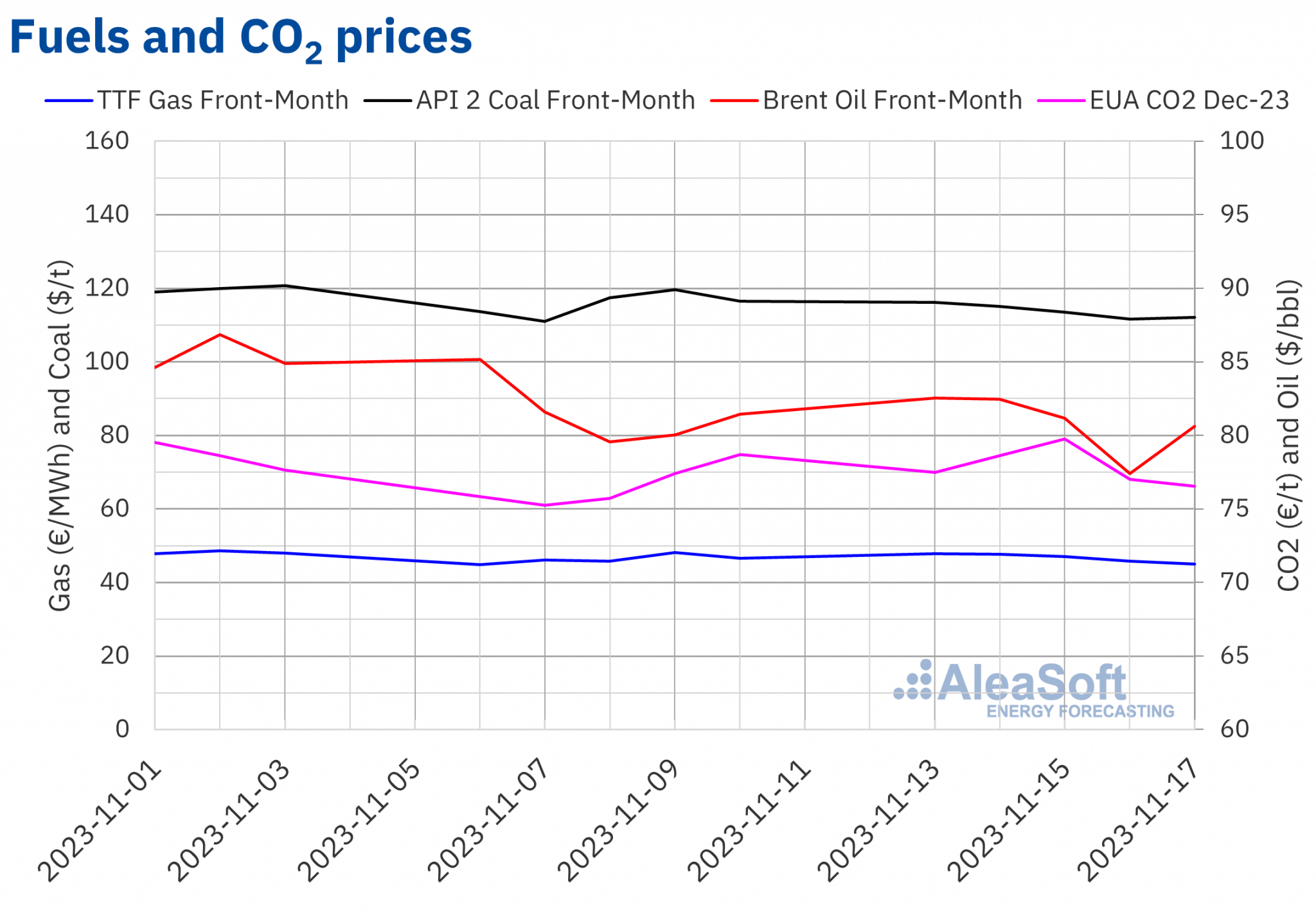

Brent, fuels and CO2

On Monday, November 13, Brent oil futures for the Entrance?Month within the ICE market registered their weekly most settlement value, $82.52/bbl. This value was 3.1% decrease than the earlier Monday. The next days of the third week of November costs declined to succeed in the weekly minimal settlement value, $77.42/bbl, on Thursday, November 16. This value was 3.2% decrease than the earlier Thursday and the bottom for the reason that first half of July. On Friday, costs elevated once more. On that day, the settlement value was $80.61/bbl. This settlement value was 1.0% decrease than the earlier Friday.

Within the third week of November, excessive provide ranges, rising US stockpiles and damaging information on US financial evolution exerted their downward affect on Brent oil futures costs. Considerations about demand in China additionally contributed to the worth decline. Nonetheless, expectations of additional manufacturing cuts by OPEC boosted costs within the final session of the third week of November.

On Monday, November 13, TTF gasoline futures within the ICE marketplace for the Entrance?Month reached the weekly most settlement value, €47.87/MWh. This value was 6.8% increased than the earlier Monday. Nonetheless, based on information analyzed at AleaSoft Vitality Forecasting, costs began to say no on Tuesday. In consequence, on Friday, November 17, they registered the weekly minimal settlement value, €45.06/MWh. This value was 3.4% decrease than the earlier Friday. For the week as a complete, the common was 0.9% above that of the earlier week.

Through the third week of November, excessive European reserve ranges and delicate temperatures in Europe contributed to the decline in these futures costs. Nonetheless, fears of potential provide disruptions resulting from instability within the Center East and decrease temperatures would possibly exert an upward affect on costs within the coming days.

As for CO2 emission rights futures within the EEX market for the reference contract of December 2023, on Monday, November 13, they registered a settlement value of €77.48/t. This value was 1.6% decrease than the final session of the earlier week however 2.2% increased than the earlier Monday. On Tuesday and Wednesday, costs elevated. In consequence, on Wednesday, November 15, the settlement value, €79.74/t, was the weekly most. This value was 5.3% increased than the identical day of the earlier week. Within the final periods of the week, costs fell once more. On Friday, November 17, these futures registered their weekly minimal settlement value, €76.55/t. This value was 2.7% decrease than the identical day of the earlier week. The weekly common was 1.7% increased than the earlier week.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ICE and EEX.

AleaSoft Vitality Forecasting’s evaluation on the prospects for power markets in Europe

Final Thursday, November 16, AleaSoft Vitality Forecasting and AleaGreen held their November webinar. On this event, Luis Marquina de Soto, President of AEPIBAL, the Enterprise Affiliation of Batteries and Vitality Storage, participated as a visitor speaker. Within the webinar, the audio system analyzed the prospects for the European power markets for the winter 2023-2024 and the imaginative and prescient of the way forward for batteries and power storage.

The AleaSoft Vitality Forecasting and AleaGreen group is already organizing the subsequent webinars of its month-to-month sequence. The December webinar will happen on the 14th and can handle AleaSoft companies for the power sector. The January webinar, scheduled for the 18th, will function audio system from PwC Spain for the fourth time.