IN November, wind vitality manufacturing reached document highs in France and Italy and was the best for a November month in Germany. Photo voltaic manufacturing additionally broke data for a November month in Spain, Portugal, France and Italy. On this context, costs on the principle European electrical energy markets remained steady, with costs rising in Nord Pool, the place they have been virtually 3 times the October common, and falling in MIBEL, the place they have been the bottom.

Concentrated Photo voltaic Energy, photovoltaic and wind vitality manufacturing

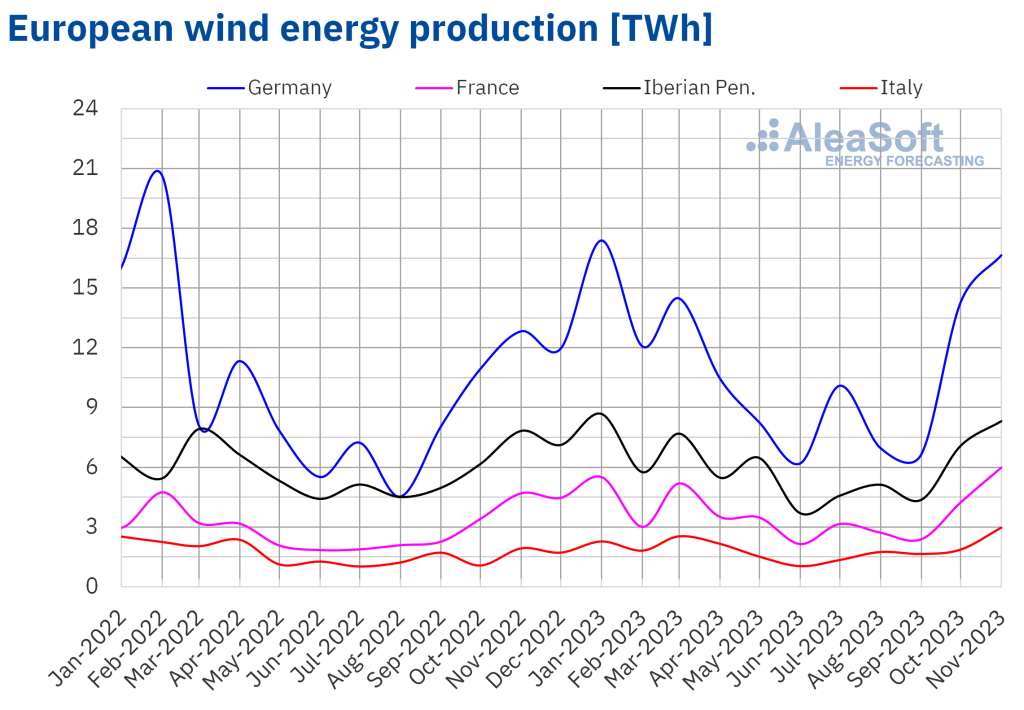

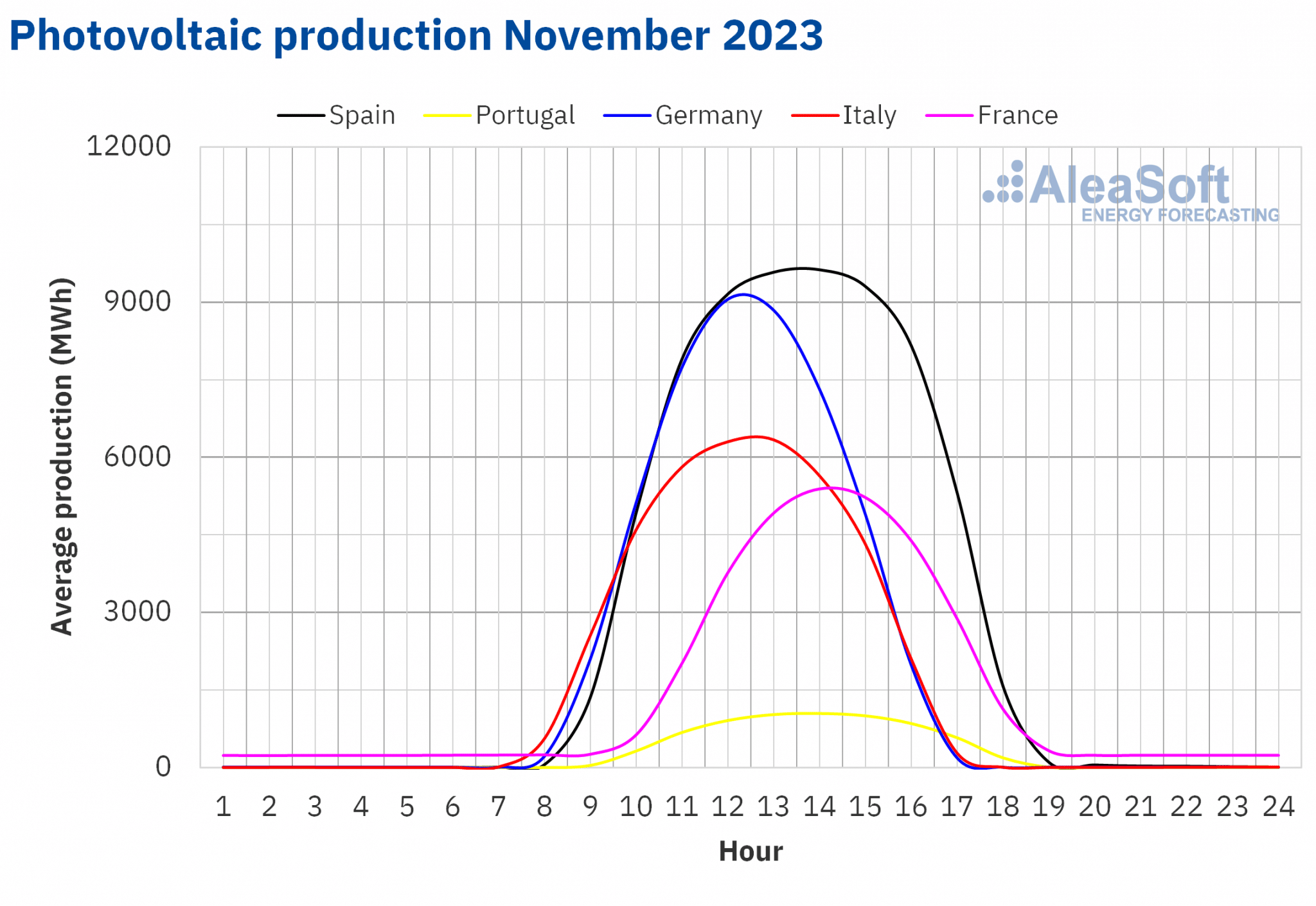

In November 2023, photo voltaic vitality manufacturing elevated in a lot of the major European electrical energy markets in comparison with the identical month in 2022. The most important will increase have been registered within the Iberian Peninsula, with values of 38% and 27% within the Portuguese and Spanish markets respectively. The French and Italian markets registered will increase of 24% and 22% respectively. The exception to this development was the German market, the place photo voltaic photovoltaic vitality manufacturing fell by 17% 12 months on 12 months.

In comparison with the earlier month, photo voltaic manufacturing decreased in November in all markets analyzed by AleaSoft Vitality Forecasting, in step with the lower in photo voltaic radiation as winter approaches. The decreases ranged from 57% within the German market to fifteen% within the Portuguese market.

It needs to be famous, nevertheless, that in comparison with historic November manufacturing in earlier years, photo voltaic vitality manufacturing in November 2023 was document excessive in Southern European markets. The Spanish market topped the checklist of record-breaking markets with 2041 GWh generated. It was adopted by the Italian and French markets with 1162 GWh and 1016 GWh respectively. The Portuguese market topped the checklist with 198 GWh produced utilizing photo voltaic know-how.

This knowledge displays the general enhance in put in photo voltaic vitality manufacturing capability in recent times. For instance, in line with REN knowledge, put in photo voltaic vitality capability in Portugal elevated by 3.0 MW between October and November 2023. As well as, in line with REE knowledge, the rise in put in photo voltaic photovoltaic vitality manufacturing capability in mainland Spain throughout the identical interval was 5.2 MW.

Supply: Ready by AleaSoft Vitality Forecasting utilizing knowledge from ENTSO-E, RTE, REN, REE and TERNA.

Supply: Ready by AleaSoft Vitality Forecasting utilizing knowledge from ENTSO-E, RTE, REN, REE and TERNA.

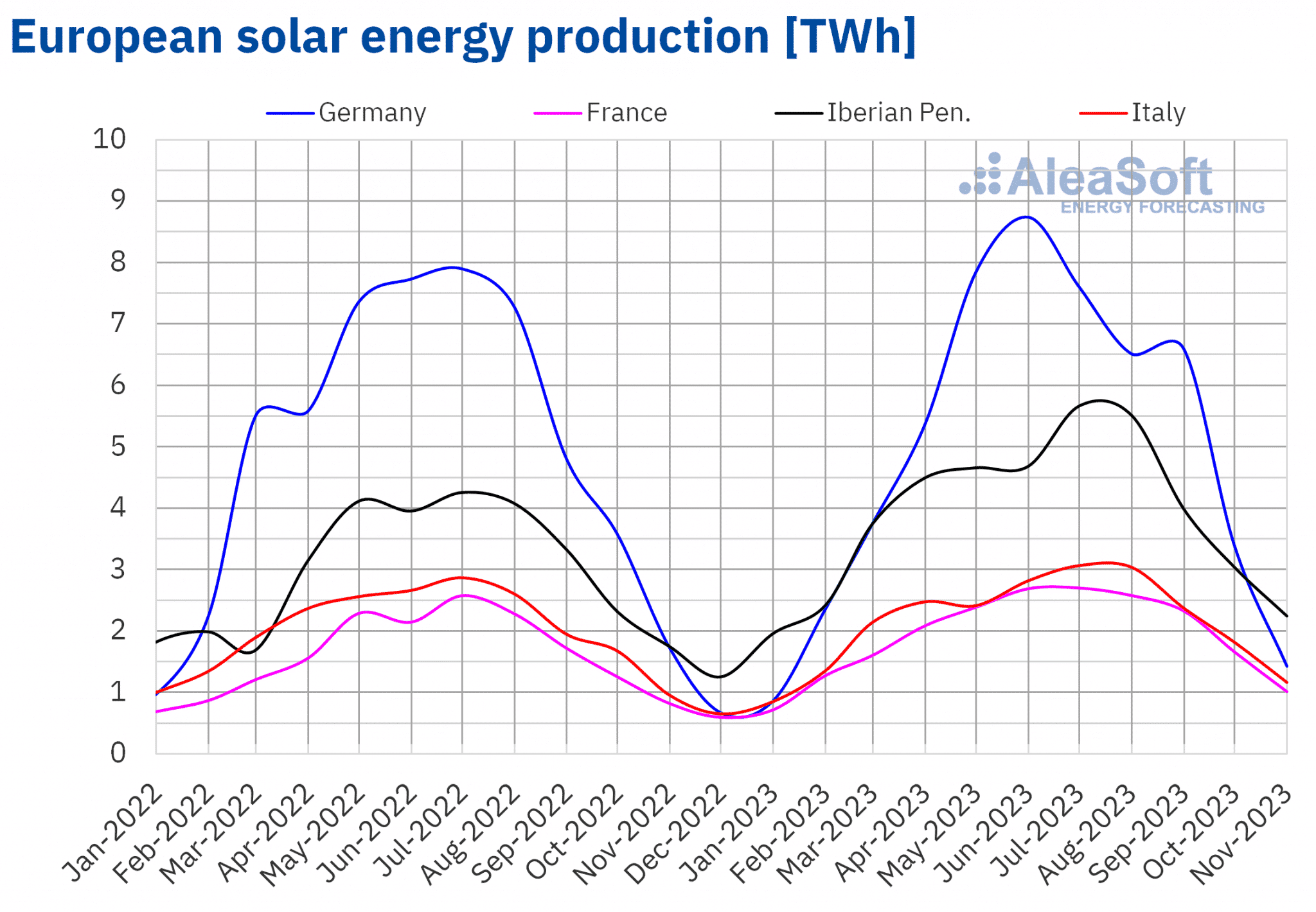

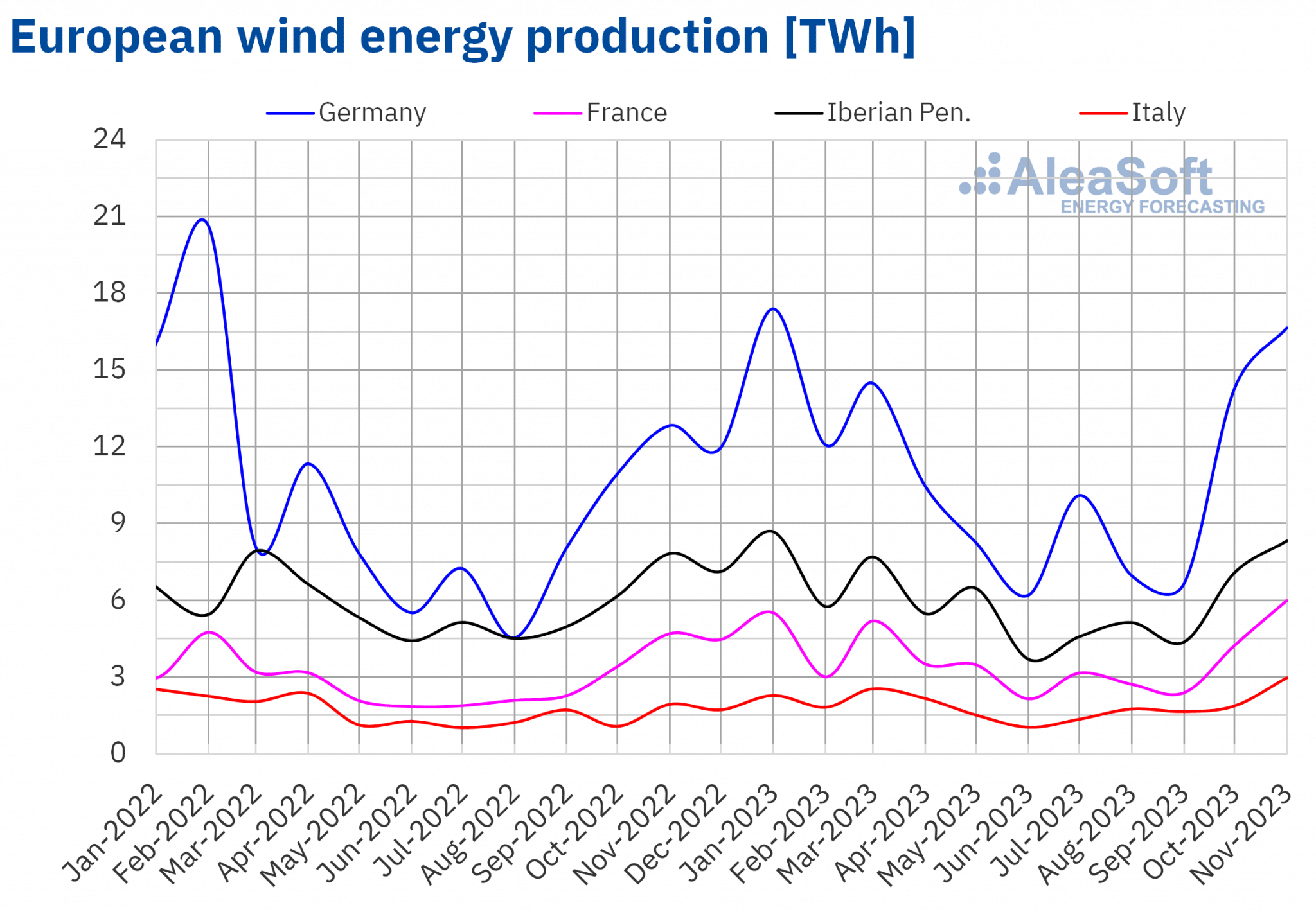

Wind vitality manufacturing registered year-on-year development in all main European markets in November 2023. The Italian market registered the best enhance at 54%. Within the different markets analyzed, will increase ranged from 5.4% within the Spanish market to 30% within the German market.

In November, wind vitality manufacturing additionally elevated in comparison with the earlier month in all European markets analyzed in AleaSoft Vitality Forecasting. The share enhance of wind vitality manufacturing in Italy was once more the best at 64%. In the remainder of the analyzed markets, the rise ranged from 4.2% in Portugal to 46% in France.

In November 2023, the French and Italian markets registered document highs in wind vitality manufacturing of 5998 GWh and 2977 GWh, respectively. As well as, the German market additionally broke the document for wind vitality manufacturing in November 2023, with 16 649 GWh in comparison with the identical month in earlier years.

Supply: Ready by AleaSoft Vitality Forecasting utilizing knowledge from ENTSO-E, RTE, REN, REE and TERNA.

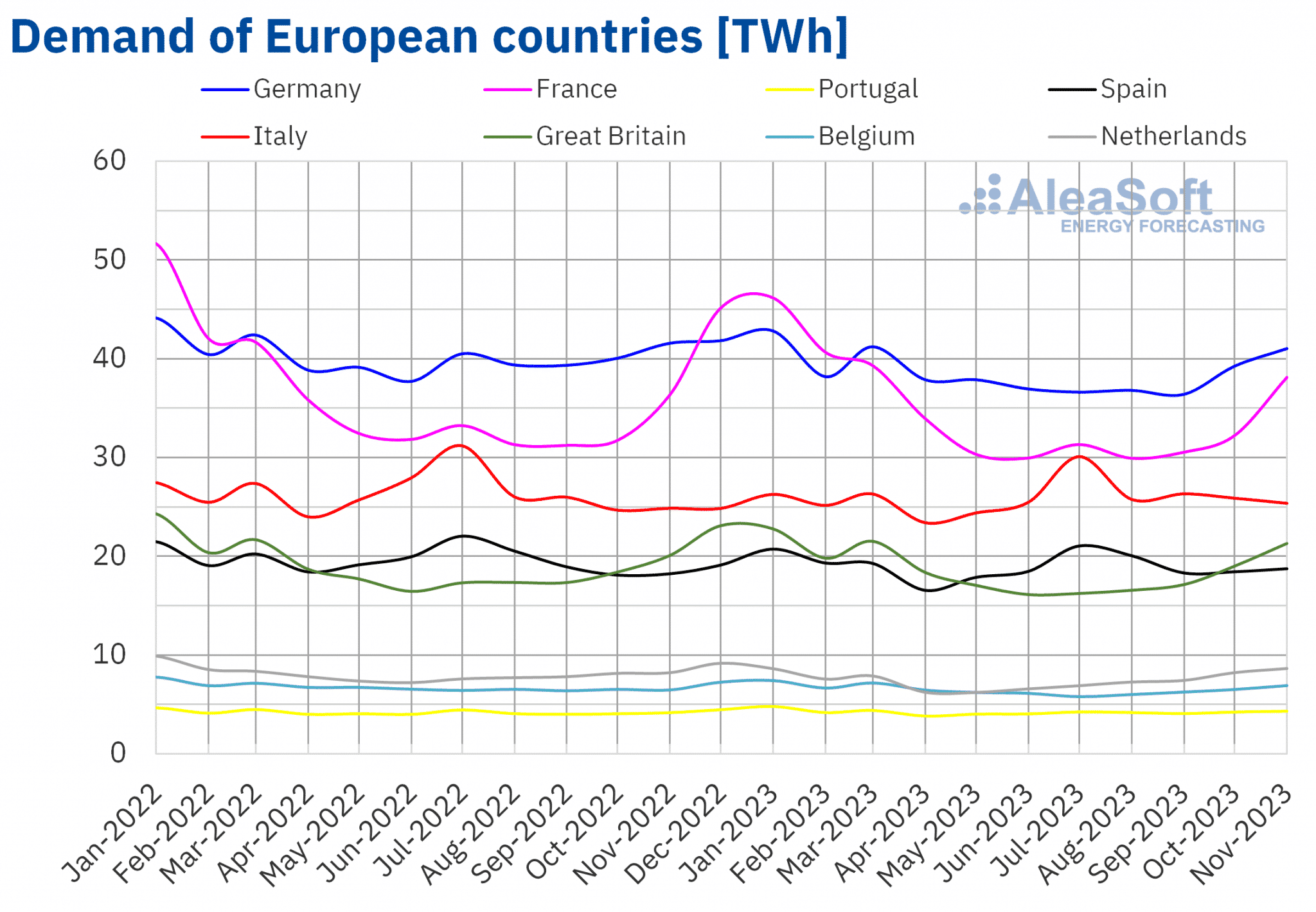

Electrical energy demand

In November 2023, electrical energy demand elevated in most main European markets in comparison with the identical interval in 2022. The will increase have been led by a 6.8% enhance within the Belgian market, adopted by a 6.0% enhance within the UK market. In distinction, the Italian market registered the smallest enhance of two.0%. Then again, the German market was the one one of many analyzed markets the place demand decreased by 1.3% year-on-year.

Evaluating electrical energy demand in October and November 2023, demand elevated in November in all European markets analyzed by AleaSoft Vitality Forecasting. The UK and French markets skilled the biggest month-over-month will increase of 16% and 22%, respectively. In the remainder of the analyzed markets, will increase ranged from 1.3% in Italy to 9.5% in Belgium.

November 2023 was barely cooler than the identical month in 2022 in most markets. The year-over-year lower in common temperatures ranged from 0.04°C in Spain to 1.7°C in the UK. Within the case of Portugal, common temperatures have been much like October.

Common temperatures in November have been decrease than in October in all markets analyzed. The Italian market registered the biggest temperature lower of seven.0°C. Within the remaining markets, temperature decreases ranged from 4.8°C within the UK to six.3°C in Germany.

Supply: Ready by AleaSoft Vitality Forecasting utilizing knowledge from ENTSO-E, RTE, REN, REE, TERNA, Nationwide Grid and ELIA.

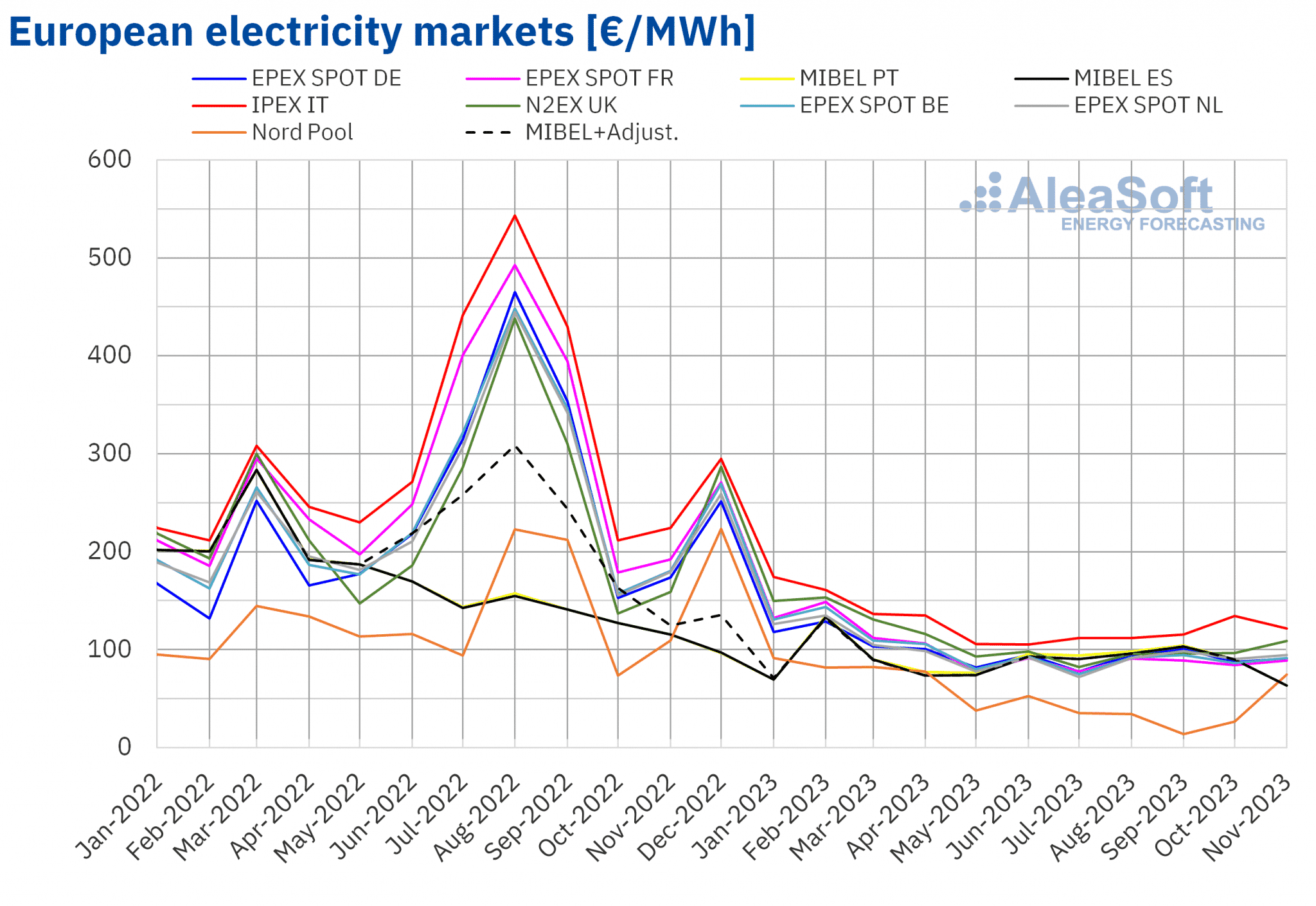

European electrical energy markets

Within the month of November 2023, the month-to-month common value exceeded €85/MWh in a lot of the main European vitality markets. The exceptions have been the MIBEL market in Portugal and Spain and the Nord Pool market within the Nordic nations, the place the averages have been €63.26/MWh, €63.45/MWh and €74.58/MWh, respectively. The Italian IPEX market registered the best month-to-month value of €121.74/MWh. Within the remaining markets, common costs ranged from €88.96/MWh in France’s EPEX SPOT market to €108.84/MWh within the UK’s N2EX market.

In current months, the common value for many European markets has remained pretty steady. In comparison with October, common costs in November elevated barely in a lot of the European electrical energy markets analyzed within the AleaSoft Vitality Forecasting. The exceptions have been the Italian market with a lower of 9.3% and the Iberian market with a lower of 30%. Then again, the Nordic market registered the best enhance of 182%. Within the remaining markets, costs elevated between 4.3% within the German market and 13% within the UK market.

Evaluating the common costs in November with these registered in the identical month of 2022, costs fell in all of the markets analyzed. On this case, the French market registered the biggest lower, at 54%. Within the different markets, value decreases ranged from 31% within the UK market to 49% within the Belgian market.

On account of the value falls registered within the MIBEL market, the November common in Spain and Portugal was the bottom since March 2021. As well as, costs on this market have been the bottom on common among the many major European electrical energy markets. In distinction, costs on the Nordic and UK markets have been the best since April 2023. Within the case of the French market, its month-to-month common was the best since August.

In November 2023, the decline within the common gasoline value and the rise in wind vitality manufacturing led to a year-on-year decline in costs on European electrical energy markets. As well as, photo voltaic vitality manufacturing elevated in virtually all markets analyzed.

Then again, regardless of the rise in wind vitality manufacturing, the overall lower in photo voltaic vitality manufacturing in comparison with the earlier month and the rise in demand contributed to cost will increase in comparison with October in a lot of the markets analyzed. The exceptions have been the Spanish, Portuguese and Italian markets, which registered the smallest month-on-month will increase in demand.

Supply: Ready by AleaSoft Vitality Forecasting utilizing knowledge from OMIE, EPEX SPOT, Nord Pool and GME.

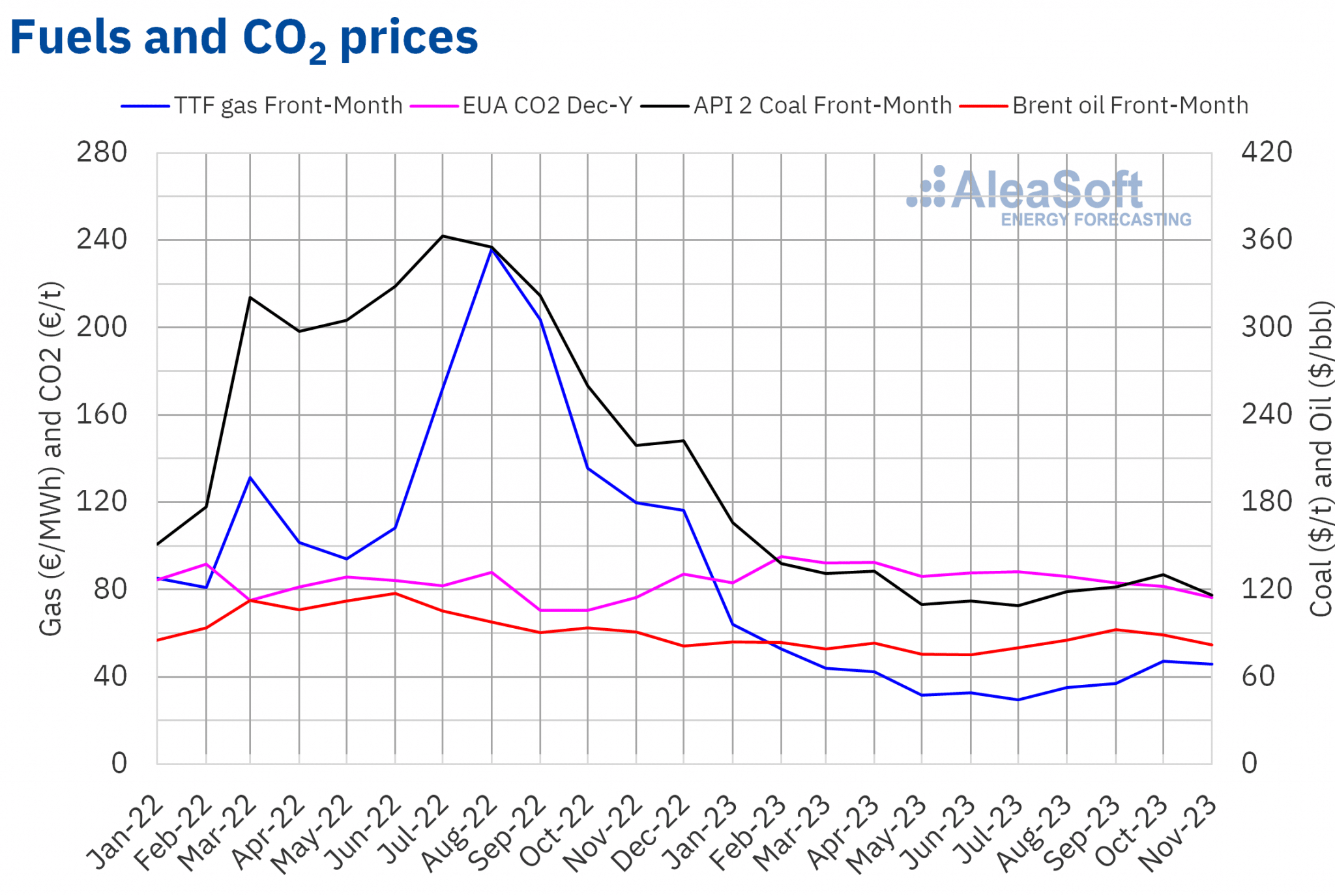

Brent, fuels and CO2

Brent oil futures for the Entrance?Month within the ICE market averaged $82.03/bbl in November. This was 7.5% decrease than the October Entrance-Month futures value of $88.70/bbl. It was additionally 9.8% decrease than the corresponding November 2022 Entrance-Month futures contract of $90.98/bbl.

In November, issues about world financial developments and their influence on oil demand continued to weigh on Brent oil futures costs. The lifting of sanctions on Venezuelan oil exports additionally contributed to the decline in these futures. Then again, fears of provide issues because of instability within the Center East diminished, which additionally allowed costs to fall.

As for the Entrance-Month TTF gasoline futures on the ICE market, the common worth registered throughout the month of November was €45.75/MWh. In comparison with the common Entrance-Month futures traded in October of €47.07/MWh, they decreased by 2.8%. In comparison with the Entrance-Month Futures traded in November 2022, when the common value was €119.71/MWh, there was a lower of 62%.

In November, excessive European inventories, ample LNG provides and delicate temperatures within the first weeks of the month led to decrease costs for TTF gasoline futures. As well as, Israel resumed gasoline provides to Egypt in early November, which additionally had a downward influence on costs.

CO2 emission rights futures on the EEX market for the December 2023 benchmark contract reached a median value of €76.22/t in November. This represents a lower of 6.5% in comparison with the earlier month’s common of €81.53/t. In comparison with the November 2022 common for the December 2022 benchmark contract of €76.26/t, the November 2023 common was solely 0.1% decrease.

Supply: Ready by AleaSoft Vitality Forecasting utilizing knowledge from ICE and EEX.

AleaSoft Vitality Forecasting’s evaluation on the prospects for vitality markets in Europe and the vitality transition

AleaSoft Vitality Forecasting and AleaGreen are internet hosting the subsequent occasions of their month-to-month webinar collection. The December webinar is scheduled for Thursday, December 14 and coincides with the fourth anniversary of the collection. This version will concentrate on AleaSoft’s providers for the vitality sector, along with discussing the outlook for European vitality markets in 2024. The first 2024 webinar might be held on January 18. PwC Spain will take part on this webinar for the fourth time.