The Federal Vitality Regulatory Fee (FERC) has unanimously accredited California Impartial System Operator’s (CAISO’s) Day-Forward Market Enhancements (DAME) and Prolonged Day-Forward Market (EDAM) proposal, successfully permitting new market choices to deal with challenges attributable to growing system variability and uncertainty within the West.

FERC’s choice issued on Dec. 20, for probably the most half, accepts CAISO’s Aug. 22, 2023–filed proposed revisions to its tariff to implement the DAME and EDAM proposals. “I consider such efforts will improve reliability, develop the financial savings and efficiencies that wholesale markets present, and contribute to customers’ backside line,” FERC Chairman Willie Phillips stated on Wednesday.

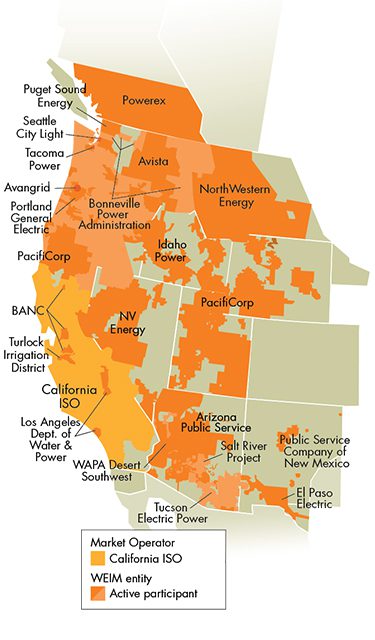

CAISO already operates a day-ahead market, a wholesale marketplace for power and ancillary companies that, much like a commodity market, allows transactions a day prematurely to make sure the system operator has enough assets obtainable in real-time. In 2014, CAISO launched the Western Vitality Imbalance Market (WEIM), which allowed balancing authority areas (BAAs) within the Western Interconnection to take part within the imbalance power portion of CAISO’s real-time market. Within the WEIM, 22 voluntary members—representing 79% of the load within the Western Interconnection—might purchase and promote power in 15- and 5-minute real-time markets to fulfill their imbalance wants.

Day-Forward Market Enhancements (DAME)

Underneath its DAME proposal, CAISO proposed two new day-ahead market merchandise—Imbalance Reserves and Reliability Capability—to deal with rising system variability challenges and enhance market effectivity and reliability. CAISO stated the DAME revisions had been wanted to deal with growing variations within the load forecast (the online load forecast) between CAISO’s day-ahead and real-time markets. The “web load forecast is a key worth for the CAISO markets as a result of it represents how a lot power the market should procure from agency dispatchable assets to fulfill system wants in real-time,” FERC stated in its choice.

CAISO famous that web load imbalances have grown in recent times, stemming from speedy development in variable power useful resource capability, excessive weather-related uncertainty, and excessive climate occasions. These components have elevated the danger that the grid operator may have inadequate capability and ramp functionality obtainable in real-time to fulfill demand, it stated.

Whereas CAISO has up to now utilized the residual unit dedication (RUC) capability course of within the day-ahead market to regulate the load forecast, DAME market merchandise “will improve effectivity by incorporating anticipated variability and uncertainty into the day-ahead market, thereby minimizing web load imbalances between day-ahead and real-time,” it argued.

The 2 new day-ahead market “bi-directional” merchandise can be procured on a co-optimized foundation with power. The Imbalance Reserves product “is meant to deal with real-time ramping wants that aren’t coated by hourly day-ahead market schedules due to uncertainty within the web load forecast used within the day-ahead market.” Assets that obtain an Imbalance Reserves award should submit financial bids within the real-time marketplace for its awarded capability vary.

The Reliability Capability product, in the meantime, takes over an RUC course of to fulfill optimistic or unfavorable variations between cleared bodily provide within the IFM (the financially binding portion of CAISO’s day-ahead market) and the day-ahead web load forecast.

The Prolonged Day-Forward Market (EDAM)

The EDAM, a multi-year stakeholder initiative that was collectively accredited by CAISO’s Board of Governors and the WEIM Governing Physique in February 2023, primarily extends CAISO’s day-ahead market to WEIM entities. The voluntary regional day-ahead market leverages options from CAISO’s day-ahead market but additionally incorporates DAME market enhancements.

The EDAM is designed to permit “for the optimized dedication of assets and use of transmission functionality throughout a bigger footprint to successfully and effectively place assets to fulfill next-day demand,” CAISO has stated. CAISO suggests annual financial advantages related to the EDAM may vary from $100 million to greater than $1 billion along with different advantages WEIM will proceed to supply.

CAISO had requested FERC to approve the EDAM tariff revisions by Dec. 21, 2023, to accommodate “preliminary EDAM onboarding and implementation provisions” and hold to an anticipated implementation timeline. Thus far, PacifiCorp and the Balancing Space of Northern California (BANC) have introduced an intent to hitch the EDAM.

“We’re working with these entities on their implementation schedules to help their participation,” CAISO says in a latest factsheet. “On account of further venture coordination and schedule alignment, and contemplating regulatory obligations with every entity, the ISO—in collaboration with PacifiCorp, BANC, and different potential entities—is estimating their onboarding to happen in 2026. Relying on the variety of events, this additionally permits for extra members to onboard in 2026.”

“By becoming a member of EDAM, an exterior BAA voluntarily enters into participation agreements to participate in CAISO’s day-ahead market, much like the prevailing WEIM,” FERC defined in its choice. “The DAME proposal would replace CAISO’s present day-ahead market to implement and accommodate EDAM features, in addition to deal with provide and cargo forecast variations, or imbalances, between the day-ahead and real-time markets,” it stated.

Collectively, EDAM and DAME enhancements “will help the optimum dedication of a geographically various set of assets throughout the footprint of all BAAs collaborating in EDAM, optimize using obtainable transmission functionality, construct upon the WEIM, and supply broad financial, reliability, and environmental advantages,” it stated.

Notable Business Pushback

Nevertheless, FERC’s choice information a number of considerations submitted by trade stakeholders. The Electrical Energy Provide Affiliation (EPSA), a bunch representing aggressive energy mills, prompt “the degree of complexity within the DAME proposal” may create “uncertainty and inefficiencies and runs counter to the primary ideas that render market guidelines simply and affordable.” The commerce group stated it believes EDAM can transfer ahead with out DAME if mandatory, “with acceptable reporting necessities for these parts of EDAM that at the moment fall quick. Market members shouldn’t be disadvantaged of the advantages of this market growth if it may be resolved on a quicker timeline,” it stated.

A number of mills, together with Shell and Vistra, additionally protested sure parts of the DAME proposal. Vistra asserted that the proposal may undermine reliability and create market distortions on account of “flaws in CAISO’s market design and that these points can be unfold regionally.” Whereas a market-based strategy for procuring upward capability to deal with rising uncertainty is an efficient goal, Vistra discovered the DAME proposal “to be flawed to the purpose the place it won’t obtain CAISO’s meant outcomes.”

CAISO, in its filings, responded that it will not consent to have the DAME proposal “severed” from the EDAM proposal, noting that the EDAM design “was premised on the DAME initiative, notably the introduction of the Imbalance Reserves product.” CAISO additionally argued that the expense and energy wanted to implement EDAM with out the Imbalance Reserves product can be “unreasonable.”

FERC agreed: “We discover that CAISO has demonstrated the DAME proposal to be simply and affordable and has defined how the Imbalance Reserves and Reliability Capability merchandise will deal with present points within the day-ahead market. We agree with CAISO that entities can decide for themselves if the DAME provisions present profit sufficient to voluntarily be a part of EDAM,” it stated.

Phillips: Reforms Are Obligatory

On Wednesday, Chairman Phillips famous that CAISO has “dedicated to repeatedly monitor the efficiency of EDAM and DAME and make enhancements, incorporating the enter of its stakeholders, if mandatory.”

“Specializing in the DAME proposal, these reforms are mandatory to make sure that the day-ahead market schedule has the ramping functionality wanted to answer real-time variations in web load,” Phillips added. “It’s at the moment troublesome for CAISO to forecast web load in every real-time interval, and this job will develop into tougher over time because the useful resource combine modifications.”

“Specializing in the EDAM and DAME proposal collectively, the unpredictable climate, the elevated penetration of renewables and different modifications such because the rising significance of storage and electrification (together with electrical autos) collectively improve complexity for grid operators and make it tougher to make sure adequate assets can be obtainable to serve real-time wants,” he stated.

“CAISO defined that it at the moment meets these wants outdoors of the market with guide interventions, which will be inefficient, elevate prices to load, and deform market outcomes. I applaud CAISO for its efforts on this proposal to scale back such guide interventions and incorporate extra of the system’s wants into the day-ahead market, thus enhancing transparency, value formation, and effectivity.”

“Establishing a day-ahead market for a bigger geographic space is difficult and represents stakeholders’ vital efforts over the previous few years to develop enhanced market mechanisms that collectively obtain reliability, affordability, and sustainability for patrons,” Phillips underscored.

Nevertheless, in his concurrence, Phillips additionally famous a number of different efforts are underway within the West to deal with shifting market wants. “States, utilities, and different stakeholders are evaluating potential participation within the Western Energy Pool’s Western Useful resource Adequacy Program, the Southwest Energy Pool, Inc.’s (SPP) RTO West, SPP’s Western Vitality Imbalance Service, and SPP’s Markets+, along with WEIM and EDAM,” he stated. “Moreover, some states are performing benefit-cost analyses relating to becoming a member of regional transmission organizations.”

—Sonal Patel is a POWER senior affiliate editor (@sonalcpatel, @POWERmagazine).