Photo voltaic, wind, and nuclear energy, in addition to battery storage methods, are the apparent winners because the world goals to decarbonize vitality methods.

It shouldn’t be a shock to anybody who has been following traits within the energy business for any size of time that renewable vitality once more led capability additions over the previous 12 months. In reality, the Worldwide Vitality Company (IEA) studies that funding in clear vitality has risen by 40% since 2020. It says the push to carry down emissions is a key motive, however not the one one. “The financial case for mature clear vitality applied sciences is robust. Vitality safety can be an necessary issue, significantly in fuel-importing international locations, as are industrial methods and the need to create clear vitality jobs,” the IEA mentioned.

Not all clear applied sciences are thriving, nevertheless. Some provide chains, notably for wind, are beneath stress. Nonetheless, greater than 500 GW of renewables era capability had been on monitor to be added in 2023, which might set a brand new file. The IEA reported that greater than $1 billion a day is being spent globally on photo voltaic deployment. In the meantime, manufacturing capability for key parts of a clear vitality system, together with photo voltaic photovoltaic (PV) modules and electrical automobile (EV) batteries (Determine 1), is increasing quick, so anticipate the vitality transition to speed up.

|

|

1. Ultium Cells, a three way partnership between Common Motors (GM) and LG Vitality Resolution, started battery cell manufacturing at its new 2.8 million-square-foot facility positioned in Warren, Ohio, in August 2022. The state-of-the-art plant employs 1,700 individuals and has a 41 GWh annual capability with room for enlargement. The batteries shall be put in in GM’s electrical automobiles, and could also be equipped to different clients together with within the rail, aerospace, heavy trucking, and marine industries. Related services are beneath development in Spring Hill, Tennessee, and Lansing, Michigan, with openings deliberate in 2024. Courtesy: Ultium Cells |

“The transition to wash vitality is going on worldwide and it’s unstoppable. It’s not a query of ‘if,’ it’s only a matter of ‘how quickly’—and the earlier the higher for all of us,” IEA Government Director Fatih Birol mentioned in a press release saying the discharge of the IEA’s World Vitality Outlook 2023 report in late October.

Drivers Behind the Vitality Transition

“Whereas among the challenges that held again renewable progress in 2023 are anticipated to proceed into subsequent 12 months, renewables will doubtless take off in 2024, albeit at totally different speeds,” Marlene Motyka, Deloitte U.S. Renewables Vitality Chief, advised POWER. “That’s as a result of unprecedented federal funding, market competitiveness, and demand will doubtless propel renewable vitality improvement whilst in addition they exacerbate grid, provide chain, and workforce challenges.”

The push of federal funds flowing into clear vitality and the pull of decarbonization demand from private and non-private entities have by no means been stronger, in response to Motyka. The Biden administration has positioned nice emphasis on increasing renewable vitality. Particularly, the Inflation Discount Act (IRA), which Biden signed into legislation on Aug. 16, 2022, has been hailed by the White Home as “the biggest funding in clear vitality and local weather motion ever.”

“The Inflation Discount Act (IRA) funding tax credit (ITCs) and manufacturing tax credit (PTCs) have made utility-scale photo voltaic and onshore wind—together with tasks paired with storage—aggressive with marginal prices of current typical era. Tasks in a position to declare the utmost accessible credit may seize low photo voltaic and wind LCOEs [levelized cost of energy],” Motyka mentioned.

In a reality sheet issued by the White Home on the one-year anniversary of the IRA’s signing, it says greater than $110 billion in new clear vitality manufacturing investments had been introduced by private-sector entities throughout the legislation’s first 12 months, together with greater than $70 billion within the EV provide chain and greater than $10 billion in photo voltaic manufacturing. Moreover, it notes the personal sector had introduced roughly $240 billion in new clear vitality manufacturing investments since Biden was elected.

The White Home additionally credit investments in clear vitality and local weather because the IRA was signed into legislation with creating greater than 170,000 jobs. In the meantime, the Labor Vitality Partnership, a joint mission of the Vitality Futures Initiative and the AFL-CIO, mentioned it analyzed the IRA and concluded that the legislation would add practically 1.5 million jobs and $250 billion to the economic system by 2030. The group additionally urged greenhouse gasoline (GHG) emissions shall be diminished by practically 40% because of the IRA.

However the IRA isn’t solely serving to renewables, it’s additionally benefiting the nuclear business. “The IRA tax credit mark a turning level for superior nuclear vitality, guaranteeing that new nuclear tasks can play a big position in decreasing emissions from electrical energy era,” Nuclear Innovation Alliance (NIA) Government Director Judi Greenwald mentioned in a press release launched in December saying the publication of a paper centered on implications of IRA tax credit for superior nuclear vitality. “We commend the foresight of policymakers in enabling new nuclear development by means of the PTC and ITC choices beneath the IRA, which is able to play an important position in making superior nuclear vitality economically viable for each ‘first-of-a-kind’ and ‘nth-of-a-kind’ superior nuclear tasks,” Greenwald mentioned.

Tax Credit and Transferability

“In 2023, we gained priceless insights into the sensible workings of sure parts of the IRA, due to a collection of issued steering. These newly clarified provisions have undeniably bolstered investor confidence, offering a strong basis for no less than a decade of sustained funding in renewable energies,” Sarp Ozkan, vice chairman of Business Product with Enverus, advised POWER.

Gabe Grosberg, managing director for North America Regulated Utilities with S&P International Rankings, agreed. “We anticipate that the IRA will gasoline the expansion of U.S. renewable energy over the subsequent decade. The legislation permits for important tax credit for renewable vitality, and likewise permits for these tax credit to be transferred to a 3rd social gathering. Transferability permits tax credit that can not be used on an organization’s personal consolidated tax return—as a result of the corporate has inadequate revenue—to be transferred to a 3rd social gathering.”

Transferability is among the nuances of the legislation that Ozkan mentioned the market nonetheless must navigate and unravel. “One of many essential themes that we are going to proceed to watch is the tax fairness and transferability markets,” he mentioned. “The abundance of prolonged, expanded, and new credit is poised to inundate conventional tax fairness markets, presenting a formidable problem for the nascent transferability market. Transferability is anticipated to cater to smaller and rising builders at a extra substantial low cost. Nonetheless, sure points of its flexibility could intrigue bigger gamers, prompting them to discover how such offers may be strategically structured to their benefit. Nevertheless, conventional tax fairness markets are anticipated to position a fair better emphasis on established, creditworthy developer counterparts. This shift is especially pushed by mounting issues relating to queue congestion and the diminishing chances of mission success.”

Grosberg mentioned investor-owned utilities will profit. “We anticipate that the investor-owned regulated utility business shall be one of many major beneficiaries of the transferability of tax credit, given each the business’s excessive enlargement of renewable vitality and taxable revenue that’s typically inadequate to make use of all accessible tax credit.”

Continued Strain to Retire Coal-Fired Models

In the meantime, America’s Energy, a nationwide commerce group that advocates on behalf of the U.S. coal fleet and its provide chain, mentioned the U.S. Environmental Safety Company (EPA) proposed or finalized no less than 4 laws in 2023 which might be more likely to pressure extra coal plant retirements. The group mentioned the EPA has additionally been slowly implementing laws centered on coal combustion residuals and regional haze, which may result in extra plant closures.

In remarks made throughout a November-held Federal Vitality Regulatory Fee (FERC) technical convention centered on reliability, Michelle Bloodworth, president and CEO of America’s Energy, mentioned until the six laws had been considerably moderated or overturned, the potential of a near-term reliability disaster was exacerbated.

“There have been quite a few warnings a few grid reliability disaster,” Bloodworth mentioned. “One of many major causes is the untimely retirement of dispatchable electrical energy assets, principally coal. Up to now, greater than 40% of the nation’s coal fleet has retired. Previous EPA laws induced or contributed to many of those retirements. Regardless of clear warnings, an alarming variety of coal-fired energy vegetation proceed to retire, and the tempo of those retirements is quicker than most individuals notice.”

America’s Energy estimates that greater than 100 GW of coal-fired energy vegetation are liable to retiring prematurely due to the “Carbon Rule.” The Carbon Rule refers to docket quantity EPA-HQ-OAR-2023-0072, which proposes 5 separate actions beneath part 111 of the Clear Air Act addressing GHG emissions from fossil fuel-fired electrical producing items. The proposal and supporting paperwork whole nearly 700 pages.

“The Carbon Rule would undermine reliability by forcing the untimely retirement of coal-fired producing capability and by inflicting the lack of important reliability attributes supplied by the coal fleet,” Bloodworth mentioned. “EPA has didn’t conduct a correct reliability evaluation that encompasses each useful resource adequacy and working reliability.”

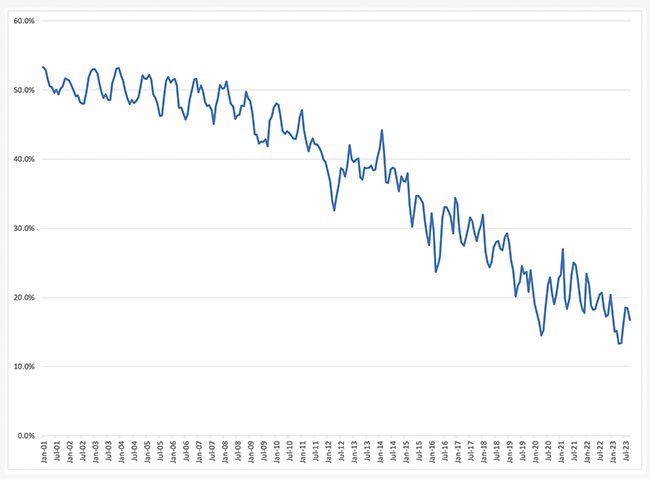

But, even when America’s Energy can quash among the unfavorable laws, it is going to nonetheless be laborious to flatten the downward trajectory coal energy is at present on (Determine 2). “The U.S. has diminished its reliance on coal-fired era by about 60% over the previous decade and we anticipate that the overwhelming majority of the remaining coal vegetation will largely be phased out by 2030, principally to get replaced with renewable energy and batteries,” mentioned S&P International Rankings’ Grosberg.

|

|

2. This chart exhibits coal’s month-to-month market share of U.S. electrical energy era from January 2001 by means of September 2023. Previous to 2001, coal constantly equipped greater than 50% of the ability produced within the U.S. In the course of the first three quarters of 2023, it averaged solely barely greater than 16% of the whole. Supply: U.S. Vitality Data Administration |

In much less developed components of the world, nevertheless, coal should still have legs. Talking on the fifth annual India Coal Convention in New Delhi, FutureCoal CEO Michelle Manook mentioned, “Authorities and finance insurance policies, which embrace a ‘cancel coal’ mantra, are short-sighted and undermine the very ambitions we search to realize as a world group.” FutureCoal, previously often known as the World Coal Affiliation, is a world multi-lateral group representing your complete coal worth chain together with the coal-fired energy business.

“The fact is, coal shall be right here for the foreseeable future, and the way forward for coal past combustion features regular momentum. As a coal worth chain, we have to remodel, unite, and make sure that a accountable narrative informs international coverage setting,” mentioned Manook. “We have to reframe this debate to the truth. There isn’t any official motive for coal to not take part in any vitality transition. Abated coal options exist they usually have to be embraced.”

Nuclear Energy Gaining Assist Worldwide

In December, on the UN Local weather Change Convention (COP28) in Dubai, United Arab Emirates (UAE), 22 nations signed onto the Internet-Zero Nuclear Initiative, collectively pledging to triple their nuclear vitality capability by 2050. The endorsing international locations had been Bulgaria, Canada, Czech Republic, Finland, France, Ghana, Hungary, Japan, Republic of Korea, Moldova, Mongolia, Morocco, Netherlands, Poland, Romania, Slovakia, Slovenia, Sweden, Ukraine, UAE, UK, and the U.S. In line with Worldwide Atomic Vitality Company (IAEA) knowledge, there are at present 277 nuclear reactors working or beneath development throughout the 22 international locations, totaling practically 270 GW of mixed internet electrical capability. Tripling that capability over the subsequent 26 years is not going to be simple.

Notably lacking from the signatories had been China and Russia. But, these two international locations clearly don’t must signal a pact to display their robust perception in nuclear energy. The IAEA studies China leads the world within the variety of reactors at present beneath development with 22 (Determine 3). In the meantime, Russia, which has three items beneath development, dominates the export scene. The World Nuclear Business Standing Report 2023, a Mycle Schneider Consulting Challenge publication issued in December, says Russia is constructing 19 items in seven different international locations, together with 4 in China. China is likewise anxious to export its personal nuclear know-how together with to each Argentina and Pakistan, amongst others.

|

|

3. China Nationwide Nuclear Corp. (CNNC) introduced that the highest head of the Hainan multi-purpose small modular reactor (SMR) demonstration mission’s metal containment vessel was efficiently hoisted into place on Nov. 3, 2023. It marks the capping of the important thing construction of the world’s first SMR demonstration reactor and the “full entry into the height interval of inside set up,” CNNC mentioned. Courtesy: CNNC |

“Demand for nuclear is surging world wide as a result of it’s clear, dependable, and reasonably priced. As I meet with world local weather leaders this week in Dubai for COP28, I’m heartened to see this momentum clearly mirrored within the dialogue happening,” Maria Korsnick, president and CEO of the Nuclear Vitality Institute (NEI), mentioned in a press release issued on Dec. 2. As international locations attempt to realize the targets established within the Internet-Zero Nuclear Initiative, business contributors stand to profit drastically.

“The importance of the Ministerial Declaration can’t be overstated. The international locations supporting this declaration are making a resolute dedication, inserting nuclear vitality on the coronary heart of their methods for local weather change mitigation. Their imaginative and prescient is one which strives for a sustainable, cost-effective, safe, and equitable vitality combine,” Dr. Sama Bilbao y León, director common of the World Nuclear Affiliation, mentioned in a press release. “If we are able to collectively notice this formidable aim, tripling nuclear capability, we now have the ability to fulfil the promise of nuclear vitality—to decarbonize total economies and supply clear electrical energy to each nook of the globe.”

“The pledge made at the moment places us on a path towards a sustainable and simply vitality transition, however making it a actuality requires daring and well timed actions by governments, buyers, and business. Collectively we are able to make this occur, and I look ahead to persevering with the conversations that may hold us dedicated to this work towards a clear vitality future,” Korsnick concluded.

Bumps Alongside the Highway

Whereas there are various causes to be optimistic about nuclear energy’s future, there are nonetheless hurdles to beat, significantly in terms of price and schedule certainty. One first-of-a-kind mission that appeared promising met its demise in November. Utah Related Municipal Energy Programs (UAMPS) and NuScale Energy Corp. agreed to terminate the Carbon Free Energy Challenge (CFPP), a small modular reactor (SMR) mission that was deliberate for development on Idaho Nationwide Laboratory (INL) property close to Idaho Falls, Idaho.

“Regardless of important efforts by each events to advance the CFPP, it seems unlikely that the mission may have sufficient subscription to proceed towards deployment. Due to this fact, UAMPS and NuScale have mutually decided that ending the mission is essentially the most prudent resolution for each events,” the builders mentioned in an announcement issued on Nov. 8.

“Regardless of the setback from the current cancellation of the NuScale Energy mission, SMRs stay a viable possibility, particularly if there’s a chance to scale up manufacturing of those services,” mentioned Enverus’ Ozkan, whereas additionally acknowledging that there are important public issues surrounding nuclear energy, even when the economics and scalability make sense.

Following termination of the CFPP, NuScale Energy was fast to level out that capital price projections had not elevated “between the Class 3 and present Class 2 estimates” when adjusted for inflation, and that the price of the corporate’s SMR know-how has additionally remained regular. Nevertheless, some business observers have urged the prices had been merely an excessive amount of for subscribers to bear. In Mycle Schneider’s report, it says price estimates had ballooned to $9.3 billion for the six-module 462-MW mission. “Regardless of large federal subsidies estimated to exceed $4 billion, the projected price of electrical energy appeared too excessive for many candidate municipalities,” the report says.

Nonetheless, the CFPP setback is unlikely to be the loss of life knell for superior nuclear tasks. NuScale has promising offers in place with different firms and international locations, and several other different microreactor and SMR suppliers even have tasks within the queue.

In Canada, for instance, Ontario Energy Technology (OPG) plans so as to add as much as 4 GE-Hitachi (GEH) BWRX-300 SMR items—with capability of 300 MW every—to its Darlington website. Moreover, a collaboration involving GEH, OPG, Orlen Synthos Inexperienced Vitality, and the Tennessee Valley Authority may end in dozens of BWRX-300 items being constructed in Poland and the U.S. In the meantime, a number of different firms together with X-energy, TerraPower, Westinghouse, Extremely Secure Nuclear Corp., and Oklo have tasks in numerous states of improvement. There may be an excessive amount of curiosity all through the business in seeing all of those accomplished efficiently.

Fuel Market Uncertainty

Lately, pure gas-fired era has pretty quietly elevated its margin because the main supply of energy within the U.S. Since overtaking coal for the highest spot in 2016, gasoline has grown to account for about 40% of the ability provide in 2022, greater than twice the share equipped by coal items, which ranked second. By way of the primary three quarters of 2023, the share of gasoline era stepped up once more, now to better than 43% of the availability, whereas coal fell under nuclear by greater than two proportion factors at 16.25%. For greater than twenty years, nuclear has often equipped from 18% to twenty% of the U.S. energy combine, which has continued in 2023.

Worldwide, demand for gasoline has elevated fairly considerably year-on-year (y-o-y). In line with the Fuel Exporting International locations Discussion board (GECF), a Doha, Qatar–based mostly intergovernmental group that caters to the world’s main gasoline producers and exporters, gasoline consumption swelled across the globe in October. In its Month-to-month Fuel Market Report, issued in November, the GECF mentioned the European Union noticed a 5.1% y-o-y improve in gasoline consumption, pushed largely by a revival in its industrial sector, whereas consumption within the U.S. swelled by 6.7% y-o-y, predominantly pushed by the ability era sector. GECF analysts mentioned “a shift away from coal-based energy, amplified cooling demand, and a decline in pure gasoline costs” had been largely accountable for the rise within the U.S. In the meantime, China’s obvious gasoline demand elevated by 5% y-o-y, pushed by an financial rebound in that nation, in response to GECF.

“The worldwide economic system has confronted important challenges as a consequence of persistently excessive inflation, stringent financial insurance policies, banking sector instability, provide chain disruptions, imposed financial restrictions, and rising geopolitical tensions. Regardless of these hurdles, the worldwide economic system has surpassed expectations, thanks partially to the gradual easing of inflationary pressures, declining commodity costs, the sturdy efficiency of the U.S. economic system, and financial restoration in China,” the report says.

For greater than 20 years, Japan and South Korea have been two of the highest three importers of liquefied pure gasoline (LNG) globally. In early December, the U.S. Vitality Data Administration reported that the 2 international locations LNG storage had been at peak month-to-month ranges for many of 2023. The U.S. was additionally well-positioned for the winter heating season, with essentially the most pure gasoline in storage since 2020. U.S. inventories had been reported to be 7% larger than in 2022.

Nonetheless, some market observers imagine European imports of LNG may create volatility in 2024. In Germany (Determine 4), for instance, the GECF mentioned progress in gasoline utilization was noticed in each the ability era and industrial sectors in October, with will increase of 9.4% and seven% y-o-y, respectively. Elements driving this progress included decrease gasoline costs; the phase-out of nuclear energy, which led to a better reliance on pure gasoline within the energy era combine; and the coverage shift from coal to gasoline.

|

|

4. Uniper’s liquefied pure gasoline (LNG) terminal in Wilhelmshaven was the primary import terminal in Germany to start out operations on Dec. 21, 2022. Tankers are unloaded and the LNG is regasified on the Floating Storage and Regasification Unit (FSRU) “Höegh Esperanza.” About 5 billion cubic meters of pure gasoline may be landed per 12 months from the terminal, which is able to meet about 6% of Germany’s gasoline demand. Courtesy: Uniper |

To gauge future demand for pure gasoline and predict market path, consultants with GECF intently monitor international gross home product (GDP) forecasts. “International financial progress is a significant factor influencing international gasoline consumption, significantly within the energy and industrial sectors,” the report says. It notes the Worldwide Financial Fund lately lowered its forecast for international GDP progress in 2024 modestly to 2.9%. It says the outlook for 2024 additionally encompasses important potential dangers, together with heightened volatility in commodity costs as a consequence of geopolitical tensions, the intensification of China’s actual property disaster, persistent inflationary pressures, and excessive debt ranges in quite a few international locations. This, mixed with inflation and different elements, could have a unfavorable impression on the safety of gasoline provide within the medium- to long-term, the report says.

Vitality Storage Offers Flexibility

Vitality storage capability is rising exponentially as of late. American Clear Energy (ACP), an advocate for the “multi-tech clear vitality business” together with vitality storage, reported utility-scale battery storage installations within the U.S. totaled 2,142 MW/6,227 MWh within the third quarter (Q3) 2023. That was a 21% improve in comparison with Q2 2023 and a 63% improve from Q3 2022. The cumulative whole of put in battery storage within the U.S. on the finish of the quarter was 13,477 MW/38,337 MWh. Many photo voltaic tasks at the moment are being paired with battery storage in a hybrid system. In reality, ACP reported 27,178 MW of hybrid tasks had been within the pipeline on the finish of Q3, 98% of which had been photo voltaic plus storage.

“Vitality storage assets may be important in utilizing variable renewable vitality sources like wind and photo voltaic. The flexibility to retailer vitality for lengthy durations—10 hours or extra—is a key to affordably and reliably working a decarbonized grid,” mentioned Dr. Andrew Maxson, senior program supervisor at EPRI.

“Decrease prices, efficiency enhancements, demonstrations at scale, and the analysis of helpful markets and use circumstances proceed to drive the acceleration of rising long-duration vitality storage options to business readiness. Integration of vitality storage to offer a better diploma of renewables and implementation of demand-side administration approaches may assist vitality firms serve clients by means of the demand curve in a low-carbon future. Confirmed dispatchable electrical energy era at the moment stays the first useful resource offering system flexibility and reliability,” Dr. Maxson advised POWER.

“Vitality storage may be key for rising grid resilience and reliability,” Deloitte’s Motyka mentioned. She famous that the Infrastructure Funding and Jobs Act designated $505 million particularly for long-duration vitality storage demonstration tasks and $7.9 billion towards the event of home battery and significant minerals provide chains.

Motyka mentioned vitality storage offers many advantages to energy firms. “Vitality storage can sort out the problem of elevated EV adoption, aiding grid administration whereas probably serving as a distributed grid stabilizer,” she mentioned. It may additionally assist remodel vitality markets. “Superior grid administration and vitality storage can allow dynamic pricing and demand response, permitting shoppers to optimize their vitality use and take part in vitality markets, and assist to create a extra versatile and environment friendly vitality ecosystem,” famous Motyka.

“Whereas battery know-how has improved and its prices have been considerably diminished, additional technological enhancements are mandatory for the battery to stay the only supply of back-up energy for a grid that’s rising its reliance on intermittent renewable energy,” mentioned S&P International Rankings’ Grosberg.

—Aaron Larson is POWER’s government editor.