The final week of the 12 months 2023 registered the anticipated drop in demand because of the Christmas vacation interval. Elevated photo voltaic vitality manufacturing in nations corresponding to Germany and France contributed to cost declines within the EPEX SPOT market. Nevertheless, wind and photo voltaic vitality manufacturing fell in Italy and the Iberian Peninsula, contributing to cost will increase in these markets. Fuel costs continued their downward development, approaching €30/MWh.

Photo voltaic photovoltaic, photo voltaic thermoelectric and wind vitality manufacturing

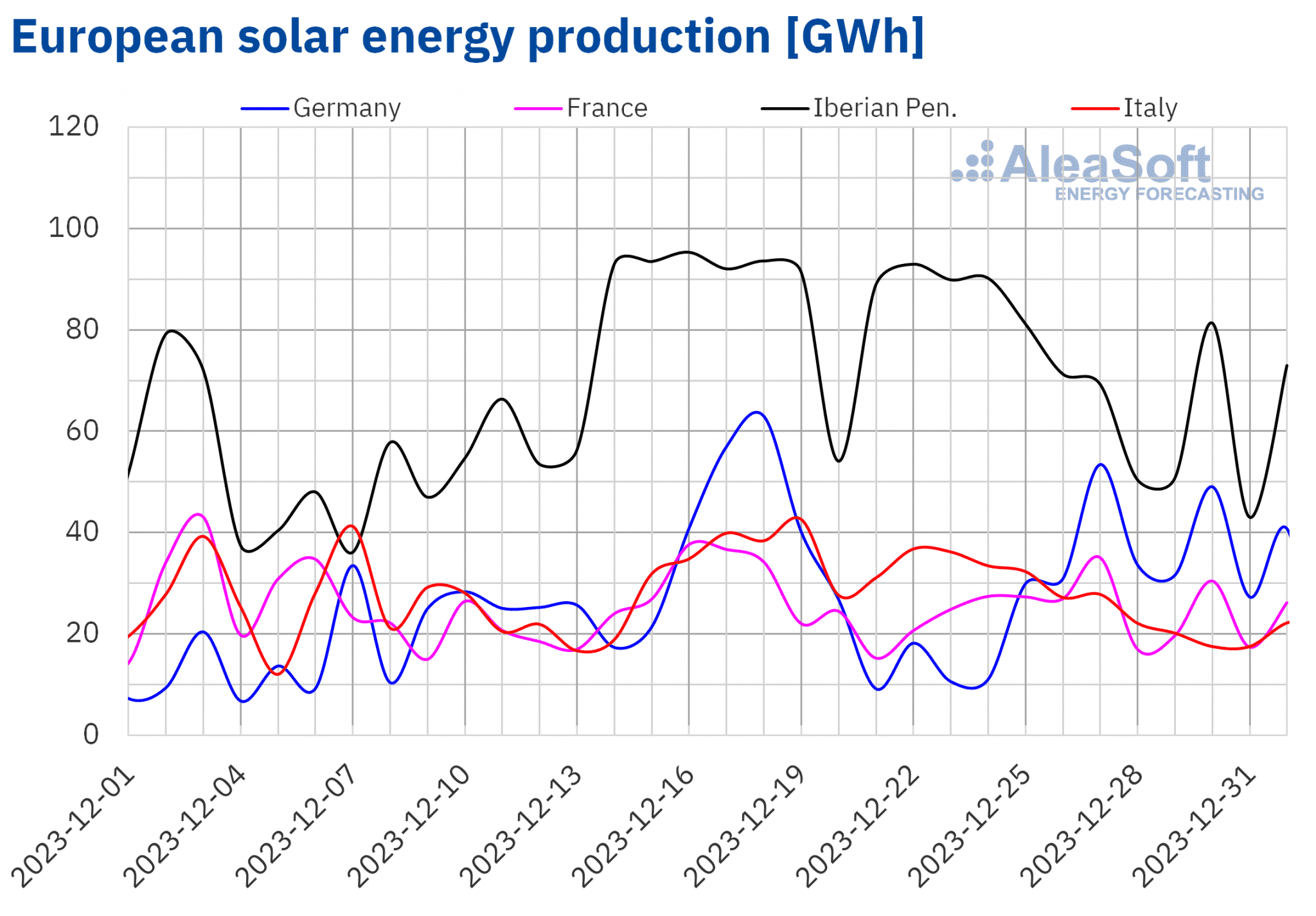

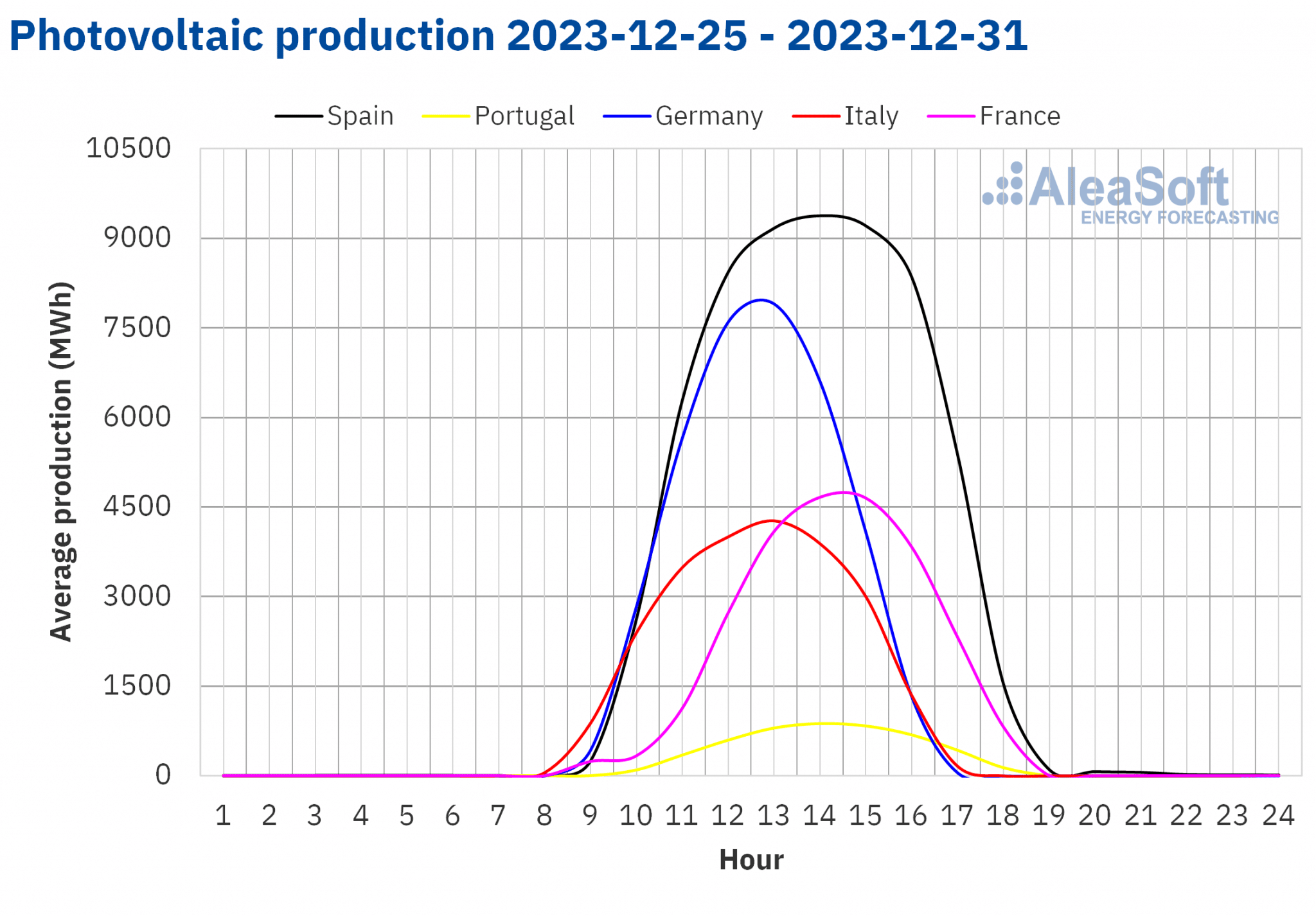

Within the week of December 25, adjustments in photo voltaic vitality manufacturing in comparison with the earlier week confirmed no clear development in the primary European electrical energy markets. Within the German and French markets, photo voltaic vitality manufacturing elevated by 43% and a pair of.9%, respectively. Within the Southern European markets, the alternative was true. In Italy and the Iberian Peninsula, photo voltaic vitality manufacturing fell by 33% and 26%, respectively.

For the week of January 1, in line with AleaSoft Vitality Forecasting’s photo voltaic vitality manufacturing forecasts, it’ll lower in Germany, Italy and Spain.

Supply: Ready by AleaSoft Vitality Forecasting utilizing knowledge from ENTSO-E, RTE, REN, REE and TERNA.

Supply: Ready by AleaSoft Vitality Forecasting utilizing knowledge from ENTSO-E, RTE, REN, REE and TERNA.

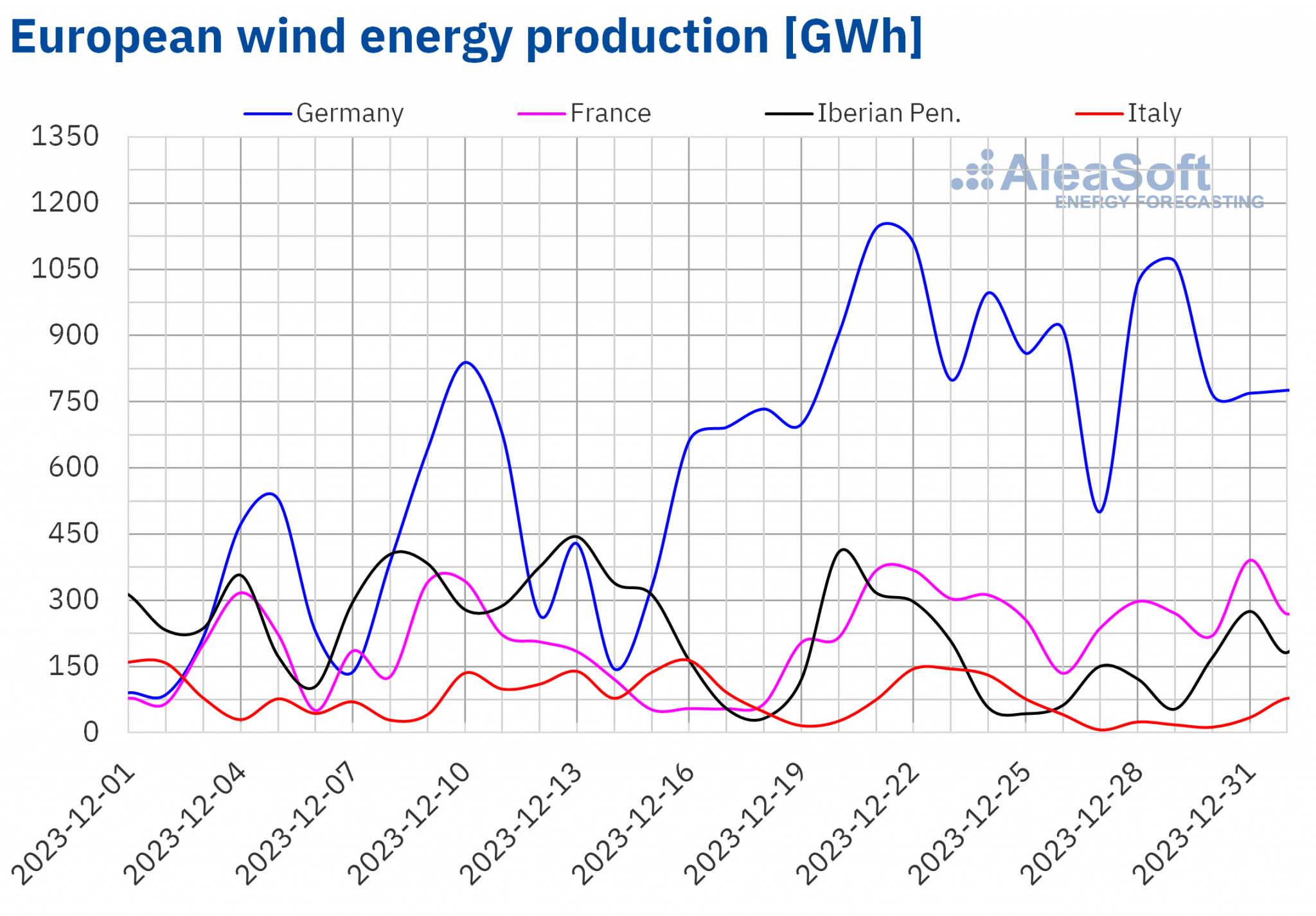

For wind vitality manufacturing, over the past week of 2023, there was a weekly decline in all main European electrical energy markets. The drop ranged from 63% in Italy to 1.6% in France. Regardless of the drop in manufacturing for the week total, on December 31 the French market generated 391 GWh of wind vitality, the best day by day worth in line with historic knowledge.

For the week of January 1, AleaSoft Vitality Forecasting’s wind vitality manufacturing forecasts point out that it’s going to improve in Spain, Portugal and Italy, however it’ll lower in France and Germany.

Supply: Ready by AleaSoft Vitality Forecasting utilizing knowledge from ENTSO-E, RTE, REN, REE and TERNA.

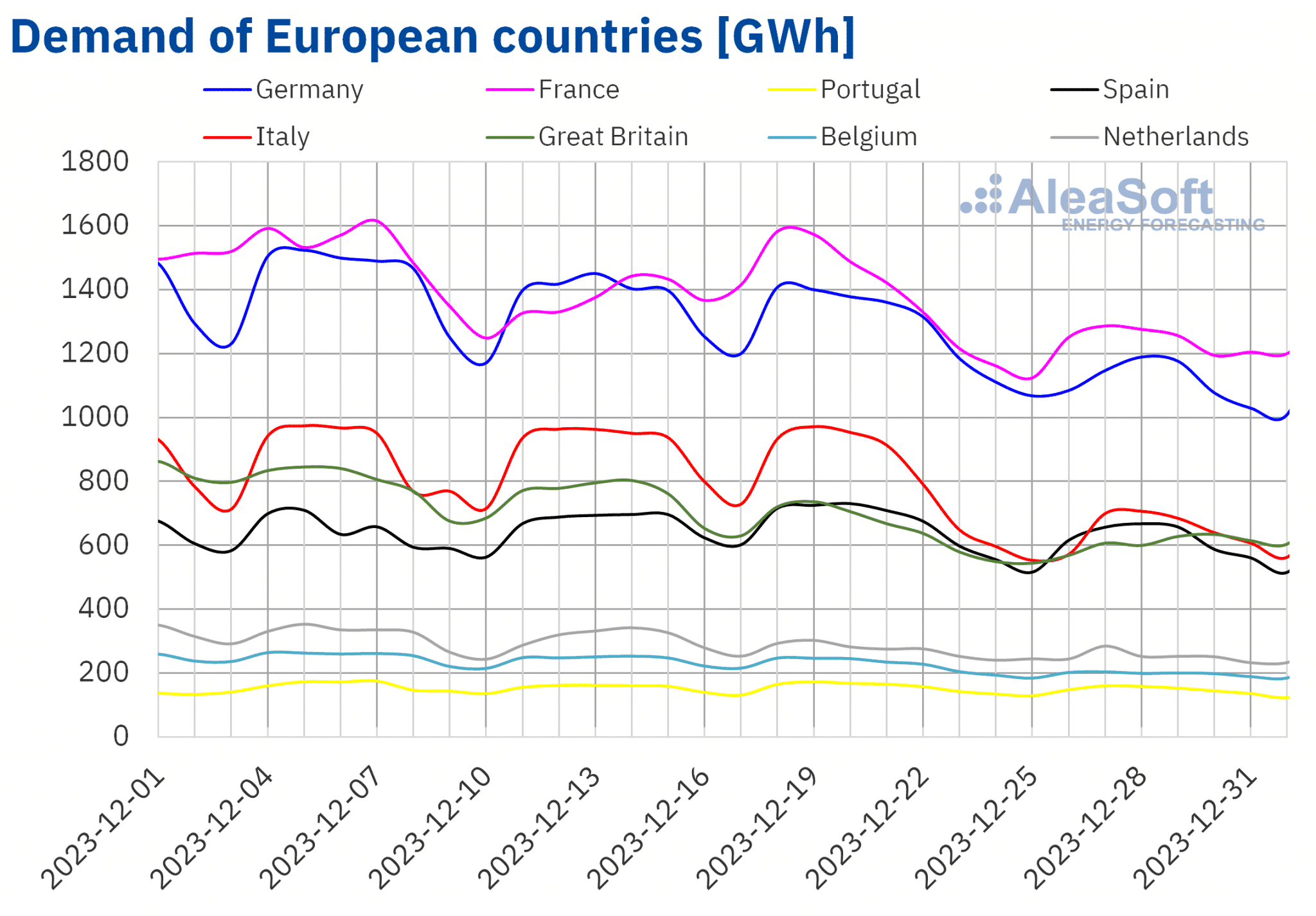

Electrical energy demand

Within the week of December 25, electrical energy demand decreased in all main European electrical energy markets in comparison with the earlier week. A drop in demand was expectable as most European nations celebrated the Christmas holidays. The Italian market registered the most important decline, 23%, whereas the Portuguese market registered the smallest drop, 7.0%.

Throughout that week, the typical temperature elevated in most analyzed nations. The rise ranged from 1.8 °C in Germany to 0.3 °C within the Netherlands. Solely the Iberian Peninsula and Nice Britain registered cooler circumstances with a temperature lower between 0.9 °C and a pair of.1 °C.

For the week of January 1, in line with AleaSoft Vitality Forecasting’s demand forecasts, electrical energy demand will improve in all analyzed markets.

Supply: Ready by AleaSoft Vitality Forecasting utilizing knowledge from ENTSO-E, RTE, REN, REE, TERNA, Nationwide Grid and ELIA.

European electrical energy markets

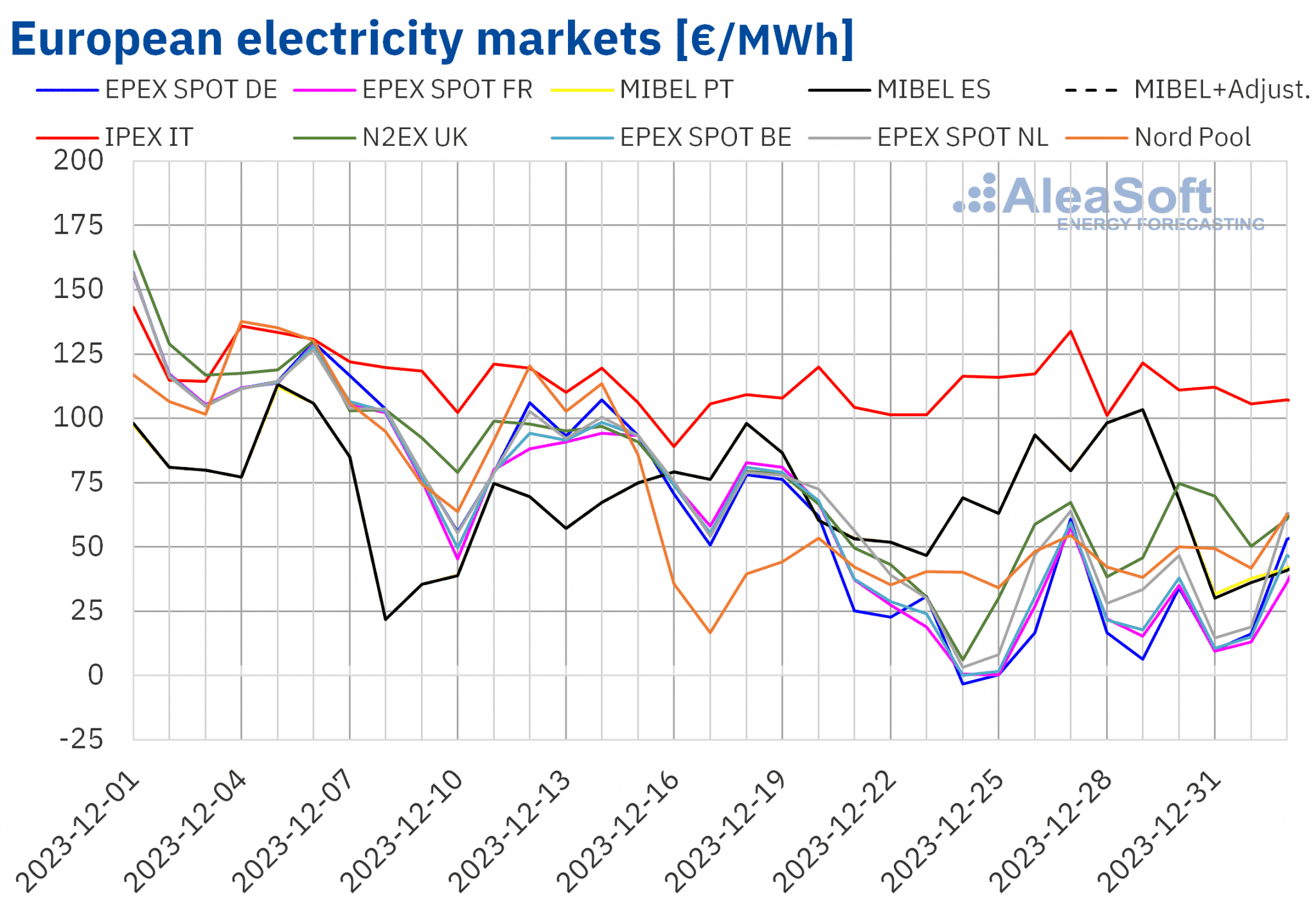

Within the week of December 25, costs in among the important European electrical energy markets fell, whereas in different markets costs elevated in comparison with the earlier week. Within the EPEX SPOT market of the Netherlands, Belgium, France and Germany, costs fell by 32%, 44%, 47% and 50%, respectively. In the remainder of the markets analyzed at AleaSoft Vitality Forecasting, costs rose between 6.9% within the IPEX market of Italy and 16% within the MIBEL market of Portugal.

Within the fourth week of December, weekly averages had been under €55/MWh in most analyzed European electrical energy markets. The exceptions had been the Spanish, Portuguese and Italian markets, with averages of €76.61/MWh, €76.86/MWh and €116.17/MWh, respectively. In the remainder of the analyzed markets, costs ranged from €20.69/MWh within the German market to €54.98/MWh within the N2EX market of the UK.

Then again, the German, Belgian, French and Dutch markets registered destructive hourly costs on most days of the final week of December, in addition to on January 1. Within the early morning hours of December 25, the German, Belgian and Dutch markets reached their lowest costs since August 8, whereas the French market reached its lowest worth since July 16. The bottom hourly worth, ?€13.37/MWh, was within the German market. The British market additionally registered destructive costs on December 25, 28 and 29 and January 1. Within the case of the Spanish and Portuguese markets, there was a worth of €0/MWh on Sunday, December 31, from 4:00 to six:00.

In the course of the week of December 25, the final drop in electrical energy demand and the rise in photo voltaic vitality manufacturing in nations corresponding to Germany and France contributed to the worth decreases registered within the EPEX SPOT market. Nevertheless, wind and photo voltaic vitality manufacturing fell in Italy and the Iberian Peninsula. This led to larger costs in these markets.

AleaSoft Vitality Forecasting’s worth forecasts point out that within the first week of January costs may improve in most European electrical energy markets. The restoration in demand and the lower in wind vitality manufacturing in some markets may contribute to this conduct. Nevertheless, the IPEX and MIBEL markets may register worth decreases. A big rise in wind vitality manufacturing in these markets would result in these worth decreases.

Supply: Ready by AleaSoft Vitality Forecasting utilizing knowledge from OMIE, EPEX SPOT, Nord Pool and GME.

Brent, fuels and CO2

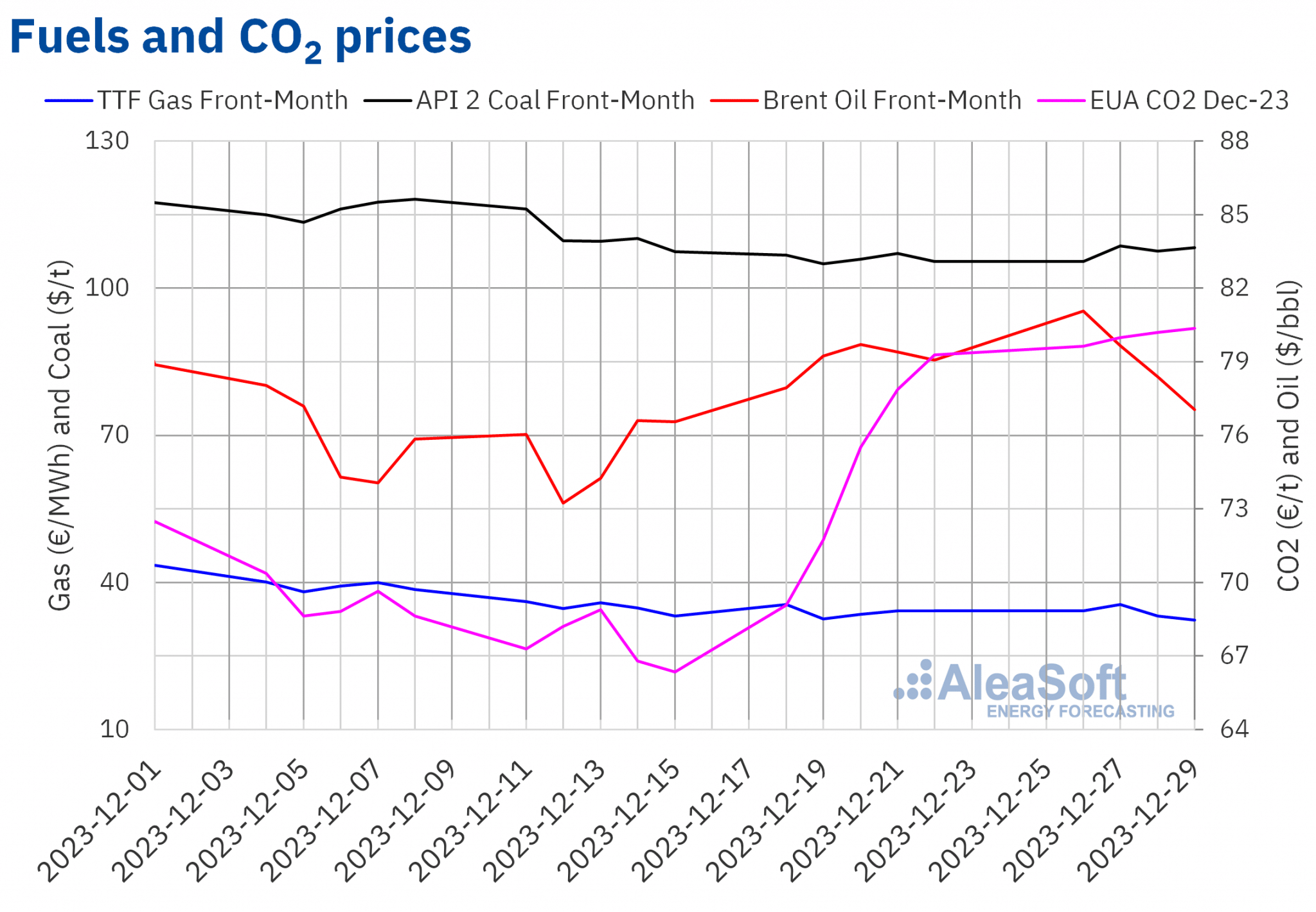

Brent oil futures for Entrance?Month within the ICE market began the final week of December up $2/bbl from the worth of the final session of the earlier week. Thus, on Tuesday, December 26, these futures registered their weekly most settlement worth, $81.07/bbl. However for the remainder of the week, costs declined. In consequence, on Friday, December 29, they reached their weekly minimal settlement worth, $77.04/bbl.

Within the final week of December, excessive manufacturing ranges in nations corresponding to the US, Brazil or Guyana and issues concerning the evolution of demand continued to exert their downward affect on Brent oil futures costs. The announcement by some firms of their intention to renew transport by means of the Crimson Sea additionally contributed to the decline in costs within the final periods of the week.

As for TTF gasoline futures within the ICE marketplace for the Entrance?Month, on Wednesday, December 27, they reached the weekly most settlement worth, €35.51/MWh. However on Thursday the worth fell by 6.8%. After falling one other 2.3%, these futures registered their weekly minimal settlement worth, €32.35/MWh, on Friday, December 29. In line with knowledge analyzed at AleaSoft Vitality Forecasting, this worth was the bottom for the reason that first week of September.

Within the final week of December, the excessive ranges of European reserves, forecasts of delicate temperatures in Northwestern Europe and uncertainty concerning the evolution of business demand led to settlement costs of TTF gasoline futures remaining under €40/MWh.

As for settlement costs of CO2 emission rights futures within the EEX market for the reference contract of December 2023, over the past week of December, they continued the upward development of the earlier week. In consequence, on Friday, December 29, they reached their weekly most settlement worth, €80.37/t. This worth was the best for the reason that second half of October.

Supply: Ready by AleaSoft Vitality Forecasting utilizing knowledge from ICE and EEX.

AleaSoft Vitality Forecasting’s evaluation on the prospects for vitality markets in Europe and the vitality transition

The primary webinar of 2024, within the sequence of month-to-month webinars organized by AleaSoft Vitality Forecasting and AleaGreen, will happen on January 18 and can function audio system from PwC Spain for the fourth time on this sequence of webinars. It’s going to analyze the evolution of European vitality markets and prospects for 2024, in addition to the imaginative and prescient of the PPA marketplace for the buyer within the present context.