A brand new report gives an outline of the hydrogen worth chain, together with an appraisal of various manufacturing strategies, distribution and the place the authors imagine it will likely be used. Market initelligence agency IDTechX writes

Decarbonization efforts have gained momentum globally lately. Renewable power, electrification, and battery storage are major options. Nevertheless, some sectors stay troublesome to decarbonize utilizing such strategies, together with heavy trade, heating, and sure transport sectors, comparable to aviation and transport. Hydrogen gives a promising answer for these difficult sectors. Its potential as a gas, power service, and chemical feedstock has led to many governments formulating nationwide hydrogen methods. Consequently, firms are seizing market alternatives, supplying a spread of companies, merchandise, and applied sciences. The burgeoning hydrogen market is drawing consideration from stakeholders globally.

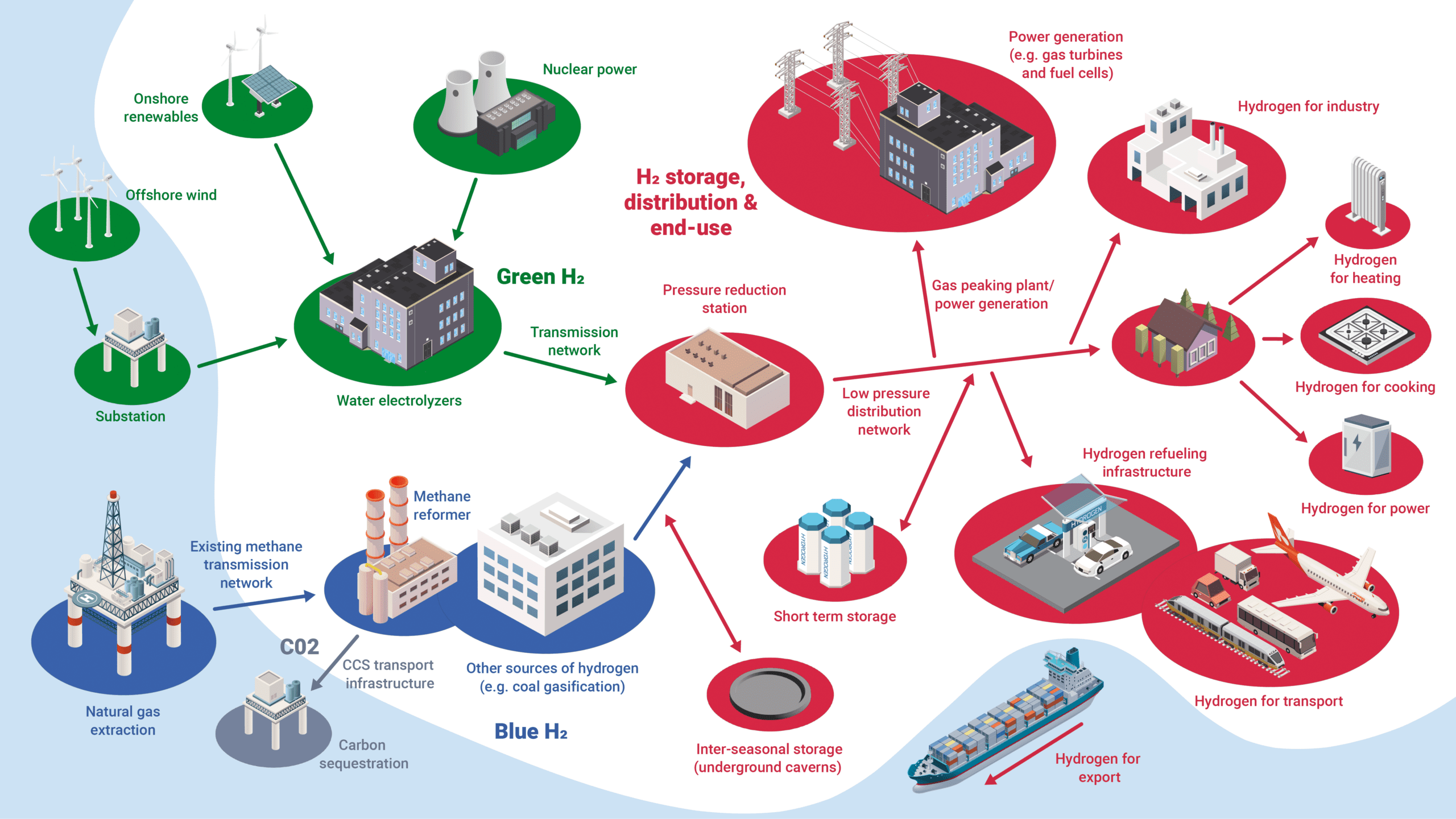

A cohesive worth chain is crucial for realizing hydrogen’s potential, encompassing low-carbon hydrogen manufacturing, storage, and distribution infrastructure, which align with end-user demand. Analogous to the oil & fuel sector, the hydrogen worth chain contains upstream (manufacturing), midstream (storage & transport), and downstream (end-use) segments. Every section poses distinctive technical and socio-economic challenges. The report “Hydrogen Economic system 2023-2033: Manufacturing, Storage, Distribution & Purposes” analyzes many of those points.

(Above) Overview of the long run hydrogen worth chain. Supply: IDTechEx. CLICK TO ENLARGE.

Hydrogen economic system: Standing vs ambition

Presently, over 98% of world hydrogen originates from fossil fuel-based gray and black hydrogen, produced utilizing steam methane reforming and coal gasification. These strategies considerably contribute to CO2 emissions. In response, quite a few firms are pioneering low-carbon hydrogen manufacturing strategies, specializing in blue hydrogen (pure fuel reforming with CO2 seize) or inexperienced hydrogen (water electrolysis utilizing renewable power).

The power transition necessitates new low-carbon hydrogen amenities. Consequently, governments are establishing definitive manufacturing targets for upcoming years. For example, the UK targets 10GW of low-carbon hydrogen by 2030 (2.5 million tonnes of blue H2 yearly, 5GW inexperienced H2), whereas the US goals for 10 million tonnes yearly. A number of different nations even have bold manufacturing aims. Nevertheless, the tempo of latest manufacturing web site undertaking announcement and improvement lags behind these targets because of the excessive prices of manufacturing (particularly for inexperienced H2), lack of supporting renewable and CCUS infrastructure, lengthy lead instances to creating remaining funding choices, in addition to challenges in securing financing and allowing. Coupled with an inadequate midstream storage and distribution community, there’s an immense alternative for improvement and innovation in each know-how and infrastructure throughout the worth chain.

Blue hydrogen manufacturing applied sciences

Presently, blue hydrogen, derived from pure fuel, is probably the most cost-effective low-carbon hydrogen manufacturing methodology, having an estimated levelized value of hydrogen (LCOH) of round US$2-4/kg H2. Compared, inexperienced hydrogen has a a lot greater LCOH at US$4-10/kg H2, relying on the manufacturing methodology and regional elements like renewable power availability. Thus, blue hydrogen is considered as a transitional answer till inexperienced hydrogen turns into commercially viable.

A number of applied sciences can produce blue hydrogen. Essentially the most prevalent is steam methane reforming (SMR). Different scalable strategies utilizing methane have emerged, such because the partial oxidation (POX) course of, which transforms waste hydrocarbon feedstocks into invaluable syngas and is utilized in some refineries globally. One other notable methodology is autothermal reforming (ATR), a hybrid of SMR and POX.

ATR is favored for its power effectivity and compatibility with carbon seize applied sciences, essential for cost-efficient blue hydrogen manufacturing. Noteworthy initiatives using ATR embody Air Merchandise’ Internet-Zero Hydrogen Vitality Complicated in Alberta, leveraging Topsoe’s SynCOR know-how. IDTechEx anticipates SMR, POX, and ATR to guide the blue hydrogen sector within the coming decade, with ATR doubtlessly dominating new manufacturing capability by 2034. Extra on such matters, in addition to novel reforming applied sciences, comparable to methane pyrolysis and electrified SMR, is accessible in IDTechEx’s “Blue Hydrogen Manufacturing & Markets 2023-2033: Applied sciences, Forecasts, Gamers” report.

Inexperienced hydrogen manufacturing applied sciences

Inexperienced hydrogen, produced via water electrolysis powered by renewable power, is garnering important curiosity. A number of applied sciences exist for its manufacturing. Essentially the most established is the alkaline water electrolyzer (AWE), which makes use of a potassium hydroxide (KOH) alkaline electrolyte. Benefiting from reasonably priced building and catalytic supplies like nickel and metal, AWE boasts decrease capital prices than its counterparts. Nonetheless, its dynamic operability is poor, and its effectivity is low beneath atmospheric strain. Therefore, pressurized AWEs have emerged in the marketplace, with most gamers supplying such programs.

The proton change membrane electrolyzer (PEMEL) is the preferred know-how as it may well combine extraordinarily effectively with renewables and comply with their profile, ramping manufacturing up or down inside minutes. This know-how has a unique construct and working precept to the AWE, utilizing polymer membranes, primarily Nafion, because the electrolyte. The draw back is its dependency on platinum group metallic (PGM) electrocatalysts, notably iridium oxide on the anode – iridium is a expensive and scarce mineral. Consequently, minimizing PGM use and creating various catalysts is a key trade focus.

Different applied sciences embody the strong oxide electrolyzer (SOEL), using a ceramic electrolyte, and the anion change membrane electrolyzer (AEMEL), which goals to merge some great benefits of AWE and PEMEL. Nevertheless, IDTechEx predicts AWE and PEMEL will lead the market within the coming decade on account of their established presence. Slicing electrolyzer plant prices (CAPEX/OPEX), working large-scale crops, and increasing electrolyzer manufacturing capability is crucial for the long run. Nevertheless, entry to reasonably priced renewable electrical energy will finally decide inexperienced hydrogen’s success. Extra on such matters, in addition to detailed evaluation of the electrolyzer market and gamers, is accessible in IDTechEx’s “Inexperienced Hydrogen Manufacturing: Electrolyzer Markets 2023-2033” report.