Half of Asia’s greatest banks nonetheless don’t have any restrictions on coal finance, and the remainder that do – specifically the most important Singapore and Japanese banks – solely have weak restrictions with slim challenge finance screens, a brand new examine discovered.

Since 2021, all three Singaporean banking giants DBS, OCBC and UOB dedicated to stop financing new coal energy tasks. Japan’s megabanks Mizuho, MUFG and SMBC have additionally pledged to cease funding new coal mining tasks as of 2022.

However lax restrictions in company finance to coal builders – alongside the growth of captive coal energy in Indonesia in addition to coal builders more and more looking for out home banks and personal fairness buyers to finance their operations – are creating new coal financing “havens” within the area.

“Though Singapore and Japanese banks, who’re leaders in relative phrases, have some insurance policies on proscribing challenge finance for coal, none of them are displaying any curiosity in proscribing company financing,” stated Will O’Sullivan, a local weather campaigner at Dutch non-governmental organisation (NGO) BankTrack.

The marketing campaign group analysed the coal insurance policies of 30 main banks with over US$8 trillion in collective belongings underneath administration throughout India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan and Thailand.

Most Asian banks whose coal funding insurance policies have been evaluated throughout 5 standards (tasks, growth, relative threshold, absolute threshold and phase-out) scored zero throughout all standards, which means they don’t have any public commitments to exclude coal from their funding portfolios. Picture: BankTrack’s Coal Havens report.

Globally, loans to particular coal-fired energy tasks are on the decline. Coal challenge financing outdoors of China hit a 12-year low in 2022 of US$544 million, in accordance to United States-based assume tank International Vitality Monitor.

However scrutiny that focuses on challenge finance overlooks large loopholes within the coal insurance policies of Asia’s prime banks: company finance and capital markets.

Although banks may need stopped giving out challenge finance, they’ll proceed to lend to the builders of those self same coal energy tasks by means of basic objective company lending and capital markets facilitation, similar to bond underwriting.

The shift in the direction of company finance for coal makes it harder to hint how the cash will get spent, particularly when prolonged to corporations with sprawling industrial pursuits.

As an example, it might be virtually unimaginable to establish the top use of a basic objective company mortgage to the Filipino conglomerate San Miguel Company, which is certainly one of Southeast Asia’s largest coal and fuel builders, and concurrently concerned in producing beer and batteries.

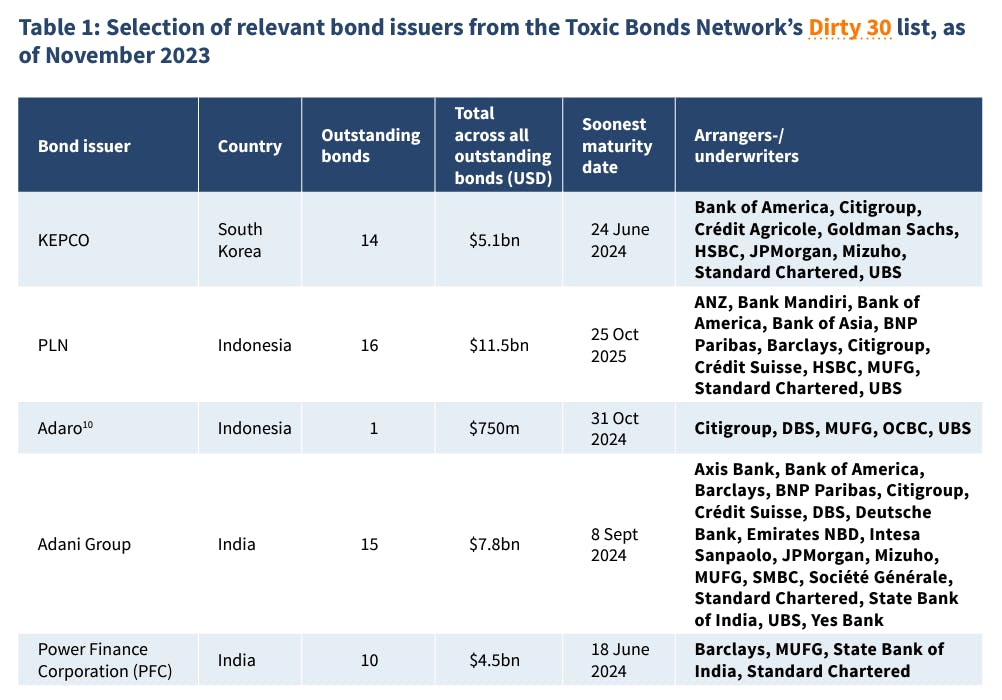

Primarily based on knowledge from Poisonous Bonds Community, a worldwide coalition of NGOs monitoring the bond market’s financing of fossil fuels, Singapore’s DBS and OCBC in addition to Japan’s MUFG have been concerned in underwriting US$750 million of world bonds issued by Indonesia’s largest coal firm Adaro, that are set to mature later this October.

In the meantime, India’s largest non-public coal mining firm Adani Group has 15 bonds price US$7.8 billion that have been underwritten by a consortium of worldwide banks that included DBS, Mizuho, MUFG and SMBC, set to mature in September.

Main Singapore and Japanese banks proceed to underwrite bond issuances to coal builders like Indonesia’s Adaro and India’s Adani Group. Picture: BankTrack’s Coal Havens report.

Within the Philippines, bonds underwritten by home Filipino banks since 2020 account for 83 per cent of coal financing – an almost threefold soar from the 28 per cent of financing they represented from 2009 to 2020, in line with the NGO Centre for Vitality Ecology and Growth.

Not like financed emissions, facilitated emissions generated from underwriting-related actions are nonetheless excluded from the discount targets of most monetary establishments. That is set to vary on the again of the launch in December of the Partnership for Carbon Accounting Financials (PCAF)’s long-awaited facilitated emissions normal after years of contentious debate.

Whereas welcomed by many environmental teams, others like ShareAction criticised PCAF’s normal for not going far sufficient, because it solely requires banks to report one-third of their capital market emissions.

Captive coal carve-outs

The report famous that non-public coal vegetation supplying energy completely to industrial services like nickel mines, aluminium smelters or metal vegetation – often known as captive coal vegetation – are rising in Indonesia and account for three-quarters of the nation’s whole deliberate 18.8 gigawatts of latest coal capability.

Nevertheless, captive coal is at present excluded from the coal phase-out plans of most financiers on this area and past.

In 2021, Singapore lenders DBS and OCBC have been among the many ten banks that secured US$625 million in financing for a nickel smelter powered by a 114 megawatt captive coal energy plant on Obi Island, Indonesia.

Notably, captive coal vegetation have been omitted from Indonesia’s Simply Vitality Transition Partnership (JETP) funding plan, a G7-led funding programme to decarbonise the facility sector. The Worldwide Finance Company (IFC), the World Financial institution’s non-public sector lending arm, additionally excludes captive coal-fired energy vegetation used for industrial purposes in its sustainability insurance policies which require shoppers to cut back their coal publicity to close zero by 2030 and, as of 2023, to cease offering challenge finance for brand spanking new coal tasks.

Moreover, specialists have raised considerations over Indonesia’s monetary regulator, the OKJ, reportedly contemplating giving captive coal vegetation the cleanest label in its inexperienced taxonomy, which might classify them in the identical tier as renewable vitality tasks.

Home banks stepping up within the unsuitable method

As worldwide banks withdraw coal financing attributable to heightened public scrutiny, home banks and personal fairness buyers are stepping in.

A living proof was when Indonesia’s Adaro reportedly struggled to boost cash final yr for a “sustainable” smelter challenge from worldwide banks that it had shut hyperlinks to, together with DBS, British lender Normal Chartered and European banks BNP Paribas, ING and Commerzbank.

The challenge ended up being financed by 4 Indonesian banks – Financial institution Central Asia (BCA), Financial institution Mandiri, Financial institution Negara Indonesia (BNI) and Financial institution Rakyat Indonesia (BRI) – alongside Permata Financial institution, a subsidiary of Bangkok Financial institution.

In India, seven and a half instances extra finance was supplied collectively by home financiers (US$86 billion) for thermal coal, in comparison with worldwide lenders (US$6.5 billion) from 2005 to August 2023, in line with the non-profit Centre for Monetary Accountability.

When chatting with Eco-Enterprise, the report’s writer O’Sullivan acknowledged the efforts by Singapore’s central financial institution, the Financial Authority of Singapore (MAS) to get native banks to interact with carbon-intensive corporations and to finance Asia’s early retirement of coal.

“MAS is encouraging banks to be concerned in early coal retirement, however we’re at present far-off from that actuality,” stated O’Sullivan. “Any good religion contribution by banks to the vitality transition would contain implementing coal insurance policies that claims you may contribute to that, however you gained’t finance an organization which generates, say, 50 per cent of its income from coal.”

“The present actuality is one the place huge quantities of cash, with no situations, are going to coal builders that are fortunately constructing a pipeline of coal energy and mining tasks.”