Join day by day information updates from CleanTechnica on electronic mail. Or observe us on Google Information!

Plugin automobiles in China as soon as once more ended the 12 months with a document month, rising by 46% 12 months over 12 months (YoY) within the final month of the 12 months to a document 980,000 items. Curiously, full electrical automobiles (BEVs) grew at a slower tempo, rising simply 31% to 618,000 items. They have been chargeable for 63% of the plugin market in December, under the 66% common of 2023, which itself is a few 8% under the 2022 ultimate consequence (74%).

That is defined by the truth that range-extended automobiles have turn out to be fashionable in China, and with most of them packing 40 kWh-ish battery packs and quick charging capabilities, one can say that the Chevrolet Volt method has discovered success in China and is on the forefront of the electrification course of on this market. [Editor’s note: More than a decade after the Chevy Volt was introduced! Also, this is often being done in larger vehicles, SUVs, like many argued GM should do a decade ago.]

Wanting again, the plugin share development is nothing lower than astonishing. On the finish of 2020, we have been celebrating a document 6.3% (5.1% BEV) market share, adopted by 15% (12% BEV) in 2021 and 30% (22% BEV) in 2022. Now, we’re at 37% (25% BEV).

With the plugin share already at 37% in 2023, and with full electrics (BEVs) alone accounting for 25%, a slowdown within the development fee is sure to occur, however even with slower charges, anticipate the Chinese language automotive market, the biggest on the planet, to cross the 50% mark by 2026. By then, BEVs ought to be chargeable for over a 3rd of the gross sales of the general market.

If Chinese language OEMs want to proceed doubling their gross sales, as many have been aiming to do, there’s one approach to do it: exports.

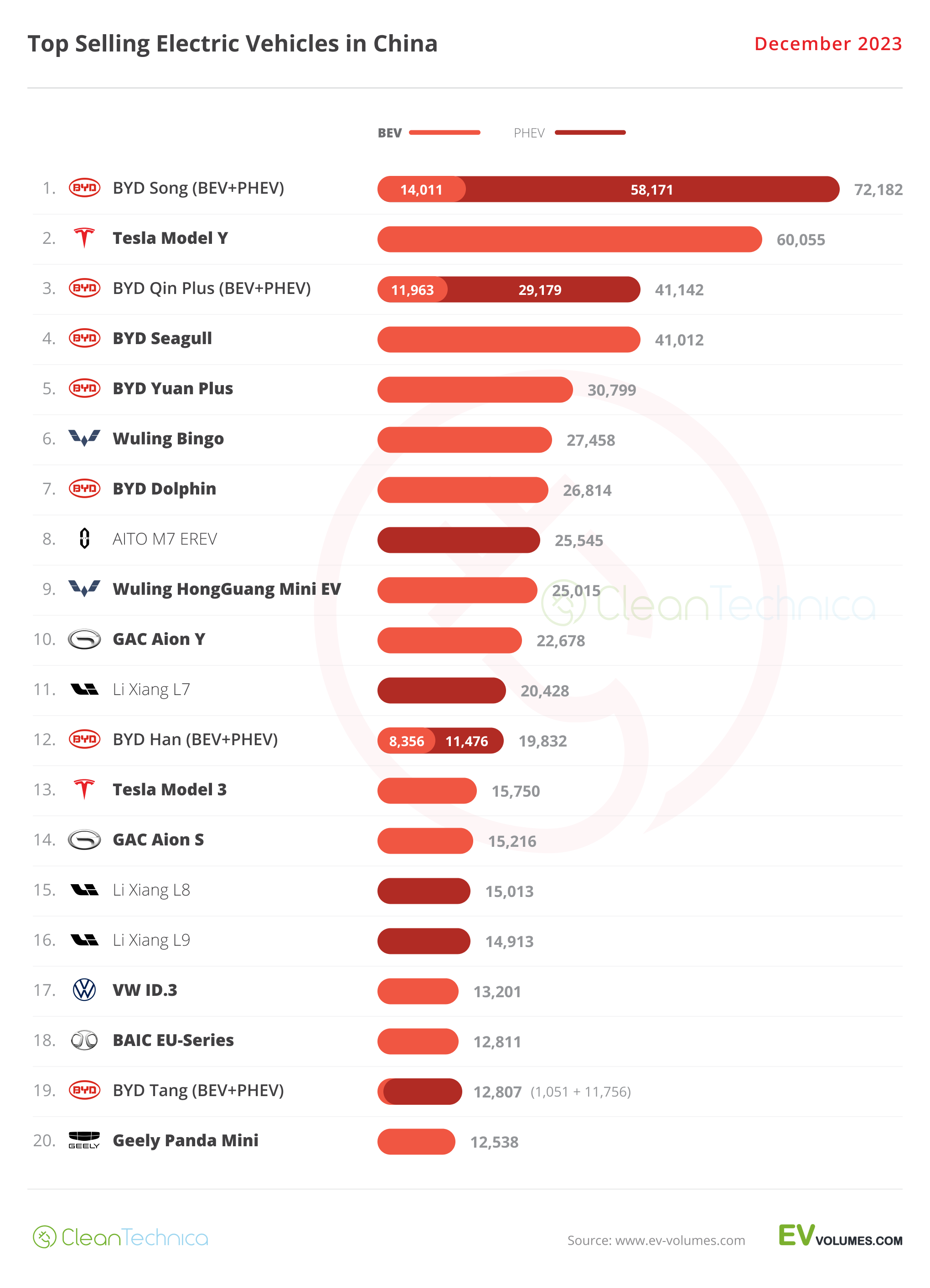

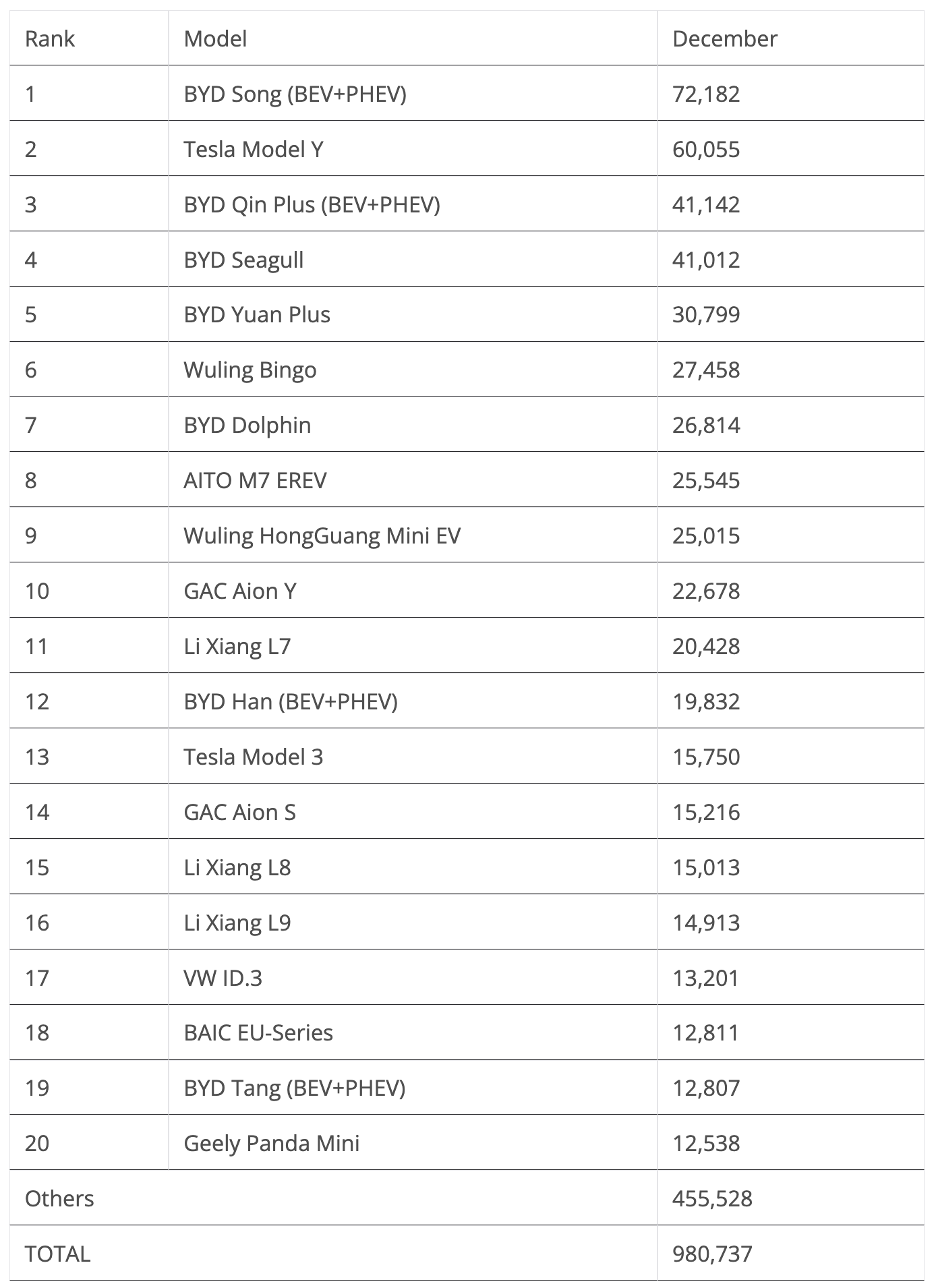

Relating to December 2023, there have been no actual surprises in the perfect sellers checklist. The BYD Tune (BEV+PHEV) received one other greatest vendor title, adopted by its arch rival, the Tesla Mannequin Y, and the BYD Qin Plus sedan. Right here’s extra on December’s prime 5 greatest promoting fashions:

#1 — BYD Tune Professional/Plus (PHEV+BEV)

The rise and rise of BYD’s midsize SUV is outstanding, with fixed document performances from each variations, and December was no exception. The BEV model reached a document 14,011 registrations (of 72,182 whole registrations), thus proving that manufacturing is tilting in direction of BEVs. Was December peak Tune? Relies upon. For the present technology, it in all probability is. To start with, the Tune was the perfect promoting mannequin within the general market in December, so the pure legal guidelines of the market will begin to play in opposition to it. Moreover, the inner competitors — particularly, the all new Tune L and upcoming Sea Lion — will probably steal vital volumes from the normal variations. These are supposed to be BYD’s actual Tesla Mannequin Y rivals, however may even make a dent in Tune buyer demand.

#2 — Tesla Mannequin Y

The bread and butter mannequin of the Tesla household had 60,055 registrations final month, a brand new document efficiency. That is an particularly spectacular consequence contemplating the context — not solely is the exterior competitors mentioned to be growing, however the refreshed Mannequin 3 may had stolen some purchasers from it. Plainly wasn’t the case, although, so anticipate the crossover to proceed posting sturdy ends in China, particularly after the introduced refresh mentioned to reach in April. With the normal BYD Tune being cannibalized by its siblings, the Tune L and Sea Lion, anticipate Tesla’s crossover to characteristic often at #1 in 2024, even when its gross sales received’t develop considerably.

#3 — BYD Qin Plus (BEV+PHEV)

An enduring participant within the BYD lineup, the Qin Plus scored 41,142 registrations final month. Count on the midsize mannequin to proceed competing for prime 5 positions all through 2024, at the very least till the brand new and improved Qin L arrives someday in 2024. The Shenzhen mannequin is main its automobile class (midsize sedans), solidly forward of GAC’s Aion S and the Tesla Mannequin 3, because of fixed updates (the present Qin Plus was launched in 2021 and BYD is ready to launch the up to date Qin L three years later). This is likely one of the secrets and techniques of the Chinese language EV business, and of BYD specifically.

#4 — BYD Seagull

BYD’s youngest star mannequin had 41,012 registrations in December, and that was NOT a document month, which appears to indicate that the supply ramp-up appears to be slowing down, at the very least for now. With exports mentioned to start out quickly, the largest influence of this child Lambo goes to be in export markets, the place many markets are hungry for small and reasonably priced EVs. One of the aggressive small EVs in the marketplace, the little BYD hatchback is ready to turn out to be a daily on this prime 5 because of aggressive pricing and specs.

#5 — BYD Yuan Plus

BYD’s electrical crossover was fifth within the desk, with 30,799 registrations final month. Wanting on the whole-year gross sales efficiency, with deliveries north of the 300,000 unit mark, it acquired a good rating. That is perhaps tough to repeat in 2024, largely due to inside competitors. (The place have I heard this earlier than?) With the cheaper Yuan Up touchdown within the first half of 2024, anticipate a part of the Yuan Plus quantity to be taken by its barely smaller sibling. Nevertheless, BYD’s home market isn’t actually the crossover’s major mission. The main focus targets will likely be export markets, particularly these in Southeast Asia and Europe.

Taking a look at the remainder of the December greatest vendor desk, in a document month, it could be pure that a number of fashions hit greatest ever scores, and they also did. Moreover those already talked about, we must also spotlight the #6 Wuling Bingo small hatchback. The Wuling EV has created a distinct segment throughout the Chinese language market, and we would even see it joint the highest 5 quickly. The #8 AITO M7 (25,545 registrations) additionally deserves a callout, with the total measurement mannequin persevering with to ramp up manufacturing. The Huawei-backed make goals to duplicate Li Auto’s success story.

Talking of Li Auto, all three of its present fashions hit document scores. (Do not forget that the Mega CyberVan will solely land in March.) The eleventh positioned L7 had 20,428 gross sales, the L8 had 15,013 gross sales, and the flagship L9 had 14,913 gross sales. So, principally, they scored over 50,000 items in December. … And they’re solely current within the full measurement class.

Elsewhere, VW’s ID.3 hatchback continues on the rise, having reached a document 13,201 gross sales. That allowed it to achieve the seventeenth place in December. Highlighting Wuling’s good month, we had the tiny Mini EV ending the month in ninth with 25,015 gross sales, a 12 months greatest. It appears the essential Wuling Mini EV is right here to remain….

Outdoors the highest 20, there have been just a few surprises final month, just like the refreshed Buick Velite 6 — a compact(!) station wagon(!!), coming from the US model(!!!) — which scored a document 8,614 gross sales. So, it appears Normal Motors has discovered a a lot wanted star participant for his lineup on this market. And what about exporting it, GM? Now, THAT could be dedication to EVs!

Nonetheless speaking international OEMs, VW’s ID.4 registered a year-best consequence, 8,130 gross sales. Add this to the ID.3’s document efficiency and it’s now seen that Volkswagen is lastly making an attempt to get out of the outlet it acquired itself into, in its largest market.

Relating to the Geely Mothership, the spotlight is the Lynk & Co 08 midsize SUV. In solely its 4th month in the marketplace, it has crossed the ten,000 gross sales mark for the primary time, scoring 10,055 deliveries.

Changan had good outcomes throughout its lineup (12,480 items for the small Lumin and 6,978 for the SL03 midsize sedan), however the spotlight was the S7 SUV, which scored 11,360 gross sales. That included 3,250 items coming from the BEV model, a brand new document for the midsize mannequin.

BYD additionally celebrated the primary full gross sales month of its new upmarket manufacturers, Fangchengbao and Yangwang, with their respective first fashions, the Bao 5 and the U8, hitting 4,388 and 1,593 gross sales every. Count on these new manufacturers to fatten the OEM’s revenue margins, which may function a pillow for BYD within the nation’s present value wars.

However the spotlight of the month comes from SAIC. Moreover the aforementioned good outcomes from the Wuling Bingo and Mini EV, we must always spotlight that Wuling’s first sedan, the Starlight, is beginning its profession with a bang. It already reached 11,453 gross sales in solely its third month in the marketplace, a significant milestone for a model beforehand identified for small and/or utilitarian automobiles. Transferring upmarket within the SAIC secure, Roewe’s tackle the BYD Qin Plus method, the latest D7, can also be on the rise. It had 7,285 registrations. On prime of Shanghai Auto’s “meals chain,” the IM LS6 SUV hit 9,878 deliveries in solely its 4th month in the marketplace — however, on this case, it appears the demand ceiling is already being hit. In January, IM (SAIC’s poshest model, which can also be backed by Alibaba) began to low cost its star participant….

High Promoting EVs in China — January–December 2023

Wanting on the 2023 rating, the BYD Tune is the 2023 greatest vendor, repeating final 12 months’s success. The Tune ended with greater than 100,000 items above the runner-up, the Tesla Mannequin Y. The Tesla Mannequin Y surpassed the BYD Qin Plus within the final stage of the 2023 race, permitting the Tesla crossover to win its second silver medal, after the one in 2021 and the bronze it received in 2022.

Nonetheless, with 5 fashions within the prime six positions, BYD had loads of causes to open the champagne. It received each measurement class, together with town automotive class, the place the Wuling Mini EV was surpassed in December by the BYD Seagull. The BYD Dolphin received the B-segment/subcompact class, the Yuan Plus took the C-segment/compact prize, the Tune received the D-segment/midsize, and the Han received the upper degree full-size class.

Yep, domination was full in 2023, and 2024 ought to see it additionally on prime in lots of classes, however there will likely be extra competitors. Not solely will the Li Xiang L7 or AITO M7 (or each) probably take away the BYD Han from the total measurement management spot, however the Tesla Mannequin Y can have an excellent probability to beat the BYD midsize armada resulting from their inside cannibalization. The identical story is prone to repeat within the compact class with GAC’s Aion Y and BYD’s Yuan (Plus and Up), all whereas within the B-segment/subcompacts, the Wuling Bingo may develop to turn out to be a powerful contender for the class title.

Elsewhere, there wasn’t a lot to speak about, with no place modifications. Evaluating the 2023 desk with the one for 2022, the highlights are: the 5-position drop of the Wuling Mini EV, to seventh, from a 44% drop in gross sales (as a result of competitors improve within the smaller class). The BYD Tang additionally dropped from eighth in 2022 to its present place of thirteenth, which highlights that BYD’s giant SUV is getting previous. In the meantime, it’s attention-grabbing to see that various small EVs have been pushed out of the desk this 12 months, just like the Changan Benni EV, Chery eQ1, and QQ Ice Cream. Whereas Changan may compensate with the rise of the cutesy Lumin, #14 in 2023, Chery misplaced its two representatives within the desk with none alternative. Hmmm…

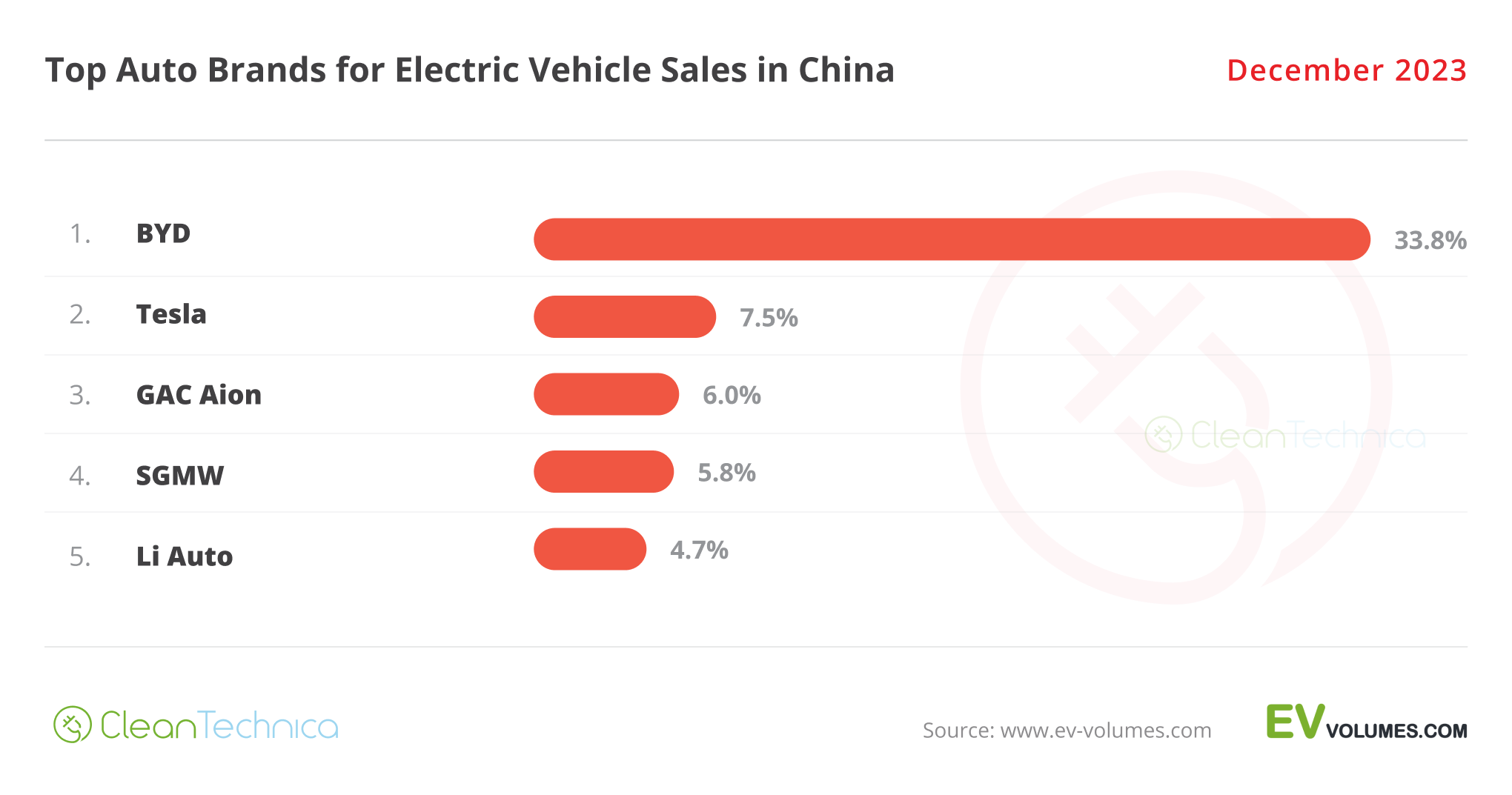

Wanting on the model rating, BYD revalidated its 2022 title in 2023, making this its third title in a row. Profitable its tenth title comfortably, it even had a better market share this 12 months than final (33.8% in 2023 vs. 30.9% in 2022). Are we witnessing peak BYD? Curiously, ever because it began making plugins, waaay again in 2008, the Shenzhen make all the time ended among the many prime two positions within the prime producers desk in China, which says lots about its significance relating to the EV Revolution in China.

In the meantime, Tesla received its first silver medal in 2023, after three bronzes, because of 7.5% share. It had a slight improve of 0.1% over 2022.

Nonetheless on the rostrum, GAC Aion received its first medal, ending in third with 6% share. That’s a optimistic consequence in comparison with the 4th place end and 4.6% share of 2022, and it’s a lot because of the success of its dynamic duo, the Aion S and Y.

The loser of 2023 was the SGMW three way partnership. Regardless of the success of the Wuling Bingo, that wasn’t sufficient to stability the numerous quantity loss (about 200,000 items) of the Wuling Mini EV. The three way partnership ended 2023 with 5.8% share, in opposition to the 8% it had in 2022.

In fifth, we’ve a brand new sheriff on the town, with the rising startup Li Auto (4.7% share, up from 4.6% in November) changing Changan (4.3%) because the final model on the desk. Nonetheless, that wasn’t too dangerous for the Chongqing-based model, because it dropped only one place in comparison with the earlier 12 months (sixth vs. fifth), and it elevated its share of the rising market, from 3.0% in 2022 to 4.3%.

Worthy of discover is that Geely was once more within the seventh spot, but ended the 12 months with 4.1% slightly than the three.7% of 2022. 2024 might be the breakout 12 months for the make.

By automotive group, the massive winner was BYD (35.5%), repeating final 12 months’s #1 title. Count on the next years to be the identical story, such is BYD’s domination right here.

Having been additionally #1 within the general market, the demand ceiling is beginning to come shut, leaving little room for vital development in China. The Shenzhen automaker is now extra fearful about going upmarket domestically and conquering abroad markets.

As for SAIC’s runner-up spot, with 7.5% share, it may be mentioned that this one was actually received within the final hour. After months of Tesla sitting within the #2 spot, SAIC profited from an incredible month of December to extend its share by 0.3% within the final month of the 12 months, to 7.5%, and thus managing to surpass the US carmaker by … 518 items.

Will the silver medal keep in Shanghai in 2024, or will it’s stolen in 2024 by both Tesla or Geely? It’s arduous to foretell at this level, however one factor is definite: #4 Geely–Volvo continues to develop. It ended the 12 months with 7.1%, a big improve in comparison with its 5.7% share of 2022.

#5 GAC acquired the ultimate place on this prime 5. It has elevated its share considerably, leaping from 4.9% in 2022 to its present 6.5%.

#6 Changan was up one place in comparison with 2022, having seen its share leap from 4% in 2022 to 4.8% in 2023.

As for Volkswagen Group, issues are going from dangerous to worse. The German conglomerate’s share was down from 3.7% in 2022 to its present 2.9%. Higher luck in 2024? The eroding market share of Volkswagen Group in Europe is one factor, however nothing is extra regarding than China’s progressive disenchantment with the German conglomerate. How will the German OEM overcome this life-threatening scenario? I suppose we are going to see the way it performs out this 12 months. However one factor is definite: the window is closing.

Oh, and the identical goes for the #2 international make in China on the general market: Toyota. It was down 20% in comparison with 2022. And that is within the context of an general rising market — 11% YoY.

Different international manufacturers which had a tough time in 2023: Buick (-41%), Ford (-16%), Cadillac (-28%), Chevrolet (-55%), Citroen (-44%), and Skoda (-48%). Of all these manufacturers, Citroen is on the best way out, Skoda might be subsequent (possibly that’s the reason they haven’t launched the Enyaq there), and Chevrolet, Cadillac, and Ford are in harmful waters.

Have a tip for CleanTechnica? Wish to promote? Wish to counsel a visitor for our CleanTech Discuss podcast? Contact us right here.

Newest CleanTechnica TV Video

I do not like paywalls. You do not like paywalls. Who likes paywalls? Right here at CleanTechnica, we applied a restricted paywall for some time, but it surely all the time felt flawed — and it was all the time robust to resolve what we must always put behind there. In principle, your most unique and greatest content material goes behind a paywall. However then fewer individuals learn it!! So, we have determined to fully nix paywalls right here at CleanTechnica. However…

Thanks!

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.