Join every day information updates from CleanTechnica on e mail. Or comply with us on Google Information!

Following up on our tales about the very best promoting plugin autos on the earth and the automotive manufacturers that promote essentially the most plugin electrical autos on the earth, we’re now closing out the 2023 World EV Gross sales Report sequence with a have a look at the automotive teams or alliances that promote essentially the most plugin electrical autos and that promote essentially the most pure 100% electrical autos.

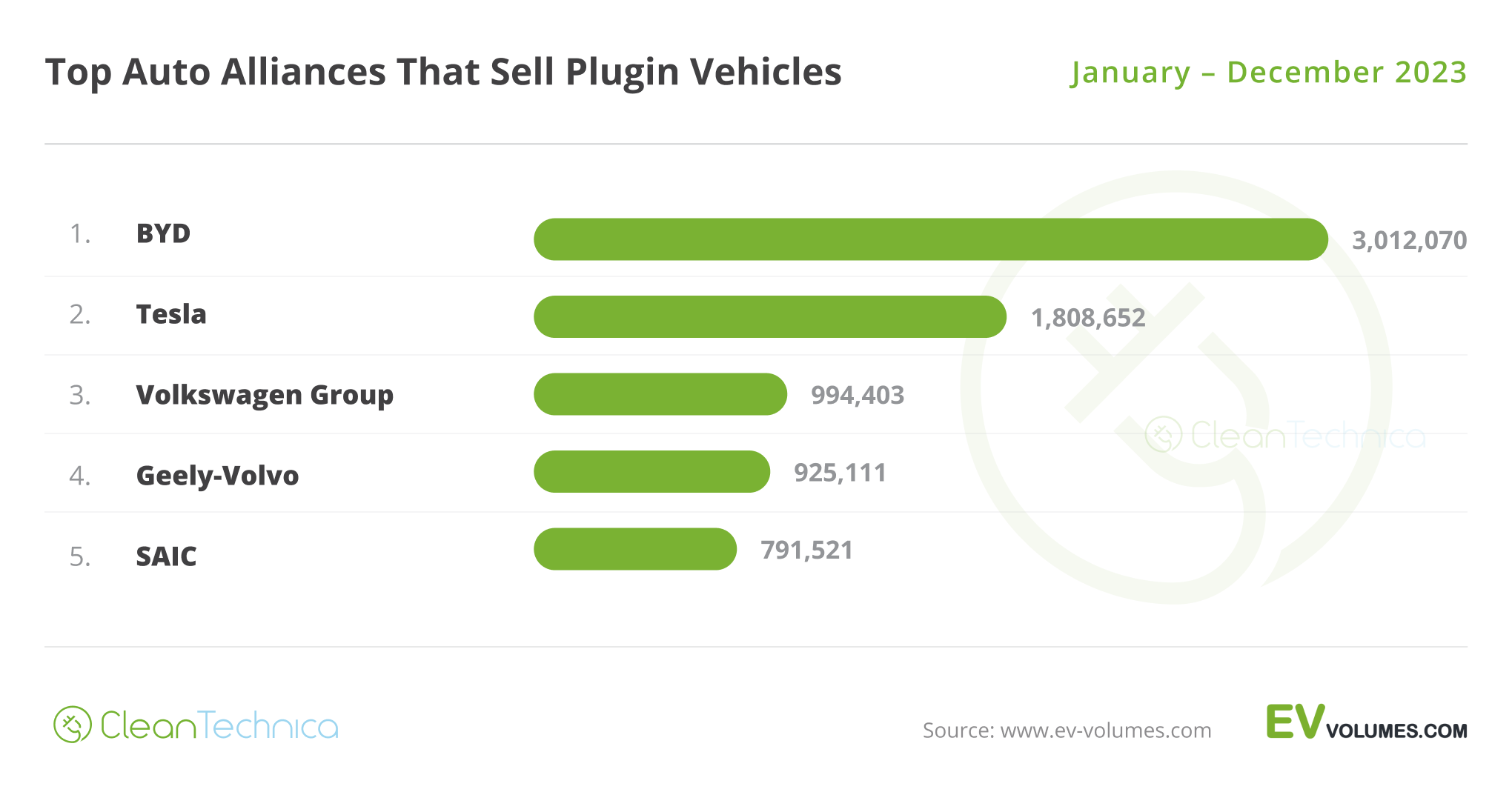

If we collect plugin automobile gross sales by automotive group, BYD (22% share of the plugin automobile market) repeated the 2022 title win, with an 8.8% share (or over 1.2 million unit) benefit over Tesla (13.2% share). BYD gained 0.1 share level in comparison with Q3 2023, and a major 3.6% factors in comparison with a yr in the past, whereas Tesla dropped 0.8% in comparison with Q3 and gained 0.2% in comparison with 2022.

These traits say that BYD has most likely already peaked in terms of market share development, which is definitely wholesome for the plugin market, as a balanced and aggressive market shouldn’t have gamers with over 20% share.

As for Tesla, after a powerful starting of the yr, little doubt because of the aggressive worth cuts of a yr in the past, it has spent the remainder of the yr slowly returning to the place it was again in 2022.

Nonetheless, these two manufacturers dwell in a league of their very own, with 35.2% share of the market between the. No different model may even dream of being at their degree proper now.

Within the B League, Volkswagen Group remained in third, gaining 0.1% market share in comparison with Q3 and shedding 0.9% in comparison with 2022. One can say that the German OEM is with none doubt the chief amongst legacy OEMs, and the one firm capable of sustain the tempo of the remaining B League gamers.

In 2023, Geely–Volvo (6.8%) changed SAIC (5.8%, up from 5.6% in November) in 4th, however the Shanghai automaker rebounded within the final quarter of the yr, gaining 0.4% share in comparison with Q3, thus decreasing its yearly losses to simply 1.4% YoY.

As for #4 Geely–Volvo, the rise and rise continues.Aafter ending 2021 with 4% international share, issues have solely gotten higher, ending 2022 with 6% share, and now ending 2023 with 6.8%. The lion’s share of the expansion (0.7%) was concentrated within the final quarter of the yr.

With the expansion pattern certainly persevering with all through 2024, and with Geely–Volvo simply half a degree under #3 Volkswagen Group, anticipate a fierce struggle for the bronze medal between these two in 2024.

With all of the contemporary steel coming from the Geely steady subsequent yr, which might be essentially the most prolific on the earth, I’ll even say the Chinese language OEM is beginning the yr as the favourite….

Within the C-League, Stellantis (4.2%) remained in sixth, however has misplaced half a share level in comparison with the tip of 2022. On the intense aspect, it reached near 600,000 items final yr. The multinational conglomerate ought to attain the crucial degree of scale (aka 1 million items) for EV profitability by 2025/26, which suggests the promised land is already on the horizon and the studies of Stellantis’ demise had been drastically exaggerated.…

BMW Group (4.1%) rose to seventh place and the German OEM needs to be competing for sixth place with Stellantis all through 2024.

The key loser on this league throughout 2023 was Hyundai–Kia(!), which dropped from seventh in 2022 to its present ninth place, shedding nearly a full share level alongside the way in which, going from 4.6% in 2022 to its present 3.7%.

The Korean OEM’s case is one thing of a paradox, as a result of whereas Kia and Hyundai EVs have been praised as among the finest out there, in 2023, gross sales didn’t comply with by. Their absence from the Chinese language market has loads to do with this, one thing that they are going to begin to deal with in 2024 with the introduction of the Kia EV5 there. Although, the actual fact stays that Stellantis can also be not in China, and however, it has grown sooner than the Korean group. What to they should return to the entrance of the C League? Increased manufacturing functionality? Wider alternative of fashions? Decrease costs? The entire above? Focus on.

Moreover BMW Group, the Korean OEM was additionally surpassed by a rising GAC in 2023, which ended the yr with 3.8% share.

No matter what occurs in 2024, the large gainers in 2023 had been BYD and Geely–Volvo.

Wanting solely at BEVs, Tesla once more bought the title, with 19.1% share of the worldwide BEV market. That could be a acquire from the 18.2% share of 2022, however a full one level lower than it had in Q3 2023, and much from the 23% it had on the finish of 2020. Nonetheless, 19.1% share is a notable feat contemplating the present diversification course of.

The silver medal once more went to BYD (16.5%), which gained 3.9% share in comparison with 2022! In comparison with Q3 2023, the Chinese language automaker grew by 0.6% share.

Now, the query many had been ready for: Will BYD beat Tesla in 2024 in BEVs?

Hmmm … Whereas a yr in the past, to that very same query, I replied: “I believe it’s too quickly.” And added: “It’s true, although, that if present traits proceed all through 2024, that may occur across the second or third quarter of that yr.”

Whereas Tesla’s market share ought to erode barely throughout 2024, BYD will proceed gaining share, one of many causes being the truth that BYD’s lineup will turn into extra BEV heavy this yr (the Yuan Up and Sea Lion will play a major position there). Another excuse is that exports are principally targeted on BEVs, with PHEVs solely being utilized in choose markets.

So, whereas BYD’s share within the plugin market may stagnate in 2024, as a result of it’ll have a better mixture of BEVs, its share within the BEV-only market will proceed to develop.

SAIC surpassed Volkswagen Group within the final month of the yr, thus repeating final yr’s bronze medal end result. It ended the yr with 7.9% share, up from 7.7% in November. The Shanghai-based OEM had a powerful This fall 2023, having recovered 0.4% share in comparison with Q3 2023. Nonetheless, this wasn’t sufficient to recuperate to the 9.3% share it had on the finish of 2022.

Volkswagen Group (7.8%) misplaced its podium place within the final stage of the race, ending the yr once more in 4th after having misplaced simply 0.1% share in contrast with 2022.

In fifth, we have now rising Geely–Volvo (6.2%). It gained 0.6% share in comparison with Q3 2023 and 0.9% share in comparison with 2022, leaving #6 GAC (5.3%) a large distance behind. However, the Guangzhou OEM had a constructive 2023, having gained 1.3% share, from 4% in 2022 to its present 5.3%.

Taking a look at these outcomes compared to the BEV+PHEV tables and charts, it’s the identical high 5 gamers. The variations are place adjustments between BYD and Tesla (with Tesla profiting within the BEV chart from being 100% BEV) and one thing comparable occurring to SAIC towards the others (as its lineup is way more BEV-based than the fleets of Volkswagen Group or Geely–Volvo).

However, total, the gamers within the A, B & C Leagues don’t change considerably, with or with out PHEVs being included.

Now, some remaining ideas on the way forward for every of the highest 5 OEMs:

BYD

With the namesake model already near its demand ceiling in its home market, BYD is now extra targeted on going upmarket with its premium manufacturers (Yangwang, Fangchengbao, Denza), than rising its market share a lot additional. With a better common worth, it’s anticipated that margins can enhance, in order that BYD can have extra pillow house to decrease costs on its mainstream fashions if wanted. And sure, with the Chinese language EV market being as aggressive as it’s, if BYD desires to maintain proudly owning a 3rd of the native EV market, it won’t solely must hold its lineup contemporary*, however will most likely additionally need to decrease costs to remain aggressive. (*BYD will definitely hold its lineup contemporary. In 2024, it’ll launch: Yuan Plus, Track L, Sea Lion 05 & 07, Qin L, and a pickup truck mannequin, simply to say a couple of coming introductions.)

As such, the expansion volumes should come from abroad markets, and BYD has been getting ready the bottom for that, not solely shopping for its personal ship carriers(!), but additionally constructing factories in locations like Thailand, Indonesia, Brazil, Hungary … and, if rumors are to be believed, Mexico. A Mexico manufacturing unit would give BYD a lift in that Latin American nation, but additionally extra crucially, into its northern neighbors….

So, whereas manufacturing received’t be an issue, demand may very well be and problem — not solely natural demand (“Will consumers purchase Chinese language EVs?”), but additionally presumably from geopolitical points (tariffs, and so forth.).

Again to 2024, anticipate BYD to remain within the lead within the subsequent couple of years, and its lead ought to solely be challenged by 2027.

Tesla

With 1.8 million items in 2023 and no contemporary steel, besides the Cybertruck ramp-up, which shouldn’t actually transfer the needle in 2024 (I’d say 100,000 items, tops), don’t anticipate quick development coming from the US automaker subsequent yr. I anticipate the ultimate numbers will finish round 2.1–2.2 million items.

And that’s Tesla’s present problem — product planning, or the dearth of.

The Mannequin S is now 12 years outdated, so it ought to have already been on its 2nd technology; the Mannequin X is on its ninth yr, so the subsequent technology ought to have been introduced by now; whereas Tesla’s star merchandise, the Mannequin 3 (2017) and Mannequin Y (2020), are actually in full maturity and their successors ought to now be on the drawing boards. Solely … they don’t seem to be. Pondering in another way and having a disruptive strategy is nice when you’re a startup disrupting the institution, however when you’re making near 2 million items per yr, you’re the institution.

Adopting the product lifecycles that grown-up OEMs have would assist Tesla at this level. However then, for that to occur, Tesla would wish to have a extra regular administration workforce….

However again to future plans. Anticipate 2025 additionally to be a sluggish development yr, however with the introduction of the long run compact mannequin in the direction of the tip of that yr (one thing like 30 items delivered in November/December), anticipate Tesla to spend 2026 in manufacturing hell ramping up its new child. In the meantime, the Mannequin 3 and Mannequin Y will probably be 9 and 6 years outdated by then and possibly on their 2nd refresh. They’ll begin to undergo from outdated age and/or the Osborne impact, that means that the primary yr of actually quick development from Tesla will probably be in 2027.

However then once more, how will the market look by then?

Volkswagen Group

If it was a basketball workforce, its current historical past might have been a story of getting three utterly totally different coaches in command, from the sleeping on the wheel model of Martin Winterkorn, which originated the Dieselgate scandal; to the MEB-based disruptive technique of Matthias Muller, which was then adopted by Herbert Diess; after which on to the present counter-disruptive administration system of Oliver Blume. Volkswagen Group has been by loads, with some highlights within the EV revolution, but additionally some bruises.

Nonetheless, it’s by far the very best performing legacy OEM, with near 1 million plugins in 2023, so its survival in the long run is effectively assured. Humorous sufficient, it was the fast EV flip made doable by the Dieselgate scandal that allowed this to occur.

So, what about development prospects in 2024? Not loads I’m afraid, because the OEM’s bread and butter fashions are maturing, with the one new fashions being the VW ID.7, Cupra Tavascan, Skoda Elroq, Porsche Macan, and Audi Q6/A6 e-tron, so no actual quantity vendor right here.

In 2025, although, issues will get attention-grabbing. The manufacturing model of the ID.2 idea, no matter it will likely be referred to as, will certainly be a giant vendor, with the query being: “How briskly will the ramp-up be?” Will it get near 2 million items?

The identical applies to the a number of ID.2 siblings, which is able to debut someplace round 2026. That may lastly push gross sales onto the quick monitor (2.5 million in 2026?), with the ultimate piece of the puzzle coming in 2027/2028 when the electric-only VW Golf, the ninth of its type, will enter manufacturing based mostly on the long run SSP platform.

However then once more, it’s the identical query as for Tesla: What is going to the market appear to be in 2027?

Geely–Volvo

So, on to Geely, and its 80 automotive manufacturers…. The Chinese language OEM has been steadily rising through the years within the OEM rating, ending 2023 in 4th with over 900,000 items registered, some 70,000 items under #3 Volkswagen Group.

Whereas the German OEM isn’t anticipated to develop considerably in 2024, Geely–Volvo will revenue from having a world presence and a dizzying array of latest fashions coming to its manufacturers subsequent yr. It’s certainly the OEM with the best output of latest EVs per yr. Anticipate the multibrand OEM, as soon as thought-about the “Chinese language Volkswagen Group,” to surpass the unique one — if not already in 2024, then certainly in 2025.

From then on, it will likely be pedal to the steel as they attempt to reduce the space between it and the 2 frontrunners. Will they obtain that purpose?

Nobody actually is aware of, simply as nobody actually is aware of if Geely received’t purchase a pair extra manufacturers within the meantime, like, say, … Renault?

One factor is true: if there’s any OEM capable of attain the long run output of BYD or Tesla, then that is it.

SAIC

Right here’s an OEM that excels in abroad markets, however might do higher in its home market.

SAIC goals to promote round 1.4 million autos (together with ICE fashions) in export markets in 2024, a quantity that’s the envy of a lot of the different Chinese language OEMs. Additionally it is vital in comparison with the entire variety of autos made by SAIC (circa 5 million items in 2023). Whereas others are nonetheless making their first steps exterior of China, SAIC is already effectively established the world over, particularly because of its MG model, which nonetheless carries some cachet from its British roots.

And, with 14 new EVs coming by 2026, SAIC hopes to copy the MG4’s success with different fashions, together with venturing into the premium finish of export markets with its new and to this point profitable IM model.

Anticipate a brand new 5 station wagon, a brand new ZS crossover, and a flagship SUV mannequin to be unveiled in 2024, which is able to assist gross sales in Europe. In the meantime, in China, the present Wuling lineup ought to pull gross sales up. And, in fact, it might assist if amongst all the opposite manufacturers, there have been a minimum of a few hits. With all of that clicking, gross sales might finish subsequent yr north of 1 million items.

Wanting additional into the long run, anticipate a gradual development sample from SAIC.

To complete, some meals for thought: Whereas it will likely be unimaginable for SAIC to purchase Normal Motors, due to … you understand, geopolitics, I might see SAIC shopping for the Buick model from GM. In any case, contemplating the extent of neglect that GM is giving the model exterior of China, it would as effectively promote it to SAIC and earn a pleasant load of {dollars} to finance GM’s electrification efforts….

Have a tip for CleanTechnica? Wish to promote? Wish to recommend a visitor for our CleanTech Discuss podcast? Contact us right here.

Newest CleanTechnica TV Video

I do not like paywalls. You do not like paywalls. Who likes paywalls? Right here at CleanTechnica, we applied a restricted paywall for some time, but it surely at all times felt fallacious — and it was at all times powerful to determine what we must always put behind there. In principle, your most unique and finest content material goes behind a paywall. However then fewer individuals learn it!! So, we have determined to utterly nix paywalls right here at CleanTechnica. However…

Thanks!

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.