In a brand new weekly replace for pv journal, OPIS, a Dow Jones firm, offers a fast take a look at the primary value tendencies within the world PV business.

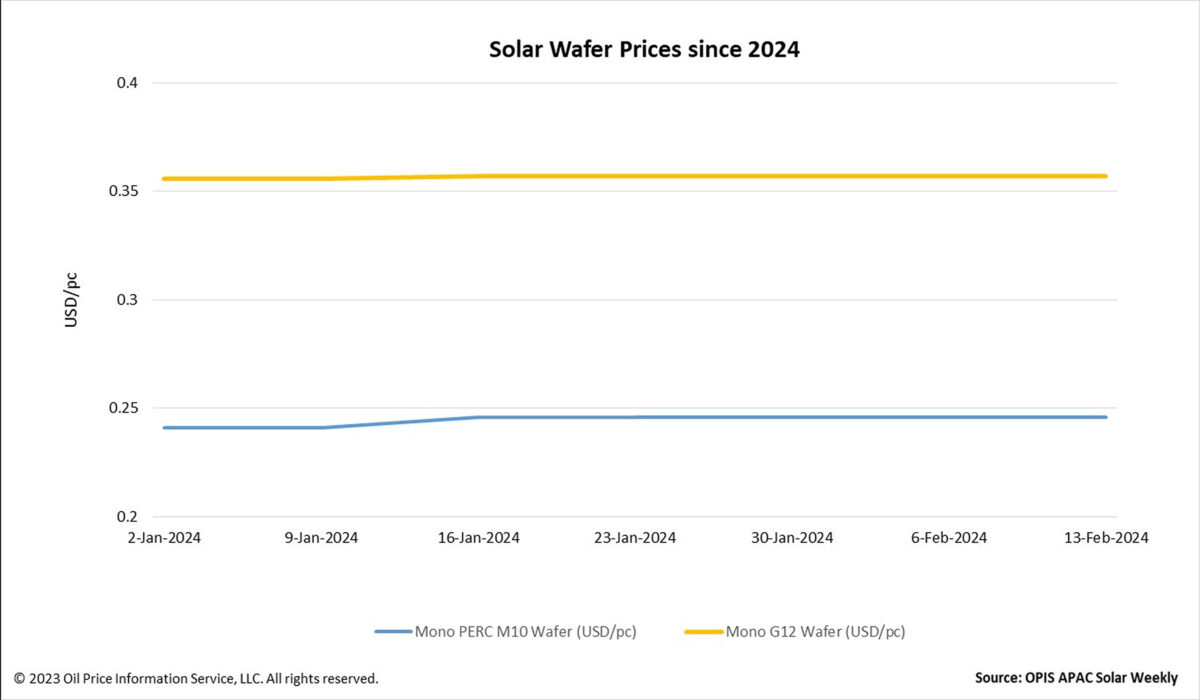

Wafer FOB China costs trended flat this week attributable to restricted buying and selling exercise through the Lunar New 12 months vacation. Mono PERC M10 and G12 wafer costs stay regular at $0.246 per piece (computer) and $0.357/computer, respectively, with none change from final week.

The truth that the provision of wafers tremendously outpaces downstream demand explains why costs for wafers have been regular for the previous 4 weeks, even when the worth of polysilicon in China has elevated considerably, an upstream supply defined.

OPIS has learnt from its market survey that downstream producers have made vital manufacturing cuts since February, and China’s cell manufacturing output in February is predicted to be between 35 GW to 40 GW solely. Nevertheless, in keeping with the Silicon Business of China Nonferrous Metals Business Affiliation, February’s wafer output in China could be roughly 55 GW. The commerce physique additionally famous that there hasn’t been a noticeable decline in wafer market working charges.

“In February, wafer stock would possibly rapidly construct up,” a market watcher instructed OPIS.

A market participant sees the outlook for the short-term wafer market as bleak, stating that the hyperlink between provide and demand will govern wafer costs. On condition that wafer output has been persistently robust up to now, the insider suggested that you will need to monitor if wafer producers must considerably cut back manufacturing output in late February.

A polysilicon insider in the meantime provided a comparatively optimistic sign: cell producers might speed up their purchases of wafers as a result of there may be sometimes a pickup in end-user demand globally beginning in March. The insider predicts that at that time, the worth of wafers would possibly rise or no less than stage off.

There have been a number of situations of cancellations or delays within the introduced photo voltaic manufacturing tasks up to now two months. China’s wafer producer, Beijing JYT Company, introduced on December 26 that it could postpone the manufacturing time of a 22 GW ingots and wafering mission on the Leshan base from the unique plan of January 2024 to December 2024, partly attributable to intensified competitors within the wafer manufacturing market and vital fluctuations in wafer costs.

Chinese language photo voltaic producer, Mubang Excessive-tech Co., LTD., introduced on February 8 that the implementation of its new 5 GW a yr n-type wafers facility in Tongling, Anhui, carries a threat of mission termination attributable to unsure financing sources.

Though these developments might seem unfavorable, they’re a optimistic transfer for the business as consolidation turns into essential, in keeping with a market observer. The businesses with the most effective methods will survive this spherical of business consolidation and foster an improved photo voltaic manufacturing ecosystem, the supply added.

One other supply concurred, stating that the following section within the photo voltaic manufacturing enterprise, which is at the moment working at a loss general, is to take away out of date and redundant manufacturing capability. “Any value hike or stability earlier than this would possibly solely be non permanent,” the supply added.

OPIS, a Dow Jones firm, offers vitality costs, information, knowledge, and evaluation on gasoline, diesel, jet gas, LPG/NGL, coal, metals, and chemical compounds, in addition to renewable fuels and environmental commodities. It acquired pricing knowledge belongings from Singapore Photo voltaic Alternate in 2022 and now publishes the OPIS APAC Photo voltaic Weekly Report.

The views and opinions expressed on this article are the creator’s personal, and don’t essentially replicate these held by pv journal.

This content material is protected by copyright and is probably not reused. If you wish to cooperate with us and wish to reuse a few of our content material, please contact: editors@pv-magazine.com.