Within the final week of September, European electrical energy market costs rose in comparison with the earlier week. In most of them, the weekly common was above €100/MWh and, in a number of markets, some hourly costs have been above €200/MWh. The rise in gasoline costs, the lower in wind power manufacturing and better demand favored this conduct. Brent futures continued to rise, reaching their highest degree since November 2022 on September 27.

Photo voltaic photovoltaic, photo voltaic thermoelectric and wind power manufacturing

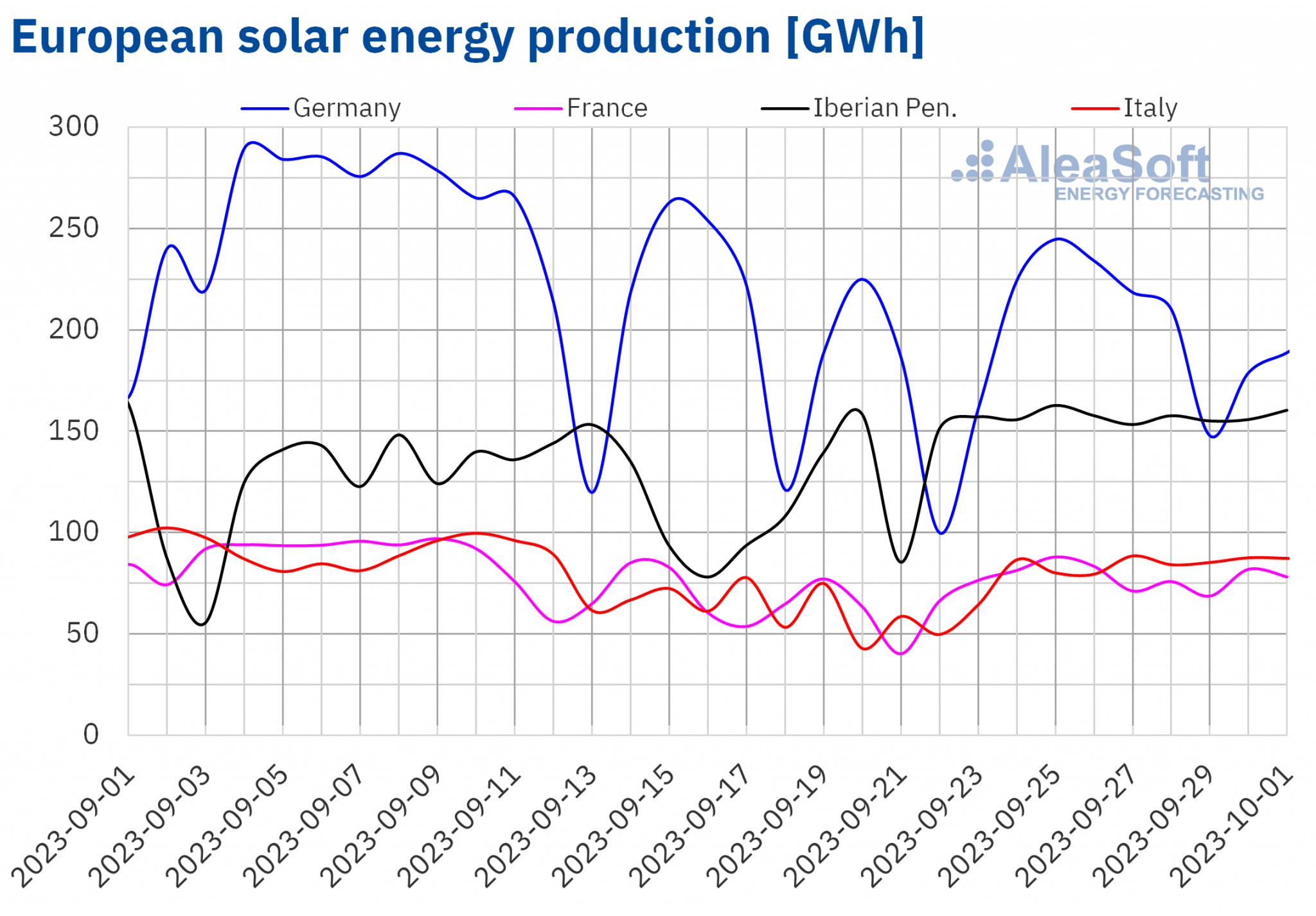

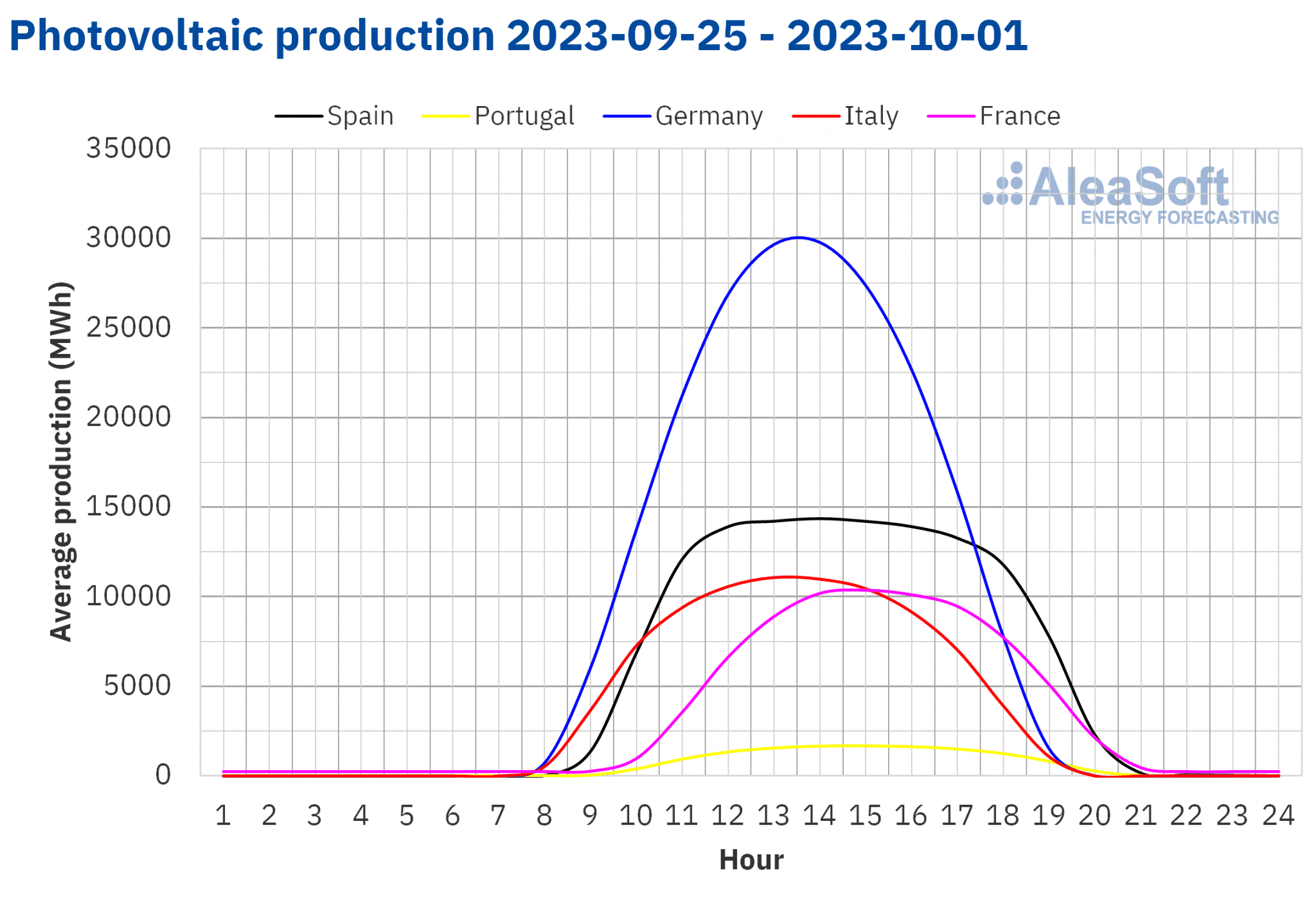

Within the week of September 25, photo voltaic power manufacturing elevated in all analyzed markets in comparison with the earlier week. The Italian market registered the most important improve, 38%. In the remainder of the markets, the rise in photo voltaic power manufacturing was very homogeneous, starting from 15% in Spain to 18% in Germany. Moreover, even supposing photo voltaic radiation decreases as winter approaches, the Iberian Peninsula produced 163 GWh of photo voltaic power on Monday, September 25, a quantity of photo voltaic power manufacturing not seen since September 1.

For the week of October 2, in keeping with AleaSoft Vitality Forecasting’s photo voltaic power manufacturing forecasts, photo voltaic power manufacturing is anticipated to say no within the analyzed markets.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

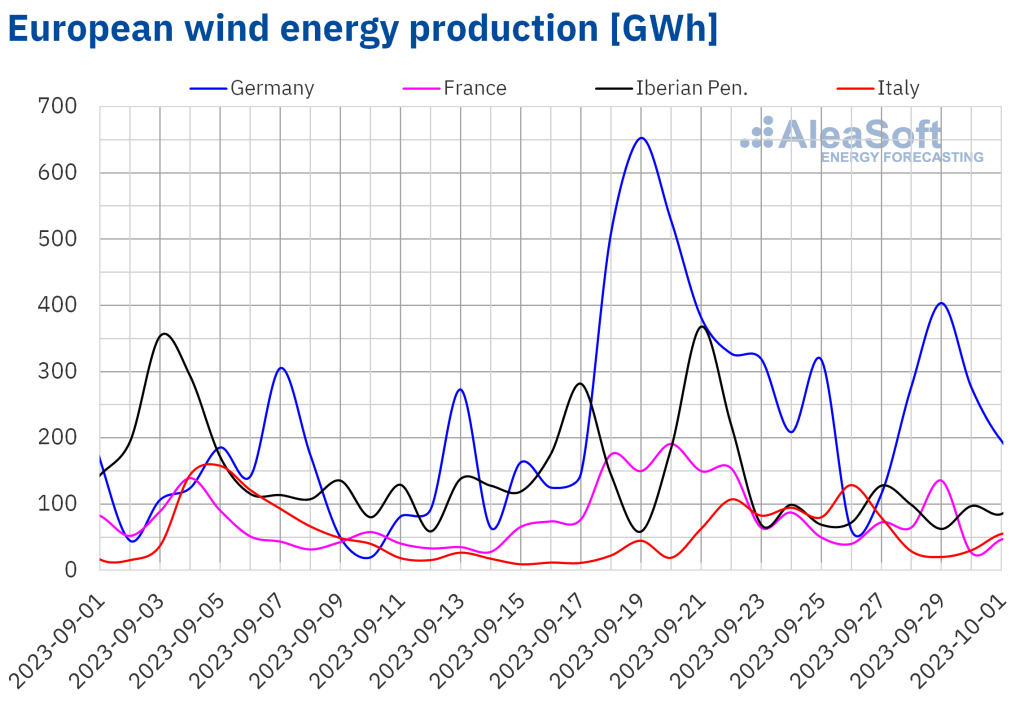

As for wind power manufacturing, the week of September 25 introduced per week?on?week lower in manufacturing with this expertise in all markets analyzed at AleaSoft Vitality Forecasting. The biggest fall, 55%, was registered within the French market and the smallest lower, 2.4%, within the Italian market. Within the remaining markets, the decline in wind power manufacturing ranged from 44% in Germany to 49% in Portugal.

For the week of October 2, AleaSoft Vitality Forecasting’s wind power manufacturing forecasts point out that wind power manufacturing will proceed to lower in Italy and France, however it’ll improve in the remainder of the analyzed markets.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

Electrical energy demand

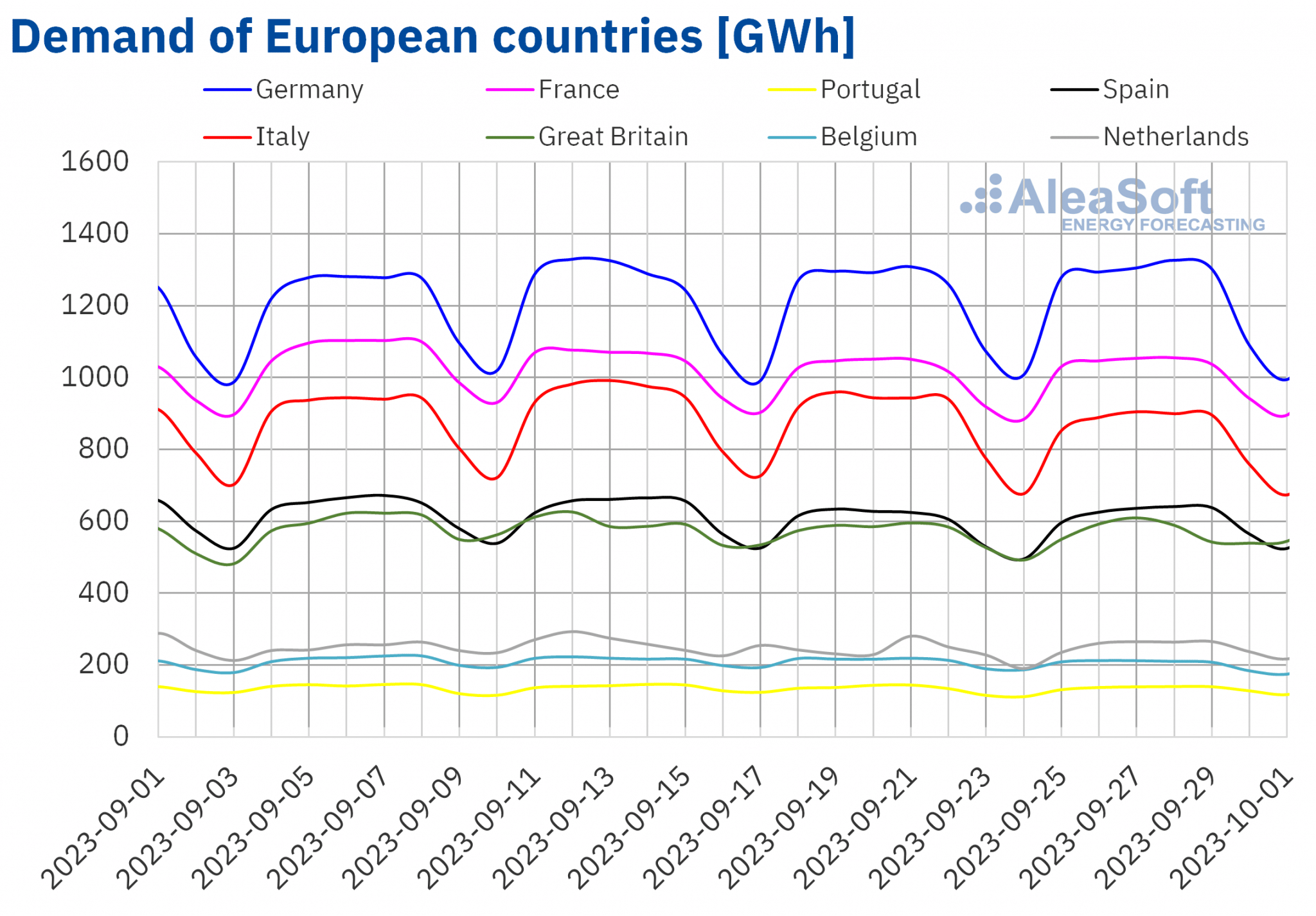

Within the week of September 25, electrical energy demand elevated in a lot of the European markets analyzed in comparison with the earlier week. The biggest improve, 5.6%, was noticed within the Dutch market, adopted by a 2.3% improve within the Spanish market. The smallest improve, 0.5%, was registered in Nice Britain. Electrical energy demand fell in solely two of the analyzed markets, by 4.5% in Italy and three.4% in Belgium.

Over the interval, common temperatures elevated in most markets, starting from 0.7 °C within the Netherlands to three.0 °C in Portugal. Nevertheless, in Italy and Germany, common temperatures decreased by 1.8 °C and 0.1 °C, respectively.

For the week of October 2, in keeping with AleaSoft Vitality Forecasting’s demand forecasts, electrical energy demand is anticipated to proceed to extend in most European markets analyzed, apart from France, Germany and Italy.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ENTSO-E, RTE, REN, REE, TERNA, Nationwide Grid and ELIA.

European electrical energy markets

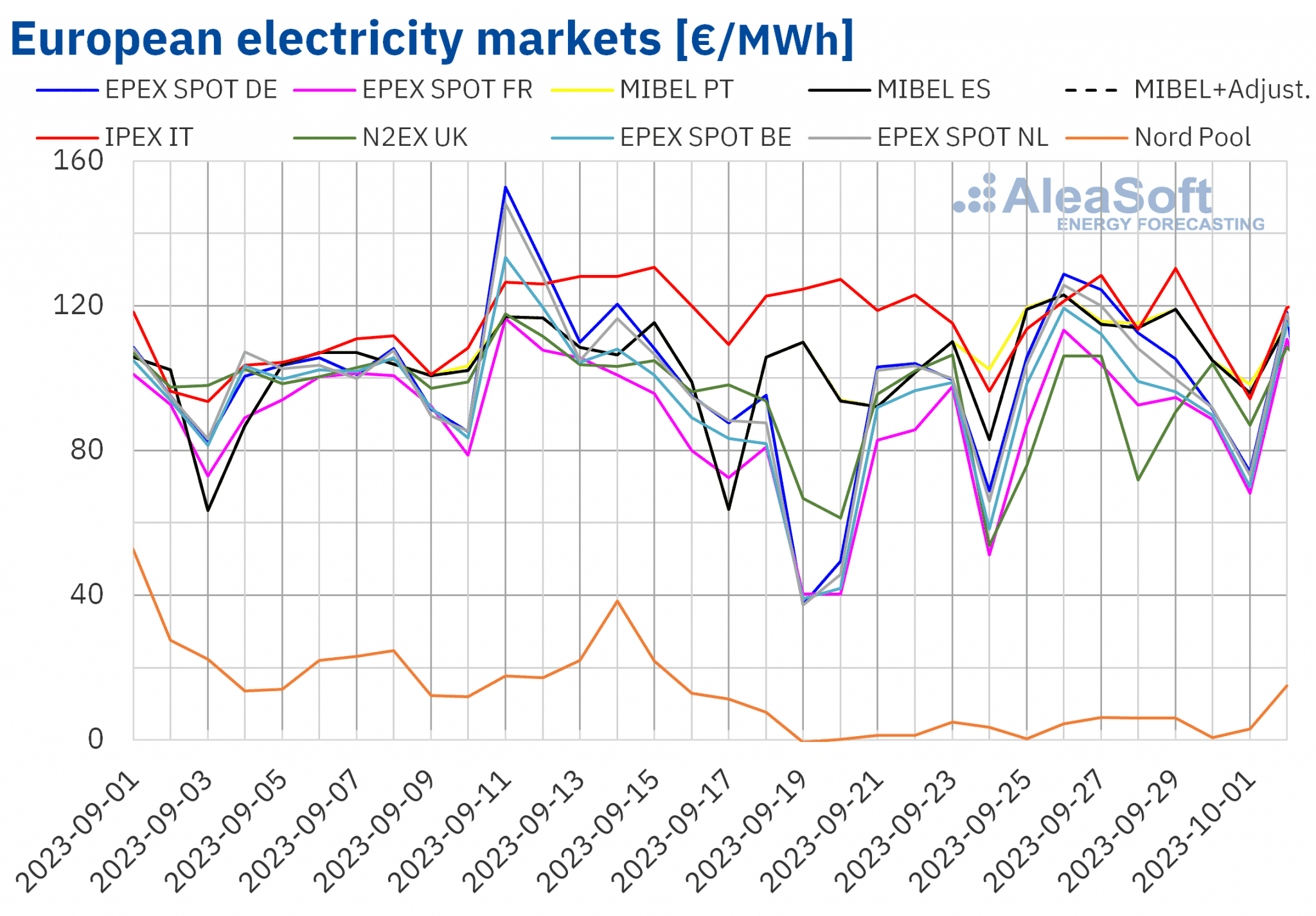

Through the week of September 25, costs in virtually all European electrical energy markets analyzed at AleaSoft Vitality Forecasting elevated in comparison with the earlier week. Whereas within the week of September 18, each day costs have been typically beneath €100/MWh, on a number of days within the week of September 25, each day costs exceeded this quantity and even €120/MWh in some markets, leading to increased weekly averages in a lot of the analyzed markets, in lots of circumstances above €100/MWh. The exception was the IPEX market of Italy, the place the worth fell barely, by 1.7%.

Alternatively, the very best proportion worth improve, 46%, was reached within the Nord Pool market of the Nordic nations. Though each day costs remained beneath €10/MWh, they elevated in comparison with the earlier week, when a damaging each day worth was registered.

Within the remaining markets, costs elevated between 11% within the MIBEL market of Portugal and the N2EX market of the UK and 35% within the EPEX SPOT market of Belgium and France.

Within the fourth week of September, weekly averages have been above €90/MWh in a lot of the European electrical energy markets analyzed. The exception was the Nordic market, the place the bottom common worth, €3.82/MWh, was reached. Alternatively, the very best weekly common, €116.21/MWh, was reached within the Italian market. In the remainder of the analyzed markets, costs ranged from €91.68/MWh within the British market to €113.67/MWh within the Portuguese market.

Within the Nordic market, damaging hourly costs have been registered on September 25, 26 and 30 and October 1. Within the British market, damaging costs have been registered on September 25 and 28. The bottom hourly worth on this market, ?£19.78/MWh, was reached on Thursday, September 28, between 5:00 and 6:00. This was the bottom worth on this market since July 16. As well as, damaging costs have been registered within the German, Belgian, French and Dutch markets on Sunday, October 1.

Nevertheless, within the fourth week of September, hourly costs above €200/MWh have been additionally reached in a number of markets. On Monday, September 25, this quantity was exceeded for 2 hours within the Belgian market. Within the German and Dutch markets, along with the 25th, costs above €200/MWh have been registered on September 26, 27 and 28. The best worth, €379.59/MWh, was registered on Monday, September 25, from 19:00 to twenty:00 in Germany and the Netherlands.

Through the week of September 25, the rise within the common gasoline worth, the rise in electrical energy demand in most markets and the overall decline in wind power manufacturing led to increased costs within the European electrical energy markets.

AleaSoft Vitality Forecasting’s worth forecasts point out that within the first week of October costs in most European electrical energy markets analyzed may lower, influenced by elevated wind power manufacturing in some markets.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from OMIE, EPEX SPOT, Nord Pool and GME.

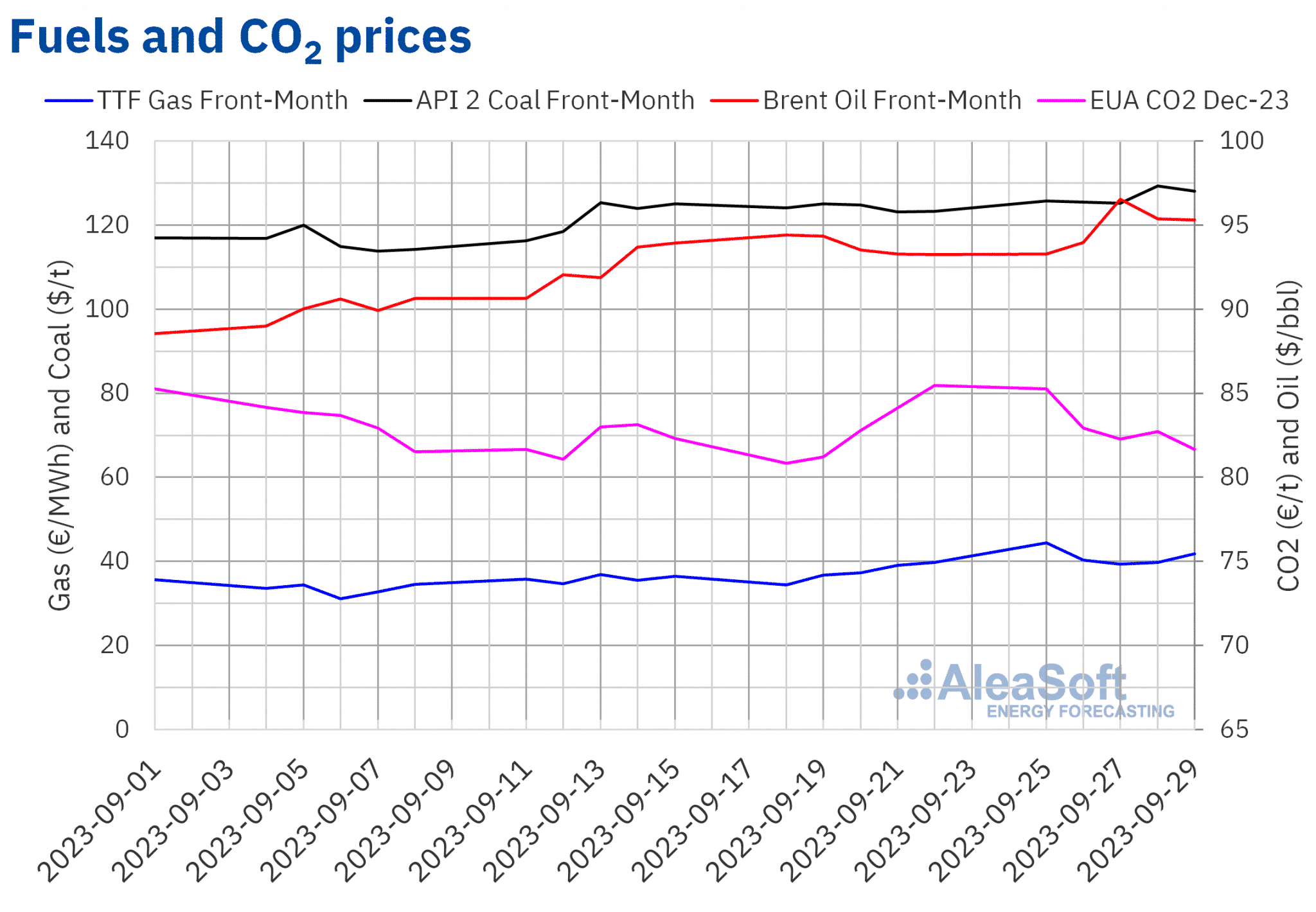

Brent, fuels and CO2

Brent oil futures for the Entrance?Month within the ICE market registered their weekly minimal settlement worth, $93.29/bbl, on Monday, September 25. This worth was 1.2% decrease than the earlier Monday, however $0.02/bbl increased than the earlier week’s Friday. Will increase continued till reaching the weekly most settlement worth, $96.55/bbl, on September 27. This worth was 3.2% increased than the earlier Wednesday and the very best since November 7, 2022. Subsequently, costs declined barely, however remained above $95/bbl. The settlement worth on Friday, September 29, was $95.31/bbl, 2.2% increased than the earlier Friday.

Within the fourth week of September, manufacturing cuts by Saudi Arabia and Russia, together with information on declining US crude stockpiles, pushed settlement costs of Brent crude oil futures increased to $96.55/bbl on September 27. Nevertheless, considerations about financial evolution led to slight worth declines within the final periods of the week. Knowledge launched on Saturday, September 30, on the evolution of the Chinese language economic system may help worth will increase within the first days of October. The rise in demand related to aviation resulting from elevated journey throughout the vacation interval in China may additionally exert an upward affect on costs.

As for TTF gasoline futures within the ICE marketplace for the Entrance?Month, on Monday, September 25, they reached the weekly most settlement worth, 44.44 €/MWh. This worth was 29% increased than the earlier Monday and the very best since early April. In distinction, the weekly minimal settlement worth, €39.30/MWh, was registered on September 27. Regardless of the decline, this worth was nonetheless 5.4% increased than on the earlier Wednesday. Within the final periods of the week, costs elevated once more. In consequence, on Friday, September 29, the settlement worth was €41.86/MWh, 5.2% increased than the earlier Friday.

Within the fourth week of September, expectations of upper demand as a result of approaching winter and the decline in renewable power manufacturing led to the very best worth in latest months on Monday. Nevertheless, excessive ranges of European shares and the prospect of gentle temperatures and better provide ranges allowed decrease costs to be registered subsequently.

As for CO2 emission rights futures within the EEX market for the reference contract of December 2023, the weekly most settlement worth, €85.27/t, was reached on Monday, September 25. This worth was 5.5% increased than on the earlier Monday. Nevertheless, this worth was already barely decrease than the earlier Friday’s worth, €85.48/t. Worth declines have been registered in most periods of the fourth week of September. In consequence, the weekly minimal settlement worth, €81.67/t, was registered on Friday, September 29, and it was 4.5% decrease than the earlier Friday.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ICE and EEX.

AleaSoft Vitality Forecasting’s evaluation on the prospects for power markets in Europe and the financing and valuation of renewable power tasks

On October 4 and 5, UNEF celebrates the X Photo voltaic Discussion board. As soon as once more, AleaSoft Vitality Forecasting might be one of many sponsors of the occasion. On Thursday 5, at 17:30, Antonio Delgado Rigal, the CEO of AleaSoft Vitality Forecasting, will take part within the spherical desk “Have priorities modified within the evaluation of financing dangers?” to investigate the impression of worth expectations in electrical energy markets on the financing circumstances of photovoltaic tasks and their profitability.

The following webinar within the month-to-month webinar sequence of AleaSoft Vitality Forecasting and AleaGreen might be held on Thursday, October 19. Within the webinar, the prospects for European power markets for the winter 2023?2024 might be analyzed. On this event, audio system from Deloitte, repeating for the fourth time, will present their imaginative and prescient and expertise on the financing of renewable power tasks and the significance of forecasting in audits and portfolio valuation.