PV manufacturing evaluation is revealing that module costs cannot “sustainably” fall considerably in 2024 with out producers promoting under value. UK-based analysts Exawatt delivered the event final week, in a pattern noticed by Australian market individuals.

With a world PV oversupply cycle in full swing and value declines of greater than 40% having rocked the market in 2023, it seems doubtless that vital reductions shouldn’t be anticipated to proceed this 12 months. Photo voltaic manufacturing advisory Exawatt reported that whereas stock ranges stay excessive, additional value reductions would doubtless characterize producers promoting under value.

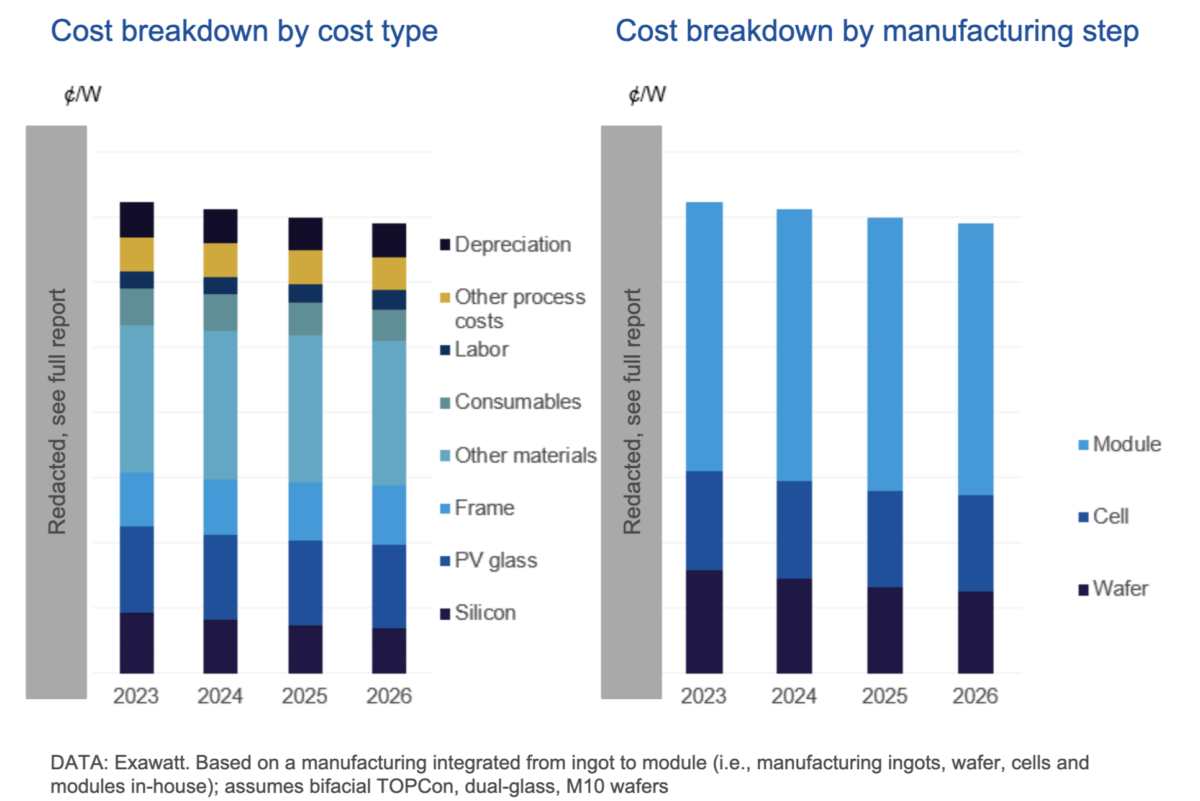

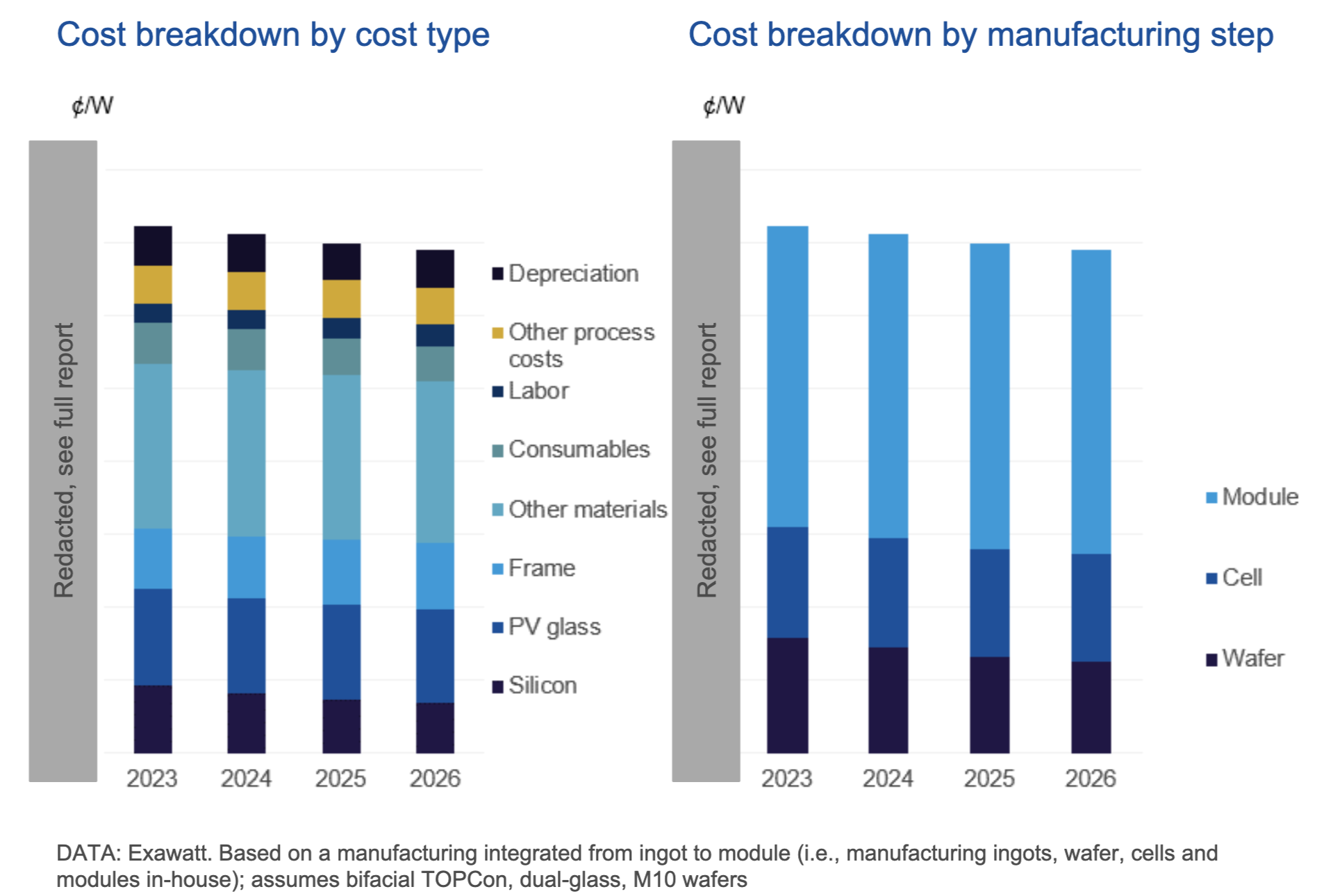

Exawatt offered a few of its value and price evaluation in a webinar final week. In the course of the occasion, the pinnacle of PV for Exawatt, Alex Barrows, mentioned that there stays little scope for vital value reductions from photo voltaic module producers within the close to time period.

“Our elementary value modelling permits us to have a look at the place ‘sustainable pricing’ can go. Within the close to time period it appears like spot costs have largely stabilised. Potential oversupply might push costs down even additional, however ‘sustainable’ value reductions within the medium time period look pretty tough,” mentioned Barrows.

The Exawatt analyst famous that with supplies and consumables comprising roughly 80% of PV module manufacturing value, there’s little room for additional value discount within the quick time period. As such, costs must stabilise if producers are to keep away from promoting at a loss.

Barrows noticed that costs for polysilicon, the first uncooked materials in crystalline silicon module manufacturing, are comparatively near the price of manufacturing at current. He mentioned with costs at USD7.5kg for the polysilicon used for p-type ingot and wafer manufacturing and USD9 for poly used for n-type – and manufacturing prices averaging USD6.5/kg, there’s little headroom for additional declines.

“There’s somewhat little bit of room for additional value reductions however not a lot,” mentioned Barrows.

Rami Fedda, the co-founder of wholesaler of Photo voltaic Juice, famous that polysilicon costs have turned a nook – after a interval of huge declines. Fedda mentioned that poly costs had elevated “for the primary time in lots of months. That is often the primary signal of the place panel costs are heading.”

Fedda made the decision in Photo voltaic Juice’s first video information replace for the 12 months, posted at this time, through which he predicted module costs would stabilize within the second quarter of 2024. He added that the annual manufacturing shutdown in China over the Lunar New Yr of two weeks, is likely to be prolonged to 3 to 4 weeks, given the oversupply market dynamic.

Whereas module consumers very properly might welcome cheaper modules being out there, Exawatt’s Barrows warned that distressed producers might sacrifice high quality in an try to chop prices.

“In case you’re a module purchaser, one of many key issues to look out for is that module suppliers will likely be prone to exiting the market this 12 months. And they are going to be beneath lots of strain to chop prices by lowering the standard of supplies they’re utilizing – backsheets, encapsulants, junction bins.

“Low value [could mean] probably decrease high quality choices,” Barrows warned.

The Exawatt group hosted the webinar final week to advertise its subscriber Photo voltaic Expertise and Value Service, that it delivers together with high quality assurance suppliers PVEL. Exawatt was acquired by commodity enterprise intelligence supplier CRU in April 2023.

This content material is protected by copyright and is probably not reused. If you wish to cooperate with us and want to reuse a few of our content material, please contact: editors@pv-magazine.com.