The Midcontinent Impartial System Operator (MISO) is warning reliability challenges have grown pressing because the nation’s energy system grapples with a “hyper-complex danger atmosphere.”

The grid operator that serves 15 U.S. states and the Canadian province of Manitoba, in its up to date Reliability Crucial report launched on Feb. 22, flagged a number of crucial challenges that the area faces. The dangers, starting from fleet modifications to new complexities associated to regulatory incentives and gas assurances, have been rendered extra complicated by excessive climate occasions, load additions, and incremental load development, it stated.

“We’ve got to face some onerous realities,” wrote MISO CEO John Bear within the report. “Research carried out by MISO and different entities point out it’s attainable to reliably function an electrical system that has far fewer typical energy vegetation and much more zero-carbon sources than we’ve right now. Nevertheless, the transition that’s underway to get to a decarbonized finish state is posing materials, opposed challenges to electrical reliability,” he burdened.

A number of Instant and Severe Challenges

The report serves as a stark name to the reliability transmission group (RTO’s) members and states to acknowledge and handle headwinds going through the U.S. energy system. Whereas the North American Reliability Company (NERC) suggests the majority energy system has typically remained extremely dependable and resilient, lately, NERC has amplified its efforts to boost consciousness of the evolving and sometimes interdependent dangers that threaten it.

Together with a collection of dismal seasonal outlooks—together with for each the summer season and winter—that underscore vulnerabilities posed by excessive climate, the designated North American Electrical Reliability Group (ERO) has warned of rising pressured outages at typical mills given new operational calls for, falling reserve margins, and surging peak demand. In August 2023, NERC, for the primary time, added “power coverage” to its checklist of “vital evolving and interdependent dangers” to grid reliability. The checklist already comprised the grid transformation, resilience to excessive occasions, safety dangers, and important infrastructure interdependencies.

In its report, MISO describes these challenges as a “hyper-complex danger atmosphere,” a time period coined by NERC to explain these evolving and interdependent dangers. Their influence is widespread, MISO recommended. “There are pressing and complicated challenges to electrical system reliability within the MISO area and elsewhere. This isn’t simply MISO’s view; it’s a well-documented conclusion all through the electrical business,” it notes.

A Shifting Energy Profile

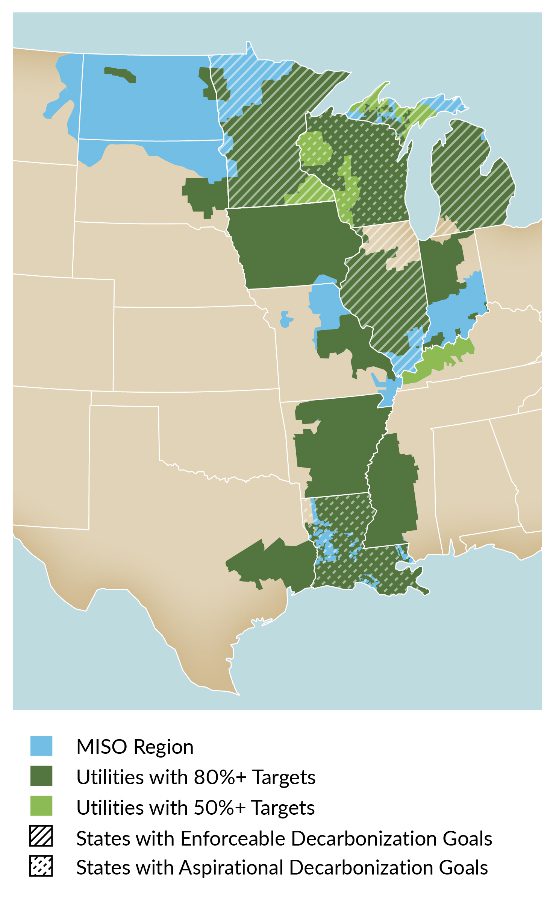

Echoing different grid operators, MISO notes about 75% of the area’s whole load is now served by utilities which have unveiled formidable decarbonization and renewable targets. “With out query, utilities and states are making outstanding progress towards their targets. Carbon emissions in MISO have already declined greater than 30% since 2005, and much larger reductions are anticipated going ahead,” the report notes.

Right this moment, wind and photo voltaic make-up about 20% of the area’s whole power. A MISO modeling state of affairs reflecting all of the publicly introduced utility and state clean-energy targets, nonetheless, means that wind and photo voltaic may serve 80% of the area’s annual load by 2042. “Fleet change of that magnitude would foster a 96% discount in carbon emissions in comparison with 2005 ranges—which might be a rare accomplishment for a area that was predominately reliant on fossil fuels not that way back,” the report says.

In its December 2023-issued Lengthy-Time period Reliability Evaluation (LTRA), NERC in the meantime suggests over the previous yr, MISO noticed coal and nuclear capability retirements of 300 MW and 140 MW, respectively. New wind and wind accreditation elevated by 725 MW, whereas photo voltaic PV and photo voltaic PV accreditation elevated by 920 MW. New gas-fired capability and elevated output from current models made up the most important capability additions—of greater than 4 GW.

In 2023, MISO transitioned to its first yr of seasonal capability auctions (summer season, fall, winter, spring), offering a greater understanding of non-summer dangers. Nevertheless, whereas NERC expects that MISO will preserve reserve margins for the following three years, starting in 2028, it initiatives MISO may face a 4.7 GW shortfall if anticipated generator retirements happen, regardless of the addition of latest sources that whole over 12 GW.

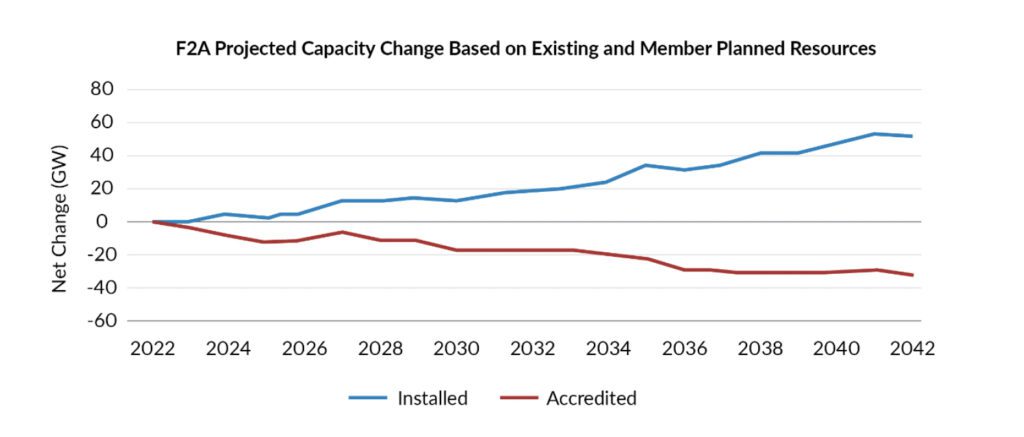

Accredited Capability Forecast to Decline by a Web 32 GW by 2042

MISO factors out that the mismatch is “as a result of the brand new sources which can be being constructed have considerably decrease accreditation values than the older sources which can be retiring.” One state of affairs that displays utility and state publicly introduced decarbonization plans suggests the area’s put in capability is forecast to extend by practically 60 GW from 2022 to 2042, primarily as a result of new wind and photo voltaic. On the similar time, owing to decrease accreditation values, the area’s degree of accredited capability is forecast to say no by a web 32 GW by 2042.

In the meantime, a 2023 MISO survey means that the area’s degree of “dedicated” sources will decline going ahead, with a “potential shortfall of two.1 GW occurring as quickly as 2025 and rising bigger over time,” the report says

These elements paint a dire image. “MISO modeling signifies {that a} discount of that magnitude may end in load interruptions of three to 4 hours in size for 13-26 days per yr when power output from wind and photo voltaic sources is decreased or unavailable,” the report notes. “Such interruptions would almost certainly happen after sundown on sizzling summer season days with low wind output and on chilly winter days earlier than dawn and after sundown.”

Provide Chain, Allowing Delays Compounding Additions

The dynamics compound MISO’s efforts to beat tight provide. During the last 10 years, “surplus reserve margins in MISO have been exhausted via load development and unit retirements,” the report says. Since 2022, MISO has been working close to the extent of minimal reserve margin necessities.

“Whereas MISO has applied a number of reforms to assist avert near-term danger, extra work is urgently wanted to mitigate reliability issues within the coming years. In truth, the area solely averted a capability shortfall in 2023 as a result of some deliberate technology retirements had been postponed and a few further capability was made out there to MISO,” it stated.

On the similar time, MISO, like different grid operators, is grappling with delays. “As of late 2023, about 25 GW of totally permitted technology initiatives in MISO’s Generator Interconnection Queue had missed their in-service deadlines by a mean of 650 days, with builders citing provide chain and allowing points as the 2 largest causes for the delays,” it stated. “An extra 25 GW of totally permitted queue initiatives had not but missed their in-service deadlines as of late 2023, however MISO expects a lot of them may even be delayed by exterior elements.”

Mass Alternative of Dispatchable Sources

Nevertheless, the shortage of provide range can be some extent of concern, MISO says. It notes that “pressing motion” is required to keep away from a looming scarcity of broader system reliability attributes, together with system adequacy, flexibility, and system stability. “No single sort of useful resource offers each wanted system attribute; the wants of the system have at all times been met by a fleet of numerous sources. Nevertheless, in lots of situations, the brand new weather-dependent sources which can be being constructed right now wouldn’t have the identical traits because the dispatchable sources they’re changing,” it says.

Whereas research present “it’s attainable to reliably function the system with considerably decrease ranges of dispatchable sources, the transformational modifications require MISO and its members to review, measure, incentivize and implement modifications to make sure that new sources present ample ranges of the wanted system attributes,” it added.

Nevertheless, MISO additionally pointed to transition-related dangers that have an effect on its current fleet. Most concern gas assurances. “Coal provides have tightened lately as a result of a confluence of things, together with contraction of the mining and transportation sectors and provide chain points. These elements enhance the danger that coal vegetation can be unable to carry out as a result of an absence of gas availability,” it famous.

Gasoline-fired sources, in the meantime, are additionally topic to fuel-assurance dangers as a result of “they depend on pipelines to ship fuel to them,” it stated. “Nevertheless, as a result of the pipeline system was largely constructed for home-heating and manufacturing functions, fuel energy vegetation generally face very difficult financial situations to obtain the gas they should function.”

Some renewables, too, additionally face “gas availability challenges.” The power output of wind can fluctuate considerably on a day-to-day and even an hour-by-hour foundation—together with multi-day durations when output drops far under common,” the report notes. Over 60 consecutive days in January-February 2020, for instance, hourly wind output in MISO averaged greater than 8,000 MW. “For 40 consecutive hours in the course of that 60-day block, common hourly wind output dropped to lower than 47 MW, and solely as soon as exceeded 200 MW in any single hour,” MISO famous.

The grid skilled an excellent longer and broader “wind drought” throughout Winter Storm Uri in 2021 when the MISO, Southwest Energy Pool, Electrical Reliability Council of Texas and PJM areas “all skilled 12 consecutive days of low wind output,” it famous.

Sooner or later, some rising applied sciences—together with long-duration battery storage, carbon seize, small modular nuclear reactors, and renewable hydrogen—present promise to mitigate challenges. For now, nonetheless, these applied sciences aren’t but commercially viable to be deployed at scale, it stated. “MISO is actively engaged in monitoring the progress of those applied sciences and is making ready to include them into the system if/when the chance arises.”

Surging Load Progress on the Horizon

Trying forward, a number of different elements might immediate a tighter provide image, it says. These embrace guidelines from the Environmental Safety Company that might immediate earlier current coal and fuel retirements. “Wall Avenue funding standards” additionally makes it “more difficult to construct new dispatchable technology, even whether it is critically wanted for reliability functions,” it famous.

Lastly, the roughly $370 billion in monetary incentives for clean-energy sources within the federal Inflation Discount Act may additional reshape the grid’s useful resource profile, it stated. Nevertheless, the grid operator is just not optimistic that federal incentives will speed up the industrial viability timelines of rising applied sciences, it stated.

Including extra complexity to the tight provide projections is that MISO expects load additions to surge. “Some components of the MISO area are having fun with a resurgence in manufacturing and/or different financial development, with corporations planning and constructing new factories, information facilities and different energy-intensive services,” it notes.

“For instance, within the MISO South subregion that spans most of Arkansas, Louisiana, Mississippi and a small a part of Texas, there are discussions and plans to construct quite a lot of new manufacturing vegetation for metal, hydrogen, liquified pure fuel and different heavy business that might add greater than 1,000 MW of latest load. The tax credit for clean-energy manufacturing within the Inflation Discount Act are serving to to drive a few of these additions.”

Electrification traits in different sectors of the economic system additionally pose new vital development prospects. “Electrical automobiles are rising in reputation, and the residential and industrial constructing sectors are more and more utilizing electrical energy for heating and cooling functions — with a need to supply this new electrical load from renewables. These traits will seemingly speed up much more as a result of substantial monetary incentives within the Inflation Discount Act for electrical automobiles, rooftop photo voltaic techniques and electrical home equipment,” it stated.

“In MISO’s 2021 Electrification Insights report, MISO discovered that electrification may rework the area’s grid from a summer-peaking to a winter-peaking system and that uncontrolled car charging and each day heating and cooling load may end in two each day energy peaks in practically all months of the yr,” it added.

Danger Mitigation a Precedence

The report notes the grid operator and its stakeholders have made vital strides via the Reliability Crucial. Notable achievements embrace the transition to a Seasonal Useful resource Adequacy Assemble permitted by FERC in August 2022. As well as, the MISO Board of Administrators in July 2022 permitted the primary $10.3 billion tranche of Lengthy Vary Transmission Planning (LRTP) initiatives, marking a historic funding within the U.S. transmission system to assist grid reliability and the combination of latest technology sources.

MISO’s introduction of a Reliability-Primarily based Demand Curve additionally goals to enhance worth indicators within the Planning Useful resource Public sale (PRA) for higher funding and retirement choices, with full implementation anticipated by the 2025 PRA. The grid operator famous it has additionally applied main upgrades to the Power Administration System and the event of latest market clearing engines.

Over the approaching yr, MISO says its priorities will embrace implementing a set of options to make sure system adequacy, flexibility, and stability. This may contain modernizing useful resource adequacy constructs, refining market indicators for flexibility wants, and enhancing inverter-based useful resource capabilities. MISO additionally plans to revise useful resource accreditation values to mirror anticipated efficiency throughout high-risk durations, proposing a three-year transition to a brand new methodology for non-thermal sources. Approval of the second tranche of LRTP initiatives is underway.

Nonetheless, MISO suggests extra work can be required, and it has issued a name to motion to utilities and states within the area: “We should work collectively and transfer sooner,” it stated.

“The challenges we face aren’t approach down the street; they’re right here proper in entrance of us,” stated MISO CEO Bear in an announcement. “We have to execute on the options that we’ve already developed with our stakeholders, and we have to collaborate extra intently to collectively handle these urgent points.”

—Sonal Patel is a POWER senior affiliate editor (@sonalcpatel, @POWERmagazine).