International ship recycling markets at the moment are being solely pushed by the relentless and futile scarcity of tonnage that’s anticipated to proceed till Spring (on the very least), says money purchaser GMS.

“The much-anticipated rebound in international recycling volumes that so many in our trade had been ready (hoping) for earlier than the flip of the yr, has sadly didn’t materialize.”

Markets in Turkey and India stay effectively off the aggressive tempo, so Pakistan and Bangladesh stay are main the market regardless of the continued drop in provide of vessels. This may be attributed to the unseasonable growth in freight charges on the again of sudden 2024 geopolitical issues.

The more and more constructive outlook in Bangladesh and Pakistan outcomes from the easing of economic hurdles and line of credit score (L/C) restrictions – that have been beforehand imposed by the respective governments and spanned over two quarters in the direction of the top of 2023. This had virtually shuttered your entire Gadani ship recycling sector.

“Elections are due in India subsequent month and with these in Pakistan and Bangladesh having solely lately concluded (about six weeks in the past), a lot of the ongoing political uncertainty and unrest that dominated the sub-continent ship recycling nations over current years ought to hopefully be settled (or a minimum of till the following election cycle),” says GMS.

In Turkey, financial / elementary woes stay rampant because the Lira continues to plummet week after week.

Total, the anticipated provide of container ships for recycling (maybe the slowest of all sectors) has but to materialize, all whereas homeowners proceed to function their getting older field carriers and exploit commerce routes presently by the continued Crimson Sea battle, and having fun with the trickledown results of this (overheated?) constitution market, says GMS.

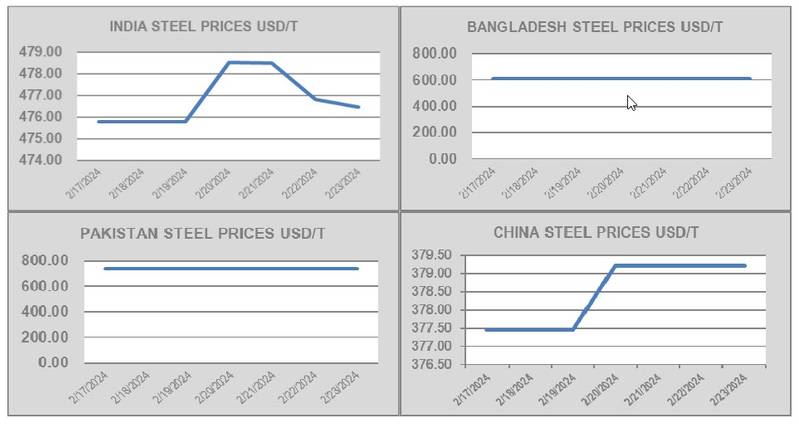

“Sub-continent recycling costs have additionally remained steady of late, hovering across the USD 500/LDT mark, as there appears much less hazard of a shock slide (and even surge) in ranges within the close to future, given present fundamentals in every market.”

For week 8 of 2024, GMS demo rankings / pricing are: