Whereas the uptake of renewable power in Southeast Asia has remained sluggish and laborious, photo voltaic and wind energy producers are more and more in search of supplementary revenue by way of a parallel marketplace for certificates that confirm their era of unpolluted electrical energy.

This dynamic has propelled the area to turn out to be one of many quickest rising originators of such “renewable power certificates”, or RECs, which corporates purchase as they work in the direction of decarbonisation objectives.

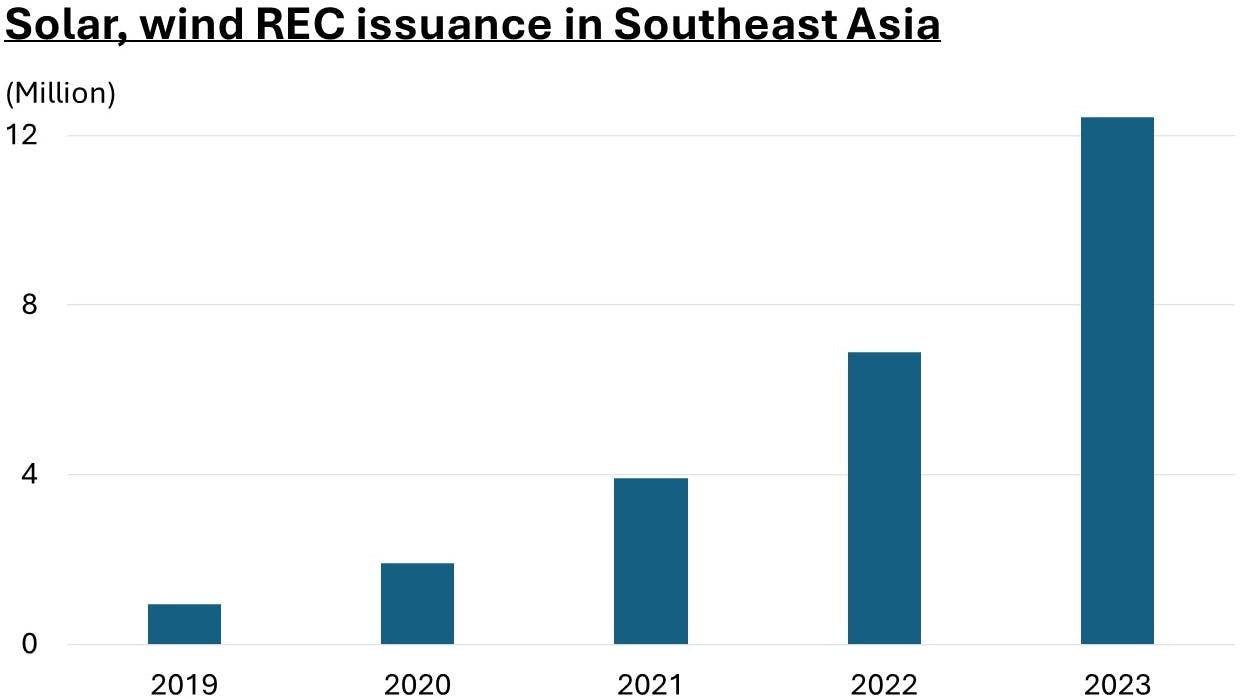

Photo voltaic and wind REC issuances from Southeast Asia rose by nearly 13 instances between 2019 and 2023, information from two main worldwide registries present. Aided additionally by the scale-up of renewables in Vietnam, provide progress for RECs in Southeast Asia was increased than the worldwide common, which grew by 9 instances over the identical interval.

Earnings from RECs stay typically small, however insiders say they assist with money circulation amid difficult financial situations, and as a carrot for attracting traders.

However market progress might be a double-edged sword. The RECs system has been criticised for permitting patrons – together with massive companies – to overstate their inexperienced credentials. There are efforts to tighten rules, although by its fundamental rules RECs take pleasure in some leeway in comparison with carbon credit in emissions accounting.

Regional gamers Eco-Enterprise spoke to say RECs create a web environmental profit in Southeast Asia, the place financing choices are restricted, whereas warning in opposition to overreliance on a variable revenue stream.

Exponential progress

In 2023, nearly 12.5 million RECs, every representing 1 megawatt-hour (MWh) of electrical energy generated, have been issued by photo voltaic and wind mission house owners in Southeast Asia. That is up from underneath 7 million in 2022 and underneath 1 million in 2019.

These figures have been tabulated from information in two main world REC registries, I-REC and TIGR, which hosts renewable power installations throughout massive swaths of Asia, Australia, Africa and the Americas. Canada, western Europe and america largely use different requirements.

Eco-Enterprise graph. Information: I-REC, TIGR registries.

On platforms like I-REC and TIGR, RECs are bought individually from electrical energy, typically to companies who aren’t immediately shopping for energy, or on the identical energy grid. For renewables turbines, the draw is the additional revenue. REC patrons, on their sustainability stories, can subtract an equal portion of their fossil-based electrical energy consumption – and the corresponding emissions – even when they didn’t use the inexperienced electrical energy related to the certificates purchased.

RECs have been round for many years, and have turn out to be more and more well-liked amongst massive corporates similar to Google, Samsung and Starbucks. Their use case is considerably much like carbon credit, though in accounting lingo, RECs “cut back” an organization’s emissions particularly from electrical energy use, whereas carbon credit “offset” the remaining emissions an organization produces after different sustainability efforts have been factored in.

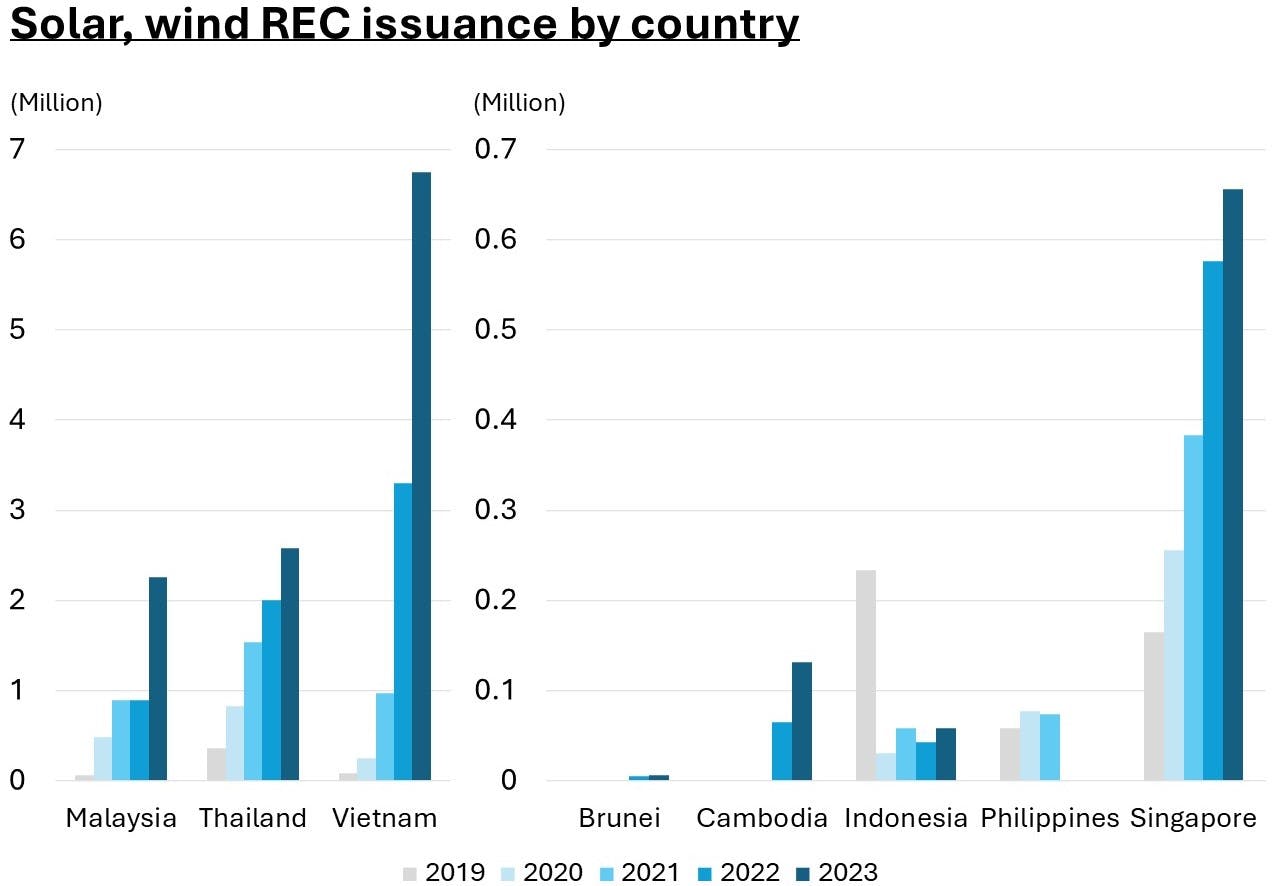

Eco-Enterprise graph. Information: I-REC, TIGR registries.

In Southeast Asia, builders in Malaysia, Thailand and Vietnam problem probably the most RECs – with Vietnamese gamers alone producing nearly 7 million RECs final yr. Singapore can be a rising participant, although output from the city-state is a magnitude decrease. The Philippines successfully left world RECs platforms to keep away from double-counting after the nation began a nationwide compliance market in 2021.

Brunei and Cambodia are fledging markets, having solely issued their first photo voltaic and wind RECs in 2022. Photo voltaic and wind gamers from Laos and Myanmar haven’t dabbled in RECs markets but.

Costs differ drastically. In keeping with world RECs dealer Monsoon Carbon, photo voltaic certificates fetch as little as US$0.70 a chunk within the oversupplied Vietnam market, and as much as US$65 in Singapore, the place company procurement urge for food outstrips rooftop photo voltaic installations. Photo voltaic RECs in Indonesia common US$3, Malaysia US$5, whereas photo voltaic and wind RECs in Thailand go at about US$2, Monsoon Carbon founder and director Angus McEwin advised Eco-Enterprise.

Restricted however rising attraction

For probably the most half, Southeast Asian renewable power gamers are usually not counting on RECs to outlive. McEwin stated that the certificates present underneath 10 per cent of electrical energy gross sales income in most markets – Singapore is certainly one of few exceptions the place RECs income is comparatively excessive in comparison with electrical energy gross sales. Nevertheless, the calculus might change sooner or later.

“As all people begins doing one thing about renewable power, and patrons begin buying RECs, demand will improve, and costs might want to improve. And that signifies that the reward for the renewable power builders will turn out to be extra important,” McEwin stated.

The reward might differ by mission kind too – with rooftop initiatives that miss out on the economies of scale of huge photo voltaic and wind farms having extra to achieve.

“For giant-scale industrial companies that want 10, 20 megawatts behind-the-meter [solar power] era, the flexibility to unbundle RECs and promote them is likely to be an fascinating approach to finance initiatives,” stated Nitin Apte, chief government of regional wind, photo voltaic and battery storage agency Vena Vitality.

Vena Vitality typically sells electrical energy and RECs bundled collectively, Apte stated. This technique often entails fastened, longer-term contracts quite than the spot-market nature of I-REC and TIGR transactions. Unbundling RECs exposes sellers to extra value fluctuations, Apte famous.

Edwin Widjonarko, co-founder and know-how director of Indonesian photo voltaic power developer Xurya, which focuses on rooftop initiatives, stated its revenue from REC gross sales, since 2021, is “supplemental”.

Widjonarko stated RECs assist initiatives get off the bottom in new markets, the place provide chain and expertise shortfalls improve capital necessities.

“We want we knew this earlier, similar to again in 2018, when it could have been tremendous useful to us,” he added. Xurya now has 165 initiatives throughout Indonesia.

Traders are additionally moving into the sport, with RECs “undoubtedly an element” in new financing choices, as funders wish to safe the offtake of recent certificates, McEwin stated.

There seems to be room for additional progress in REC issuances in Southeast Asia: the 12.5 million quantity final yr – representing 12.5 terawatt-hours (TWh) of photo voltaic and wind energy era – is a fraction of the entire 50 TWh produced within the area in 2022, in keeping with analyst Ember.

Imperfect answer

Though RECs assist wind and photo voltaic power builders, critics say it helps overblown environmental claims by patrons. A 2022 examine discovered {that a} group of 115 corporations reported a 30-plus per cent discount in “Scope 2” emissions – from electrical energy use – between 2015 and 2019, although the determine drops to underneath 10 per cent when RECs are excluded.

In principle, the environmental profit from inexperienced energy manufacturing already contributes to decreasing the grid emissions issue on the native energy community, so extra emissions reductions claimed by corporations shopping for RECs, however not utilizing the facility, might quantity to over-counting. RECs additionally don’t strictly adhere to the carbon market’s core precept of “additionality” – that emissions reductions occur solely due to income from certificates gross sales – since in most cases economically viable energy era precedes REC issuance.

Proponents of RECs say the elevated money circulation to renewable power builders will nonetheless spur progress. There have been strikes to tighten rules across the commerce – world company RE100 initiative requires RECs to be purchased from energy initiatives youthful than 15 years. Customary-setter GHG Protocol asks corporations shopping for RECs to report two Scope 2 figures: one factoring within the certificates, and one with out.

There’s additionally growing consensus that RECs ought to solely be sourced in the identical market as the place an organization operates, to maintain advantages native. Monsoon Carbon’s McEwin estimates 90 per cent of corporations are already adopting this observe.

Inside Southeast Asia, specialists say RECs regulation might but turn out to be extra difficult with the rise of cross-border electrical energy buying and selling, which raises the danger of double counting and probably protectionist measures in opposition to unfavourable value swings. They are saying long-term financing for brand new photo voltaic and wind improvement by way of energy buy agreements stays key to the sectors’ progress.

For Xurya, beside RECs, “steady, clear and enforceable rules” round company energy offers will even be helpful. “There are all the time modifications in particulars each one or two years, which makes it a problem for us to formulate energy buy agreements,” Widjonarko stated.

However RECs might nonetheless play a viable function within the decarbonisation of the area. “RECs cope with the intermittent noise – you should buy right down to the megawatt-hour in precept. It offers with the variable part that longer-term agreements can not buffer for,” stated Dr David Broadstock, senior analysis fellow at Nationwide College of Singapore’s Sustainable and Inexperienced Finance Institute. Extra transparency round pricing will assist stakeholders choose the utility of the market, he stated.

“Till there’s something higher, that is the perfect answer. There isn’t any different sensible and easy method for many electrical energy customers to supply renewable power,” McEwin stated.