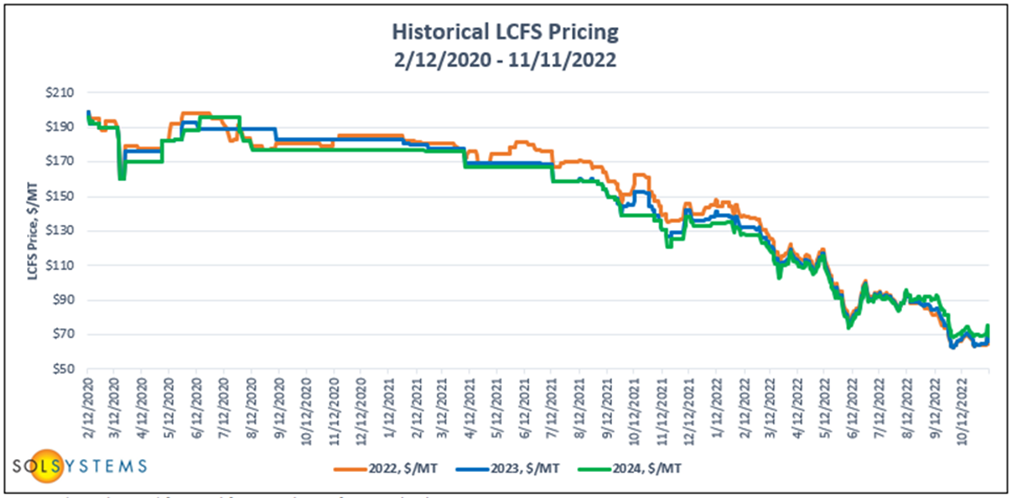

LCFS credit score costs in California proceed to plummet as provide outpaces demand. Present spot costs for rapid supply are within the low to mid $60s, a ~30 p.c drop from costs final quarter.

Much like previous quarters when the California Air Assets Board (“CARB”) held stakeholder convenings, the market did see a slight uptick on pricing following CARB’s November 9, 2022 assembly when pricing was across the $63-69 vary. Nevertheless, the uptick was brief lived.

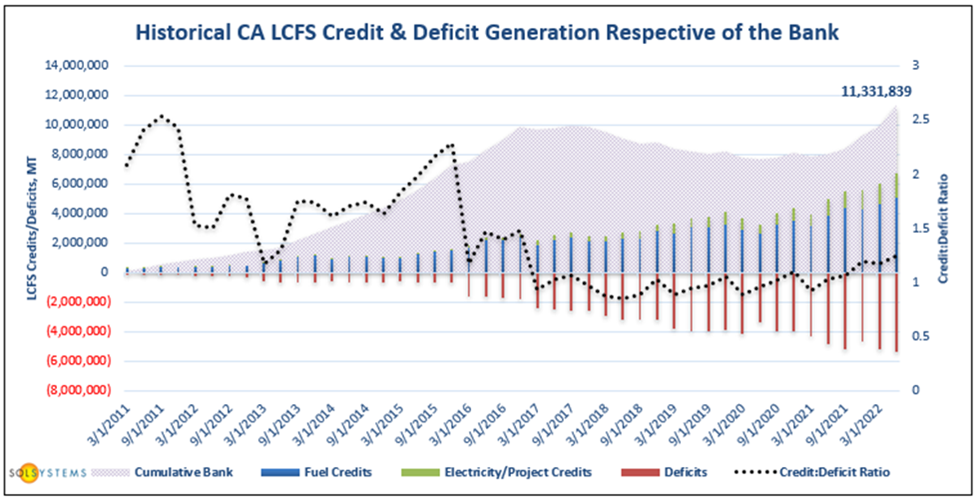

CARB’s Q2 2022 information posted on October 31, 2022 exhibits an all-time excessive of credit outpacing deficits with a surplus of 1.35 million metric tons of credit generated in Q2. The credit score financial institution now sits at 11.3 million metric ton credit.

The downward spiral of LCFS pricing over the previous 12 months has impacted many stakeholders’ infrastructure growth plans in addition to LCFS credit score monetization methods. Close to challenge buildout, builders and buyers have been taking a extra cautious strategy, both delaying or halting initiatives altogether. For LCFS monetization, many market individuals, notably these within the electrical energy pathway, are re-thinking the cost-benefit evaluation of using renewable power credit (“RECs”) to decrease carbon depth (“CI”) scores. Previously, there was no query of whether or not buying RECs was value it because the delta between REC buy prices and LCFS income was massive sufficient to make the REC funding pay for itself in multiples (i.e. regardless of the added REC procurement prices, market individuals would generate sufficient extra LCFS credit from the acquisition to come back out forward). Because the delta shrinks, buying RECs might not be value it. The place that threshold is will differ from participant to participant primarily based on the automobile sort utilized, the power financial system ratio, and different elements. Sol Techniques can work with shoppers to reply any REC associated questions and decide what the optimum REC procurement technique could also be. This market dynamic might also put a downward strain on REC pricing in CA.

This evaluation was featured within the November 2022 version of the Sol Commonplace, a quarterly e-newsletter that gives up-to-date pricing information, market evaluation, and coverage tendencies to maintain shoppers in control on the nation’s rising low carbon and clear fuels packages. To subscribe and entry previous editions of the The Sol Commonplace, fill out our subscribe type right here.