Join day by day information updates from CleanTechnica on e mail. Or comply with us on Google Information!

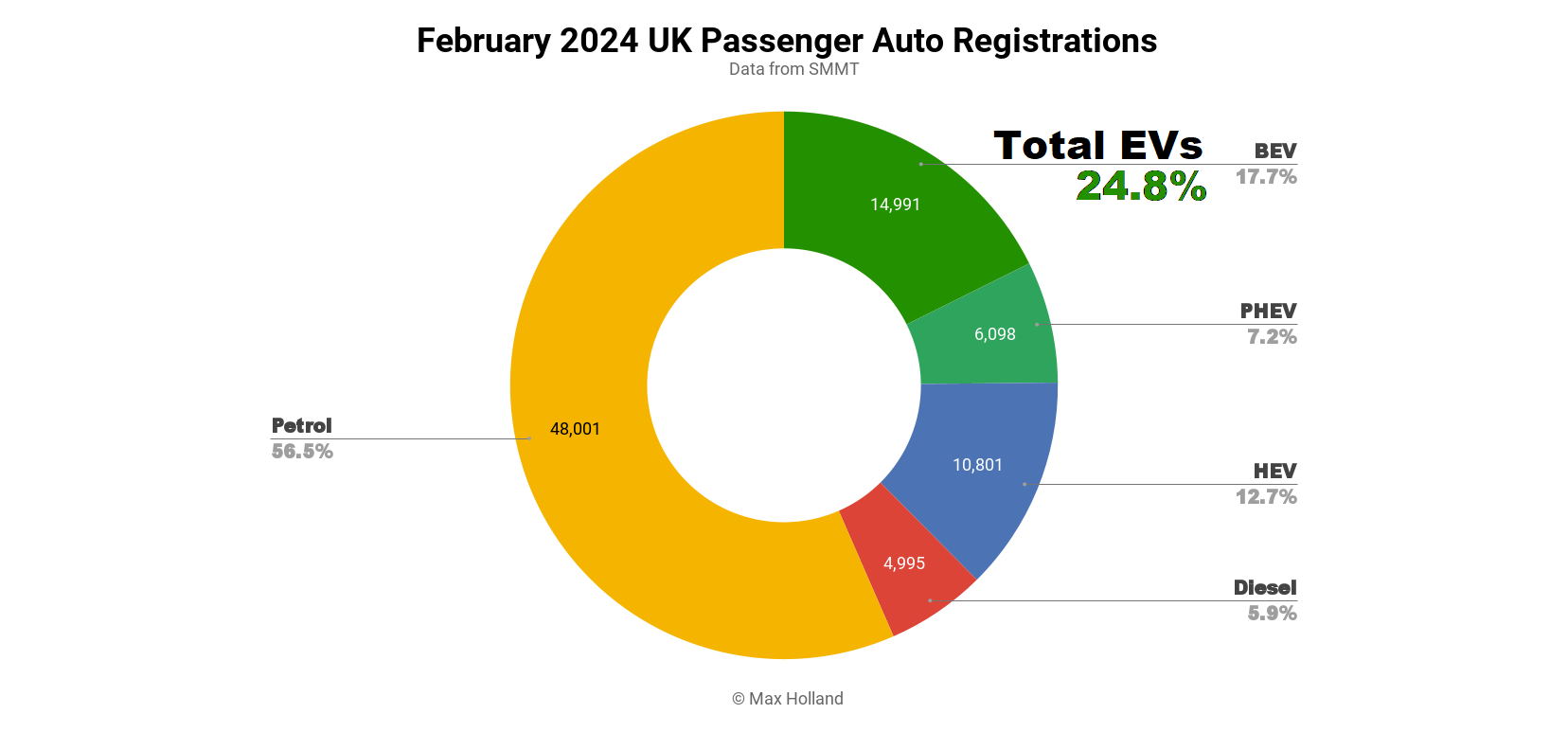

February noticed plugin EVs at 24.8% share of the UK auto market, up from 22.9% yr on yr. Full electrical quantity elevated by 1.21× YoY, with plugin hybrids up by 1.29×. Total auto quantity was 84,886 models, up 13% YoY and the best February in 20 years. Tesla was the UK’s main BEV model.

February’s outcomes noticed mixed plugin EVs at 24.8% share, with full electrics (BEVs) taking 17.7% and plugin hybrids (PHEVs) taking 7.2%. These evaluate with shares of 22.9% mixed, 16.5% BEV and 6.3% PHEV, yr on yr.

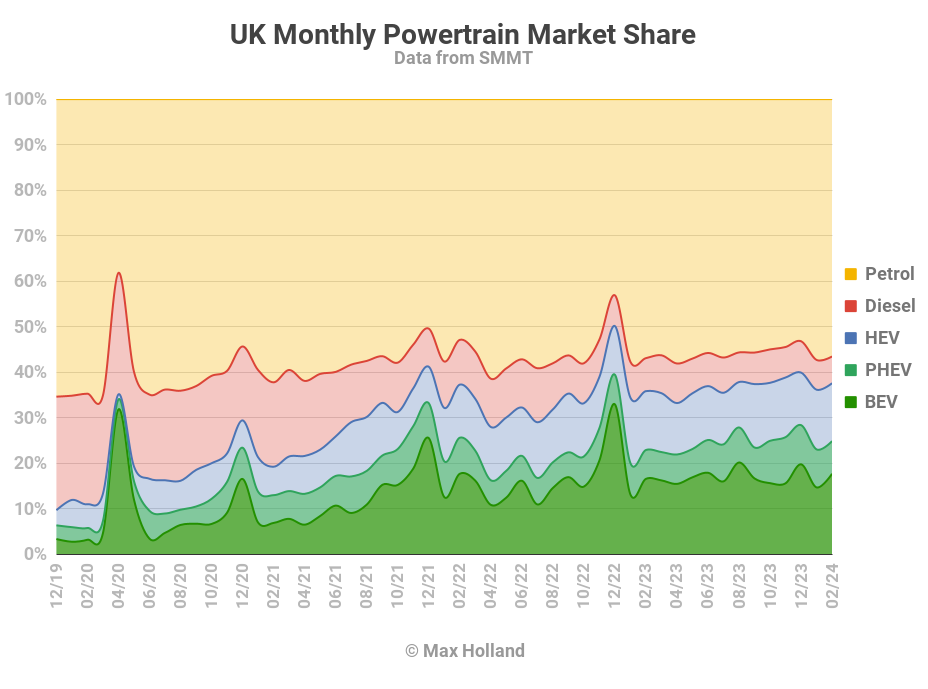

With the brand new zero emissions car (ZEV) mandate in place, February sees the worst laggards — like Toyota, Honda, and Mazda — within the novel place of truly making noticeable volumes of BEV gross sales. This follows on from the primary indicators of this that emerged in January. Stellantis manufacturers had additionally delayed deliveries in This autumn 2023 and are releasing them in Q1 2024 to assist obtain the brand new mandate.

In market quantity phrases, BEVs have been up 21% YoY to 14,991 models and PHEVs up 29% (from a low baseline) to 6,098 models. The general auto market quantity was up 13.3% YoY, which was matched by the expansion in petrol autos (no change in share).

HEVs barely underperformed the general market, at 12% quantity progress, or 10,801 gross sales, dropping share from 12.9% to 12.7% YoY. It’s too early to say whether or not HEVs have already peaked within the UK — they’ve been pretty flat for the previous 18 months, largely hovering round 12% to 12.5% share.

Diesel gross sales misplaced 8.5% in quantity YoY, to a file low of 4,995 models. Diesel market share additionally hit a brand new low, 5.9% (from 7.3% YoY).

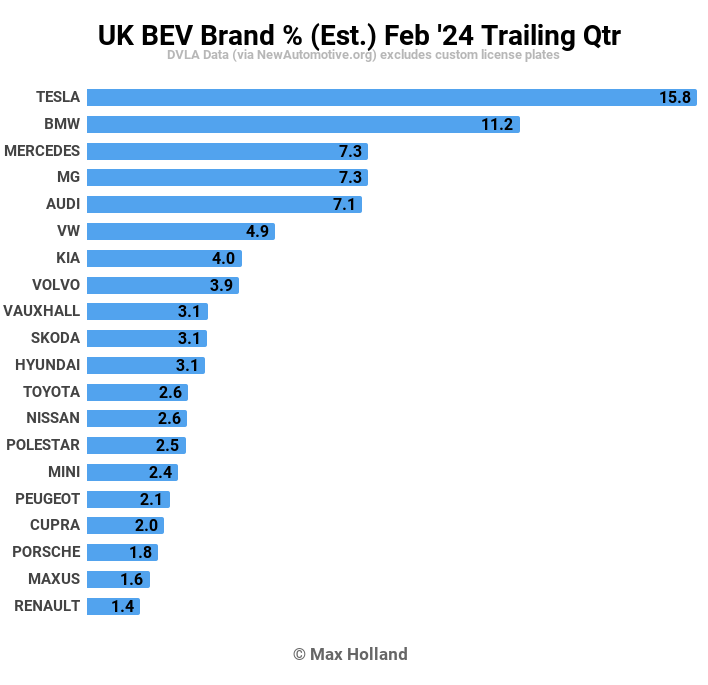

Finest Promoting BEV Manufacturers

Tesla took the BEV lead again from BMW in February, pushing the Bavarian model right down to second place once more. MG Motors got here in third.

Tesla is again with a transparent lead, with over twice the share of runner-up BMW, a margin that’s clear when trying on the chart. Tesla’s lead in March, when its deliveries historically peak, will doubtless be bigger once more. Extra on the Tesla vs. BMW race additional beneath.

Recall that within the model dialogue in final month’s UK report, we discovered that Toyota, Honda, Mazda, and a number of other Stellantis manufacturers have been all making uncharacteristically giant BEV deliveries in January, in comparison with 2023 This autumn supply volumes. Clearly, they have been making an attempt to get a soar on the 2024 ZEV mandate.

This sample continued for a few of these manufacturers in February. Information confirmed Stellantis’ Vauxhall (Opel) model once more at unusually excessive volumes in comparison with This autumn final yr (when it was in eleventh place), and climbing as much as sixth place consequently. Different Stellantis manufacturers — Citroen, Jeep, and Fiat — have been all considerably up in rank in comparison with This autumn.

We are able to see that Toyota has climbed into tenth place, whereas its This autumn rating was twenty third.

As I stated final month, we are going to get a clearer image within the months forward about how laggard automakers are responding to the ZEV mandate. The BEV quantity leaders — most clearly Tesla, BMW, and MG — are already method forward of the mandate and their efficiency received’t present a step-change. Many different manufacturers should seriously change this yr in an effort to meet the bar, and we are going to see this variation rising of their numbers.

Let’s now flip to the trailing-3-month rankings:

Tesla has a transparent lead as soon as extra. BMW has second place rating, with a major margin over others. It’s good to see a decent race for third, with Mercedes, MG, and Audi neck-and-neck.

Within the dialogue beneath final month’s report, the place BMW had a slight lead within the trailing-quarter ranks, a few BMW followers jumped into the chat. My commentary that “we will count on Tesla to be again within the lead in February” was met with dismay … and but right here we’re.

It is perhaps value simply taking a step again to know why Tesla will almost certainly proceed to dominate the UK BEV market over the subsequent yr or so (and maybe longer).

Tesla and BMW have been competing within the UK BEV market for a few years. Nissan (with the Leaf) and BMW (with the i3) repeatedly had the UK’s prime two spots from 2014 till Q3 2019 when the Tesla Mannequin 3 began arriving in enormous numbers. Earlier than that, even the mixed Mannequin S (from June 2014) and Mannequin X (from late 2016) had by no means been forward of BMW’s i3.

After mid 2019, the BMW i3 was not solely outcompeted by the Tesla Mannequin 3, however was additionally steadily overtaken in month-to-month quantity by the refreshed VW Golf, the Hyundai Kona, and the Kia Niro, in addition to dearer vehicles just like the Jaguar I-PACE and Audi e-tron. BMW fell far down the UK BEV model ranks, and for many of 2020 and 2021 was exterior the highest 10.

Issues began to show round for BMW from September 2021, when the brand new iX and the iX3 arrived on the UK market. By December 2021, BMW was again within the race, within the 4th spot within the rankings, simply behind Nissan and Volkswagen.

By Q3 2022, BMW was again in second place, this time behind Tesla, and has stayed largely in or across the prime three since then, usually vying with MG for second spot. BMW now has a variety of nice BEVs (albeit on the expensive finish of the market), which I repeatedly commend in my European reviews.

The tip of January 2024 briefly noticed BMW forward of Tesla within the trailing-quarter rankings, primarily resulting from a current quiet interval for Tesla. This had BMW followers believing that Tesla’s dominance was coming to an finish, and that their champion may now make a sustained problem for the highest spot within the UK.

The BMW followers ignored that Tesla had an unusually quiet December within the UK (not essentially demand restricted, maybe RHD logistics restricted) and was low on Mannequin 3 deliveries forward of the refresh, which arrived in late January. The “Highland” refresh began delivering on January twenty seventh and deliveries have surged, as anticipated. As soon as the honeymoon interval wears off, the Mannequin 3 will doubtless be again to round 30% of Tesla’s UK quantity.

I believe we will all agree that, as BEVs have turn into regular in Europe, it’s actually the case that Tesla’s two quantity fashions might not have the wow issue that they as soon as did. However for anybody searching for worth BEV within the UK, the Mannequin Y and Mannequin 3 are nonetheless extraordinarily arduous to beat (not least due to their pricing, vary, and DC charging benefit). If demand cools, Tesla nonetheless has room to additional cut back the value of those fashions, forward of the subsequent “Redwood” mannequin which will probably be decrease priced and see a lot greater demand.

The Redwood ought to arrive within the UK in 2026. There’ll most likely be a short lived Osborne impact on Tesla’s gross sales within the few months earlier than Redwood arrives within the UK (the place different manufacturers have an opportunity to quickly seize prime spot)! Because of this Musk has been speaking down the Redwood mannequin (simply as pre-2017 he generally talked down the Mannequin 3 in comparison with the Mannequin S).

As soon as Redwood arrives, Tesla will probably be again to excessive general volumes, and really doubtless again within the lead within the UK, not less than within the premium market. If, by that point, historically greater quantity manufacturers (Volkswagen? BYD?) have stepped as much as provide unconstrained volumes of reasonably priced, competent BEVs, then, sure, Tesla might not have the general BEV quantity lead within the UK. I might like to see such reasonably priced fashions in plentiful volumes. Who wouldn’t? I don’t see it occurring pre-Redwood, sadly.

If BMW can provide a sub-£39,000 BEV, and undercut the Mannequin 3 on value, and on vary and ease-of charging, they may have an opportunity to beat Tesla’s volumes earlier than the Redwood arrives. Or may BMW have its personal secret grasp plan to go sub £29,000 and compete straight with the Redwood itself? Something is feasible, however I might not put cash on both of these issues occurring. On the finish of the day, although, all this competitors is welcome and advantages customers.

For those who agree or disagree with this take, please soar into the feedback beneath and make your case (ideally with knowledge).

Outlook

Regardless of the rising auto market, current financial output within the UK additional weakened within the newest knowledge from This autumn 2023, with unfavorable 0.2% progress YoY. Inflation was flat at 4%, and rates of interest flat at 5.25%. Manufacturing PMI improved barely to 47.5 factors in February, from 47.0 in January.

The UK auto trade physique, the SMMT, has requested the federal government cut back VAT on BEVs (although, not suggesting a value cap on this, which is a non-starter) and cut back VAT on electrical energy at public chargers (extra lifelike). As far as I can see, within the breaking finances bulletins, neither of those requests have moved the federal government coverage within the official 2024 finances planning.

The ZEV mandate will imply that the share of BEVs will proceed to develop for the foreseeable future.

What are your ideas on the UK EV transition? Please be a part of within the dialogue beneath.

Have a tip for CleanTechnica? Need to promote? Need to counsel a visitor for our CleanTech Speak podcast? Contact us right here.

Newest CleanTechnica TV Video

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.