Join each day information updates from CleanTechnica on e-mail. Or comply with us on Google Information!

A massacre is coming.

The precise timeline we don’t know, not but at the least. However the omens are right here already with the Chinese language market slowing down and the Chinese language EV business reaping the fruit of early investments, huge economies of scale, and close to whole management over battery provide chains. After probing the waters in Southeast Asia, China’s EV business appears to have chosen 2024 because the 12 months to start a severe offensive all around the world.

Today has been foretold many occasions on this and different websites, but seeing it firsthand feels … totally different. Thrilling, even. As Chinese language EVs develop into extra inexpensive, as choices improve and other people acquire confidence, as we transfer ever nearer to cost parity, it’s a provided that gross sales will improve … on the expense of legacy ICE automobiles. The US, the EU, and/or Japan could but resort to protectionism, however that received’t assist them in international markets, together with (most just lately) Latin America.

Most of you in all probability guessed the BYD Dolphin Mini (BYD Seagull rebranded for international markets) is the rationale for my phrases, and that’s a part of it … however solely half. A number of components have coalesced: apart from the arrival of the Dolphin Mini at a surprisingly inexpensive value in three markets within the area (Brazil, Uruguay, and Mexico), we have now the value wars heating up in China and the competitors from different Chinese language EV makers that, lastly, appear to have the ability to decrease their costs and compete in energy not towards different EVs, however towards legacy ICE automobiles. The time of reckoning could also be upon them.

Mexico: BYD triggers a value struggle, JAC and SEV reply in type

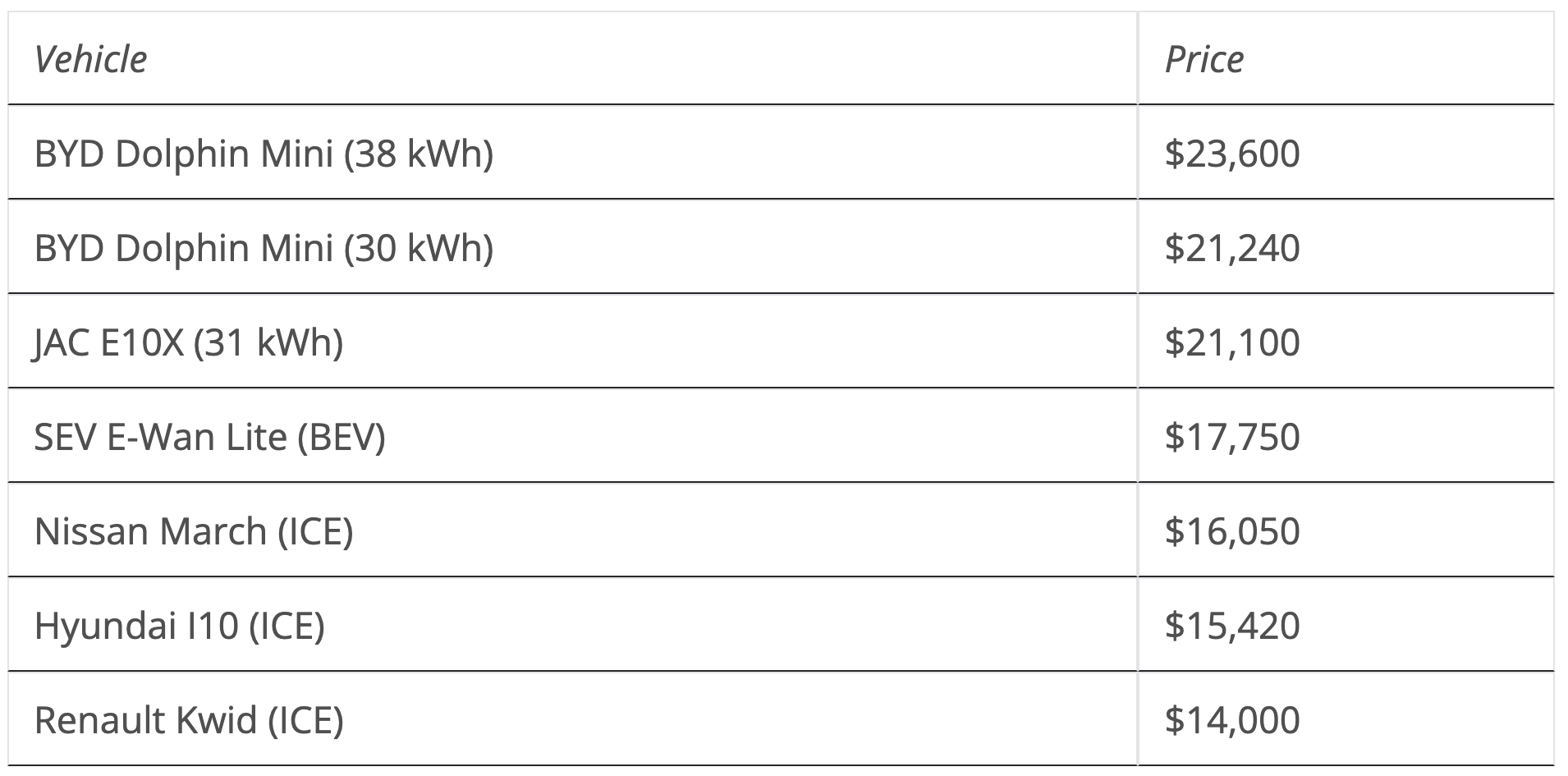

Zach already reported in regards to the arrival of the BYD Dolphin Mini in Mexico at costs that convey it a lot nearer to ICE competitors: a 30 kWh model being supplied at MXN$358,800 ($21,000) and a 38 kWh model at MXN$398,800 ($23,000).

The 38-kWh model is revolutionary in and by itself: it’s the primary time a city-car boasts important vary (as much as 380 km/236 mi within the optimistic NEDC). Up till in the present day, city-cars with 31 kWh batteries at most had been the norm in Latin America, helpful for town and round it, however unable to reliably deal with something for much longer than 220 km (137 miles) on a highway journey.

The truth that this lengthy(ish)-range model arrived at decrease costs than the short-range variations already accessible has pressured the hand of the competitors. BYD appears to have triggered a value struggle in Mexico, with JAC responding in type and reducing the value of its E10X (31 kWh) to MXN$357,000 ($21,100).

JAC wasn’t the one one dropping costs, although. SEV, a Mexican model providing Chinese language EVs that’s additionally to start out native manufacturing, additionally introduced stunning value cuts, bringing down the value of its E-Wan to a formidable MXN$299,000 ($17,750) and even providing a brand new, extra inexpensive model for MXN$279,300 ($16,500)! I’m nonetheless checking if these have the identical 30 kWh battery. Hopefully that’s the case.

The truth that they responded so shortly and decisively to BYD’s problem signifies that JAC and SEV have the margins and the capabilities to supply inexpensive EVs in important numbers. JAC additionally has the backing of Mexico’s richest particular person, so there’s that. As BYD additionally goals to fabricate in Mexico within the close to future, the struggle is more likely to develop into native.

Relating to the highway to cost parity:

EVs have gotten cheaper and higher, and essentially the most inexpensive choices have already attain parity with some ICE city-cars. Mexico stood at 1.3% plug-in market share in 2023, with a lot fewer choices and far worse costs. It’s clear that development must be exponential beneath the brand new market situations, however change has been so quick and dramatic I’m unable to make any predictions. There’s additionally the truth that different segments could current related enhancements because the 12 months goes on, rising strain on ICEVs throughout their line-ups.

And each EV offered shall be one much less ICEV for Legacy Auto.

Colombia: Auteco Blue alerts the arrival of value parity with the Dongfeng S50

Right here in Colombia, we’re nonetheless ready for the BYD Dolphin Mini, however since pricing has been constant throughout Latin America, I anticipate no surprises.

This isn’t about BYD, however about Auteco Blue, the motorbike firm that selected to guess every little thing on EVs some time again. The corporate is engaged on rising its lineup and has additionally lowered costs on a number of of its accessible EVs, however it just lately introduced a automotive that acquired everybody unexpectedly: the Dongfeng S50.

It is a Mannequin 3-sized sedan boasting a 57 kWh battery (sadly, not an LFP one) that can solely be offered — for now — to fleets or as a taxi: in line with Auteco, the automotive ought to be capable of go some 415 km (258 mi) on one cost. And the pricing is out of this world: COP$104,000,000, or $26,630, for the taxi model (the fleet model being barely cheaper).

At this level, it isn’t EVs that should get cheaper to compete, however ICEVs: this Dongfeng principally beats all competitors no matter powertrain. The VW Jetta, for instance, begins at $27,900.

I’m unsure why Auteco isn’t bringing this as an choice for the final market: they might be scared it can cannibalize each different mannequin as a result of it’s insanely cheaper. For example, the comparable JAC EJ7 could also be a lot sexier however boasts related specs and prices a staggering 50% extra: $40,450.

I don’t know what recreation Auteco is enjoying right here, however I’m hopeful this can be a transfer to start out value reductions in all of their lineup, bringing them nearer to essentially the most superior market within the area: Costa Rica (the place these automobiles are already way more inexpensive).

A small snippet of reports: Chevrolet has lowered the native value of the Chevy Bolt by 20%, down from almost $50,000 to $40,000. It’s clear that this isn’t a transfer to make the mannequin extra standard (as they’re sadly not being constructed anymore), however to filter out the stock left from 2023. It seems that if you convey an inexpensive car at almost twice the value, it received’t promote as a lot. Heh, who would’ve thought?

Chip in a couple of {dollars} a month to assist assist unbiased cleantech protection that helps to speed up the cleantech revolution!

Brazil, Uruguay: the BYD Dolphin Mini arrives at an inexpensive value

In Brazil and Uruguay, for now, the information is proscribed to the Dolphin Mini. Which remains to be nice, in fact.

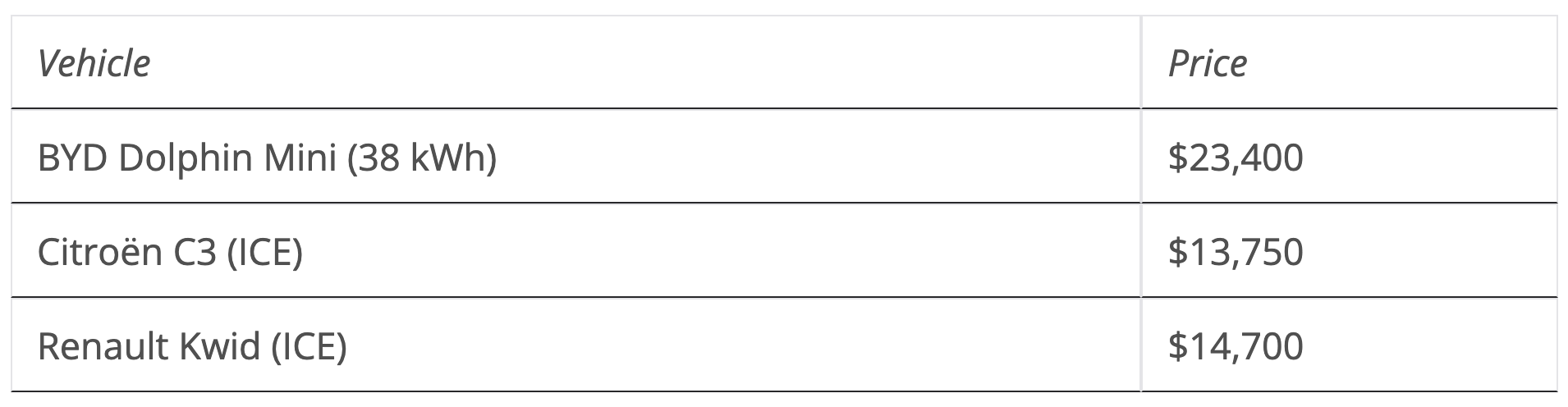

The automotive is to be produced in BYD’s new plant in Brazil (anticipated to be working in late 2024), however for now, it can come from China at a value of BRL $115,800 ($23,400) for the 38 kWh model. Although, those that reserve early can get a BRL $10,000 ($2,000) low cost. This value consists of taxes and a sort 2 charger that comes with the automotive.

Brazil’s market has been fairly aggressive for the reason that arrival of the cheaper BYD Dolphin in 2023, and has thus far maintained over 5% plug-in market share in 2024. The arrival of the Dolphin Mini will little doubt make a splash, and I’m beginning to marvel if we might be able to attain 10% market share by the top of this 12 months. A easy value comparability could lead you to consider that this car will make little distinction out there, however the gist of the matter is that the Dolphin Mini is a significantly better car than the EV competitors, so it’s a given it can power JAC, Chery, and Renault to decrease their very own costs and produce them nearer to ICE city-cars.

In Uruguay, the Dolphin Mini arrived in two variations, the 38 kWh one being offered at $23,990 and the 30 kWh one at $21,990. Similar to Brazil, Uruguay is a comparatively developed market the place BEVs have surpassed 3% market share, so the arrival of the Dolphin Mini may assist the market to achieve 6% or maybe much more this 12 months.

It’s not solely the Dolphin Mini, although. The BYD Dolphin arrived in Uruguay in July 2023 at a value of $40,990, but in the present day it’s being offered at $28,990, which implies it was discounted by 30% in the previous few months! In case you recall our report on Latin American EV gross sales, Uruguay was completely dominated by BYD, and it’s possible that this may stay and maybe even improve in 2024.

Closing ideas: on the way forward for the Latin American EV market

The promise of extra inexpensive EVs has been instructed for years, however right here in Latin America, it’s solely now that we’re lastly seeing it. Because the markets transfer past 1% BEVs and get nearer to (or hopefully above) 10%, a brand new set of questions and challenges come up.

I used to be as soon as of the thought that as quickly as value parity was achieved, the sport would already be over for ICEVs, and we’d transfer to 100% BEVs (or almost) in a matter of weeks. I now query that premise, for essentially the most profitable market within the area (Costa Rica) is already very shut to cost parity, and but EV gross sales, although booming, are nonetheless beneath 20% of whole car gross sales within the nation.

It’s clear the market might want to develop and types might want to acquire belief and confidence. Although, some have superior fairly far on this matter (BYD and JAC, at the least). As quick as this course of could also be, it’s unlikely that we’ll see it end earlier than the top of the last decade, and yearly that we’re not at value parity is another 12 months this may take.

This doesn’t essentially imply excellent news for legacy automakers. Latin American markets should not significantly rising, and already, native examples akin to Costa Rica and international ones akin to Thailand have proven that with enough pricing, new EV manufacturers can acquire market share at electrifying pace. Even when we take some time to get to 100%, development can take a rustic from 1% to twenty% EV market share in a few years, as we simply noticed occur in Thailand. Each EV offered is one much less ICE car, and legacy manufacturers are more likely to wrestle an increasing number of as their market share shrinks.

However, given the above, I do marvel if the method shall be gradual sufficient to permit them to outlive based mostly upon their very own EVs that will not but be on par with the Chinese language, however which are additionally getting higher yearly. The Renault 5 is more likely to be a hit within the area, and there’s additionally hope for Chevrolet’s electrified lineup within the higher segments (I can see a $40,000 Equinox EV being an entire success right here). Stellantis can be presenting comparatively inexpensive EVs able to at the least providing some competitors to their Chinese language friends in Latin American markets.

Paradoxically, as we see ICE car market share evaporate, I consider Toyota shall be one of many short-term winners: common hybrids are its bread and butter, and people are additionally rising exponentially. Nonetheless, as BEVs develop into higher and extra inexpensive I see hybrid market share additionally shrinking quickly. When will that be? I wish to say that will probably be quickly (2026 on the newest), however, frankly, I’ve been too optimistic earlier than, so I’ll sit this one out.

Ultimately, as EV gross sales develop, charging turns into a extra urgent situation. Quick charging stations on this area are few and much between, and it’s widespread to search out there’s just one charger on an necessary highway which will already be in use, or, worse, that could be damaged. Traces are in all probability going to get longer, wait occasions could develop into insufferable, and chargers will fail extra usually the extra they’re used. And as inexpensive EVs normally include comparatively small batteries, it’s arduous for folks to contemplate one in these situations. Since governments don’t normally have that many funds to spend money on this stuff, EV firms should bear this funding if they need for gross sales to develop as quick as they need them to.

I imply, I’ve been annoying my relations about shopping for an EV for years, however now that it has develop into an actual chance, I have to inform them to attend. The inexpensive EVs they might be fascinated about should not capable of reliably make the journey from their metropolis to the capital metropolis in a single cost (a visit all of them make frequently), and, as just one charger exists in both path (none with GB/T chargers), it’s an excessive amount of of a danger to get stranded if it fails. All we’d like is one good charging station … however we don’t have that but, and the deployment of quick chargers has truly slowed down in current months. However this is a matter that shall be solved ultimately for sure.

As development will increase, challenges may also improve. Nonetheless, the longer term seems brilliant.

Have a tip for CleanTechnica? Wish to promote? Wish to recommend a visitor for our CleanTech Discuss podcast? Contact us right here.

Newest CleanTechnica TV Video

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.