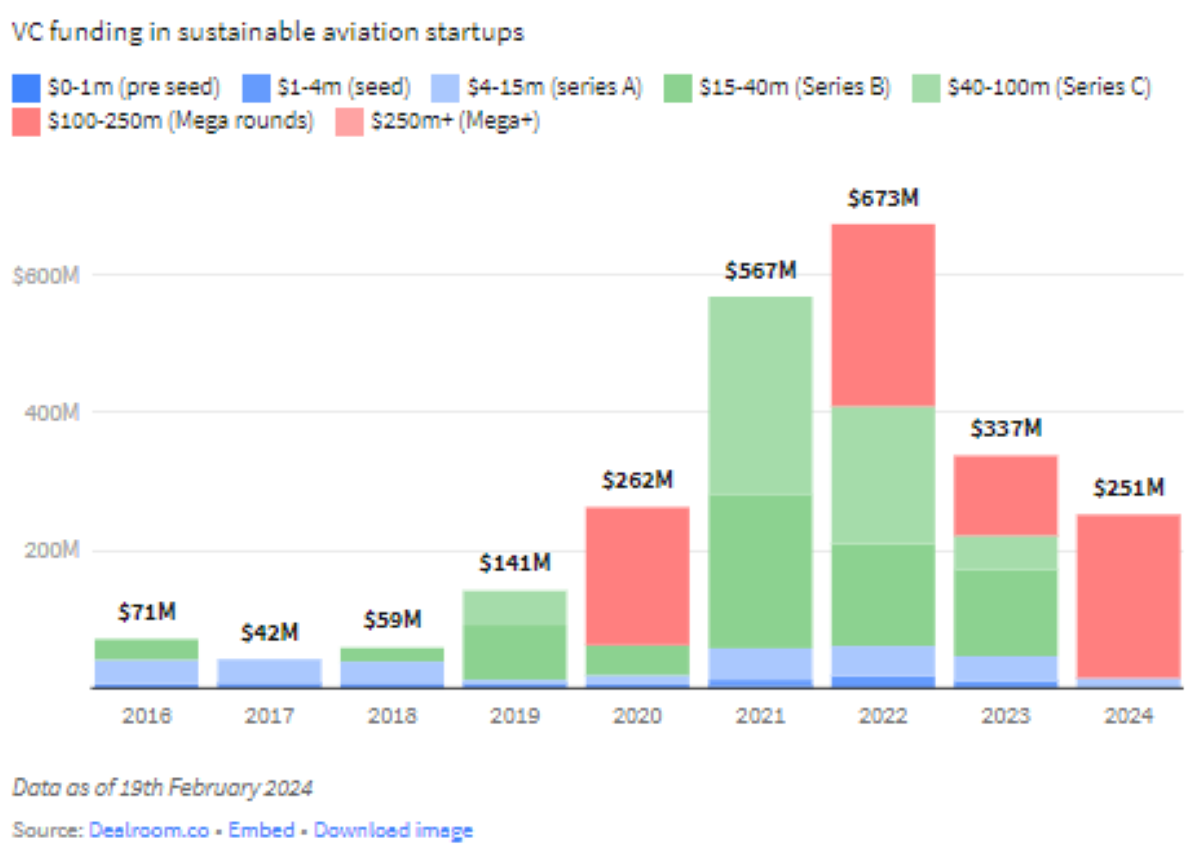

Since 2016, some $2.4 billion value of enterprise capital flowed to firms creating electrical aviation and different air journey decarbonization applied sciences with a robust begin in funding quantity in 2024, in response to Dealroom.co, a Dutch information and intelligence agency.

Since 2016, there was $2.4 billion value of enterprise capital flowing to firms creating applied sciences to decarbonize aviation, in response to Dealroom.co, a Netherlands-based supplier of world information and intelligence on startups and tech ecosystems.

The phase had a robust begin in 2024, famous Dealroom.co senior analyst Lorenzo Chiavarini.

“Aviation is among the segments the place we nonetheless don’t have a transparent profitable expertise path to decarbonization to succeed in 2050 net-zero targets,” he informed pv journal. “In my evaluation, it might be a risk or alternative, both we don’t hit the targets, or we hit the targets thanks to very large investments and technological advances. A 3rd possibility is we hit the targets because of large social change. That’s, flying turns into one thing we solely do if there is no such thing as a different different. So, if we wish folks to fly, and restrict local weather disruption and biodiversity collapse, we have to get critical about decarbonizing aviation now.”

Primarily based on Dealroom.co information, a complete of $2.4 billion was invested within the so-called sustainable aviation since 2016. “Underneath sustainable aviation, we embrace issues like electrical plane, plane batteries, and hydrogen plane; sustainable aviation fuels comparable to e-fuels and biofuels, in addition to new plane fashions, airships, and software program options for contrail avoidance,” he defined.

The startups that attracted many of the funding are creating electrical plane, hydrogen plane, e-fuels and biofuels. Biofuel is probably the most mature of those segments whereas electrical, hydrogen and e-fuels are rising.

“Funding peaked in 2022 at nearly $700 million earlier than dropping 50% to $337 million in 2023,” Chiavarini mentioned. “Apparently, early-stage investments stayed almost fixed from 2021 to 2023, greater than double the extent of any earlier yr. It enabled a robust early-stage startup scene that should show it will possibly scale within the subsequent few years. Additionally notable, Europe appears to have gained a share of innovation by each the quantity invested and the variety of rounds.”

Enterprise capital throughout all sectors decreased 38% from 2022 to 2023, totaling lower than half of the 2021 peak, even contemplating the hype about synthetic intelligence startups. “Sustainable aviation isn’t precisely mirroring the broader market, as it’s such an rising phase, particularly the applied sciences for electrical and hydrogen plane and e-fuels,” Chiavarini said.

The surge in new investments, nevertheless, needs to be taken with warning. “We’re very early in 2024,” mentioned Chiavarini. “It was primarily pushed by two very massive rounds, particularly Swedish startup Coronary heart Aerospace, which makes hybrid-electric regional plane, and Ineratec, a German firm that goals to make use of CO2 and inexperienced hydrogen as feedstock for artificial fuels and artificial chemical substances. I’d add that it is not uncommon to announce rounds in January that have been in actuality closed on the finish of the earlier yr. In any occasion, we’re seeing each late-stage and early-stage exercise, which is an effective signal.

In response to Dealroom.co, over 400 buyers have made at the very least one wager on sustainable aviation startups. Probably the most energetic based mostly on the variety of offers is Breakthrough Vitality Ventures, a fund backed by Microsoft founder Invoice Gates, with 8 investments from Sequence A to Sequence C, together with Coronary heart Aerospace, ZeroAvia, U.S.-based hydrogen plane developer, and Viridos, U.S.-based developer of microalgae biofuel.

JetBlue Know-how Ventures, the company enterprise arm of the US-based JetBlue Airways, is probably the most energetic company investor with 6 seed and collection A stage investments, together with Common Hydrogen, a U.S. supplier of end-to-end hydrogen flight options, and Electrical Energy Methods, a U.S. developer of batteries for electrical plane.

Along with the sustainable aviation exercise, Dealroom.co tracked $5.6 billion invested in electrical vertical takeoff and touchdown (eVTOL) and electrical City Air Mobility (UAM) startups since 2016. Most eVTOLs don’t contribute to the decarbonization of the aviation trade because of a predominant deal with only a few passengers, sometimes 2 to eight passengers, and restricted flight vary, sometimes lower than 300 km.

“They’re extra about enabling new mobility fashions in city and semi-urban areas, with use circumstances comparable to quick journeys to the airport from city facilities,” Chiavarini mentioned.

“They’re corresponding to the use circumstances of helicopters and short-distance personal jets in the present day, they usually cater to a rich buyer base. A couple of eVTOLs deal with longer ranges and extra passenger seats, so might contribute to decarbonizations, comparable to France-based Voltaero and US-based XTI Plane.”

The hope is that they’ll nonetheless contribute positively to the event of aviation by pushing ahead using rising applied sciences and making regulators extra comfy with certifying electrical plane. “However on their very own, they aren’t fixing any sustainability issues in aviation,” Chiavarini concluded.

This content material is protected by copyright and is probably not reused. If you wish to cooperate with us and want to reuse a few of our content material, please contact: editors@pv-magazine.com.