Within the first week of March, photo voltaic photovoltaic vitality manufacturing reached the very best every day worth for a March month in historical past in most main European electrical energy markets. This didn’t stop weekly common market costs from being greater than within the earlier week, supported by greater demand and fuel and CO2 costs, in addition to decrease wind vitality manufacturing in most markets. The MIBEL market registered the bottom costs once more and on Sunday, March 10, it reached the bottom value since February 2014.

Photo voltaic photovoltaic, photo voltaic thermoelectric and wind vitality manufacturing

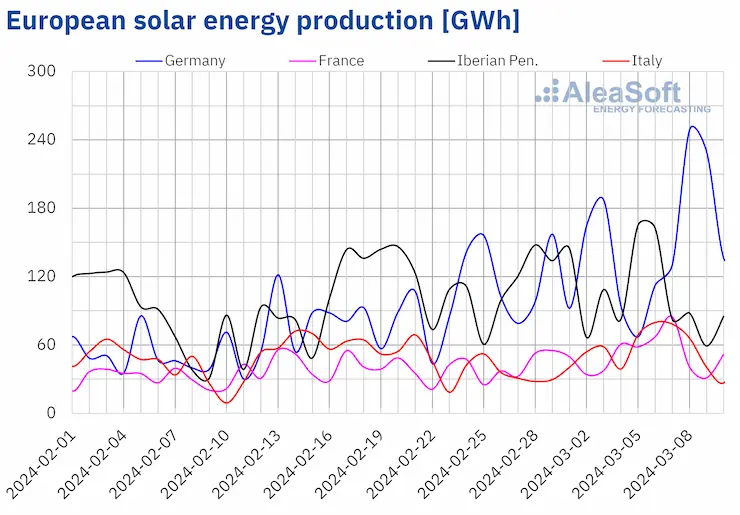

Within the week of March 4, photo voltaic vitality manufacturing elevated in most main European electrical energy markets in comparison with the earlier week. The Italian market skilled the biggest rise, 44%, reversing the downward development of the earlier two weeks. The German market registered the smallest enhance, 16%, rising persistently for the fourth consecutive week. Solely the Iberian Peninsula registered a lower in photo voltaic vitality manufacturing, by 6.5% in Portugal and 12% in Spain.

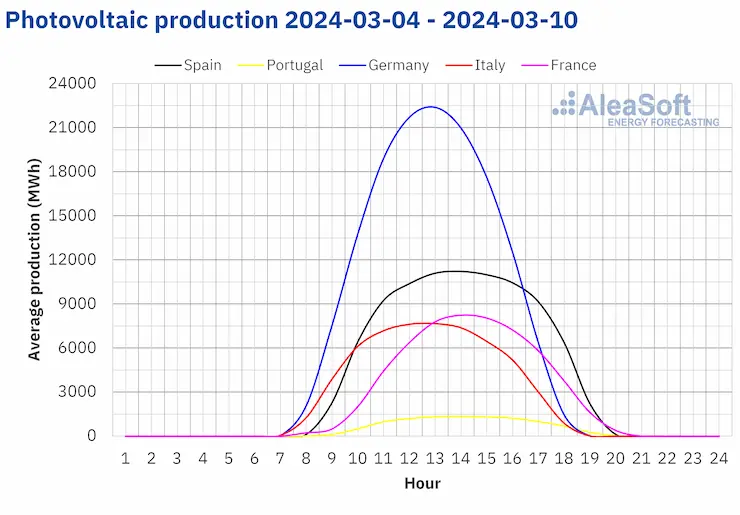

In most analyzed markets, there have been the very best every day photovoltaic vitality manufacturing ranges ever registered for a March month. The checklist begins with the German market, which produced 249 GWh on March 8, which can also be the very best worth since mid?September. The Spanish market generated 137 GWh on two days in a row, on March 5 and 6, a stage final seen in the summertime, on August 31. The French market generated 85 GWh on March 7, which can also be the very best worth for the reason that finish of September. The checklist is rounded off by Portugal, the place photo voltaic vitality manufacturing reached 13 GWh on March 5, barely under the information registered in February, however nonetheless the very best ever registered in a March month.

For the week of March 11, in line with AleaSoft Vitality Forecasting’s photo voltaic vitality manufacturing forecasts, this week’s upward development will proceed and photo voltaic vitality manufacturing will enhance in Germany, Spain and Italy.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

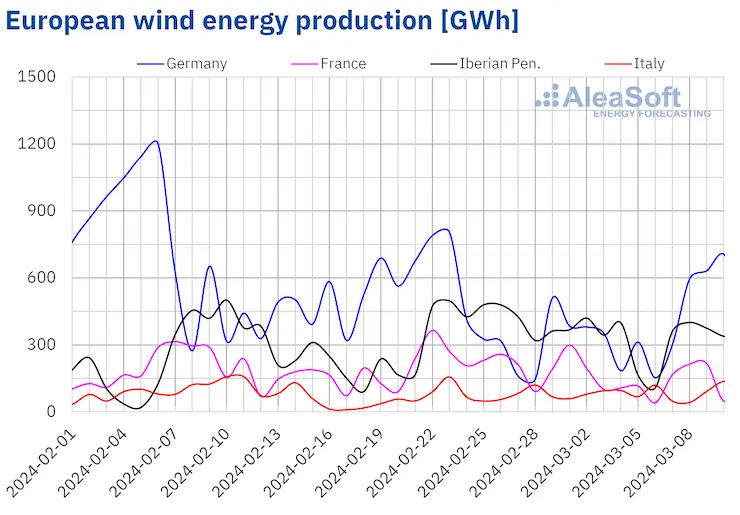

Within the week of March 4, wind vitality manufacturing decreased in most main European electrical energy markets in comparison with the earlier week. The French market registered the biggest decline, 32%, persevering with the development of the earlier week. The Portuguese market registered the smallest decline, 13%, reversing the will increase of the earlier two weeks. In distinction, wind vitality manufacturing in Germany elevated by 28%. The Italian market adopted the same development for the third consecutive week, this time with a 7.6% enhance.

For the week of March 11, AleaSoft Vitality Forecasting’s wind vitality manufacturing forecasts point out that the downward development will proceed within the Iberian Peninsula and France. Italy will even register a lower in wind vitality manufacturing, reversing the upward development of current weeks. Solely Germany will register will increase in wind vitality manufacturing.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

Electrical energy demand

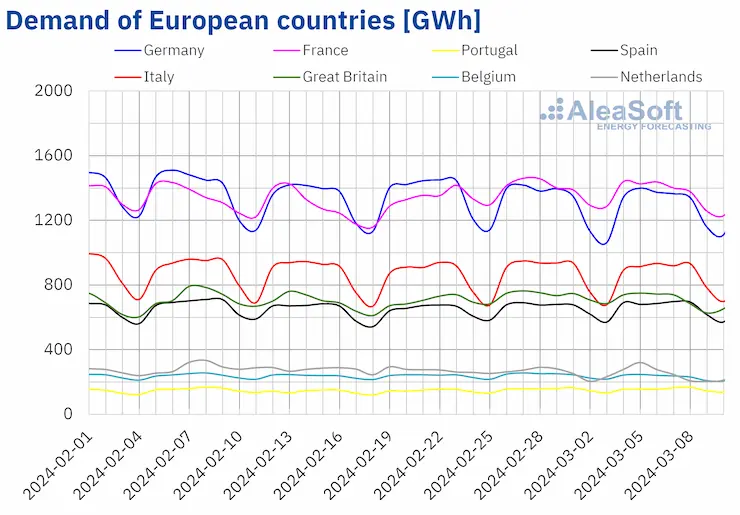

Within the week of March 4, electrical energy demand fell in most main European electrical energy markets on every week?on?week foundation, reversing the upward development of the earlier week. Falls ranged from 0.5% within the Italian and German markets to 4.7% within the Belgian market. Within the Dutch and German markets, demand fell for the fourth and second consecutive week, respectively. The Iberian Peninsula was the exception to the downward development noticed in the remainder of analyzed markets. The Portuguese and Spanish markets registered a rise in demand, for the third consecutive week, of 0.3% and 1.0%, respectively.

Within the first week of March, common temperatures decreased between 0.1 °C and 0.7 °C in comparison with the earlier week in most analyzed European markets. Solely in Nice Britain, Belgium and France common temperatures elevated between 0.5 °C and 0.9 °C.

For the week of March 11, in line with AleaSoft Vitality Forecasting’s demand forecasts, there can be a rise in Germany, Portugal, Nice Britain and the Netherlands, reversing most often the downward development of the earlier week. In distinction, demand will fall within the French, Spanish, Italian and Belgian markets.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ENTSO-E, RTE, REN, REE, TERNA, Nationwide Grid and ELIA.

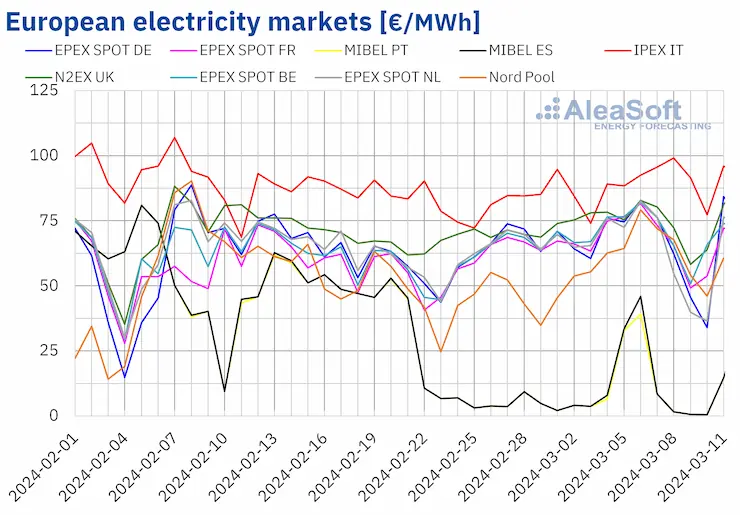

European electrical energy markets

In the course of the week of March 4, common costs of the principle European electrical energy markets continued to extend. The exception was the EPEX SPOT market of Germany and the Netherlands, with falls of 4.1% and seven.0%, respectively. In distinction, the MIBEL market of Spain and Portugal, which had registered declines the earlier week, reached the biggest proportion value rises, because of the low costs registered on this market, particularly within the final week of February. The typical of the Portuguese market elevated by 183% and that of the Spanish market by 211%, though the weekly averages have been €12.81/MWh and €14.10/MWh, respectively. In the remainder of the markets analyzed at AleaSoft Vitality Forecasting, costs elevated between 1.1% within the N2EX market of the UK and 31% within the Nord Pool market of the Nordic international locations.

Regardless of these will increase, within the first week of March, weekly averages remained under €70/MWh in most analyzed European electrical energy markets. The exceptions have been the Belgian market, the British market and the IPEX market of Italy, with averages of €70.44/MWh, €73.03/MWh and €90.51/MWh, respectively. In distinction, the Portuguese and Spanish markets registered the bottom weekly costs once more, €12.81/MWh and €14.10/MWh, respectively. In the remainder of the analyzed markets, costs ranged from €62.63/MWh within the Dutch market to €67.79/MWh within the French market.

Relating to hourly costs, on March 9 and 10, the German market registered 7 hours with unfavorable costs. The Dutch market additionally registered 11 hours with unfavorable costs from March 8 to 10. The bottom hourly value, ?€39.79/MWh, was reached within the Dutch market on March 9, from 13:00 to 14:00. This value was the bottom on this market for the reason that first half of August 2023. Then again, regardless of the rise within the weekly common, the mix of excessive renewable vitality manufacturing and low demand additionally led to low costs within the MIBEL market. On this case, from March 8 to 10, there have been 38 hours with a value of €0/MWh. Within the case of every day costs, on Sunday, March 10, the MIBEL market of Spain and Portugal averaged €0.54/MWh. This value was the bottom since February 2014 within the Iberian market.

In the course of the week of March 4, the rise within the common value of fuel and CO2 emission rights led to greater costs in European electrical energy markets. The decline in wind vitality manufacturing in most analyzed markets additionally contributed to this conduct. Within the case of the MIBEL market, furthermore, photo voltaic vitality manufacturing fell and electrical energy demand elevated. Then again, the rise in wind and photo voltaic vitality manufacturing in Germany contributed to decrease costs in that market.

AleaSoft Vitality Forecasting’s value forecasts point out that within the second week of March value will increase would possibly proceed in European electrical energy markets. The autumn in wind vitality manufacturing in most markets and the rise in demand in a few of them will result in this conduct.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from OMIE, EPEX SPOT, Nord Pool and GME.

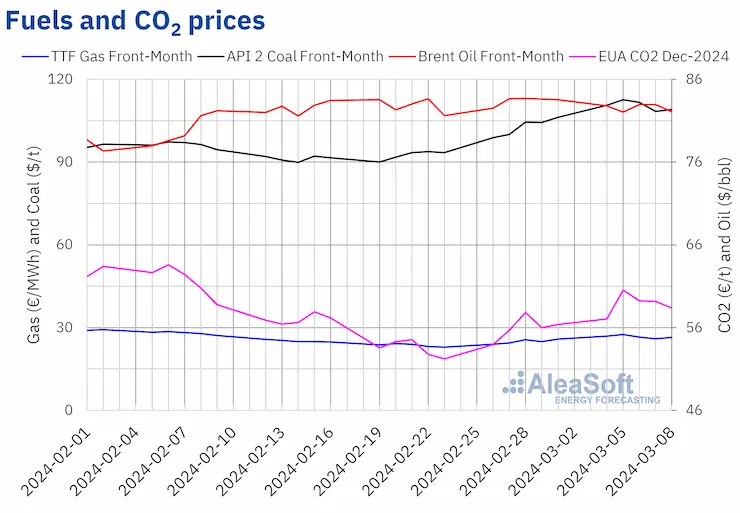

Brent, fuels and CO2

Within the first week of March, settlement costs of Brent oil futures for the Entrance?Month within the ICE market remained under $83/bbl. Costs declined to register the weekly minimal settlement value, $82.04/bbl, on Tuesday, March 5. Subsequently, on March 6 and seven, the settlement value was $82.96/bbl, the very best of the week. On Friday, the settlement value dropped once more. It was $82.08/bbl, 1.8% decrease than on the earlier Friday.

Within the first week of March, considerations about demand evolution in China exerted a downward affect on Brent oil futures costs. Nonetheless, instability within the Center East and manufacturing cuts by OPEC+ member international locations helped to maintain settlement costs above $82/bbl.

As for TTF fuel futures within the ICE marketplace for the Entrance?Month, settlement costs elevated to achieve their weekly most settlement value, €27.47/MWh, on Tuesday, March 5. In keeping with information analyzed at AleaSoft Vitality Forecasting, this value was 13% greater than the earlier Tuesday and the very best within the final 4 weeks. In distinction, on Thursday, March 7, these futures registered their weekly minimal settlement value, €25.99/MWh. On Friday, costs recovered and, within the final session of the week, the settlement value was €26.39/MWh, 2.3% greater than the earlier Friday.

Within the first week of March, provide considerations because of delays within the return to full operation of the Freeport liquefied pure fuel export plant exerted an upward affect on TTF fuel futures costs. Nonetheless, excessive ranges of European reserves allowed costs to stay under €28/MWh.

As for CO2 emission rights futures within the EEX market for the reference contract of December 2024, the upward development began on the finish of the earlier week continued till Tuesday, March 5. On that day, these futures registered their weekly most settlement value, €60.54/t. In keeping with information analyzed at AleaSoft Vitality Forecasting, this was the one event when settlement costs exceeded €60/t within the final 4 weeks. In the remainder of the periods of the primary week of March, costs declined. Because of this, on Friday, March 8, the settlement value was €58.39/t, nonetheless 3.6% greater than the earlier Friday’s value.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ICE and EEX.

AleaSoft Vitality Forecasting’s evaluation on the prospects for vitality markets in Europe and the financing and valuation of renewable vitality tasks

Subsequent Thursday, March 14, AleaSoft Vitality Forecasting and AleaGreen will maintain their third webinar of 2024, the 12 months of the 25th anniversary of the inspiration of AleaSoft Vitality Forecasting. On this event, visitor audio system from EY will take part for the fourth time within the month-to-month webinar collection. The webinar will analyze the prospects for European vitality markets, regulation, financing of renewable vitality tasks, PPA, self?consumption, portfolio valuation, the inexperienced hydrogen public sale and the Innovation fund.