Join every day information updates from CleanTechnica on electronic mail. Or comply with us on Google Information!

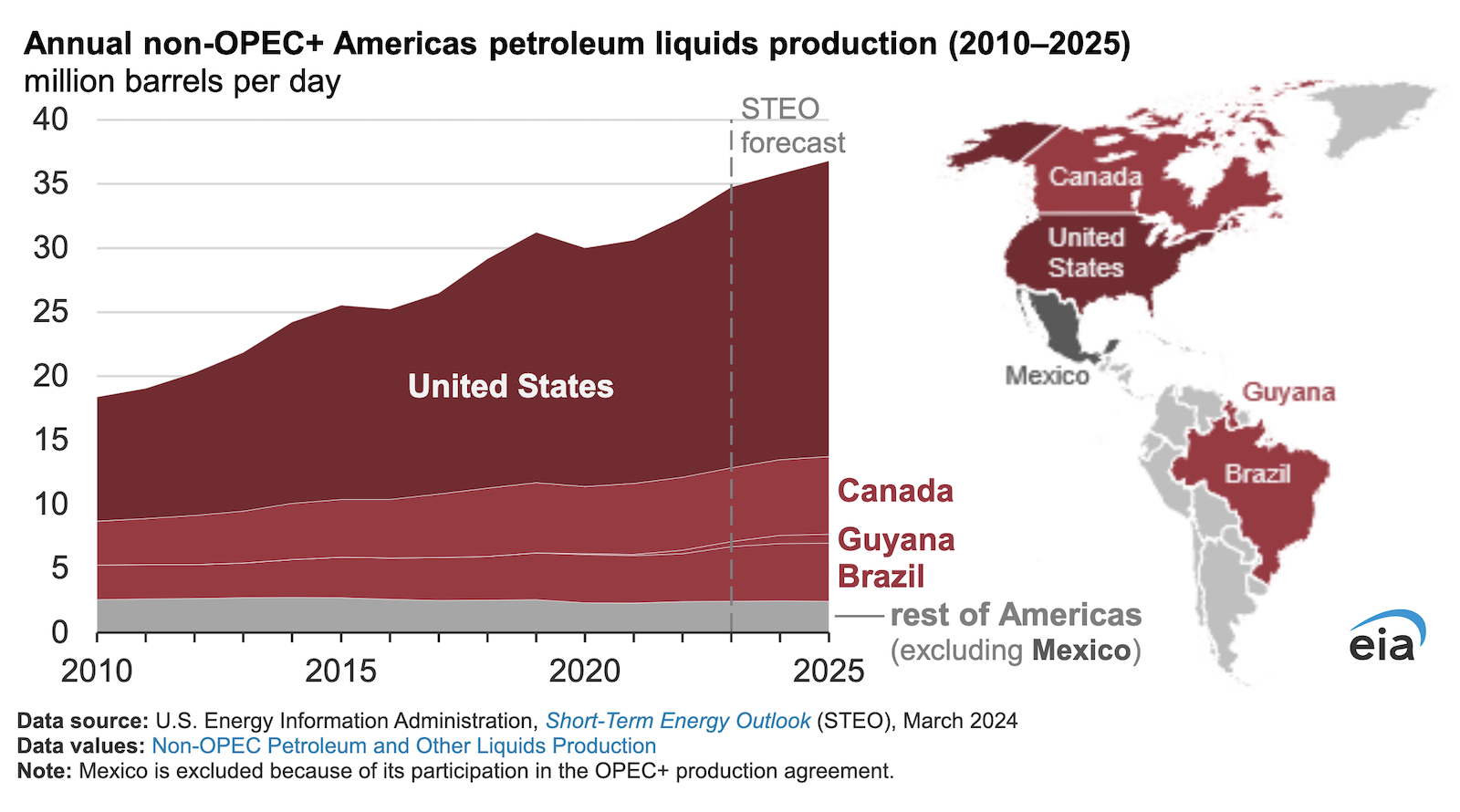

In 2023, the world produced an estimated 101.8 million barrels per day (b/d) of petroleum and different liquids: largely crude oil but in addition lease condensate, pure fuel liquids, biofuels, and different liquids from hydrocarbon sources. We anticipate the worldwide petroleum and different liquids provide to extend by about 0.4 million b/d in 2024 and a couple of.0 million b/d in 2025. This development will likely be pushed primarily by rising crude oil manufacturing from 4 international locations within the Americas—america, Guyana, Canada, and Brazil—which might partially offset near-term voluntary manufacturing cuts in 2024 that we anticipate from international locations taking part within the OPEC+ settlement.

Collectively, OPEC+ international locations accounted for 43% (43.7 million b/d) of world liquids manufacturing in 2023. We forecast that OPEC+ petroleum liquids manufacturing will fall by 1.0 million b/d this 12 months after which improve by 0.9 million b/d in 2025 after most current manufacturing cuts expire. We assume OPEC+ members will keep some voluntary manufacturing cuts by way of 2025 to offset sluggish demand development. The OPEC+ manufacturing targets are based mostly on crude oil volumes fairly than all petroleum liquids, and we anticipate the crude oil portion of manufacturing in these international locations to say no by 1.1 million b/d in 2024 after which improve by 0.9 million b/d in 2025.

Complete petroleum liquids manufacturing exterior of OPEC+ grows by 1.4 million b/d in 2024 and one other 1.1 million b/d in 2025 in our forecast. Though we anticipate most of this development will come from america, we anticipate petroleum liquids manufacturing in Canada, Brazil, and Guyana to every improve by 0.3 million b/d by way of 2025, which limits important upward crude oil worth strain in our forecast. Mexico is the one nation within the Americas that participates in OPEC+ agreements, so these agreements have little affect on manufacturing within the Americas. Though Venezuela is an OPEC member, it’s exempt from the OPEC+ settlement, and Ecuador left OPEC in 2020.

Crude oil costs over the previous 20 years have been sufficiently excessive to drive the long-term improvement and completion of initiatives within the Americas. A few of these initiatives embody oil sands manufacturing in Canada and floating manufacturing and storage offshore vessels off the coasts of Brazil and Guyana. Latest crude oil costs have additionally supported the technological change that has elevated crude oil manufacturing from tight oil formations in america.

4 international locations account for greater than 80% of world provide development in our forecast

The USA continues to provide extra crude oil and petroleum liquids than every other nation. After falling to lower than 10.0 million b/d in mid-2020, U.S. crude oil manufacturing elevated to 13.3 million b/d in late 2023 on account of elevated drilling effectivity. Regardless of a short decline in early 2024 because of winter climate disruptions, we anticipate manufacturing of petroleum liquids in america to extend by 0.4 million b/d in 2024 and by 0.8 million b/d in 2025.

Canada’s crude oil manufacturing has additionally grown steadily over the past decade, pushed by the event of oil sands manufacturing in Alberta. Most just lately, nonetheless, development on this area has slowed due to distribution bottlenecks limiting the flexibility to maneuver the crude oil past home refining markets, together with to refiners alongside the U.S. Gulf Coast. The Trans Mountain Enlargement (TMX) pipeline undertaking, which may come on line this 12 months, is designed to extend Canada’s entry to international crude oil markets from ports on the Pacific Coast.

Commerce press sources point out the TMX pipeline is sort of full and that the Trans Mountain Company plans to carry it on line someday within the first half of 2024. We anticipate almost 600,000 b/d of latest takeaway capability—which can successfully triple the area’s present takeaway capability—will cut back the present low cost for Canada’s crude oil and drive elevated manufacturing.

In Brazil, plenty of important offshore oil discoveries are in improvement, which is rising crude oil manufacturing within the nation. Floating manufacturing and storage offshore (FPSO) vessels within the pre-salt fields of Tupi, Buzios, and Sapinhoá within the Santos Basin, as nicely the current start-up of FPSO manufacturing from the Mero subject within the Campos Basin within the South Atlantic, have elevated manufacturing. Petrobras (Brazil’s nationwide oil firm) has introduced plans for 11 new FPSO vessels by way of 2027. We anticipate a number of of those to be on line and rising Brazil’s manufacturing by way of 2025.

Guyana has elevated its oil manufacturing remarkably in its very quick historical past as a significant oil producer. After first discovering crude oil in 2015 and starting manufacturing in late 2019, the speedy improvement of the Liza undertaking and, extra just lately, the Payara undertaking elevated Guyana’s crude oil manufacturing to 645,000 b/d in early 2024, in accordance with Exxon estimates. We forecast the start-up of the Yellowtail undertaking will assist improve Guyana’s petroleum liquids manufacturing by an extra 100,000 b/d in 2025, and Guyana’s whole petroleum liquids manufacturing will exceed 0.8 million b/d in fourth-quarter 2025.

Undertaking delays and transit points may have an effect on international provide and commerce flows

A lot of the expansion in oil manufacturing in these international locations is the results of long-term initiatives which have been in improvement for a number of years and, subsequently, we assume are prone to come on line earlier than the top of 2025. The precise timing of any undertaking’s start-up, nonetheless, is much less sure as a result of points round allowing, capital necessities, technical hurdles, or different unexpected delays are doable.

As well as, altering international commerce flows may have an effect on the flexibility of those new sources to achieve international markets. Particularly, the ongoing assaults on ships in or close to the Purple Sea are affecting commerce routes and, in the event that they escalate, they may restrict the flexibility to freely or economically transfer oil to international markets. Equally, ongoing developments round comparatively low water ranges within the Panama Canal, which have been easing, may have an effect on commerce flows, The supply of the Panama Canal transport channel is essential to ensure that many of those crude oil barrels to effectively attain international markets.

Principal contributor: Sean Hill

Initially on U.S. EIA’s At this time in Power.

Have a tip for CleanTechnica? Wish to promote? Wish to counsel a visitor for our CleanTech Discuss podcast? Contact us right here.

Newest CleanTechnica TV Video

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.