European electrical energy market costs resist rising fuel and CO2 costs due to renewable power.

Within the third week of March, European electrical energy market costs remained at comparable ranges to these of earlier weeks. In most of them, the weekly common decreased in comparison with the earlier week as a result of low costs registered on the finish of the week on account of excessive wind power manufacturing and decrease demand on these days. Photo voltaic power manufacturing elevated in most markets, reaching the all?time file of day by day photovoltaic power manufacturing for a March month in France and Italy. Fuel and CO2 costs elevated.

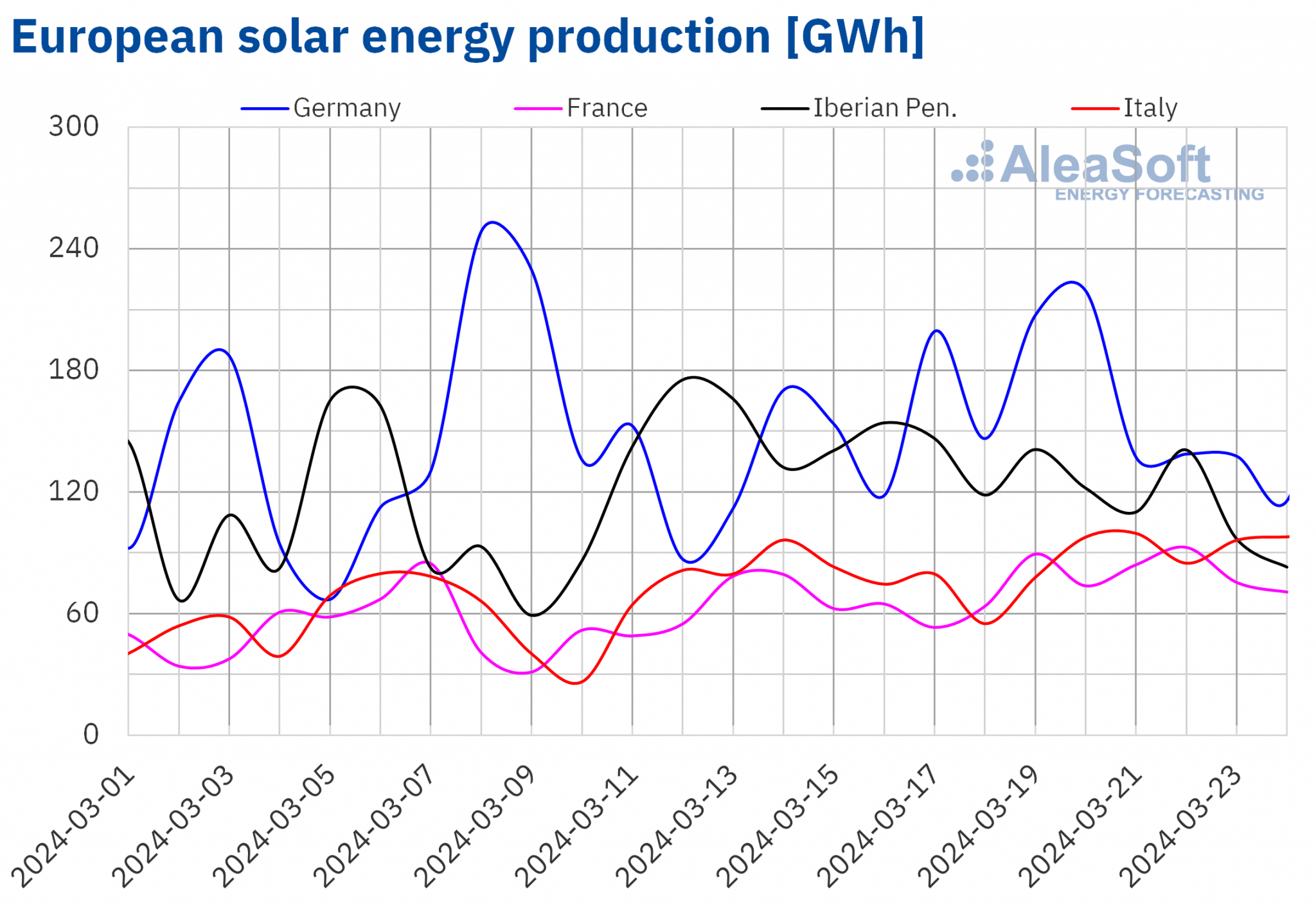

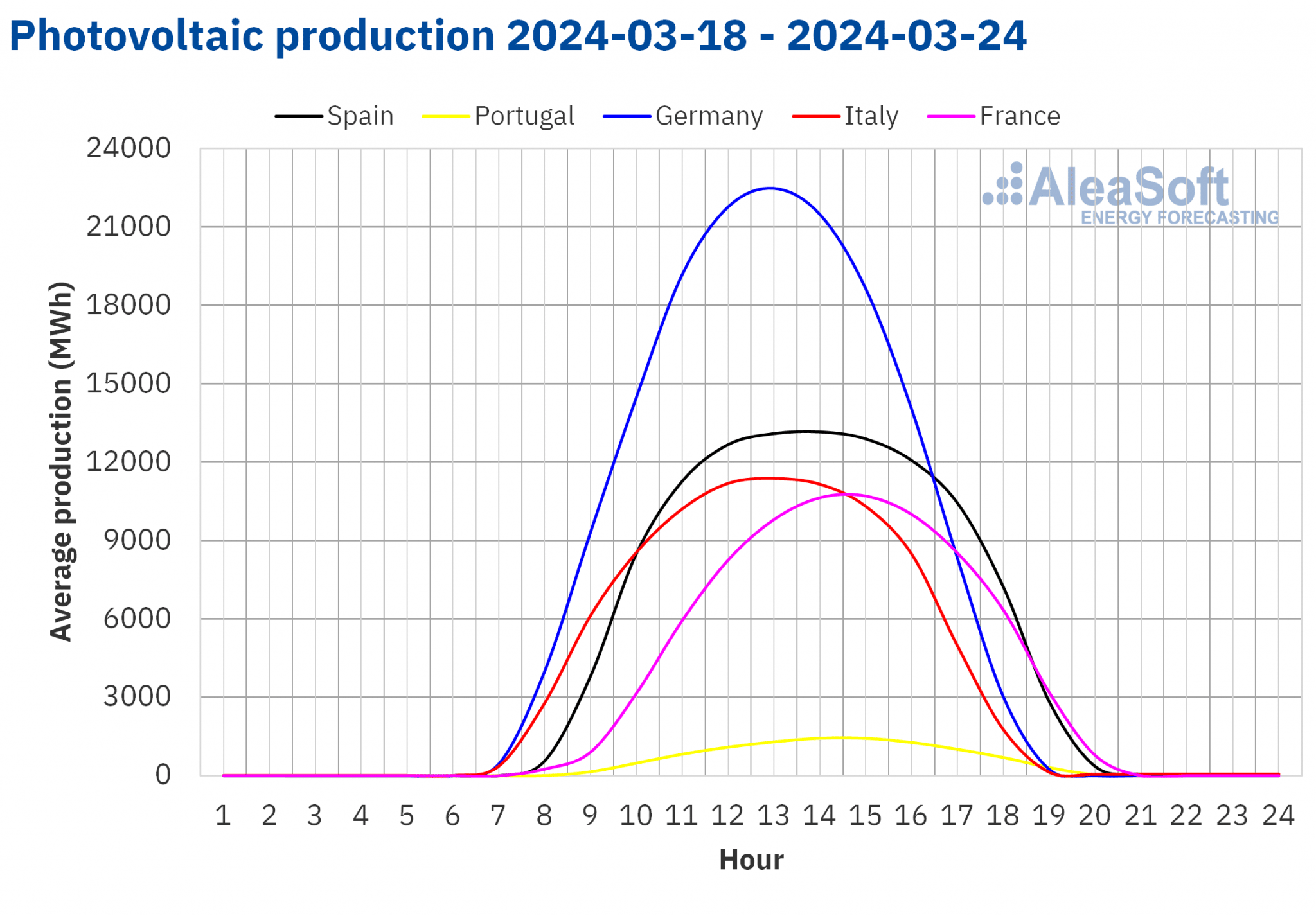

Photo voltaic photovoltaic, photo voltaic thermoelectric and wind power manufacturing

Within the week of March 18, photo voltaic power manufacturing elevated in most main European electrical energy markets in comparison with the earlier week. The French market registered the biggest improve, 24%, sustaining the upward development for the fourth consecutive week. The Italian market registered the smallest improve, 9.0%, persevering with its upward development for the third week. These two markets registered the very best ranges of day by day photo voltaic photovoltaic power manufacturing for a March month ever. On March 21, the Italian market produced 99 GWh and sooner or later later the French market generated 93 GWh. Each markets final reached these manufacturing ranges within the first half of September. Within the German market, photo voltaic power manufacturing additionally rose, on this case by 11%.

Within the Iberian Peninsula, nonetheless, photo voltaic power manufacturing fell by 23%, reversing the upward development of the earlier week.

For the week of March 25, in response to AleaSoft Vitality Forecasting’s photo voltaic power manufacturing forecasts, the upward development will proceed within the German market. In Spain and Italy, photo voltaic power manufacturing will fall.

Supply: Ready by AleaSoft Vitality Forecasting utilizing knowledge from ENTSO-E, RTE, REN, REE and TERNA.

Supply: Ready by AleaSoft Vitality Forecasting utilizing knowledge from ENTSO-E, RTE, REN, REE and TERNA.

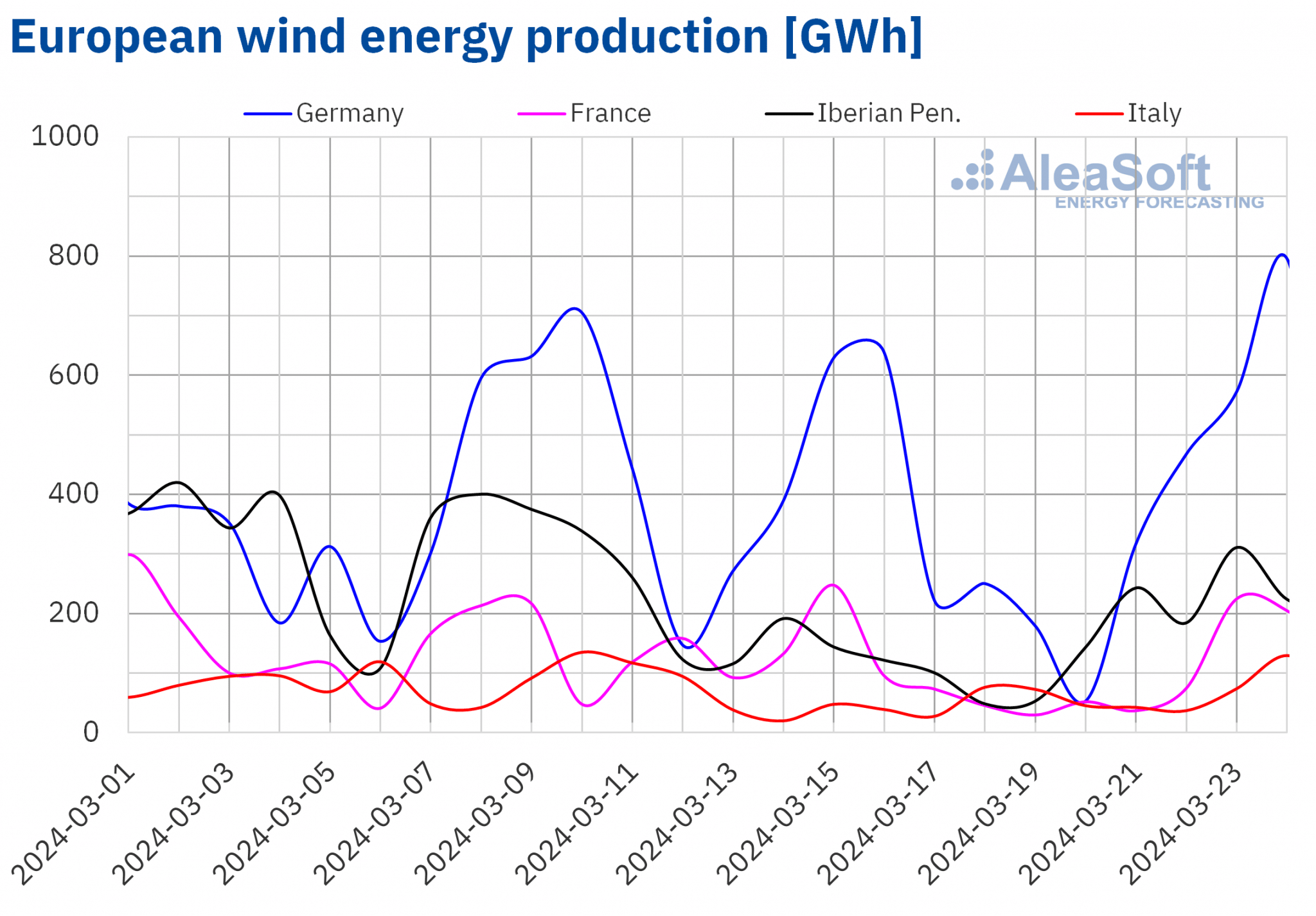

Within the week of March 18, wind power manufacturing elevated in most main European markets in comparison with the earlier week, reversing the downward development of the earlier week. Will increase ranged from 14% within the Iberian market to 24% within the Italian market. In distinction, within the French and German markets, wind power technology fell by 27% and three.9%, respectively.

Regardless of the weekly decline, the German market generated 796 GWh of wind power on Sunday, March 24, the very best day by day worth within the final 4 weeks.

Throughout the week of March 25, in response to AleaSoft Vitality Forecasting’s wind power manufacturing forecasts, manufacturing utilizing this expertise will proceed the upward development with will increase in Spain, Portugal, Italy and France. In Germany, nonetheless, wind power manufacturing will decline.

Supply: Ready by AleaSoft Vitality Forecasting utilizing knowledge from ENTSO-E, RTE, REN, REE and TERNA.

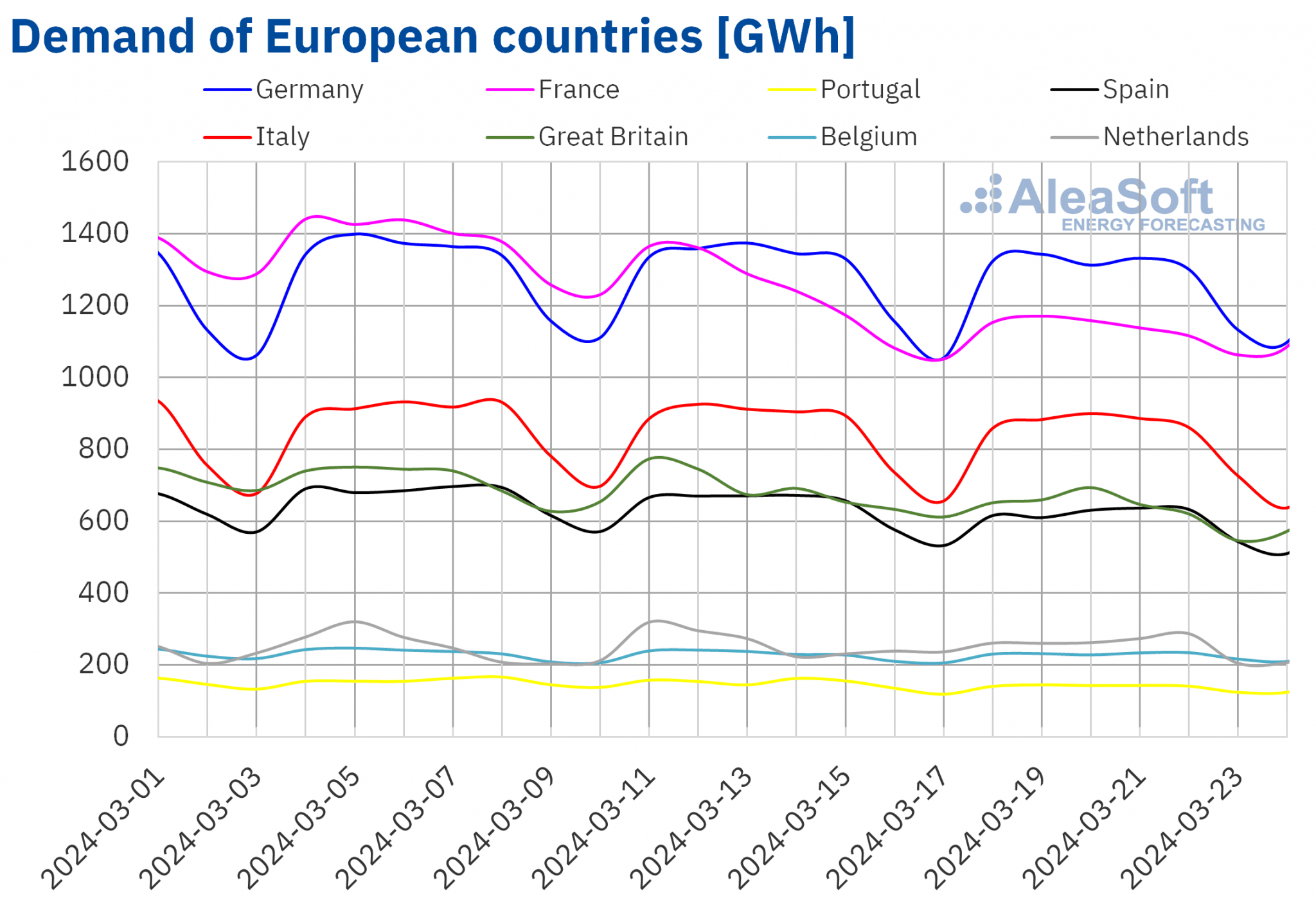

Electrical energy demand

Within the week of March 18, electrical energy demand fell in all main European electrical energy markets on every week?on?week foundation, persevering with the downward development of earlier weeks. The Nice Britain market registered the biggest decline, 8.2%, and the Belgian market the smallest, 0.4%. In each circumstances, this was the third consecutive week of declines. In Germany and the Iberian Peninsula, demand fell for the fourth and second consecutive week, respectively. Within the case of the Dutch market, the upward development registered the earlier week reversed within the week of March 18.

Throughout the third week of March, common temperatures elevated in Southern Europe and France, between 1.0 °C and a pair of.6 °C. In the remainder of the markets, common temperatures decreased between 0.7 °C in Germany and 0.1 °C in Belgium.

For the week of March 25, in response to AleaSoft Vitality Forecasting’s demand forecasts, the downward development will proceed in Germany, Spain, Italy and the Netherlands. In distinction, demand will improve in France, Portugal, Nice Britain and Belgium.

Supply: Ready by AleaSoft Vitality Forecasting utilizing knowledge from ENTSO-E, RTE, REN, REE, TERNA, Nationwide Grid and ELIA.

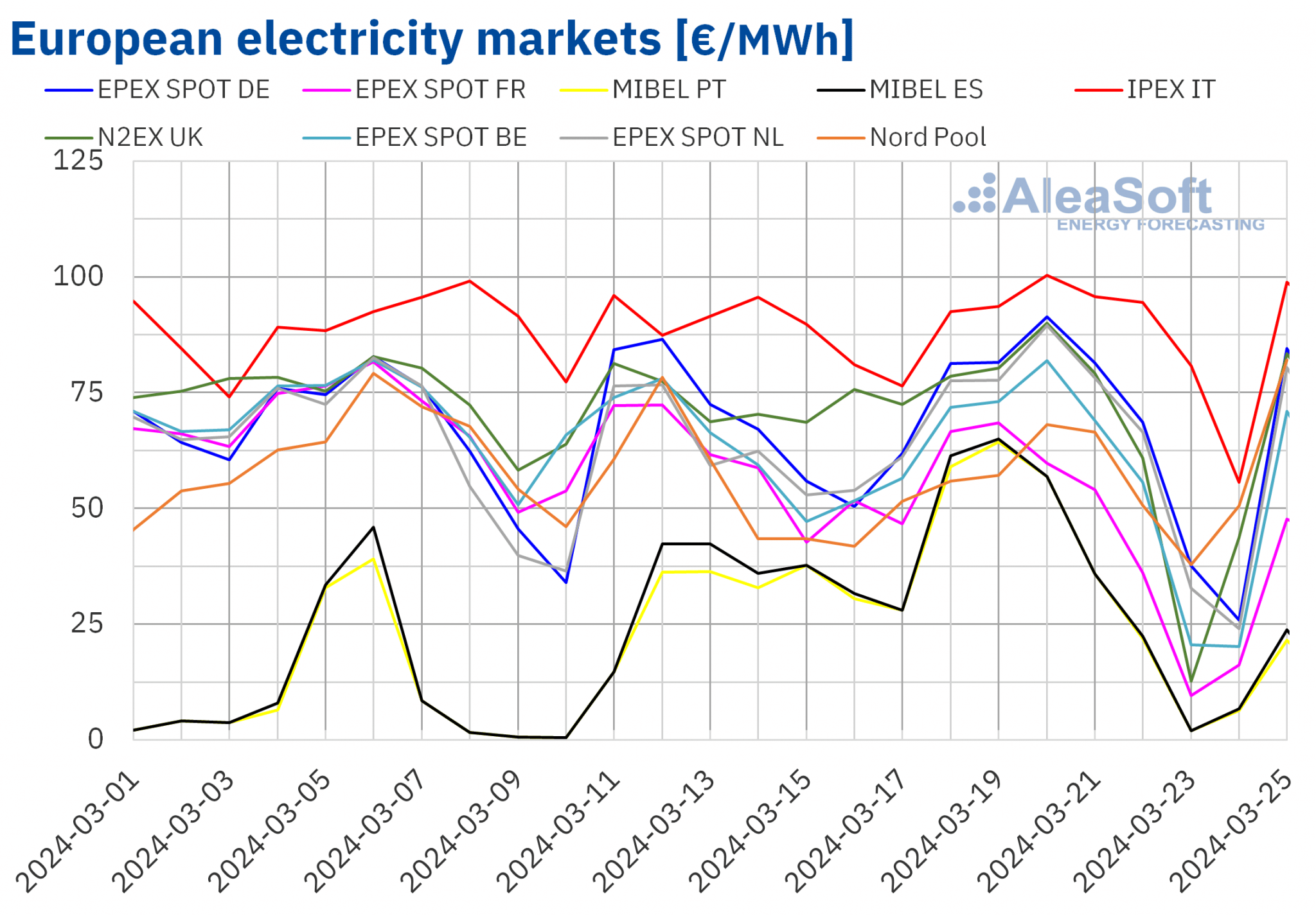

European electrical energy markets

Between Monday and Wednesday of the third week of March, costs in the primary European electrical energy markets elevated, though they remained at ranges much like these of latest weeks. Throughout the second half of the week, costs decreased beneath the affect of elevated wind power manufacturing and decrease demand over the weekend. Consequently, weekly averages fell in most markets in comparison with the earlier week. Nonetheless, within the EPEX SPOT market of the Netherlands, the Nord Pool market of the Nordic nations and the MIBEL market of Spain and Portugal, common costs elevated by 0.8%, 1.8%, 7.6% and 14%, respectively. In the remainder of the markets analyzed at AleaSoft Vitality Forecasting, costs decreased between 0.7% within the IPEX market of Italy and 24% within the EPEX SPOT market of France.

Within the week of March 18, weekly averages remained beneath €65/MWh in most analyzed European electrical energy markets. The exceptions had been the German and Italian markets, with averages of €66.79/MWh and €87.59/MWh, respectively. In distinction, the Portuguese and Spanish markets registered the bottom weekly averages, for the seventh consecutive week, €35.20/MWh and €35.76/MWh, respectively. In the remainder of analyzed markets, costs ranged from €44.37/MWh within the French market to €63.74/MWh within the Dutch market.

As for hourly costs, on Saturday, March 23, the German, Belgian, British, French and Dutch markets registered unfavorable costs. The latter market reached the bottom value, ?€10.00/MWh, from 13:00 to 14:00. On Sunday, March 24, there have been no unfavorable costs, however these markets registered hourly costs of €0/MWh. The Iberian market additionally registered costs of €0/MWh throughout 22 hours on March 23 and 24.

Throughout the week of March 18, the final decline in electrical energy demand exerted its downward affect on European electrical energy market costs. Within the case of Italy, the rise in wind power manufacturing additionally helped to decrease costs. As well as, photo voltaic power manufacturing elevated in most analyzed markets. Nonetheless, within the MIBEL market, manufacturing utilizing this expertise decreased, contributing to the worth improve on this market.

AleaSoft Vitality Forecasting’s value forecasts point out that within the fourth week of March costs may lower in most analyzed European electrical energy markets, influenced by elevated wind power manufacturing in most markets and decrease demand in some circumstances.

Supply: Ready by AleaSoft Vitality Forecasting utilizing knowledge from OMIE, EPEX SPOT, Nord Pool and GME.

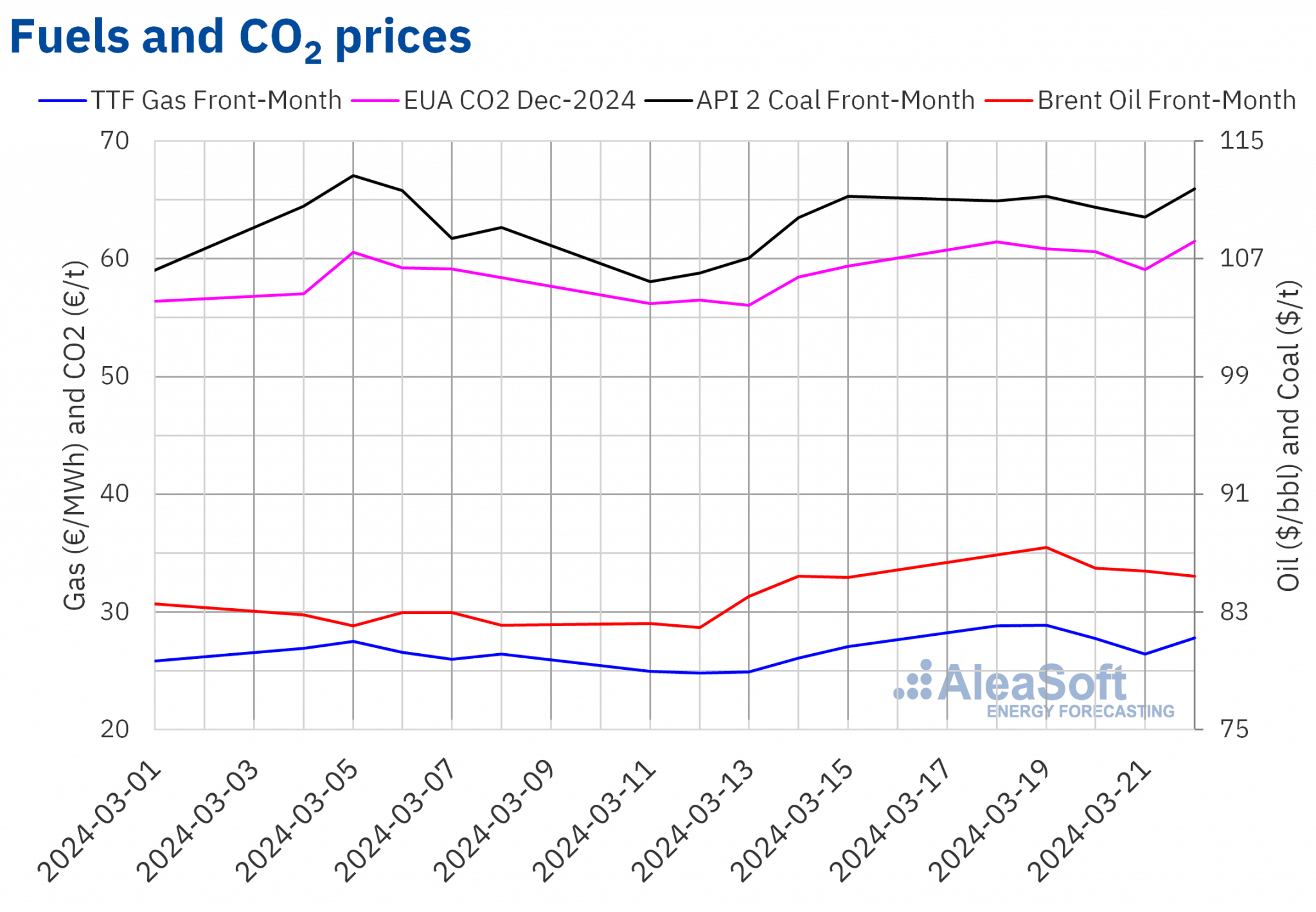

Brent, fuels and CO2

Settlement costs of Brent oil futures for the Entrance?Month within the ICE market elevated within the first two classes of the third week of March. On Tuesday 19, they reached the weekly most settlement value, $87.38/bbl. In line with knowledge analyzed at AleaSoft Vitality Forecasting, this value was 6.7% increased than the earlier Tuesday and the very best since late October 2023. As of Wednesday, costs declined. Consequently, these futures reached their weekly minimal settlement value, $85.43/bbl, on Friday, March 22. This value was solely 0.1% increased than the earlier Friday.

OPEC+ manufacturing cuts, in addition to assaults on Russian refineries, contributed to the rise in Brent oil futures costs within the first classes of the third week of March. Nonetheless, the Center East peace negotiations and the choice to keep up rates of interest in the USA exerted their downward affect on costs within the final classes of the week. The potential for value cuts in Russian oil additionally contributed to cost declines.

As for TTF fuel futures within the ICE marketplace for the Entrance?Month, within the third week of March they continued the upward development of the earlier week to achieve the weekly most settlement value, €28.87/MWh, on Tuesday, March 19. In line with knowledge analyzed at AleaSoft Vitality Forecasting, this value was 17% increased than the earlier Tuesday and the very best since early February. In distinction, these futures registered their weekly minimal settlement value, €26.40/MWh, on Thursday, March 21. This settlement value was nonetheless 1.4% increased than the earlier Thursday. Within the final session of the week, the settlement value elevated by 5.2% from the day prior to this to €27.78/MWh.

Within the third week of March, provide considerations continued to drive up costs, which remained restricted by the excessive ranges of European reserves. Nonetheless, the assault on a Ukrainian fuel storage infrastructure over the weekend may exert its upward affect on costs within the coming days, as a number of European nations retailer fuel in Ukraine.

As for settlement costs of CO2 emission rights futures within the EEX market for the reference contract of December 2024, in the course of the third week of March, they remained above €60/t in nearly all classes. The exception was Thursday, March 21. On that day, these futures registered their weekly minimal settlement value, €59.07/t. However, on Friday, March 22, they registered the weekly most settlement value, €61.51/t. In line with knowledge analyzed at AleaSoft Vitality Forecasting, this value was 3.6% increased than the earlier Friday and the very best because the first half of February.

Supply: Ready by AleaSoft Vitality Forecasting utilizing knowledge from ICE and EEX.

AleaSoft Vitality Forecasting’s evaluation on the prospects for power markets in Europe and the renewable power tasks financing

Coherent and high quality lengthy?time period value curve forecasts are important for renewable power builders. After the fuel value disaster, present electrical energy market costs could have an effect on these builders who used overly optimistic forecasts to get higher financing situations. In early April, AleaSoft Vitality Forecasting and AleaGreen will replace lengthy?time period value forecasts bearing in mind market evolution in the course of the first three months of the yr.

On Thursday, April 11, AleaSoft Vitality Forecasting and AleaGreen will maintain the 43rd webinar of their month-to-month webinar collection and the fourth in 2024, the yr of the 25th anniversary of the inspiration of AleaSoft Vitality Forecasting. On this event, the visitor speaker can be Raúl García Posada, Director at ASEALEN, the Spanish Vitality Storage Affiliation, who will take part for the third time within the month-to-month webinars. The April 2024 webinar will analyze the regulation, the present scenario and the prospects for power storage for the approaching months.