GE Hitachi Nuclear Power (GEH) is forming a gaggle of certified provide chain corporations to assist make sure the deployment of its BWRX-300 small nuclear modular reactor (SMR). The transfer comes as energy corporations vie for parts amid a provide chain pressure that has led some sectors to delay vital infrastructure tasks and ramped up competitors for scarce assets and long-lead parts.

GEH on April 29 stated the aim of the provider group “is to assist guarantee a dependable, cost-effective, and progressive course of for the manufacture and commercialization of the BWRX-300. “Provider collaboration is predicted to assist construct capability and help value discount, challenge schedule objectives, and scalability as we deploy the BWRX-300 globally,” famous GEH president and CEO Jay Wileman on Monday.

Suppliers Will Meet Pre-Outlined Standards

GEH’s provider group will comprise suppliers “who meet pre-defined standards, buyer necessities and reveal a willingness to spend money on BWRX-300 provide chain capabilities are eligible for choice to the group,” the corporate added.

The primary firm to affix the group is BWXT Canada, a subsidiary of Lynchburg, Virginia–based mostly manufacturing and engineering agency BWXT Applied sciences. On April 19, BWXT introduced a notable C$80 million ($58.4 million) funding to broaden a producing plant in Cambridge, Ontario, the place it designs and manufactures giant and heavy nuclear parts. The enlargement will help “ongoing and anticipated clients’ investments in [SMRs], conventional large-scale nuclear and superior reactors, in Canada and around the globe,” it famous. The funding is predicted to “improve capability considerably, enhance productiveness, and create greater than 200 long-term jobs for expert employees, engineers, and help employees within the space,” the agency stated.

On Monday, John MacQuarrie, president of BWXT Industrial Operations, famous the anticipated world demand for nuclear energy was a “important issue” in BWXT’s choice to broaden the manufacturing facility. “Our plans to extend the positioning’s manufacturing capability by 50% for giant parts and to spend money on superior manufacturing tools over the subsequent few years will additional place our enterprise to assist ship the BWRX-300 and different reactor applied sciences for our clients around the globe,” he added.

One other Massive Step for the BWRX-300

The announcement marks a big strategic step for GE Hitachi, a three way partnership between GE Vernova and Hitachi (the place GE Vernova owns the bulk curiosity exterior of service operations in Japan), signaling its dedication to the way forward for the BWRX-300 challenge.

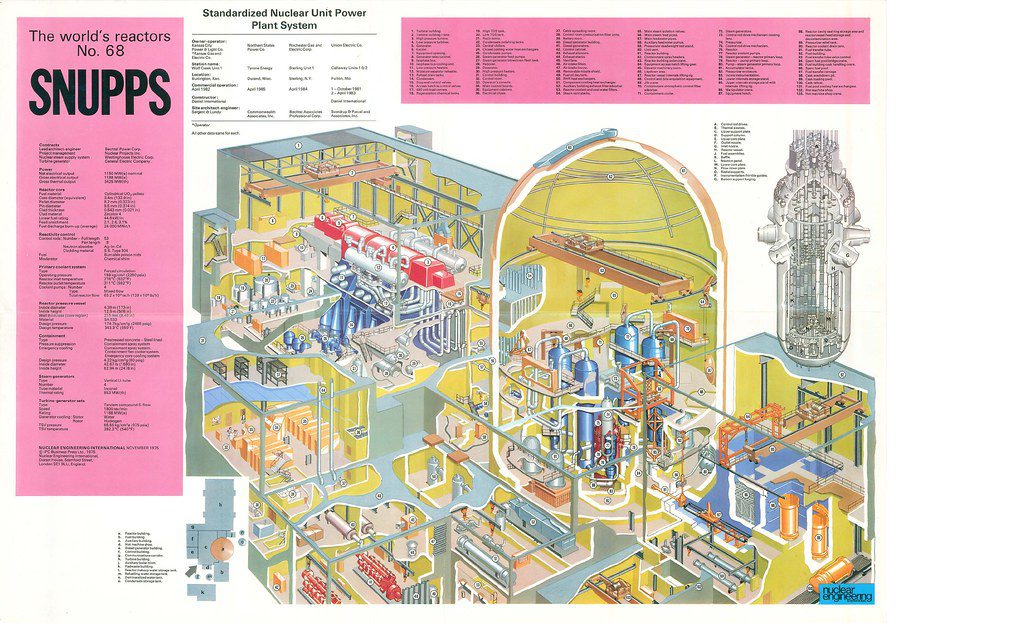

The BWRX-300, GEH’s flagship SMR, is the tenth evolution of GE’s boiling water reactor (BWR) design. The design is predicated on the Gen III+ 1,520-MW ESBWR, which the Nuclear Regulatory Fee (NRC) licensed in 2014.

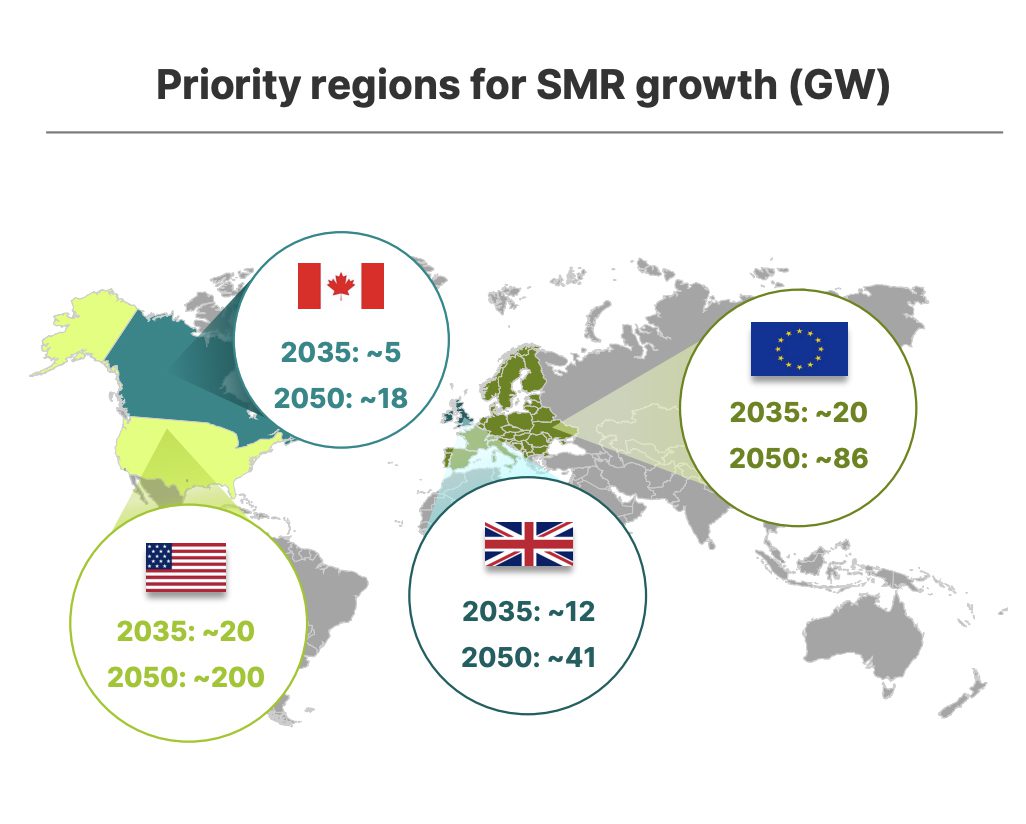

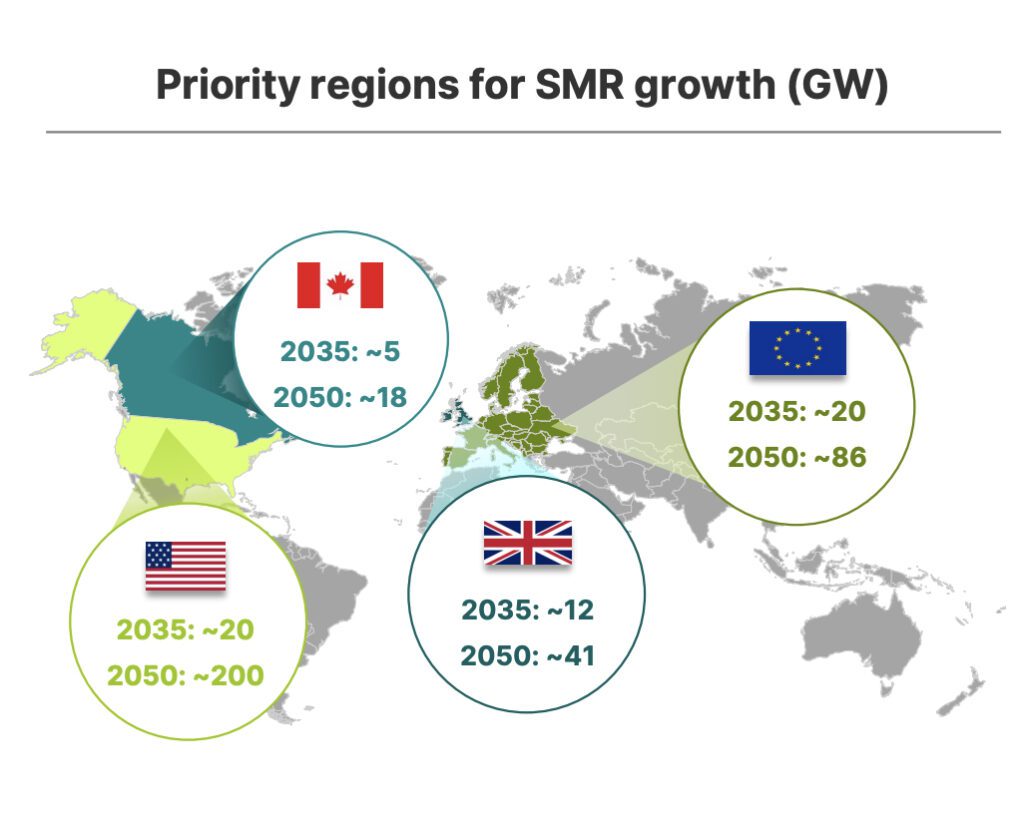

In March, GE Vernova steered demand for superior nuclear crops could possibly be evenly break up between giant reactors and SMRs, with “every accounting for round 375 GW by 2050.” Demand for giant reactors might be led by rising markets, led by China and India, whereas North America and Europe will “strongly favor SMRs,” it stated. “SMR’s worth proposition is predicated on decrease capital at-risk, smaller footprint, and larger modularity,” it stated.

Up to now, GEH is ready to construct its first 300-MW BWRX-300 reactor at Ontario Energy Technology’s (OPG’s) Darlington New Nuclear Challenge (DNNP) website east of Darlington Station in Bowmanville, Ontario, anticipating it might be prepared for industrial operation in 2029. A number of different prospects are within the pipeline, together with three extra SMRs at Darlington, two potential items in Saskatchewan, and 24 BWRX-300 SMRs at six websites in Poland, for which the Polish authorities has introduced selections in precept.

OPG, the Tennessee Valley Authority (TVA), and Polish agency Synthos Inexperienced Power (SGE) in March 2023 kicked off efforts to collaborate on a regular design for the BWRX-300 to hurry up the expertise’s regulatory acceptance and spur future deployments. Beneath the collaboration, the businesses will even develop the businesses will even develop a detailed design for key BWRX-300 energy plant parts, comparable to reactor stress vessels and internals. As well as, the three energy corporations are slated to kind a “Design Heart Working Group” whose function might be “guaranteeing the usual design is deployable in a number of jurisdictions.”

A month earlier than, in February 2023, GEH unveiled a partnership with Canadian companies OPG, AtkinsRéalis, and Aecon to help the development of the primary BWRX-300 at Darlington. The businesses’ alliance settlement—the primary of its type for a grid-scale SMR in North America—represented a deliberate effort to sort out building complexities, potential delays, and price overruns related to the brand new construct.

Earlier this yr, the UK granted GEH £33.6 million ($42.7 million) underneath its Future Nuclear Enabling Fund, a program aimed toward boosting nuclear expertise maturation to additional develop the BWRX-300 within the UK. GEH notes it has been creating a UK provide chain, which features a memorandum of understanding with Sheffield Forgemasters for a possible provide settlement for UK-sourced metal forgings in help of the deployment of BWRX-300 SMRs.

In keeping with GE Vernova, these efforts are a part of a strategic effort to deploy the BWRX-300 utilizing a “design-to-cost method.” Particularly, “the BWRX-300 leverages a singular mixture of current gasoline, plant simplifications, confirmed parts, and a design based mostly on an NRC-certified reactor design,” the corporate famous.

Mass SMR Deployment Depends Closely on an Satisfactory Nuclear Provide Chain

The hassle is important provided that consultants agree attaining a mass scale-up of SMR deployment will closely depend on streamlining the provision chain. “The dimensions of SMR deployment will rely on the success in delivering first-of-a-kind tasks and within the industrialization and modularization of producing and provide chain actions,” the OECD Nuclear Power Company (NEA) lately stated in supplies related to a nuclear provide chain workshop it hosted alongside the World Nuclear Affiliation in March.

A key challenge dealing with the nuclear business pertains to a declining variety of nuclear-grade suppliers and a lack of abilities in some areas, NEA famous. Provide chain growth, notably for superior nuclear, would require a robust emphasis on high quality supply, which would require strengthened administration of superior manufacturing and commercial-grade procurement. It’s going to additionally require a eager consciousness of continued dangers “related to counterfeit and fraudulent actions and potential strategies to mitigate dangers in a continuously altering surroundings,” NEA stated.

Within the U.S., the Division of Power (DOE) is pursuing a number of notable actions to bolster a provide chain to help the prevailing nuclear fleet and help a build-out for superior nuclear.

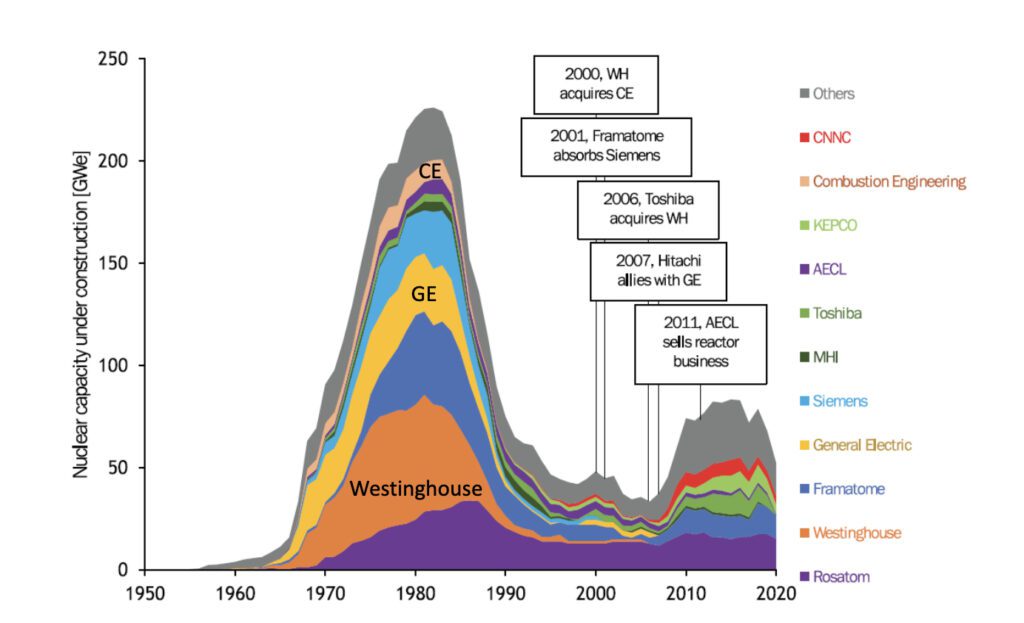

It notes that whereas the U.S. led the primary world wave of building from the Sixties to the Eighties, U.S. distributors have constructed few reactors domestically or globally throughout the second building wave that begain within the early 2000s. That wave was dominated by Russia’s Rosatom, France’s Framatome, Japan’s Toshiba, and South Korea’s Korea Electrical Energy Corp. The vast majority of new reactors over the previous decade have been in-built China. The DOE suggests a lot work stays on all fronts. For instance, “The U.S. O&M provide chain has atrophied as U.S. reactor exports have declined,” the DOE acknowledges, noting: “The U.S. O&M provide chain would profit each from progress within the home nuclear fleet and from progress in U.S. reactors exports.”

In a detailed 2022 report, the company pointed to a number of gaps together with as they relate to labor, vital minerals, gasoline, useful resource extraction, materials and element manufacturing, and building. Over the long run, the U.S. might have to handle much more provide points associated to nuclear waste disposal and the simultaneous decommissioning of many U.S. nuclear crops, it has stated.

The DOE has to this point taken concerted steps to handle the nuclear gasoline cycle. As of March 22, it had closed requests for proposals (RFPs) for the acquisition of enriched and deconverted high-assay low enriched-uranium (HALEU), essential elements of the superior nuclear gasoline provide chain. The measure is furnished by $700 million allotted by the 2022 Inflation Discount Act (IRA) to help actions underneath the HALEU Availability Program (which Congress established within the Power Act of 2020).

The DOE on April 19 additionally famous that Centrus Power’s American Centrifuge Challenge has now enriched greater than 100 kilograms (kg) of HALEU at its Piketon, Ohio, plant and was working towards a further 900 kilograms. As well as, the DOE stated the U.S. is “working hand-in-glove” with the UK, France, Japan, and Canada—the “Sapporo 5”—to ascertain a “safe and resilient” world nuclear gasoline provide chain to make sure continued operation and help the expansion of nuclear vitality deployment around the globe freed from Russian affect.

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).