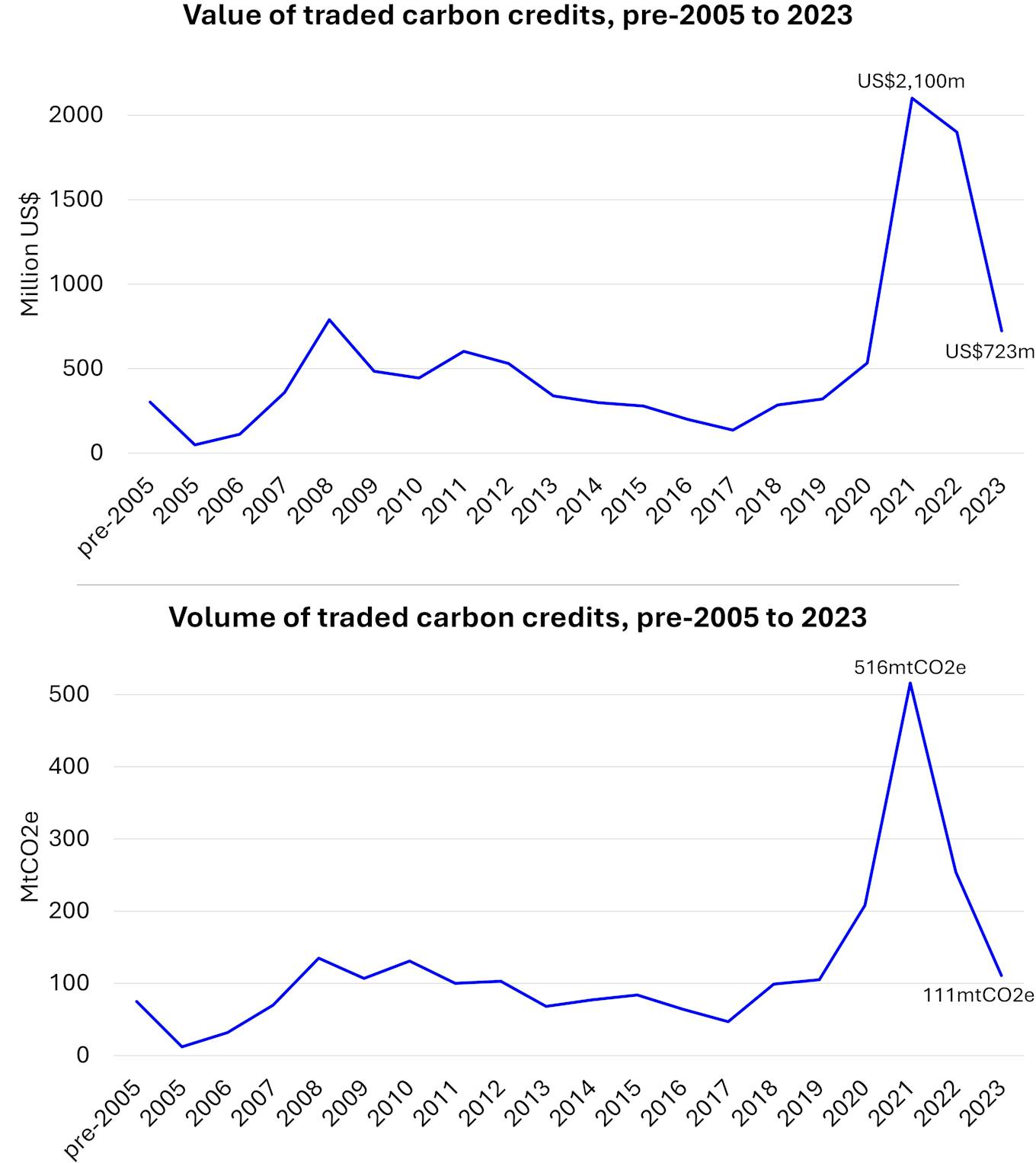

The worldwide carbon offsetting enterprise recorded yet one more retraction in 2023, with its worth plunging to US$723 million from the 2021 excessive of US$2.1 billion, whereas commerce fell by nearly 5 occasions over the identical interval.

The information by analyst Ecosystem Market reveals the extent of investor pullback from the troubled sector lately. The US$1.1 billion drop in market worth from 2022 is the biggest annual fall ever registered.

The typical worth of carbon credit fell barely to US$6.53 a bit, however stays greater than the years earlier than 2022. Companies purchase such credit – every representing a tonne of carbon dioxide saved from efforts resembling defending forests and putting in clear vitality – to offset their very own carbon footprint.

Worth and quantity of traded carbon credit have fallen sharply for the reason that 2021 spike. Knowledge: Ecosystem Market.

Media studies that carbon credit don’t reside as much as their environmental credentials, and that commerce is badly managed, are mentioned to have solid a pall over the business, holding consumers away and vexing challenge builders with advanced due diligence necessities.

Key allegations lately embrace that Verra, the business’s largest offsets verifier, has allowed challenge builders to oversell carbon credit. An analogous overissuance accusation was levelled at an enormous forest challenge in Zimbabwe linked to challenge developer South Pole.

Verra, which has a roughly 70 per cent market share, noticed its transaction quantity fall 64 per cent from 158 million credit in 2022 to 56.2 million in 2023. Complete commerce worth fell 70 per cent.

“We see the market in a state of transition. Whereas transaction volumes are falling, it’s extra of a return to a stage that we noticed earlier than 2021,” mentioned report writer Alex Procton.

Dee Lawrence, founder and director at United States charity Excessive Tide Basis, mentioned it was irritating to see US$1.1 billion in finance for local weather mitigation “evaporate” in comparison with the 12 months prior.

“To place it bluntly, our international local weather targets simply bought just a little farther out of attain,” Lawrence mentioned.

Knowledge: Ecosystem Market.

The market plunge was felt inconsistently throughout challenge sorts. Forest and renewable vitality initiatives, the 2 largest segments, recorded each quantity and worth drops of round 70 per cent year-on-year.

In recent times, many of the angst has been levelled at forest conservation, or “REDD+”, initiatives, with naysayers claiming these ventures create distorted eventualities of prevented deforestation to generate massive volumes of carbon credit.

REDD+ initiatives misplaced 62 per cent of their worth year-on-year whereas commerce quantity fell 51 per cent.

One optimistic market development was a worth enhance for carbon credit from tree-planting initiatives, together with greater buying and selling quantity within the classes of family and group units – often clean-burning cookstoves – and vitality effectivity upgrades.

Asia and Latin America, the 2 largest sources of carbon initiatives, particularly for REDD+ initiatives, had been additionally hit the toughest. Asian carbon initiatives skilled plunges of 78 per cent in quantity and 83 per cent in worth. Latin America figures had been down 72 per cent for each classes.

Ecosystem Market mentioned company offsetters have already grow to be extra discerning. As an example, carbon credit from initiatives providing co-benefits to biodiversity and native communities fetched the next common worth of over US$8 a bit, in comparison with underneath US$6 for these with out – although the market dimension of the latter is twice as huge.

The minority of initiatives that take away carbon dioxide from the environment, resembling by way of reforestation or engineered direct air seize of the greenhouse fuel, additionally attracted a a lot greater promoting worth of just about US$16 a bit, in comparison with about US$4.60 for the standard emissions avoidance initiatives in vitality effectivity or prevented deforestation.

Undertaking builders look like banking on market restoration, with nearly 700 new registrations to carbon credit score verifiers, a climb from each 2021 and 2022 however nonetheless markedly decrease than round 1,300 in 2020.

Business integrity efforts are anticipated to begin soothing investor anxiousness. Final 12 months, the Voluntary Carbon Markets Integrity initiative launched a information on how companies can responsibly use carbon credit. Sister group Integrity Council for the Voluntary Carbon Market has dominated on which carbon credit score certifiers it considers reliable.

However the world stays sceptical of the offsetting enterprise, seen from the outcry when local weather objectives checker Science Primarily based Targets Initiative floated the concept that carbon credit can be utilized to cancel out corporations’ oblique worth chain emissions.