Within the first week of October, common costs in most European electrical energy markets have been beneath €85/MWh and decrease than the earlier week in virtually all markets. Nonetheless, in some hours and markets, costs exceeded €200/MWh. In MIBEL, the best hourly value since March was registered on the 9th. Wind vitality manufacturing elevated and in Germany on the threerd it was the best since March. Gasoline and CO2 costs fell, with CO2 reaching its lowest stage since June on the threerd.

Photo voltaic photovoltaic, photo voltaic thermoelectric and wind vitality manufacturing

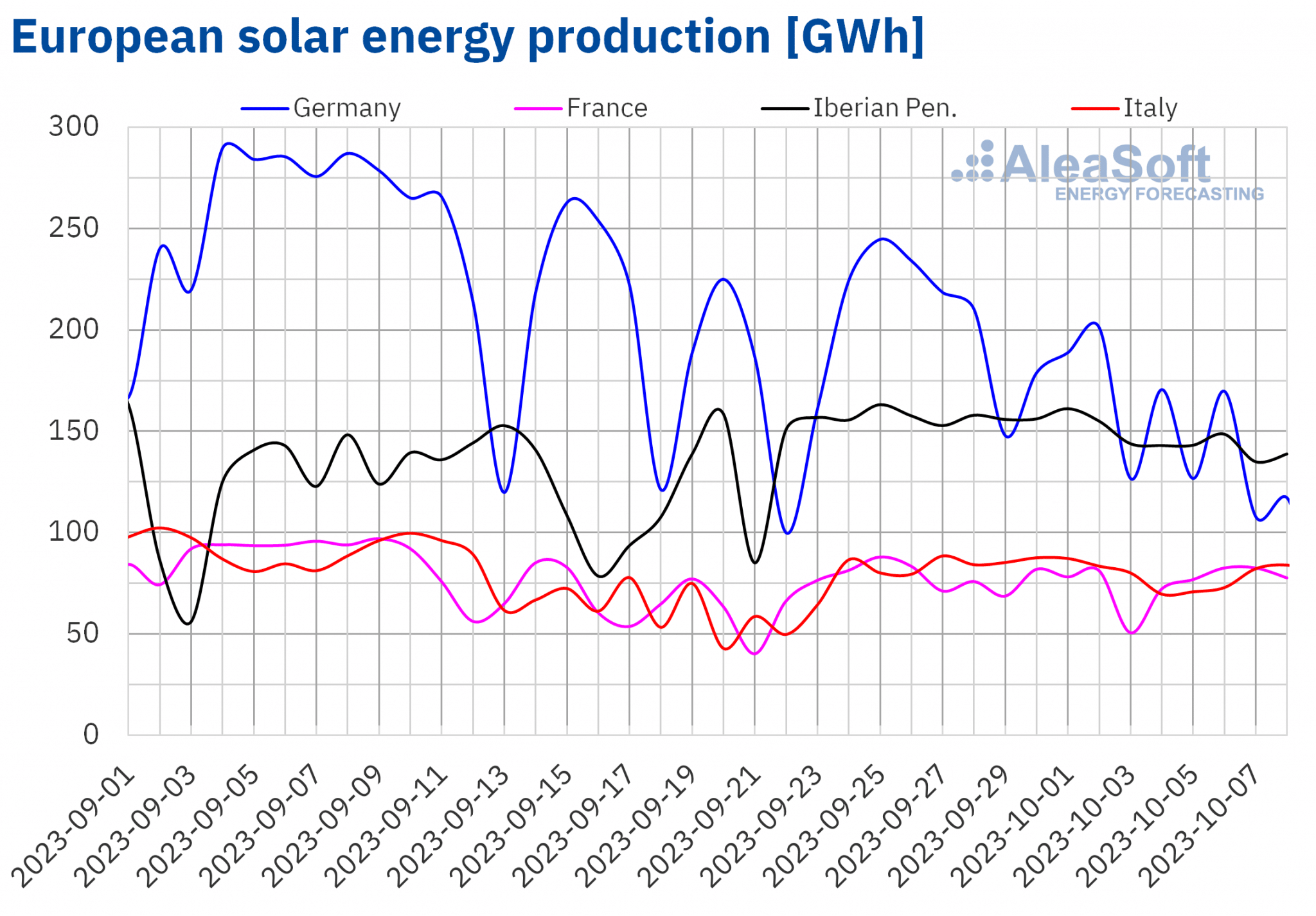

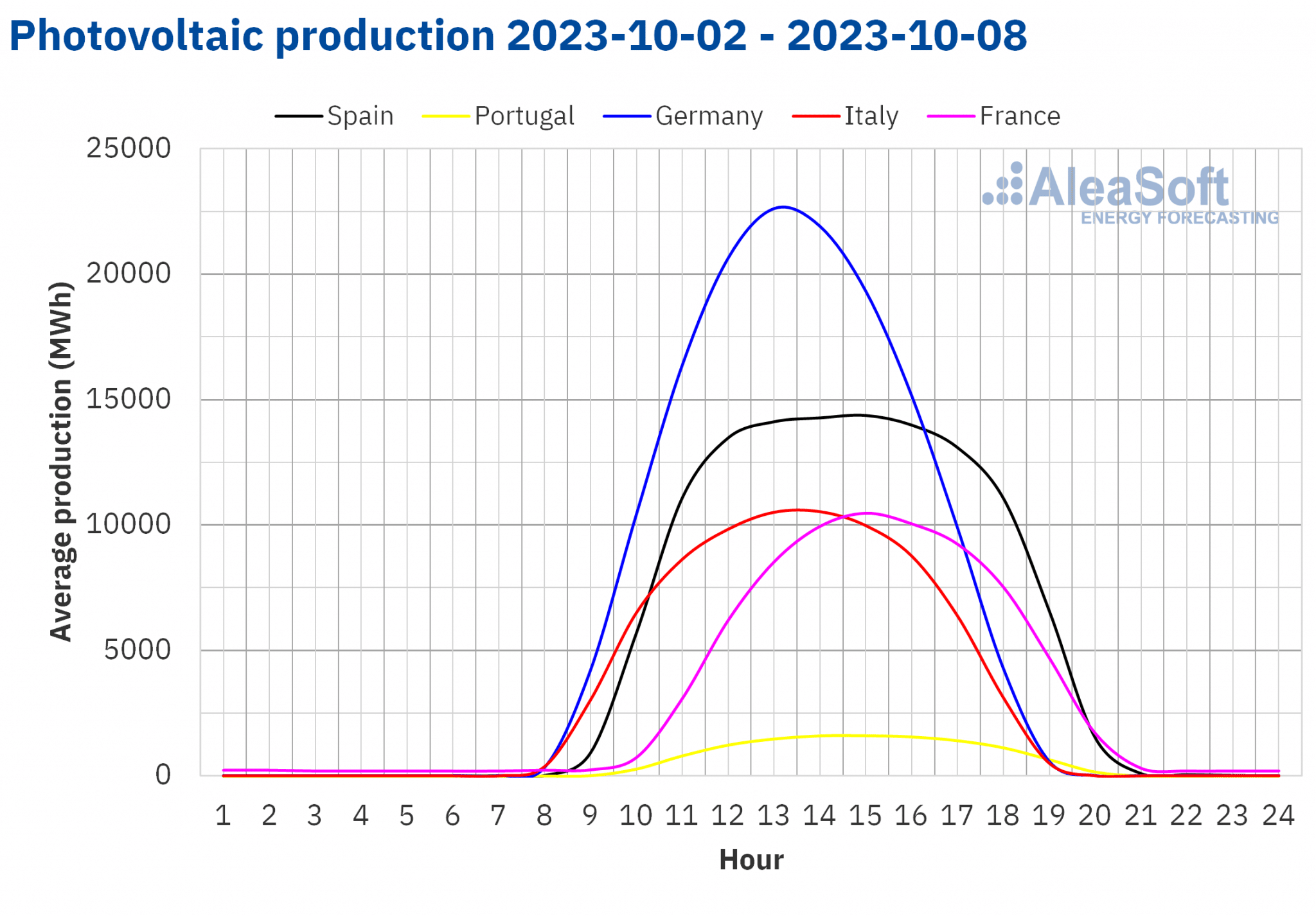

Within the week of October 2, photo voltaic vitality manufacturing decreased in all analyzed markets in comparison with the earlier week. The German market registered the most important drop, 28%. Within the different markets, the lower in photo voltaic vitality manufacturing ranged from 9.1% in Portugal to 4.3% in France.

In keeping with AleaSoft Power Forecasting’s photo voltaic vitality manufacturing forecasts for the week of October 9, photo voltaic vitality manufacturing is anticipated to lower in all analyzed markets besides the Spanish market.

Supply: Ready by AleaSoft Power Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

Supply: Ready by AleaSoft Power Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

The week of October 2 introduced per week?on?week improve in wind vitality manufacturing in a lot of the markets analyzed at AleaSoft Power Forecasting. The most important improve, 108%, was registered within the German market. On this market, 753 GWh of wind vitality was generated on Tuesday, October 3, the best worth since March 25. Within the different markets, the rise ranged from 7.5% in France to 55% in Portugal. The exception was the Italian market, the place wind vitality manufacturing fell by 59% in comparison with the earlier week.

For the week of October 9, AleaSoft Power Forecasting’s wind vitality manufacturing forecasts point out that wind vitality manufacturing will lower in all analyzed markets.

Supply: Ready by AleaSoft Power Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

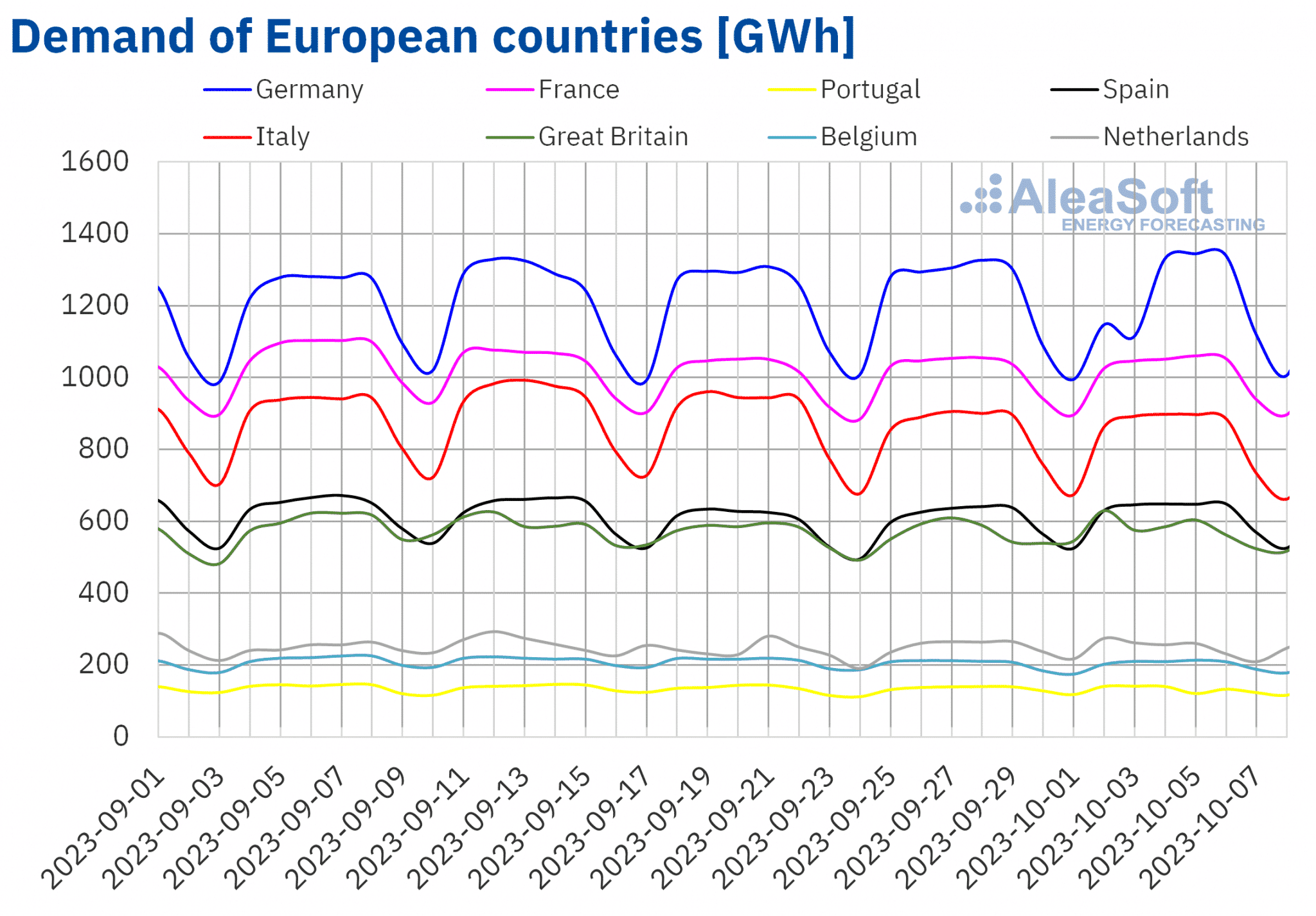

Electrical energy demand

Within the week of October 2, the evolution of electrical energy demand in comparison with the earlier week didn’t present a typical pattern within the analyzed European markets. In some circumstances, demand elevated in comparison with the earlier week. The Spanish market registered the most important improve, 2.1%. It was adopted by the British and French markets with the corresponding will increase of 0.7% and 0.2%. Within the Belgian market, demand remained much like that of the earlier week. Within the different analyzed markets, demand decreased. The most important declines, 2.2% and a couple of.0%, have been registered in Germany and Portugal, respectively. In the course of the week, each international locations celebrated nationwide holidays: Germany’s Unity Day on October 3 and Portugal’s Republic Day on October 5. Italy and the Netherlands registered smaller declines, 0.8% and 0.2%, respectively.

Throughout the identical interval, common temperatures decreased between 1.6°C and 0.2 °C in most analyzed markets. The exception was Spain, the place temperatures rose by 0.1 °C.

In keeping with AleaSoft Power Forecasting’s demand forecasts for the week of October 9, electrical energy demand is anticipated to extend in most analyzed European markets, apart from Spain, the place the Spanish Nationwide Day can be celebrated on October 12.

Supply: Ready by AleaSoft Power Forecasting utilizing information from ENTSO-E, RTE, REN, REE, TERNA, Nationwide Grid and ELIA.

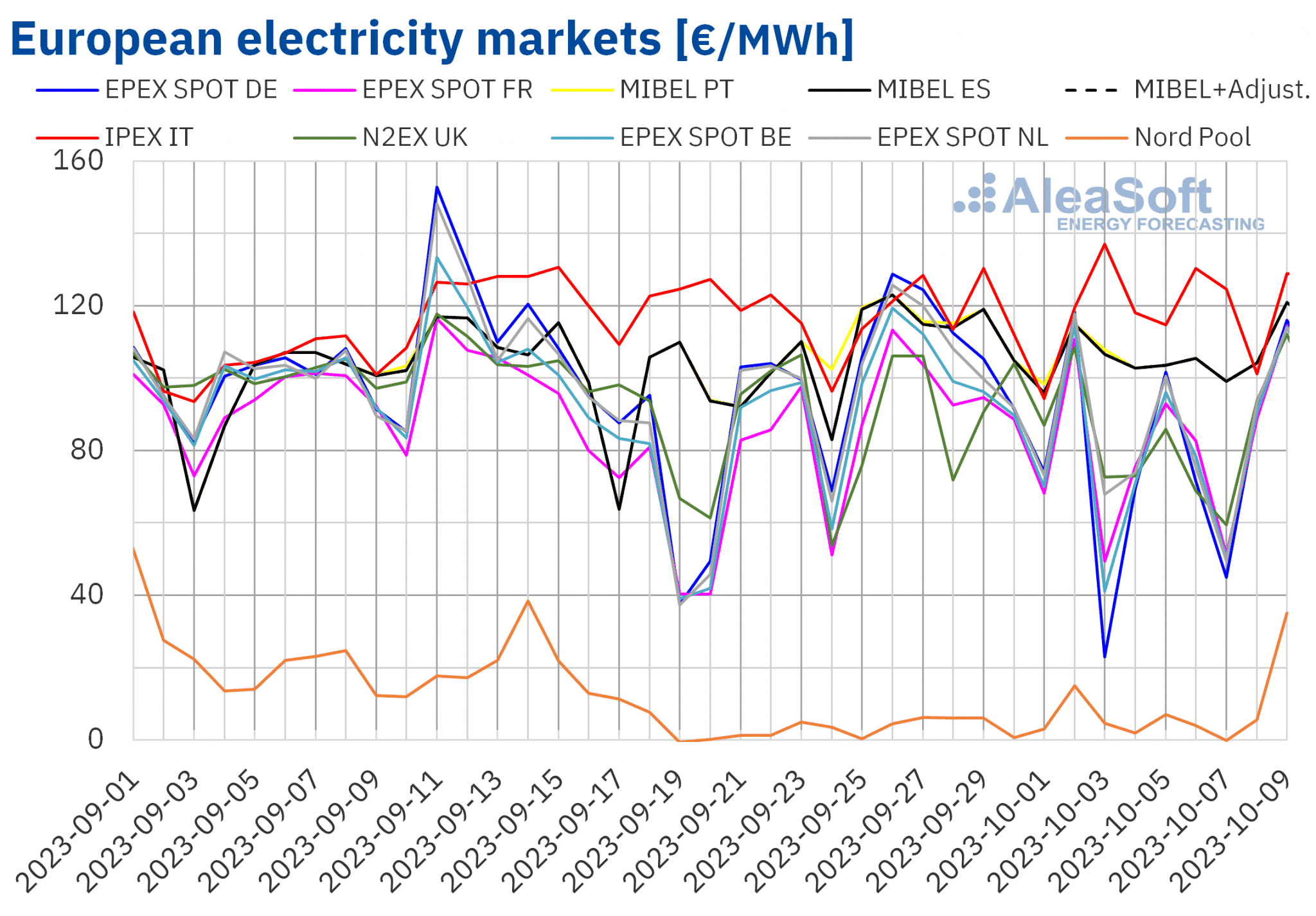

European electrical energy markets

In the course of the week of October 2, costs in most European electrical energy markets analyzed at AleaSoft Power Forecasting decreased in comparison with the earlier week. The exceptions have been the IPEX market of Italy and the Nord Pool market of the Nordic international locations, the place the value elevated by 3.9% and 43%, respectively. However, the EPEX SPOT market of Germany registered the most important decline, 30%. Within the different markets, costs fell between 6.8% within the MIBEL market of Spain and 21% within the EPEX SPOT market of Belgium.

Within the first week of October, weekly averages have been beneath €85/MWh in a lot of the analyzed European electrical energy markets. The exceptions have been the Spanish, Portuguese and Italian markets, the place the averages have been €105.23/MWh, €105.41/MWh and €120.79/MWh, respectively. However, the bottom common value, €5.45/MWh, was reached within the Nordic market. Within the different analyzed markets, costs ranged from €74.20/MWh within the German market to €82.61/MWh within the Dutch market.

By way of hourly costs, on October 3, unfavourable costs have been registered within the German, Belgian and French markets, whereas, on October 4, 5, 6 and seven, unfavourable costs have been registered within the Nordic market. The bottom hourly value, ?€11.07/MWh, was reached within the German market on October 3, from 13:00 to 14:00. This was the bottom value within the German market for the reason that first half of August.

However, within the first week of October, costs above €200/MWh have been additionally registered within the German, Belgian, Italian and Dutch markets. The very best hourly value, €250.28/MWh, was reached within the German market on October 5, from 19:00 to twenty:00. As well as, on Monday, October 9, hourly costs above €200/MWh have been registered within the German, Belgian, French, Italian and Dutch markets. On that day, within the Spanish and Portuguese markets, from 20:00 to 21:00, a value of €184.50/MWh was reached, the best value registered in these markets since March. Within the case of the N2EX market of the UK, on Monday, October 9, from 19:00 to twenty:00, a value of £184.24/MWh was registered, the best since August.

In the course of the week of October 2, the lower within the common value of fuel and CO2, in addition to the rise in wind vitality manufacturing in most markets, led to decrease costs in European electrical energy markets. Nonetheless, within the Italian market, wind vitality manufacturing decreased, contributing to the value improve in that market.

AleaSoft Power Forecasting’s value forecasts point out that within the second week of October costs may improve in a lot of the analyzed European electrical energy markets, influenced by the overall decline in wind vitality manufacturing and the rise in demand in most markets.

Supply: Ready by AleaSoft Power Forecasting utilizing information from OMIE, EPEX SPOT, Nord Pool and GME.

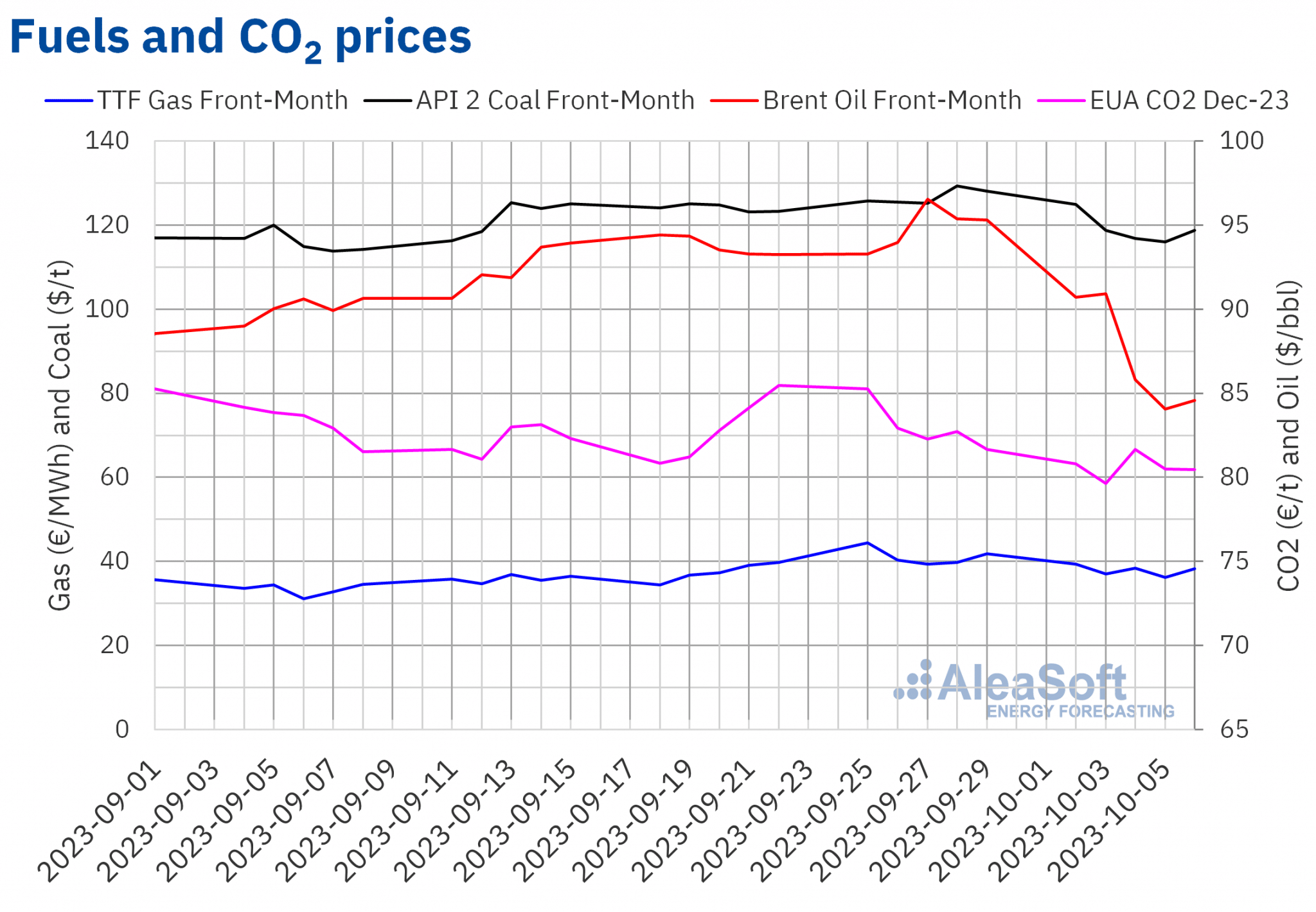

Brent, fuels and CO2

Brent oil futures for the Entrance?Month within the ICE market reached the weekly most settlement value, $90.92/bbl, on Tuesday, October 3. This value was 3.2% decrease than the earlier Tuesday. Subsequently, costs decreased and within the final two periods of the primary week of October settlement costs remained beneath $85/bbl. The weekly minimal settlement value, $84.07/bbl, was registered on Thursday, October 5. This value was 12% decrease than the earlier Thursday and the bottom since August.

Within the first week of October, considerations in regards to the evolution of the worldwide financial system and demand exerted their downward affect on Brent oil futures costs. Nonetheless, fears of provide issues associated to rising instability within the Center East may exert an upward affect on costs within the second week of October.

As for settlement costs of TTF fuel futures within the ICE marketplace for the Entrance?Month, in the course of the first week of October they remained beneath €40/MWh. On Monday, October 2, the weekly most settlement value, €39.33/MWh, was reached. This value was 11% decrease than the earlier Monday. The weekly minimal settlement value, €36.21/MWh, was registered on October 5 and it was 8.9% decrease than the earlier Thursday. However on Friday costs elevated once more till registering a settlement value of €38.23/MWh, which was nonetheless 8.7% decrease than the earlier Friday.

The excessive stage of European reserves and the forecast of gentle temperatures contributed to costs being beneath €40/MWh in the course of the first week of October. However the potential of strikes at Australian liquefied pure fuel export amenities led to the value improve registered on the finish of the week.

CO2 emission rights futures within the EEX market for the reference contract of December 2023 reached the weekly most settlement value, €81.67/t, on October 4. This value was 0.8% decrease than the identical day of the earlier week. However, the weekly minimal settlement value, €79.65/t, was registered on Tuesday, October 3, and it was 4.0% decrease than the earlier Tuesday. Moreover, this value was the bottom for the reason that starting of June.

The excessive stage of renewable vitality manufacturing decreased the demand for emission rights related to fossil gas electrical energy manufacturing and had a downward impression on costs within the first week of October.

Supply: Ready by AleaSoft Power Forecasting utilizing information from ICE and EEX.

AleaSoft Power Forecasting’s evaluation on the prospects for vitality markets in Europe and the financing and valuation of renewable vitality initiatives

The following webinar within the sequence of month-to-month webinars of AleaSoft Power Forecasting and AleaGreen can be held on Thursday, October 19. Audio system from Deloitte will take part within the webinar for the fourth time, sharing their imaginative and prescient and expertise on the financing of renewable vitality initiatives and the significance of forecasting in audits and portfolio valuation. The webinar can even analyze the prospects for European vitality markets for the winter 2023?2024.

However, till October 15, AleaSoft Power Forecasting is providing a promotion on lengthy?time period value curve forecasts. This promotion features a particular low cost for the fourth quarter report.