Within the third week of October, European electrical energy market costs remained usually steady, with an upward development generally in comparison with the earlier week. Nevertheless, within the MIBEL market costs fell as a consequence of excessive wind vitality manufacturing, which reached an all?time file in Portugal and the best worth up to now in 2023 in Spain. Fuel costs averaged larger than the earlier week, electrical energy demand rose and photo voltaic vitality manufacturing fell.

Photo voltaic photovoltaic, photo voltaic thermoelectric and wind vitality manufacturing

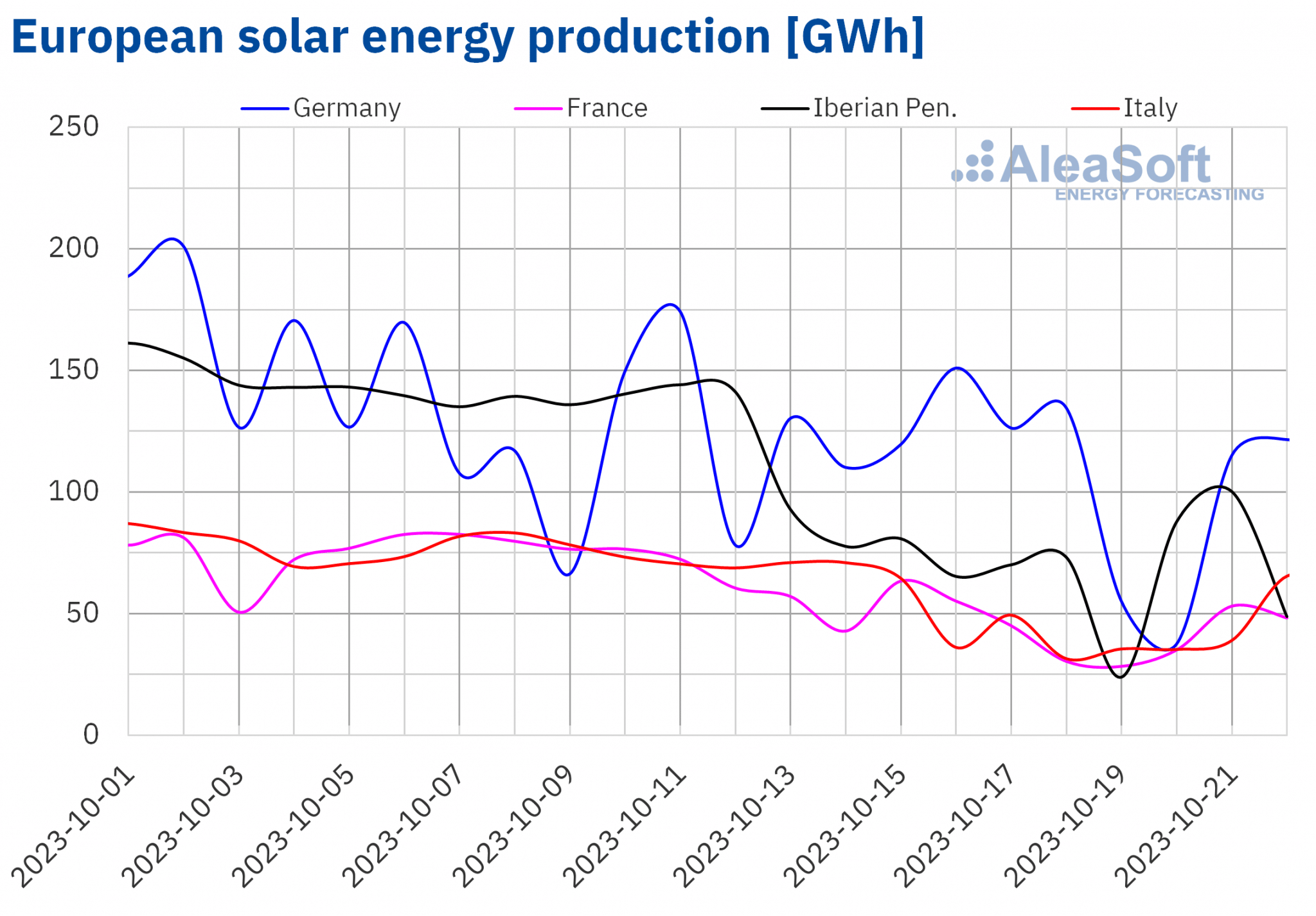

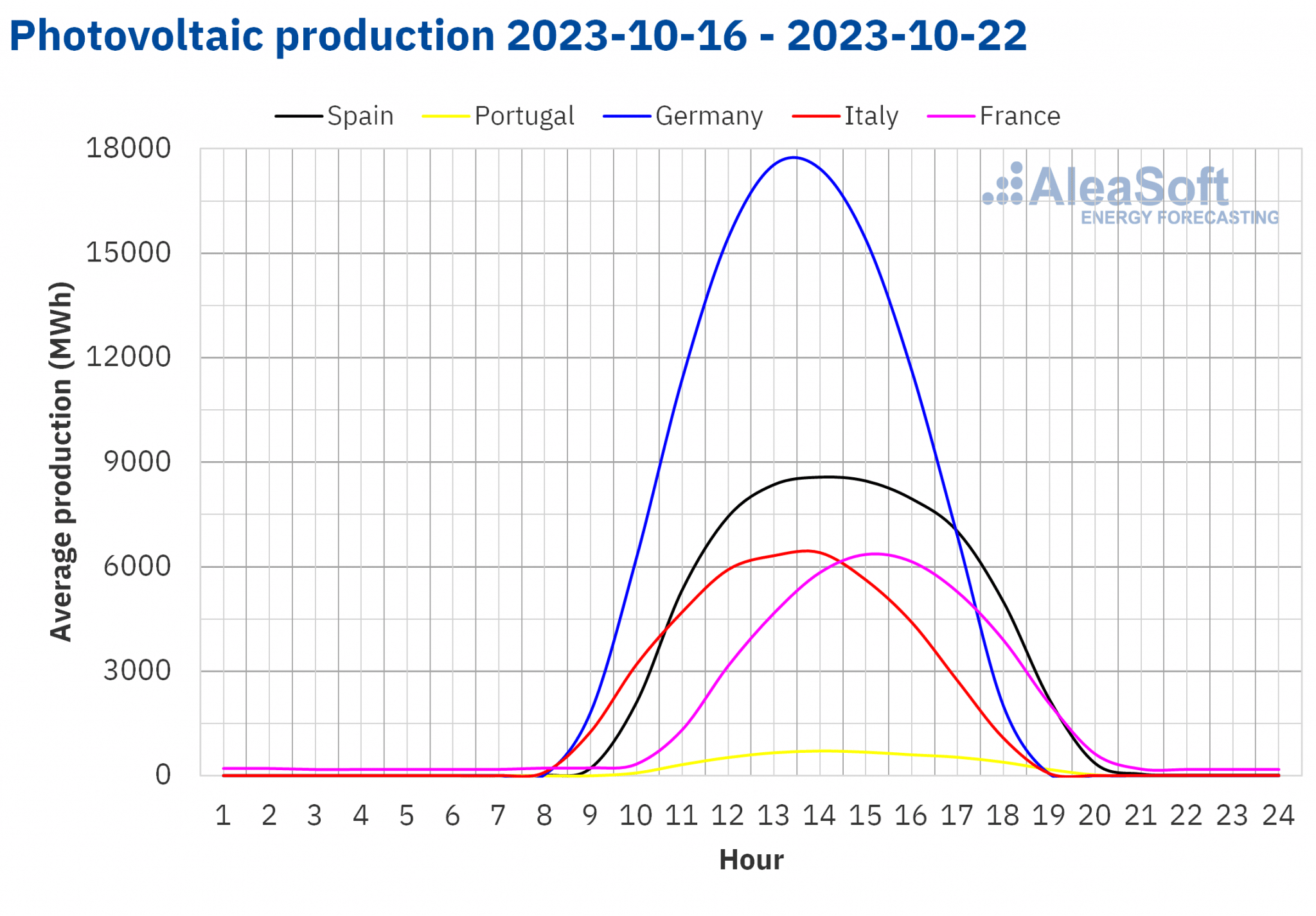

Within the week of October 16, photo voltaic vitality manufacturing decreased in all main European markets in comparison with the earlier week. The biggest declines, which had been 42% and 41%, had been registered within the Iberian Peninsula and Italy, respectively, whereas the smallest drop, 11%, was registered within the German market.

For the week of October 23, based on AleaSoft Vitality Forecasting’s photo voltaic vitality manufacturing forecasts, photo voltaic vitality manufacturing is anticipated to extend in all analyzed markets in comparison with the earlier week.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

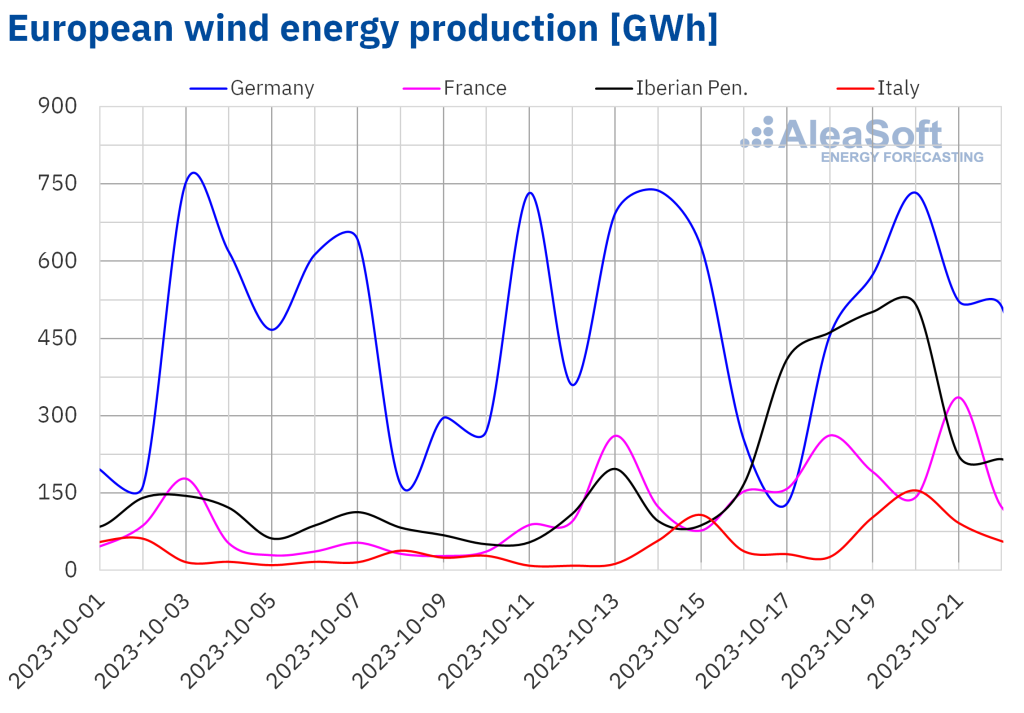

In distinction, the week of October 16 introduced every week?on?week improve in wind vitality manufacturing in a lot of the main European markets. The Portuguese and Spanish markets had been probably the most distinguished, with will increase of 294% and 272%, respectively. As well as, on Tuesday, October 17, the Portuguese market broke its all?time file with a day by day wind vitality manufacturing of 108 GWh. Throughout the identical week, on Friday, October 20, 420 GWh was produced from wind vitality within the Spanish market, the best worth since December 2021. The German market was the one one the place wind vitality manufacturing decreased, by 14% in comparison with the earlier week.

For the week of October 23, AleaSoft Vitality Forecasting’s wind vitality manufacturing forecasts point out that it’s going to lower in all analyzed markets besides Italy.

Within the third week of October, European electrical energy market costs remained usually steady, with an upward development generally in comparison with the earlier week. Nevertheless, within the MIBEL market costs fell as a consequence of excessive wind vitality manufacturing, which reached an all?time file in Portugal and the best worth up to now in 2023 in Spain. Fuel costs averaged larger than the earlier week, electrical energy demand rose and photo voltaic vitality manufacturing fell.

Photo voltaic photovoltaic, photo voltaic thermoelectric and wind vitality manufacturing

Within the week of October 16, photo voltaic vitality manufacturing decreased in all main European markets in comparison with the earlier week. The biggest declines, which had been 42% and 41%, had been registered within the Iberian Peninsula and Italy, respectively, whereas the smallest drop, 11%, was registered within the German market.

For the week of October 23, based on AleaSoft Vitality Forecasting’s photo voltaic vitality manufacturing forecasts, photo voltaic vitality manufacturing is anticipated to extend in all analyzed markets in comparison with the earlier week.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

In distinction, the week of October 16 introduced every week?on?week improve in wind vitality manufacturing in a lot of the main European markets. The Portuguese and Spanish markets had been probably the most distinguished, with will increase of 294% and 272%, respectively. As well as, on Tuesday, October 17, the Portuguese market broke its all?time file with a day by day wind vitality manufacturing of 108 GWh. Throughout the identical week, on Friday, October 20, 420 GWh was produced from wind vitality within the Spanish market, the best worth since December 2021. The German market was the one one the place wind vitality manufacturing decreased, by 14% in comparison with the earlier week.

For the week of October 23, AleaSoft Vitality Forecasting’s wind vitality manufacturing forecasts point out that it’s going to lower in all analyzed markets besides Italy.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

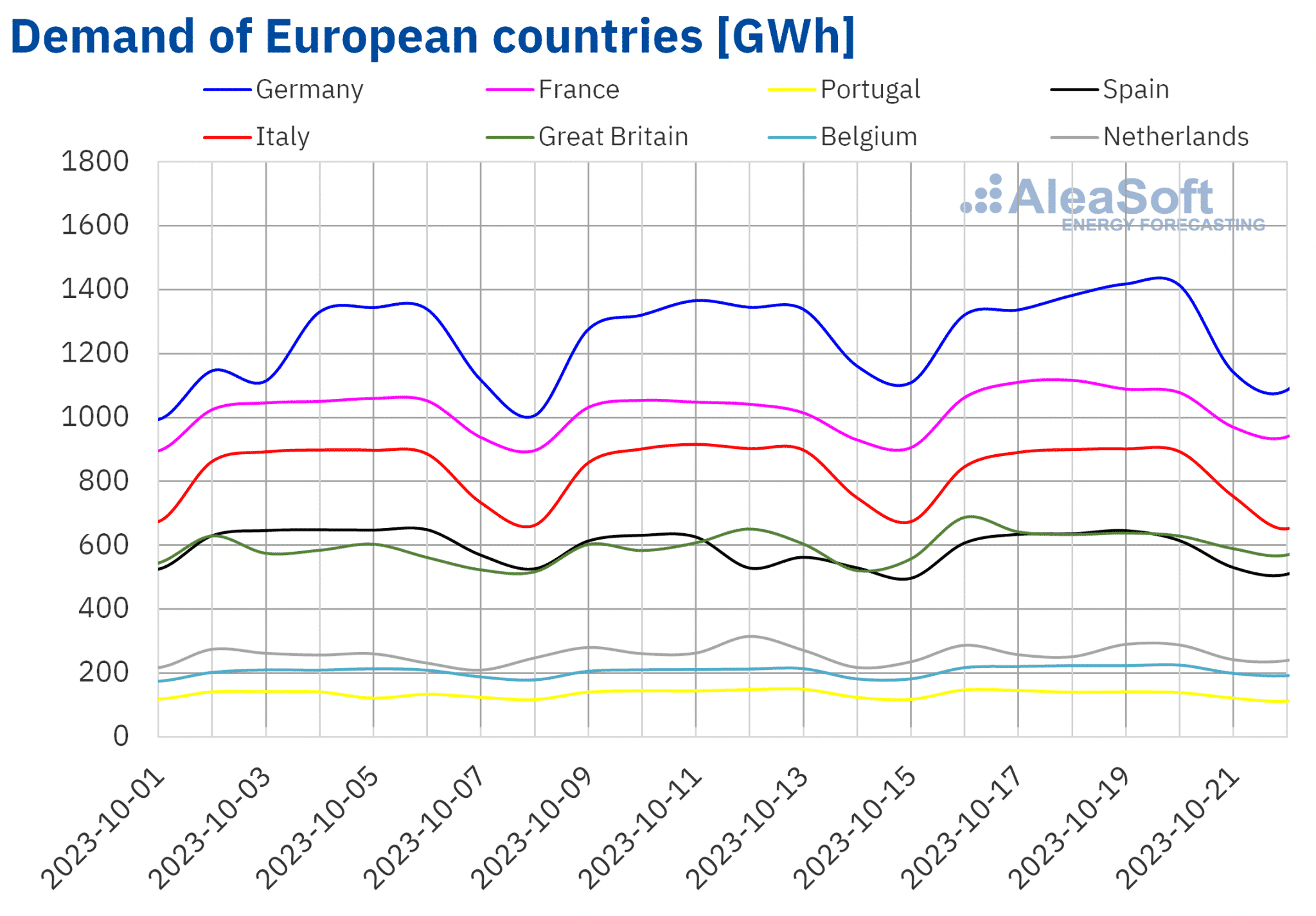

Electrical energy demand

In the course of the week of October 16, electrical energy demand elevated in most main European markets in comparison with the earlier week. Will increase ranged from 0.7% within the Dutch market to six.4% within the British market. Nevertheless, demand decreased in two Southern European markets. In Portugal, demand fell by 2.2% and, in Italy, by 1.1%.

Throughout the identical interval, common temperatures decreased in all analyzed markets. The biggest lower, 5.6 °C, was registered in Germany. In distinction, Spain and Italy registered the smallest temperature decreases, every by 2.3 °C.

For the week of October 23, based on AleaSoft Vitality Forecasting’s demand forecasts, demand is anticipated to extend in Portugal, Italy, Nice Britain and the Netherlands and to lower in Spain, Germany and Belgium. In France, demand is anticipated to stay related.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ENTSO-E, RTE, REN, REE, TERNA, Nationwide Grid and ELIA.

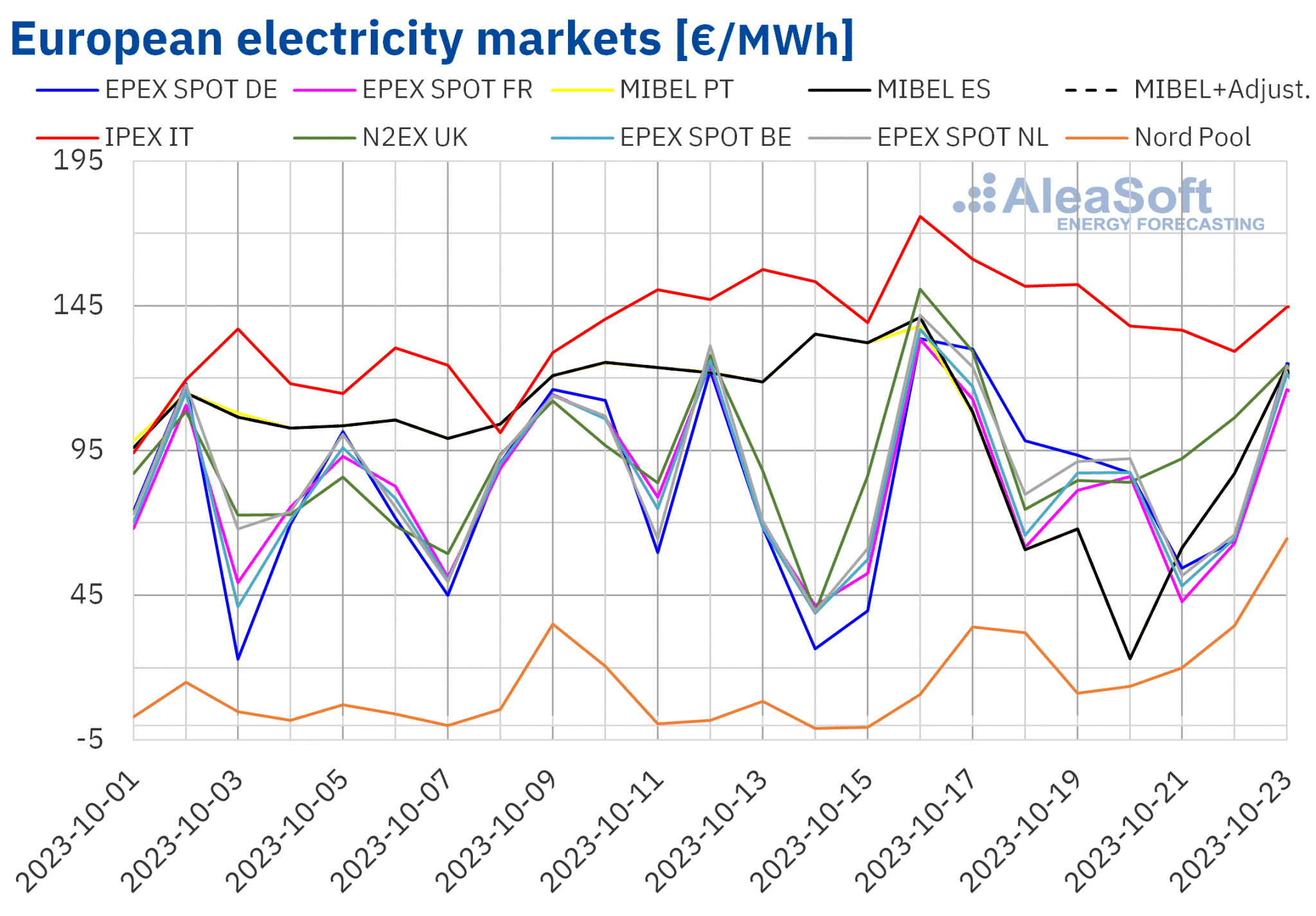

European electrical energy markets

Within the week of October 16, costs in the primary European electrical energy markets remained usually steady, with a sure upward development in comparison with the earlier week generally. Nevertheless, within the MIBEL market of Spain and Portugal, costs fell by 37% and 38%, respectively. Within the EPEX SPOT market of France, a slight decline of 1.2% was additionally registered. Alternatively, the most important proportion value rise, 141%, was reached within the Nord Pool market of the Nordic international locations, whereas the smallest improve, 2.7%, was registered within the IPEX market of Italy. Within the remaining markets, costs elevated between 3.7% within the EPEX SPOT market of Belgium and 21% within the EPEX SPOT market of Germany.

Within the third week of October, weekly averages had been under €95/MWh in a lot of the analyzed European electrical energy markets. The exceptions had been the British and Italian markets, the place costs had been €103.08/MWh and €149.23/MWh, respectively. In distinction, the bottom common value, €22.29/MWh, was reached within the Nordic market. In the remainder of the analyzed markets, costs ranged from €77.98/MWh within the Portuguese market to €94.45/MWh within the German market.

On October 16, the best hourly costs within the week had been registered in a lot of the analyzed European electrical energy markets. On that day, the TTF fuel value within the spot market was the best within the third week of October, exceeding €50/MWh. Within the German, Belgian, French, Italian and Dutch markets, from 19:00 to twenty:00, a value of €240.00/MWh was reached. This value was the best since August 24 within the French and Italian markets. Within the N2EX market of the UK, on October 16, from 19:00 to twenty:00, the best value since January, £241.19/MWh, was reached. Additionally at the moment on the identical day, the best value since January was registered within the Spanish market, which was €220.00/MWh.

Within the case of the Portuguese and Nordic markets, peak costs weren’t as excessive. Furthermore, the best costs had been reached on Monday, October 23. Within the Portuguese market, a value of €215.02/MWh was registered from 20:00 to 21:00, the best value for the reason that finish of January. Within the Nordic market, from 8:00 to 9:00, a value of €87.66/MWh was reached, the best value for the reason that finish of June on this market.

In the course of the week of October 16, the rise within the common value of fuel, the rise in demand in most markets and the overall decline in photo voltaic vitality manufacturing led to larger costs within the European electrical energy markets. Within the case of the German market, wind vitality manufacturing additionally fell, contributing to the worth improve on this market. Alternatively, the manufacturing with this expertise elevated significantly on the Iberian Peninsula and in France, resulting in decrease costs within the MIBEL and French markets.

AleaSoft Vitality Forecasting’s value forecasts point out that within the fourth week of October costs in most analyzed European electrical energy markets would possibly improve, influenced by decrease wind vitality manufacturing and better demand in most markets.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from OMIE, EPEX SPOT, Nord Pool and GME.

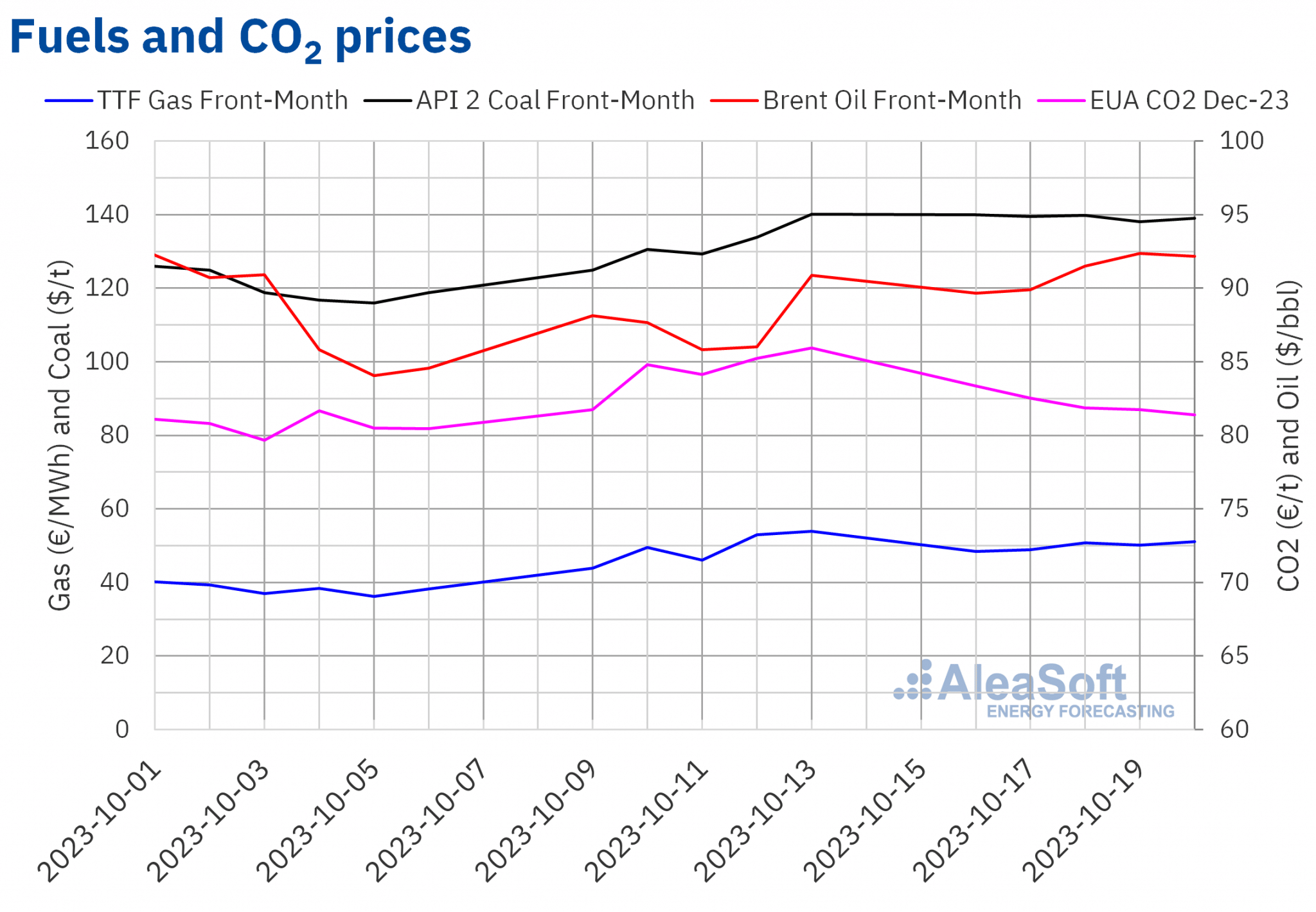

Brent, fuels and CO2

Within the third week of October, Brent oil futures for the Entrance?Month within the ICE market registered their weekly minimal settlement value, $89.65/bbl, on Monday, October 16. This value was 1.7% larger than the earlier Monday. Subsequently, costs elevated and by Wednesday settlement costs exceeded $90/bbl. The weekly most settlement value, $92.38/bbl, was reached on Thursday, October 19. This value was 7.4% larger than the earlier Thursday.

Originally of the third week of October, information of a potential lifting of sanctions on Venezuelan oil pushed Brent oil futures costs decrease. Nevertheless, considerations about potential provide disruptions associated to instability within the Center East continued to exert an upward affect on costs.

As for settlement costs of TTF fuel futures within the ICE marketplace for the Entrance?Month, on Monday, October 16, the weekly minimal settlement value, €48.47/MWh, was reached. However this value was 10% larger than the earlier Monday. Subsequently, costs elevated. The weekly most settlement value, €51.11/MWh, was reached on Friday, October 20. Nevertheless, this value was 5.3% decrease than that of the earlier Friday, which had been the best since mid?February.

Within the third week of October, provide considerations associated to instability within the Center East continued, inflicting settlement costs of those futures to stay above €48/MWh. Nevertheless, forecasts of delicate temperatures, ample provide and excessive ranges of European shares allowed settlement costs to stay under the utmost value reached within the earlier week.

As for settlement costs of CO2 emission rights futures within the EEX market for the reference contract of December 2023, in the course of the third week of October they registered a downward development. The weekly most settlement value, €83.35/t, was reached on Monday, October 16, and it was 2.0% larger than on the earlier Monday. Nevertheless, because of the declines registered in the course of the week, the weekly minimal settlement value, €81.41/t, was registered on Friday, October 20. This value was 5.3% decrease than on the identical day of the earlier week.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ICE and EEX.

AleaSoft Vitality Forecasting’s evaluation on the prospects for vitality markets in Europe and the financing and valuation of renewable vitality tasks

The 37th webinar of AleaSoft Vitality Forecasting and AleaGreen was held on Thursday, October 19. The subjects of the webinar had been the financing of renewable vitality tasks, the significance of forecasting in audits and portfolio valuation and the prospects for European vitality markets for the winter 2023?2024. Audio system from Deloitte participated within the webinar for the fourth time.

The subsequent webinar within the month-to-month webinar collection of AleaSoft Vitality Forecasting and AleaGreen can be held on November 16. On this event, along with the prospects for European vitality markets, the imaginative and prescient of the longer term for batteries and vitality storage can be analyzed. For this goal, audio system from AEPIBAL will take part within the webinar.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

Electrical energy demand

In the course of the week of October 16, electrical energy demand elevated in most main European markets in comparison with the earlier week. Will increase ranged from 0.7% within the Dutch market to six.4% within the British market. Nevertheless, demand decreased in two Southern European markets. In Portugal, demand fell by 2.2% and, in Italy, by 1.1%.

Throughout the identical interval, common temperatures decreased in all analyzed markets. The biggest lower, 5.6 °C, was registered in Germany. In distinction, Spain and Italy registered the smallest temperature decreases, every by 2.3 °C.

For the week of October 23, based on AleaSoft Vitality Forecasting’s demand forecasts, demand is anticipated to extend in Portugal, Italy, Nice Britain and the Netherlands and to lower in Spain, Germany and Belgium. In France, demand is anticipated to stay related.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ENTSO-E, RTE, REN, REE, TERNA, Nationwide Grid and ELIA.

European electrical energy markets

Within the week of October 16, costs in the primary European electrical energy markets remained usually steady, with a sure upward development in comparison with the earlier week generally. Nevertheless, within the MIBEL market of Spain and Portugal, costs fell by 37% and 38%, respectively. Within the EPEX SPOT market of France, a slight decline of 1.2% was additionally registered. Alternatively, the most important proportion value rise, 141%, was reached within the Nord Pool market of the Nordic international locations, whereas the smallest improve, 2.7%, was registered within the IPEX market of Italy. Within the remaining markets, costs elevated between 3.7% within the EPEX SPOT market of Belgium and 21% within the EPEX SPOT market of Germany.

Within the third week of October, weekly averages had been under €95/MWh in a lot of the analyzed European electrical energy markets. The exceptions had been the British and Italian markets, the place costs had been €103.08/MWh and €149.23/MWh, respectively. In distinction, the bottom common value, €22.29/MWh, was reached within the Nordic market. In the remainder of the analyzed markets, costs ranged from €77.98/MWh within the Portuguese market to €94.45/MWh within the German market.

On October 16, the best hourly costs within the week had been registered in a lot of the analyzed European electrical energy markets. On that day, the TTF fuel value within the spot market was the best within the third week of October, exceeding €50/MWh. Within the German, Belgian, French, Italian and Dutch markets, from 19:00 to twenty:00, a value of €240.00/MWh was reached. This value was the best since August 24 within the French and Italian markets. Within the N2EX market of the UK, on October 16, from 19:00 to twenty:00, the best value since January, £241.19/MWh, was reached. Additionally at the moment on the identical day, the best value since January was registered within the Spanish market, which was €220.00/MWh.

Within the case of the Portuguese and Nordic markets, peak costs weren’t as excessive. Furthermore, the best costs had been reached on Monday, October 23. Within the Portuguese market, a value of €215.02/MWh was registered from 20:00 to 21:00, the best value for the reason that finish of January. Within the Nordic market, from 8:00 to 9:00, a value of €87.66/MWh was reached, the best value for the reason that finish of June on this market.

In the course of the week of October 16, the rise within the common value of fuel, the rise in demand in most markets and the overall decline in photo voltaic vitality manufacturing led to larger costs within the European electrical energy markets. Within the case of the German market, wind vitality manufacturing additionally fell, contributing to the worth improve on this market. Alternatively, the manufacturing with this expertise elevated significantly on the Iberian Peninsula and in France, resulting in decrease costs within the MIBEL and French markets.

AleaSoft Vitality Forecasting’s value forecasts point out that within the fourth week of October costs in most analyzed European electrical energy markets would possibly improve, influenced by decrease wind vitality manufacturing and better demand in most markets.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from OMIE, EPEX SPOT, Nord Pool and GME.

Brent, fuels and CO2

Within the third week of October, Brent oil futures for the Entrance?Month within the ICE market registered their weekly minimal settlement value, $89.65/bbl, on Monday, October 16. This value was 1.7% larger than the earlier Monday. Subsequently, costs elevated and by Wednesday settlement costs exceeded $90/bbl. The weekly most settlement value, $92.38/bbl, was reached on Thursday, October 19. This value was 7.4% larger than the earlier Thursday.

Originally of the third week of October, information of a potential lifting of sanctions on Venezuelan oil pushed Brent oil futures costs decrease. Nevertheless, considerations about potential provide disruptions associated to instability within the Center East continued to exert an upward affect on costs.

As for settlement costs of TTF fuel futures within the ICE marketplace for the Entrance?Month, on Monday, October 16, the weekly minimal settlement value, €48.47/MWh, was reached. However this value was 10% larger than the earlier Monday. Subsequently, costs elevated. The weekly most settlement value, €51.11/MWh, was reached on Friday, October 20. Nevertheless, this value was 5.3% decrease than that of the earlier Friday, which had been the best since mid?February.

Within the third week of October, provide considerations associated to instability within the Center East continued, inflicting settlement costs of those futures to stay above €48/MWh. Nevertheless, forecasts of delicate temperatures, ample provide and excessive ranges of European shares allowed settlement costs to stay under the utmost value reached within the earlier week.

As for settlement costs of CO2 emission rights futures within the EEX market for the reference contract of December 2023, in the course of the third week of October they registered a downward development. The weekly most settlement value, €83.35/t, was reached on Monday, October 16, and it was 2.0% larger than on the earlier Monday. Nevertheless, because of the declines registered in the course of the week, the weekly minimal settlement value, €81.41/t, was registered on Friday, October 20. This value was 5.3% decrease than on the identical day of the earlier week.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ICE and EEX.

AleaSoft Vitality Forecasting’s evaluation on the prospects for vitality markets in Europe and the financing and valuation of renewable vitality tasks

The 37th webinar of AleaSoft Vitality Forecasting and AleaGreen was held on Thursday, October 19. The subjects of the webinar had been the financing of renewable vitality tasks, the significance of forecasting in audits and portfolio valuation and the prospects for European vitality markets for the winter 2023?2024. Audio system from Deloitte participated within the webinar for the fourth time.

The subsequent webinar within the month-to-month webinar collection of AleaSoft Vitality Forecasting and AleaGreen can be held on November 16. On this event, along with the prospects for European vitality markets, the imaginative and prescient of the longer term for batteries and vitality storage can be analyzed. For this goal, audio system from AEPIBAL will take part within the webinar.