The oil and fuel trade, because the largest contributor to local weather change alongside coal, faces immense stress in a altering power economic system. Its conventional enterprise mannequin is underneath stress, but it has needed to navigate complicated selections in opposition to the backdrop of nice uncertainties about the kind of power transition actions which are viable, particularly if corporations within the trade wish to be financially sustainable in the long run.

Yinson, a Malaysia-based power infrastructure and know-how firm has considered how local weather dangers may impression its steadiness sheets and determined to diversify its companies from the oil and fuel sector. The corporate, which has its roots in transport and logistics, ventured into marine transport companies in 2010 after which into chartering floating, storage and offloading (FPSO) vessels for offshore oil and fuel manufacturing a yr later. It’s at the moment one of many largest unbiased FPSO leasing corporations on the planet. As main operators world wide begin how carbon emissions may be lowered in offshore manufacturing, Yinson sought to place itself as a market chief in driving the transition to scrub power and setting clear targets for net-zero emissions, aligned with the Paris Settlement.

In 2019, Yinson started to diversify into sustainability-focused industries, beginning with renewable power manufacturing with the organising of Yinson Renewables. A yr later, in 2020, Yinson ventured into inexperienced know-how by one other subsidiary, Yinson GreenTech, with a concentrate on e-mobility companies. It regarded into increasing and working an electrical car (EV) charging infrastructure community in Malaysia, and conducting analysis on electrifying transportation at sea.

Yinson’s new enterprise construction after including its Renewables and Greentech models. Supply: Yinson

Yinson has additionally taken steps to handle its local weather dangers, having laid out a Local weather Targets Roadmap. It targets to be carbon impartial by 2030 and obtain net-zero emissions by 2050. These objectives are operationalised by a three-pronged framework, which includes carbon discount, carbon removing and carbon compensation.

Because the power transition progresses, corporations within the oil and fuel trade have at their disposal an array of methods to hitch the transition and de-risk their enterprise. A few of these methods may embrace diversification into and leveraging sustainable power sources. One other key enabler for sustainability for the trade has been the emergence of inexperienced applied sciences, notably the promise of viable carbon seize, utilisation and storage (CCUS) applied sciences which might enable for speedy drawdown of carbon within the environment.

Yinson’s local weather technique capitalises on these alternatives by strategically increasing into the quickly rising renewables and inexperienced know-how industries, in addition to using low-carbon applied sciences of their present property.

Q & A with Yinson’s Head of Company Sustainability, Dr Renard Siew

Dr Renard Siew, head of company sustainability, Yinson

We spoke to Dr Renard Siew, who leads company sustainability efforts at Yinson in regards to the firm’s journey in diversifying into renewables and inexperienced know-how, and the challenges of managing local weather danger.

Uncertainty in regards to the future is a key problem going through conventional oil and fuel majors, and firms face inertia when deciding if they need to diversify their power operations. Earlier than Yinson selected to pivot to inexperienced renewables, what had been a number of the key danger assessments that it regarded into?

We did a benchmarking train on the environmental, social and governance (ESG) necessities of bankers and financiers, and noticed that power gamers had been more and more held to extra stringent requirements. This led to the conclusion that climate-related developments had been going to pose each materials monetary and non-financial dangers to the corporate. In 2021, we introduced our assist for the Taskforce on Local weather-related Monetary Disclosures (TCFD). In the identical yr, Yinson revealed our first local weather report and was one of many first few Malaysian corporations to publish a devoted TCFD-aligned report.

The Report articulates very clearly our technique and method to managing climate-related dangers. Adopting the TCFD suggestions, we have now built-in climate-related dangers into our present Enterprise Threat Administration (“ERM”) processes, with every climate-related danger having distinctive danger identification numbers. On the identical time, Yinson conducts numerous danger assessments to determine our bodily and transition dangers. These embrace situation evaluation to assist us navigate the longer term trajectory of transition and bodily parameters. We imagine that with each danger comes alternative, so we wished to leverage this and begin the place the alternatives are alongside the power transition spectrum.

Why did Yinson determine to put money into electrical car charging infrastructure? How does it see the EV panorama evolving in Malaysia?

Should you have a look at Malaysia’s breakdown of carbon emissions reported within the United Nations Framework Conference on Local weather Change (UNFCCC) biennial report, you possibly can see transportation makes up a big chunk of its emissions. This indicators that the electrification of the nation’s transportation performs an important function in decarbonisation.

Fairly curiously, Yinson was based as a humble transport and logistics firm, even because it subsequently expanded into the FPSO enterprise. From 2019 onwards, the Group recognised the significance of enterprise transformation and diversification whereas making certain power affordability and accessibility for everybody. In 2022, as a part of embracing an inclusive power transition, Yinson started making strategic investments into the EV charging infrastructure by its inexperienced know-how options supplier, Yinson GreenTech. We started by partnering with Malaysian Inexperienced Know-how Company (MGTC) to assist develop the set up of EV charging stations. In 2022, we took operational management of ChargeEV, and are proud to have expanded to develop into Malaysia’s largest EV charging community.

There are large development alternatives on this house. Nonetheless, the problem stays to get all key gamers to align on the decarbonisation method. I imagine we’d like a whole-of-government, all-of-society method, making certain we have now the best insurance policies in place and a conducive setting for personal sector gamers to reach this enterprise phase. In brief, we have to arrange an EV ecosystem to assist Malaysia decarbonise its transportation sector.

Yinson Greentech’s DrivEV leases electrical autos. Picture: Yinson.

Yinson designs and operates manufacturing property for the offshore oil and fuel trade, however on the identical time, it has adopted a ‘Zero Carbon FPSO’ idea. Why did it determine to take action? What are a number of the challenges it took into consideration?

Yinson not too long ago launched its “30 by 30” initiative, which particulars a set of fabric and aspirational ESG targets that it’s trying to obtain by 2030. It additionally has in place a local weather transition roadmap which articulates its aspirations to be carbon impartial by 2030 and web zero by 2050. The Zero Carbon FPSO idea is key to reaching these objectives.

We imagine that Yinson is an early mover within the decarbonisation of FPSO operations, as articulated by this idea. To one of the best of our information, we’re forward of our trade friends when it comes to know-how growth and implementation.

I feel the truth of the state of affairs is that something we do depends upon the transition methods of the international locations by which we function. In Malaysia, there’s the chance that we are going to nonetheless depend on pure fuel as an interim base load gas past 2040 as we part out coal energy vegetation. There’ll nonetheless be demand for oil and fuel within the foreseeable future. It is very important maintain operational emissions at their lowest. As we progress in the direction of web zero in 2050, that is one thing that we have now to have a look at intently and do what we will to play our half in decarbonisation.

“

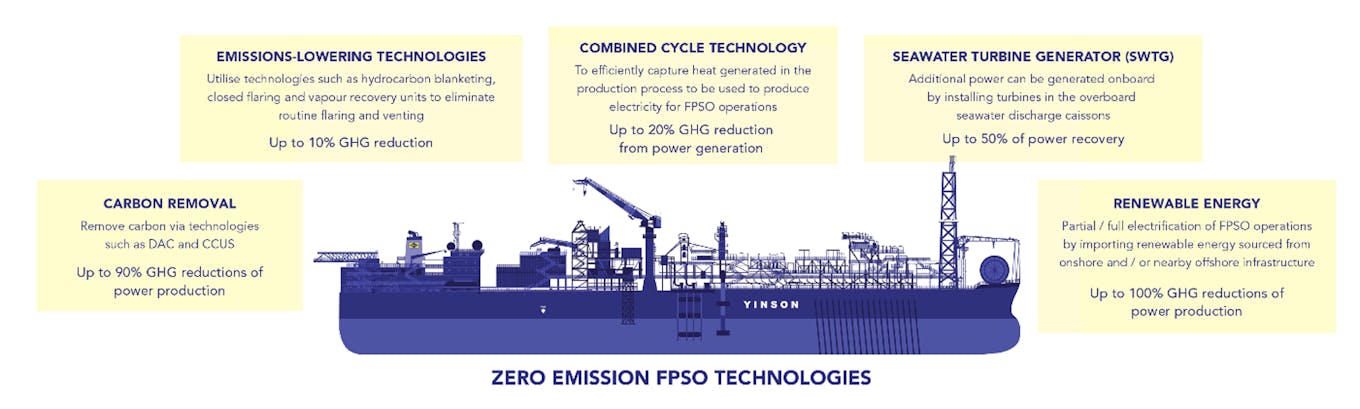

Yinson’s ‘Zero Carbon FPSO’ method

Key to Yinson’s local weather transition roadmap is the idea of ‘Zero Emissions FPSO’, which includes using applied sciences that may enable their offshore infrastructure to function with minimal local weather impression.Offshore manufacturing, Yinson’s major enterprise division, is at the moment the biggest greenhouse fuel contributor, making up round 97 per cent of the corporate’s total carbon emissions in 2022. As such, Yinson’s local weather technique is concentrated on decreasing emissions within the division, by using technological options which might cut back operational emissions of its FPSOs.

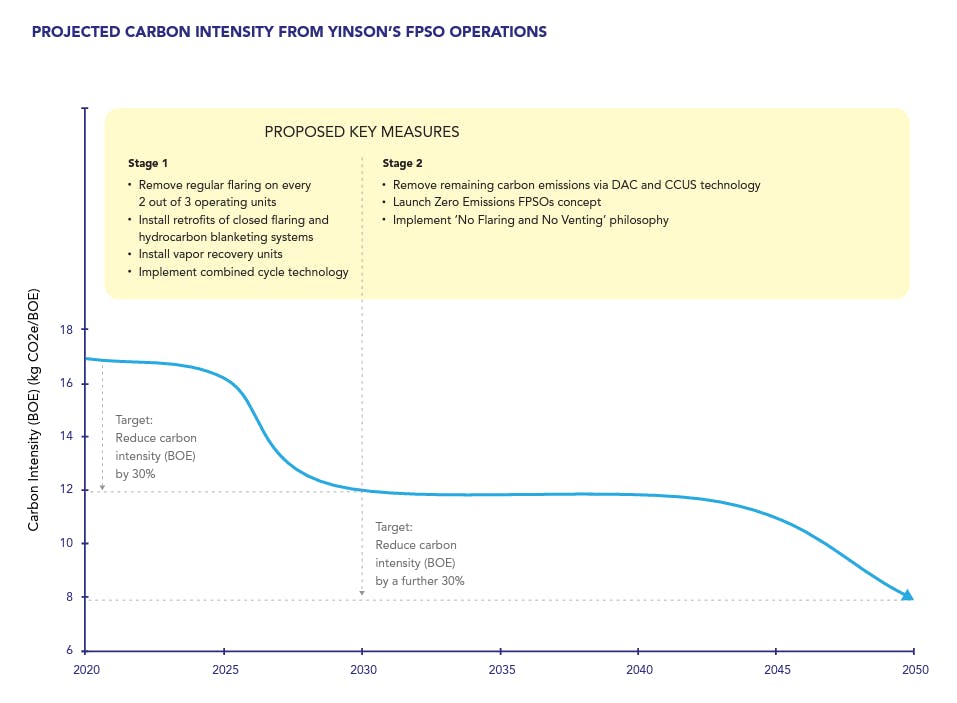

Yinson has divided its local weather roadmap into two levels: Stage 1, which seems to be on the interval as much as 2030, and Stage 2, which is between 2030 and 2050. Even underneath a lowered carbon emissions pathway, Yinson’s forecasted emissions trajectory reveals an upward development in Stage 1, because it goals to scale back emissions depth by 30 per cent by measures corresponding to decreasing flaring in the identical interval. Yinson has considered that for FPSOs which are already operational, put in know-how onboard is prone to stay till the top of the contract interval, and legacy FPSOs with out emissions discount applied sciences will proceed to emit carbon on the present excessive intensities.

Yinson expects to start rolling out its Zero Emissions FPSO by 2030 (Stage 2), the place newly designed FPSOs can have emissions discount applied sciences put in earlier than starting operations, with the goal of decreasing carbon depth by an extra 30 per cent and eradicating the remaining carbon emissions utilizing applied sciences corresponding to direct air seize (DAC) and carbon seize, utilisation and storage (CCUS). Picture: Yinson

Applied sciences concerned within the growth of Zero Emission FPSO. Picture: Yinson.

In embarking on its diversification and decarbonisation methods, how did Yinson get buy-in from key board members and stakeholders?

Our board and senior administration have all the time been very supportive of our sustainability transition. They’re staunch advocates as a result of Yinson is within the power trade. Lots of people are speaking in regards to the eventual phasing out of fossil fuels and there’s speedy growth surrounding the United Nations COP course of and the necessity to mitigate and adapt to the impacts of local weather change. Financiers and bankers now have extra ESG necessities, and lots of have established insurance policies on sustainable financing and are introducing extra stringent necessities on power gamers. As we’re concerned in capital-intensive industries, we do should depend on capital from our financiers to fund the development of a few of these initiatives. To a sure extent, we’re compelled to embrace adaptation and prioritise longevity and sustainability in order that Yinson will nonetheless be right here for a few years to return, which is why we launched into the journey of organising new divisions in renewables and inexperienced tech a few years again.

Yinson Renewables’ Nokh photo voltaic undertaking. Picture: Yinson.

How have shareholder expectations shifted, and the way does Yinson attempt to meet them?

Shareholder expectations have modified through the years. There hasn’t been as a lot scrutiny as there’s now when it comes to the corporate’s environmental efficiency. At present, our shareholders are asking: what’s the firm’s efficiency or carbon depth going to appear to be within the subsequent one yr, three years, and 5 years? Are carbon depth ranges declining? When will your emissions peak? These are the varieties of questions that we’re getting from our financiers and institutional traders.

Yinson was one of many first corporations in Malaysia to challenge a RM1 billion sustainability-linked bond (SLB) in December 2021, which was oversubscribed by 1.66 occasions. The issuance was supported by our Sustainability-Linked Financing Framework, pegging the SLB to 3 Key Efficiency Indicators (KPIs). These are renewable power technology, carbon depth per barrel of oil equal, and carbon depth per unit of electrical energy generated. As a part of our dedication to be accountable and clear to our stakeholders, we are going to guarantee these KPIs and associated efficiency acquire exterior assurance and verification yearly.

Yinson Manufacturing’s Helang FPSO. Picture: Yinson.

How do you see the oil and fuel trade in Malaysia evolving to adapt to the low-carbon transition dangers? What alternatives are there for companies on this sector?

We imagine the secret’s to method the transition holistically, orderly and inclusively. Considerate enterprise planning and methods are required to make sure sustainable worth creation for all stakeholders.

I do encourage our friends within the power trade to start by figuring out key climate-related dangers and alternatives of their companies, take into account a variety of local weather situations to find out their impression, in addition to allocate key assets and develop the required ability units for the transition. Power corporations throughout the worth chain recognise that power transition is inevitable, and we have now seen different key gamers available in the market pivoting and diversifying to different enterprise segments.

It is very important take into account that as we transition in the direction of a low-carbon economic system, we have to guarantee a steadiness in power provide for a simply transition. Power is instantly linked to the wellbeing, prosperity and growth of each economic system. On the nationwide stage, power provide doesn’t develop on the identical charge in every single place within the nation and is affected by components corresponding to availability, infrastructure, market competitors and authorities insurance policies. Hydrocarbons corresponding to fuel will nonetheless be wanted to fill within the gaps as different types of power alone can’t fulfill the power demand of all sections of society. For instance, there are roughly 250,000 properties in East Malaysia that lack a constant electrical energy provide and depend on hydrocarbons for his or her power wants. It’s important for all stakeholder teams to be a part of the power transition dialog in order that nobody is left behind.

This text was first revealed on Bursa Maintain, Bursa Malaysia’s one-stop information hub that promotes and helps growth in sustainability, company governance and accountable funding amongst public-listed corporations.