Forward of the COP28 local weather convention in Dubai, oil majors are dealing with mounting scrutiny over how their enterprise fashions nonetheless stay wedded to a way forward for ever extra demand for fossil fuels.

Amongst most of the sector’s controversial practices, a course of that makes use of trapped carbon dioxide from industrial processes to extract extra oil, often called enhanced oil restoration (EOR), has been criticised most, particularly as oil and gasoline corporations are speaking up their inexperienced credentials with their efforts to develop carbon seize applied sciences.

In Southeast Asia, EOR practices are gaining traction, although Exxon has gone on the report to say that its newest offers within the area – particularly in Indonesia and Malaysia the place it has been bullish about carbon seize and storage (CCS) tasks – aren’t targeted on EOR.

What’s Enhanced Oil Restoration?

Enhanced oil restoration, or EOR, is a course of through which carbon dioxide is injected into current oil area, often mature ones which have ceased to be productive, to recuperate extra oil.

It’s often the final stage in a three-stage course of when oil is faraway from a properly. On this ultimate stage, when CO2 is injected, it mixes with the oil, expands and propels the oil towards the floor. EOR at the moment accounts for round 4 per cent of oil manufacturing in america.

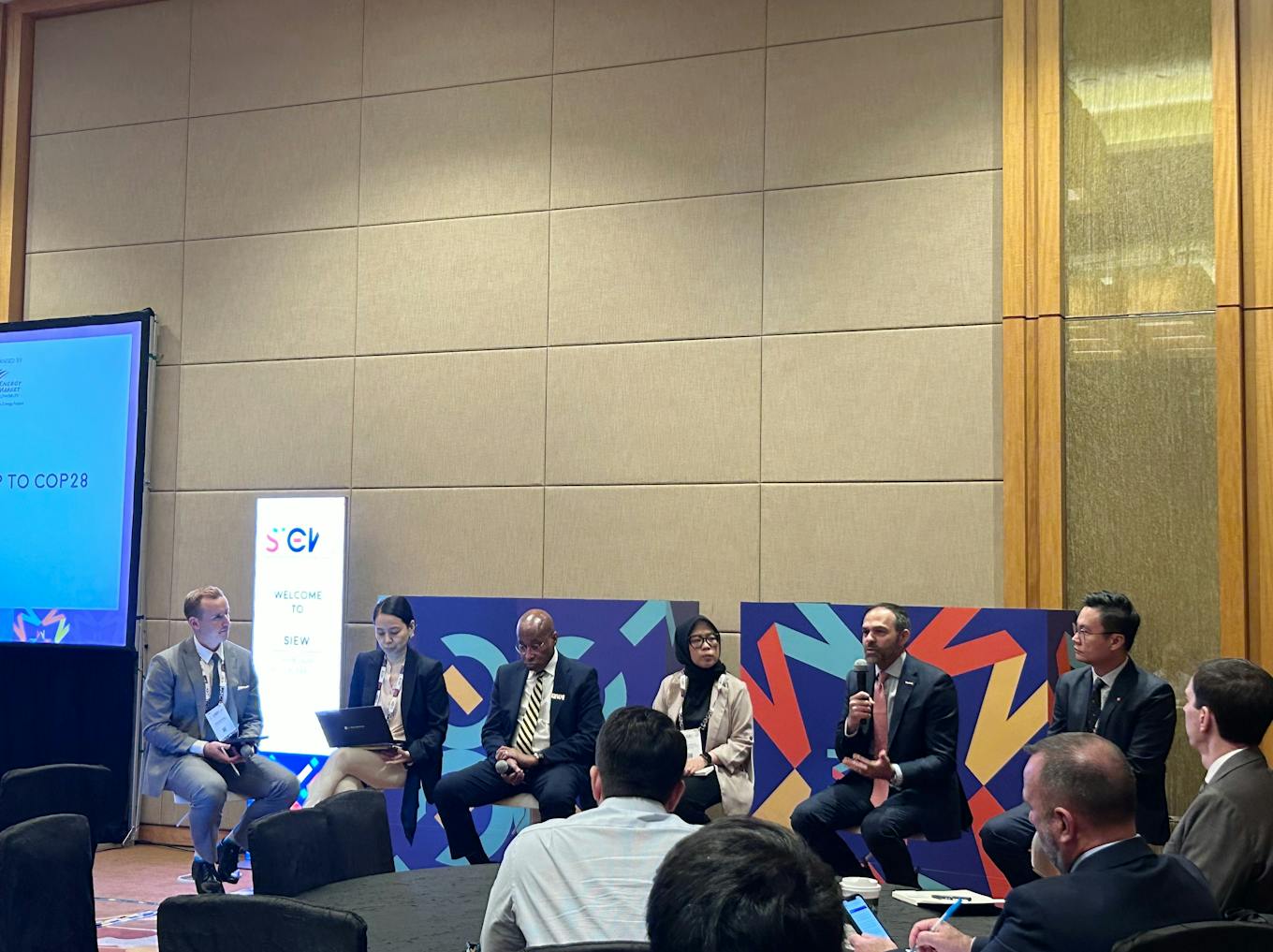

At a panel dialogue hosted by American worldwide affairs suppose tank Atlantic Council and Japan’s Institute of Vitality Economics (IEE) on the Singapore Worldwide Vitality Week, Irtiza Sayyed, president of ExxonMobil’s low carbon options unit in Asia Pacific, stated that EOR has not “labored economically” and that the corporate’s conversations in Southeast Asia are “purely about CCS”. Its use of CCS in Southeast Asia is much like its strategy in america, he stated.

“Frankly, EOR is a pleasant concept but it surely doesn’t fairly work commercially, nor does it work technically, significantly in Asia the place there must be cross-border cooperation on carbon dioxide transport and sequestration,” he stated.

“We’re targeted on carbon seize for storage, and never to be used.”

Irtiza was responding to a question from Eco-Enterprise concerning the safeguards that Exxon is putting in to make sure that its CCS partnerships in Southeast Asia will finally result in emissions reductions, amid allegations that oil giants are usingcarbon seize tasks to lengthen the fossil gas period.

“

Enhanced oil restoration is a pleasant concept but it surely doesn’t fairly work commercially nor does it work technically, significantly in Asia the place there must be cross-border cooperation on carbon dioxide transport and sequestration.

Irtiza Sayyed, president, Asia Pacific, low carbon options, ExxonMobil

His feedback come every week after the Washington Publish ran a scathing report on how the lion’s share of CO2 captured by oil corporations doesn’t return into the bottom, however is used to extract extra oil – a observe that the publication stated is supported financially by the US authorities.

Lacking elements for Southeast Asia’s CCS ambitions

Elaborating on EOR, Irtiza stated that for the method to work, an emissions supply must be linked on to the restoration location, and this could not be technically possible in Asia.

“In case you are capturing CO2 throughout the border, say in Japan, then desiring to convey it to Indonesia for storage, that’s going to be a two-point system that’s going to be expensive. For EOR processes, it’s best to do it in a single place, safely. You wouldn’t need to ship the sequestered CO2,” he stated.

The presence of a excessive variety of depleted oil and gasoline reservoirs makes Indonesia and Malaysia potential hubs for the secure and everlasting storage of carbon. Final November, Exxon signed an settlement with Indonesian state oil and gasoline firm Pertamina to collectively develop a carbon storage hub; in January this 12 months, it additionally inked a deal with Malaysian oil and gasoline agency Petronas to develop CCS tasks.

ExxonMobil Asia government Irtiza Sayyed (second from proper) talking on a panel on the Singapore Worldwide Vitality Week. Irtiza believes that resolving the difficulty of the way to finance decarbonisation worth chains needs to be the precedence of the COP28 local weather summit. Picture: Ng Wai Mun / Eco-Enterprise

Nonetheless, Irtiza stated that for Asia’s potential CCS hubs to take off, past the proper technical options, enabling insurance policies that align and channel financing from economies like Singapore, South Korea and Japan to international locations like Indonesia and Malaysia can be key.

“Cash has to come back from someplace, and the (lack of a) fee mechanism is the place the actual problem is. For rising economies like Indonesia and Malaysia, financially supporting CCS tasks can develop into fairly taxing and burdensome,” he stated, including that these international locations additionally don’t but have in place a carbon tax coverage to cost carbon correctly. “In my conversations with the assorted heads of states, it isn’t one thing that they’re ready to tackle.”

However, Irtiza stated international locations like Singapore aren’t endowed with the house wanted to retailer carbon, so they’re reliant on their neighbours.

Irtiza, a educated engineer who joined ExxonMobil with a major accountability to develop its conventional oil and gasoline enterprise, additionally spoke about Exxon’s decarbonisation methods, which in contrast to its friends, don’t lean in direction of renewable power like photo voltaic and wind, however are targeted on lowering carbon emissions from its personal operations, betting on three areas – CCS, hydrogen and biofuels – which it says are extra intently aligned with its experience and expertise within the oil and gasoline enterprise.

“A query I get requested very often is why Exxon isn’t investing in wind and photo voltaic,” he stated. “We now have analysed all of the applied sciences, all the things below the solar, and realised the place we are able to convey one thing totally different and distinctive to the desk when it comes to technological differentiation are the areas we’re specializing in now.”

This 12 months, Exxon promised that it’ll inject billions of {dollars} into this new “low carbon” enterprise line. Critics, nonetheless, say that its investments into lower-emissions applied sciences are solely about 10 per cent of its general spending over 5 years, and that the shift is extra about making the most of the Joe Biden administration’s flagship local weather regulation, the Inflation Discount Act, which incorporates beneficiant subsidies for a variety of inexperienced applied sciences.

Exxon additionally plans to broaden its oil and gasoline manufacturing by 3 per cent a 12 months by to 2027, setting it other than its European rivals that say they’re holding output regular or letting it decline.

In america, Exxon is rising a portfolio of CSS tasks alongside the Texas and Louisiana Gulf Coast. Irtiza highlights three tasks, which embody partnerships with fertiliser maker CF Industries, steelmaker Nucor and multinational chemical firm Linde. Irtiza didn’t point out, nonetheless, that Exxon additionally purchased carbon seize and exploration firm Denbury, an enhanced oil restoration specialist, in a US$4.9 billion deal in July this 12 months.

‘Service fashions’ past JETP

On the roundtable occasion, the Atlantic Council, together with Boston Consulting Group, additionally offered concepts on the way to crack the clear power transition drawback in Southeast Asia. To this point, Simply Vitality Transition Partnership (JETP) offers led by US and Japan in Indonesia and Vietnam, although signed with well-meaning intentions to boost local weather ambitions, have stalled, partly because of political complexities.

However, in Southeast Asia, Chinese language corporations are already “taking the share” in the case of their stakes in clear power tasks “due to their potential to take the dangers” related to working in a extra unsure coverage panorama, stated Marko Lackovic, managing director and companion of BCG Singapore, who consults on power, local weather and sustainability.

“The alternatives in Southeast Asia are fragmented … regardless of the area’s clear power potential, inadequate capital, buying and selling boundaries and monopolies are creating challenges for US exports,” he stated.

BCG and Atlantic Council are trying into how the US can present “extra service fashions” past JETP that mixes technical experience with low price financing, and the place the difficulty of danger averseness amongst US buyers when placing capital in Southeast Asia will be resolved.