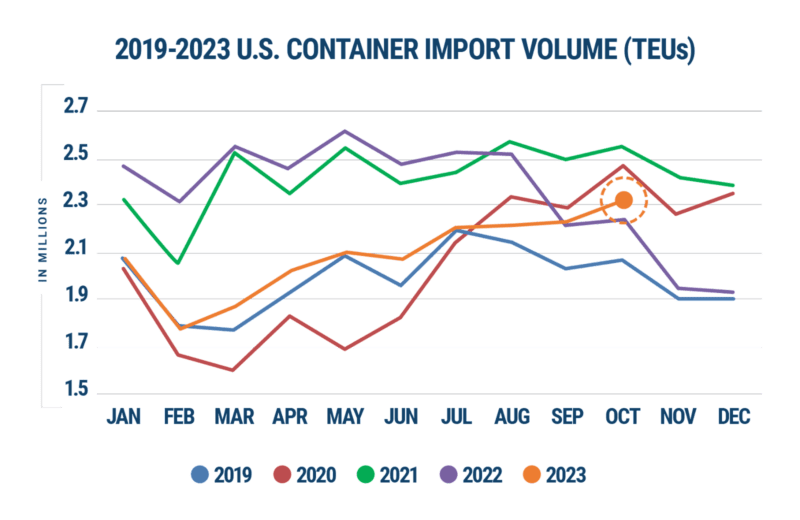

U.S. container import quantity noticed a major improve in October 2023 in comparison with September and has even surpassed the degrees seen in October 2019 earlier than the pandemic, in response to the most recent report by Descartes Methods Group.

The November World Delivery Report reveals U.S. container import volumes in October 2023 rose by 4.7% from September, reaching 2,307,918 twenty-foot equal items (TEUs). This marked a considerably shocking 3.9% improve in comparison with final October, and a considerable 11.4% leap from pre-pandemic ranges in October 2019.

Opposite to the same old pre-pandemic peak season decline that sometimes begins in August, import volumes have continued to rise and have approached the degrees that triggered port congestion throughout the pandemic, in response to Descartes.

Imports from China elevated by 2.3% in October 2023 in comparison with September, reaching 886,842 TEUs. Nonetheless, that is nonetheless a lower of 11.6% from the height in August 2022. China accounted for 38.4% of whole U.S. container imports in October, a lower of 0.9% from September and three.1% from February 2022.

Regardless of favorable labor circumstances and issues concerning the Panama Canal drought, the highest West Coast ports continued to lose market share of imports. The highest 5 East and Gulf Coast ports accounted for 45.1% of the overall import container quantity in October, marking a 3.0% improve. Alternatively, the highest 5 West Coast ports noticed their market share lower to 39.6%, which was down by 3.7%.

Regardless of elevated import quantity, port transit instances improved or remained steady, reaching a few of their lowest ranges. Most prime ports noticed delays lower in October, with the Port of Seattle experiencing the best enchancment of 1.6 days. The Port of New York/New Jersey, nonetheless, noticed a slight improve of 0.1 days in comparison with September.

“October has historically been a stronger month than September. Nonetheless, the final two months present a rise above pre-pandemic 2019 import ranges, that are counter to the declines anticipated on the finish of the 12 months,” stated Chris Jones, EVP Business at Descartes. “The drought in Panama nonetheless doesn’t seem like affecting Gulf Coast port volumes or to have triggered a shift to West Coast ports.”