Sodium ion batteries are present process a essential interval of commercialization as industries from automotive to power storage wager massive on the expertise. Established battery producers and newcomers are jostling to get from lab to fab with a viable various to lithium ion. With the latter commonplace for electrical mobility and stationary storage, new expertise should provide confirmed benefits. Sodium ion appears effectively positioned, with superior security, uncooked materials prices, and environmental credentials.

Sodium ion units don’t want essential supplies, counting on considerable sodium as an alternative of lithium, and no cobalt or nickel. As lithium ion costs rose in 2022, amid predictions of fabric shortages, sodium ion was tipped as a rival and curiosity stays sturdy, at the same time as lithium ion costs have began to fall once more.

“We’re presently monitoring 335.4 GWh of sodium ion cell manufacturing capability out to 2030, highlighting that there’s nonetheless appreciable dedication to the expertise,” mentioned Evan Hartley, senior analyst at Benchmark Mineral Intelligence.

In Might 2023, the London-based guide had tracked 150 GWh to 2030.

Cheaper

Sodium ion cells, produced at scale, may very well be 20% to 30% cheaper than lithium ferro/iron-phosphate (LFP), the dominant stationary storage battery expertise, primarily due to considerable sodium and low extraction and purification prices. Sodium ion batteries can use aluminum for the anode present collector as an alternative of copper – utilized in lithium ion – additional decreasing prices and provide chain dangers. These financial savings are nonetheless potential, nonetheless.

“Earlier than sodium ion batteries can problem current lead acid and lithium iron phosphate batteries, business gamers might want to cut back the expertise’s price by enhancing technical efficiency, establishing provide chains, and reaching economies of scale,” mentioned Shazan Siddiqi, senior expertise analyst at United Kingdom-based market analysis firm IDTechEx. “Na-ion’s price benefit is barely achievable when the size of manufacturing reaches a producing scale similar to lithium ion battery cells. Additionally, an extra worth drop of lithium carbonate might cut back the worth benefit sodium presents.”

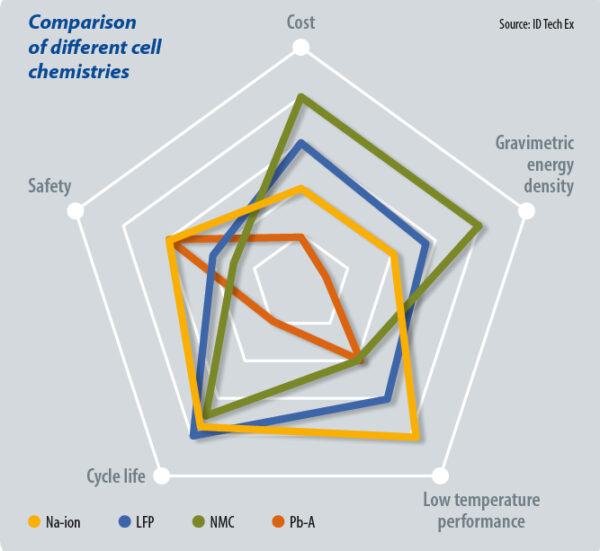

Sodium ion is unlikely to supplant lithium ion in functions prioritizing excessive efficiency, and can as an alternative be used for stationary storage and micro electrical autos. S&P International analysts count on lithium ion to produce 80% of the battery market by 2030, with 90% of these units primarily based on LFP. Sodium ion might make up 10% of the market.

Proper decisions

Researchers have thought of sodium ion because the mid-Twentieth century and up to date developments embody enhancements in storage capability and gadget life cyle, in addition to new anode and cathode supplies. Sodium ions are bulkier than lithium counterparts, so sodium ion cells have decrease voltage in addition to decrease gravimetric and volumetric power density.

Sodium ion gravimetric power density is presently round 130 Wh/kg to 160 Wh/kg, however is predicted to high 200 Wh/kg in future, above the theoretical restrict for LFP units. In energy density phrases, nonetheless, sodium ion batteries might have 1 kW/kg, larger than nickel-manganese-cobalt’s (NMC) 340W/kg to 420 W/kg and LFP’s 175 W/kg to 425 W/kg.

Whereas a sodium ion gadget lifetime of 100 to 1,000 cycles is decrease than LFP, Indian developer KPIT has reported a lifespan with 80% capability retention for six,000 cycles – depending on cell chemistry – similar to lithium ion units.

“There may be nonetheless no single profitable chemistry inside sodium ion batteries,” mentioned IDTechEx’s Siddiqi. “A lot of R&D efforts are being undertaken to search out the right anode/cathode lively materials that enables scalability past the lab stage.”

Referring to United States-based security science oganization Underwriter Laboratories, Siddiqi added that “UL standardization for sodium ion cells is, subsequently, nonetheless some time away and this makes OEMs [original equipment manufacturers] hesitant to decide to such a expertise.”

Prussian white, polyanion, and layered oxide are cathode candidates that includes cheaper supplies than lithium ion counterparts. The previous, utilized by Northvolt and CATL, is broadly out there and low cost however has comparatively low volumetric power density. United Kingdom-based firm Faradion makes use of layered oxide, which guarantees larger power density however is stricken by capability fade over time. France’s Tiamat makes use of polyanion, which is extra secure however options poisonous vanadium.

“Nearly all of cell producers planning sodium ion battery capability might be utilizing layered oxide cathode expertise,” mentioned Benchmark’s Hartly. “In actual fact, 71% of the [cell] pipeline is layered oxide. Equally, 90.8% of the sodium ion cathode pipeline is layered oxide.”

Whereas cathodes are the important thing price driver for lithium ion, the anode is the costliest element in sodium ion batteries. Arduous carbon is the usual alternative for sodium ion anodes however manufacturing capability lags behind that of sodium ion cells, ramping up costs. Arduous carbon supplies have not too long ago been derived from various precursors akin to animal waste, sewage sludge, glucose, cellulose, wooden, coal and petroleum derivatives. Artificial graphite, a typical lithium ion anode materials, depends nearly completely on the latter two precursors. With its creating provide chain, laborious carbon is extra expensive than graphite and represents one of many key hurdles in sodium ion cell manufacturing.

Partially mitigating larger prices, sodium ion batteries exhibit higher temperature tolerance, significantly in sub zero situations. They’re safer than lithium ion, as they are often discharged to zero volts, decreasing threat throughout transportation and disposal. Lithium ion batteries are sometimes saved at round 30% cost. Sodium ion has much less hearth threat, as its electrolytes have the next flashpoint – the minimal temperature at which a chemical can vaporize to type an ignitable combination with air. With each chemistries that includes comparable construction and dealing ideas, sodium ion can typically be dropped in to lithium ion manufacturing traces and tools.

In actual fact, the world’s main battery maker CATL is integrating sodium ion into its lithium ion infrastructure and merchandise. Its first sodium ion battery, launched in 2021, had an power density of 160 Wh/kg, with a promised 200 Wh/kg sooner or later. In 2023, CATL mentioned Chinese language automaker Chery could be the primary to make use of its sodium ion batteries. CATL informed pv journal late in 2023 that it has developed a fundamental business chain for sodium ion batteries and established mass manufacturing. Manufacturing scale and shipments will rely upon buyer venture implementation, mentioned CATL, including that extra must be accomplished for the massive scale industrial rollout of sodium ion. “We hope that the entire business will work collectively to advertise the event of sodium ion batteries,” mentioned the battery maker.

Cost to sodium

In January 2024, China’s largest carmaker and second-biggest battery provider, BYD, mentioned it had began building of a CNY 10 billion ($1.4 billion), 30 GWh per yr sodium ion battery manufacturing facility. The output will energy “micromobility” units. HiNa, spun out of the Chinese language Academy of Sciences, in December 2022 had commissioned a gigawatt-hour-scale sodium ion battery manufacturing line and introduced a Na-ion battery product vary and electrical automotive prototype.

European battery maker Northvolt unveiled 160 Wh/kg-validated sodium ion battery cells in November 2023. Developed with Altris – spun out of Uppsala College, in Sweden – the expertise might be used within the firm’s next-generation power storage gadget. Northvolt’s present providing is predicated on NMC chemistry. On the launch, Wilhelm Löwenhielm, Northvolt senior director of enterprise growth for power storage methods, mentioned the corporate needs a battery that’s aggressive with LFP at scale. “Over time, the expertise is predicted to surpass LFP considerably by way of cost-competitiveness,” he mentioned.

Northvolt needs a “plug-and-play” battery for quick market entry and scale-up. “Key actions for bringing this explicit expertise to market are scaling the provision chain for battery-grade supplies, which Northvolt is presently doing, along with companions,” mentioned Löwenhielm.

Smaller gamers are additionally doing their bit to deliver sodium ion expertise to commercialization. Faradion, which was acquired by Indian conglomerate Reliance Industries in 2021, says it’s now transferring its next-generation cell design to manufacturing. “We’ve developed a brand new cell expertise and footprint with 20% larger power density, and elevated cycle-life by a 3rd in comparison with our earlier cell design,” mentioned Faradion Chief Govt Officer (CEO) James Quinn. The corporate’s first-generation cells demonstrated an power density of 160 Wh/kg. In 2022, Quinn mentioned that Reliance’s plan was to construct a double-digit-gigawatt sodium ion manufacturing facility in India. For now, evidently these plans are nonetheless in place. In August 2023, Reliance Chairman Mukesh Ambani informed the corporate’s annual shareholder assembly that the enterprise is “centered on fast-track commercialization of our sodium ion battery expertise … We’ll construct on our expertise management by industrializing sodium ion cell manufacturing at a megawatt stage by 2025 and quickly construct as much as gigascale thereafter,” he mentioned.

Manufacturing

Startup Tiamat has moved ahead on its plans to start out building of a 5 GWh manufacturing plant in France’s Hauts-de-France area. In January 2024, it raised €30 million ($32.4 million) in fairness and debt financing and mentioned that it expects to finish the financing of its industrial venture within the coming months, bringing the overall financing to round €150 million. The corporate, a derivative from the French Nationwide Centre for Scientific Analysis, will initially manufacture sodium ion cells for energy instruments and stationary storage functions in its manufacturing facility, “to meet the primary orders which have already been obtained.” It can later goal scaled-up manufacturing of second-generation merchandise for battery electrical car functions.

In the USA, business gamers are additionally ramping up their commercialization efforts. In January 2024, Acculon Power introduced sequence manufacturing of its sodium ion battery modules and packs for mobility and stationary power storage functions and unveiled plans to scale its manufacturing to 2 GWh by mid-2024. In the meantime, Natron Power, a derivative out of Stanford College, meant to start out mass-producing its sodium ion batteries in 2023. Its aim was to make 600 MW of sodium ion cells at battery producer Clarios Worldwide’s exiting lithium ion Meadowbrook facility, in Michigan. Updates on progress have been restricted, nonetheless.

Funding

In October 2023, Peak Power emerged with $10 million in funding and a administration workforce comprising ex-Northvolt, Enovix, Tesla, and SunPower executives. The corporate mentioned it’ll initially import battery cells and that was not anticipated to alter till early 2028. “You want round a billion {dollars} for a small scale gigawatt manufacturing facility – suppose lower than 10 GW,” Peak Power CEO Landon Mossburg mentioned on the launch. “So the quickest strategy to get to market is to construct a system with cells out there from a 3rd get together, and China is the one place constructing capability to ship sufficient cells.” Finally, the corporate hopes to qualify for home content material credit beneath the USA Inflation Discount Act.

Some suppliers, akin to India’s KPIT, have entered the house with none manufacturing plans. The automotive software program and engineering options enterprise unveiled its sodium ion battery expertise in December 2023 and launched into a seek for manufacturing companions. Ravi Pandit, chairman of KPIT, mentioned that the corporate has developed a number of variants with power density starting from 100 Wh/kg to 170 Wh/kg, and doubtlessly reaching 220 Wh/kg. “Once we began work on sodium ion batteries, the preliminary expectation of power density was fairly low,” he mentioned. “However during the last eight years the power density has been going up due to the developments that we and different firms have been finishing up.” Others are looking out for provide partnerships. Final yr, Finnish expertise group Wärtsilä – one of many world’s main battery power storage system integrators – mentioned that it was looking for potential partnerships or acquisitions within the subject. On the time, it was shifting towards testing the expertise in its analysis services. “Our workforce stays dedicated to pursuing new alternatives by way of diversifying power storage applied sciences, akin to incorporating sodium ion batteries into our future stationary power storage options,” mentioned Amy Liu, director of strategic options growth at Wärtsilä Power Storage and Optimization, in February 2024.

Nearshoring alternative

Following many mass-production bulletins, sodium ion batteries at the moment are on the make-or-break level and investor curiosity will decide the expertise’s destiny. IDTechEx’s market evaluation, carried out in November 2023, suggests anticipated progress of at the very least 40 GWh by 2030, with an extra 100 GWh of producing capability hinging in the marketplace’s success by 2025.

“These projections assume an impending growth within the [sodium ion battery] business, which depends upon industrial dedication throughout the subsequent few years,” mentioned Siddiqi.

Sodium ion might provide yet one more alternative to near-shore clear power provide chains, with the required uncooked supplies so available throughout the globe. It seems that prepare has already left the station, nonetheless. “As with the early levels of the lithium ion battery market, the primary bottleneck for the worldwide business would be the dominance of China,” mentioned Benchmark’s Hartley. “As of 2023, 99.4% of sodium ion cell capability was primarily based in China and this determine is barely forecast to fall to 90.6% by 2030. As coverage in Europe and North America seeks to shift lithium ion battery provide chains away from China, because of the reliance on its home manufacturing, so too will a shift be wanted within the sodium ion market to create localized provide chains.”

This content material is protected by copyright and will not be reused. If you wish to cooperate with us and want to reuse a few of our content material, please contact: editors@pv-magazine.com.