The small modular reactor (SMR) idea has lengthy been considered by many throughout the nuclear sector and by policymakers as considerably of an arriviste—an upstart with daring guarantees however missing credibility and a monitor file.

SMRs had been touted to save lots of the nuclear trade from its authentic sins of delays and price overruns, typical for all giant infrastructure tasks whatever the sector, by providing smaller, extra economical, and versatile nuclear energy options. But for almost twenty years, it was nonetheless “only a idea” based mostly on the idea that the great outdated modularization precept, which has labored remarkably effectively in lots of comparable sectors, would work for nuclear power too. With out operational examples, nonetheless, all these had been usually seen as overly optimistic or speculative.

The world’s first SMR-based facility, Russia’s floating nuclear energy plant Akademik Lomonosov, launched in 2019 and deployed within the Arctic, stays, to date, the one challenge that has reached the stage of economic operation. Out of greater than 100 SMR designs which have been reported over the past 20 years as being developed at numerous phases, about half have been scrapped, shelved, or placed on maintain. Because the nuclear trade as an entire struggled to be accepted as sustainable and aggressive, most SMR start-ups had been primarily ready within the wings.

A Change of Fortune

It wouldn’t be an exaggeration to say that 2023 witnessed a sea change. Nuclear power has lastly staged a strong—although lengthy overdue—comeback. On the COP28 convention in Dubai, 22 international locations, together with the U.S., UK, Japan, South Korea, and France, signed a declaration that acknowledges “the important thing function of nuclear power in reaching international net-zero” and pledged to triple their nuclear capability by 2050. The measure signifies an rising international consensus on the vital function of nuclear energy in power transition. The declaration features a particular dedication to “small modular and different superior reactors” and guarantees to help their growth and development.

In Brussels, nuclear power appears now not perceived as “controversial.” The European Parliament, which was lengthy break up over the popularity of nuclear as “inexperienced” or “sustainable” within the EU funding taxonomy, on Dec. 12, 2023, in a landmark transfer permitted by a large margin (409 votes in favor versus solely 173 towards) to help the deployment of SMRs throughout Europe. The European Fee has declared its dedication to sustaining “European technological and industrial management in nuclear” and provided its help to a newly shaped European SMR-focused industrial alliance.

Governments internationally, together with personal buyers—from Invoice Gates and OpenAI’s Sam Altman to retail buyers—are queueing for “sizzling” SMR start-ups’ shares forward of their public choices and are actually pouring billions into the sector.

In opposition to this backdrop, the New Nuclear Watch Institute, a London-based assume tank based in 2014, has printed a report, “Scaling Success: Navigating the Way forward for Small Modular Reactors in Aggressive World Low Carbon Vitality Markets,” which fastidiously assesses the prospects of the worldwide SMRs buildout by 2050.

Beginning Small, Rising Huge

In keeping with the NNWI’s base-case state of affairs, the overall put in capability of the worldwide SMR fleet by the center of the century could be within the area of 150 to 170 GW(e). About one-third of that progress could be within the U.S. and Canada, nearly 1 / 4 in China, and one other quarter within the rising markets of Africa, Asia, and Latin America.

The report highlights that SMR deployment might face challenges throughout the sector amongst totally different SMR designs (competing for particular market segments relying primarily on dimension and co-generation choices). Nevertheless, it might additionally face exterior challenges from different low-carbon power sources, equivalent to utility-scale power storage, superior geothermal applied sciences in some locations on this planet, and carbon seize utilization and storage, that are additionally advancing in the direction of full-fledged commercialization. Giant reactor segments additionally pose competitors.

Beneath such circumstances, speedy scaling is essential for profitable tasks to leverage the economies of modularization and collection deployment. The trouble will cater to price reductions in a restricted and fragmented market, which can possible be dominated by first movers.

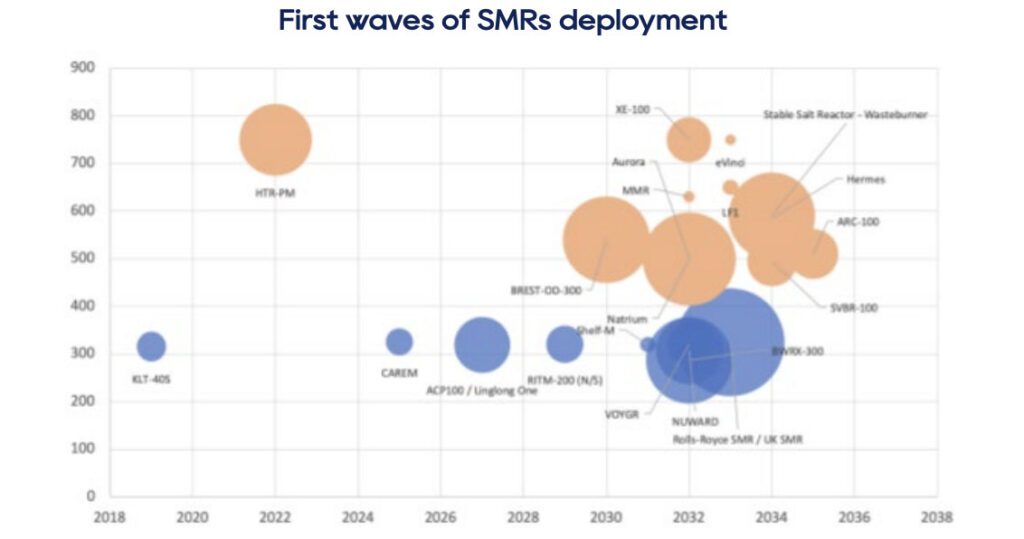

The report examines a number of dozen SMR designs which might be below growth worldwide. It identifies 25 “increased viability” designs, based mostly on a set of complete standards that features know-how maturity, licensing progress, enterprise mannequin viability, provide chain readiness, financial competitiveness, market potential, spent gas and waste administration, gas cycle and provide, monetary backing and state help mechanisms, and potential market cluster dimension and competitors inside respective clusters.

the comparatively newest phases of growth, by way of their most certainly (base-case state of affairs) timing of deployment.” Supply: NNWI/Rohunsingh et all, 2023

The 25 shortlisted designs are then grouped into classes equivalent to “first movers and front-runners,” “area of interest tasks,” “high-risk potential disruptors,” and so forth. The front-runner group contains 5 designs on the most superior phases of growth and deployment, that are prone to capitalize on accessible institutional and monetary backing to scale up first, scale back prices as a result of economies of the training curve and collection deployment, and safe the most important shares of the worldwide market by 2050.

The group contains Rosatom’s RITM-200, China Nationwide Nuclear Corp.’s (CNNC’s) ACP-100/Linglong One, NuScale’s VOYGR, GE Hitachi’s BWRX-300, and X-Vitality’s XE-100. The next is a short dialogue of the deserves and challenges that every of the front-runners faces.

RITM-200 (Rosatom, Russia)

The Russian RITM collection at the moment contains the RITM-200 and RITM-400 for icebreakers; the RITM-200S, RITM-200M, and RITM-400M for floating energy vegetation; and the RITM-200N for onshore nuclear vegetation. The RITM collection leverages an built-in “plant-as-a-service”—primarily a“one-stop-shop” enterprise mannequin that’s anticipated to dominate the worldwide SMR market’s off-grid phase. Owing to complete state help (together with funds allotted to the Arctic and the Northern Sea Route growth program for a brand new nuclear icebreakers fleet and SMR-based floating nuclear energy vegetation), Rosatom has now successfully reached the stage of collection SMR manufacturing. To date, eight RITM-200 have already been manufactured and put in on icebreakers and 6 extra are at the moment being manufactured for naval functions. Six others are deliberate to be deployed as new floating energy vegetation, together with two extra for a land-based plant in Yakutia. By 2030, Rosatom is anticipated to have 16 to 22 operational RITM reactors—a complete of about 900-1200 MWe of capability.

Not like most SMRs based mostly on pressurized water reactor (PWR) designs, the RITM is designed to make use of nuclear gas using high-assay low-enriched uranium (HALEU), which is nuclear materials enriched to lower than 20%. For now, Rosatom stays the world’s solely business HALEU vendor, and it absolutely controls a gas provide chain.

RITM gas assemblies use enhanced, accident-tolerant, nickel-chrome alloy rod cladding that includes an power content material per rod of 8 to 11 (for RITM-200M) TWh. The gas permits the reactor to have a lot increased measurability in comparison with common PWR efficiency, with the pace of the change of output at 6% nominal per minute, extending the size of time between refueling to 6-7 years (in contrast with the typical of 2-3 years). It additionally improves the burnup fee to 109.5 GWd/t U. These options guarantee utility versatility, each in on-grid (load-following) and off-grid (together with distant places) contexts, and the next capability issue (as much as 98% availability), which interprets into decrease levelized price of electrical energy (LCOE).

Leveraging its first-mover benefit, the RITM-200 is the primary design anticipated to achieve the stage at which the training curve would deliver the goal value right down to about $50-60 by the mid-2030s. This successfully means value parity with unsubsidized coal energy era and present giant nuclear vegetation.

Rosatom can also be set to profit from a just about “closed” (“all the pieces in-house”) provide chain for its SMR, vital for speedy scaling within the face of provide chain imbalances. Though geopolitical fragmentation would bar Russian SMRs from just about all markets in Organisation for Financial Co-operation and Growth (OECD) member international locations, Rosatom is prone to lengthen its dominance within the giant reactors sector (with a market share of over 80% in exporting new nuclear builds) to the SMR sector as effectively, primarily within the rising markets of the World South and its home market. Rosatom’s RITM collection is anticipated to seize about 17–18% of the worldwide fleet’s capability by 2025.

ACP-100/Linglong One (CNNC, China)

China’s ACP-100, or Linglong One, is a flexible PWR with a capability of 310 MWth (125MWe) designed for land and floating platforms and numerous co-generation functions, together with district heating (three hundredth/h sizzling steam + 62.5 MWe in co-generation mode). Linglong One, together with ACP100S designed for floating nuclear energy vegetation, is anticipated to observe carefully, capturing 15-16% of the worldwide fleet in 2050.

The Linglong One is ready to be the primary onshore SMR in business operation from 2026–2027. The primary-of-a-kind set up is below development on the website of the Changjiang nuclear energy plant within the Hainan province in China, the place CNNC poured first concrete in July 2021. As of the top of 2023, the metal containment dome is reported to have been put in.

Benefiting from lower-cost manufacturing capabilities and cost-saving development strategies, equivalent to an open-top development methodology, Linglong One is estimated to have a median in a single day development price of $5,000/kW. It holds additional discount potential owing to studying curve and scaling alternatives. With full state help, the design is anticipated to be deployed broadly in China. Use circumstances embrace energy and warmth provide within the North-eastern provinces of Liaoning, Jilin, and Heilongjiang, floating energy vegetation within the Bohai Sea, and energy and steam provide together with seawater desalination within the coastal provinces of Zhejiang, Fujian, and Hainan. Amongst its closest commerce companions and allies throughout the Belt and Highway initiative. Moreover, China is prone to promote the deployment of its SMRs by Chinese language mining firms working in Africa.

NuScale VOYGR (NuScale, U.S.)

Regardless of current setbacks associated to the cancelation of its demonstration challenge on the Idaho Nationwide Laboratory within the U.S., NuScale’s VOYGR is projected to safe round a tenth of the worldwide put in capability by 2050 (together with its floating energy vegetation modification of VOYGR it’s growing with at the side of Prodigy Clear Vitality).

NuScale’ VOYGR is at the moment the one absolutely licensed American SMR design (and the second absolutely licensed design on this planet after the Korean SMART). NuScale, nonetheless, continues to be within the means of acquiring the license for its up to date, increased capability 77-MWe design, which is anticipated to be accomplished in 2025. It’s prone to be the primary among the many OECD distributors to construct a commercially working plant, increasing quickly into Jap and Central Europe, aided by European nuclear regulators’ familiarity with PWR know-how and localization choices. The corporate has a mature manufacturing ecosystem and has shaped a partnership with ENTRA1 as a developer, providing versatile deployment fashions, together with build-own-operate schemes, much like the one adopted by Russia’s Rosatom.

To reinforce its load-following capabilities the design includes a turbine bypass system, for instance, which may bypass as much as 100% steam at full reactor energy on to the condenser with out the necessity to alter the efficiency of the reactor itself. NuScale is working towards extending its reactor’s potential functions to the method warmth industrial sector, which, on account of decrease outlet temperatures in comparison with superior, next-generation reactors, has been thought of out of attain for mild water reactors (LWRs). The idea is predicated on the concept the steam generated by a normal LWR reactor module may be compressed and heated to provide course of steam. At present the corporate has achieved a temperature of 500C, with an additional potential to increase the temperature to about 650C. This might allow NuScale to produce course of warmth for oil refining, plastic waste recycling, and so forth.

The corporate is at the moment on monitor to construct a pilot export plant in Doicesti, in Dambovita County in Romania. On the G7 Leaders in Japan earlier this yr, the U.S. administration introduced a public-private dedication of up to $275 million to help the deployment of NuScale’s Romanian challenge. The funding, contributed by the U.S., Japan, South Korea, and the United Arab Emirates (UAE), will support in materials procurement, design work, challenge administration, and website evaluation for the challenge at Doicesti.

The U.S. Export-Import Financial institution and the U.S. Worldwide Growth Finance Company additionally issued Letters of Curiosity for as much as $4 billion in challenge financing. The VOYGR-6 energy plant, aiming to provide 462 MWe, is already being licensed by the Romanian regulator. Polish copper and silver producer KGHM Polska Miedź additionally plans to construct a NuScale VOYGR modular nuclear energy plant with a capability of 462 MWe consisting of six modules by the early 2030s.

BWRX-300 (GE-Hitachi, U.S)

GE-Hitachi’s BWRX-300 can also be anticipated to be among the many first movers and shakers, by 2050, holding about 5% of the worldwide market share.

Chosen by Ontario Energy Technology (OPG) in December 2021, the design is advancing towards a development allow for a pilot plant on the Darlington nuclear station website. If profitable, this might symbolize the primary business SMR contract within the US. The seller and operator plan for the primary unit to be operational by 2029. In December 2023, Poland’s Ministry of Local weather and Setting tentatively permitted the development of six BWRX-300 energy vegetation that includes 24 BWRX-300 reactors throughout these websites (a mixed 7.2 GWe capability). Orlen Synthos Inexperienced Vitality (OSGE) introduced these places after shortlisting them for geological surveys.

Strategic benefits of the BWRX-300 embrace its evolutionary nature and (in contrast with most superior designs) restricted publicity to gas safety of provide dangers, because the design makes use of normal (boiling water reactor) BWR gas assemblies. Nevertheless, licensing BWR know-how in international locations with out earlier BWR expertise could also be time-consuming, as BWRs have a special operational and security profile in comparison with extra widespread PWRs. Moreover, on account of its dimension, 300 MWe, the BWRX-300 competes within the extremely crowded on-grid market phase, which limits its deployment potential.

GE-Hitachi claims that BWRX-300 permits financial savings of as much as 60% of capital price per MW “when put next with different typical water-cooled SMR and huge nuclear designs out there” ($2,250/kWe for nth-of-a-kind) and is “deployable globally as early as 2029.” Nevertheless, traditionally, nearly all ex-ante price and timeline targets in engineering innovation, each nuclear and non-nuclear, have tended to underestimate—generally dramatically—the required assets. Many sensible implementation constraints stay unknown till deployment is tried.

XE-100 (X-energy, U.S.)

X-Vitality’s XE-100 reactor is a high-temperature fuel reactor (HTGR) designed to function as a single 80-MWe unit with a attainable configuration as a four-unit 320 MWe plant. It’s poised to seize a big market share within the international SMR panorama, doubtlessly reaching 7% by 2050. X-energy and Dow have proposed a four-unit 320-MWe Xe-100 superior nuclear reactor facility at Union Carbide Corp. Seadrift Operations, a Dow chemical supplies manufacturing website in Seadrift, Calhoun County, Texas. X-Vitality additionally has an settlement with Vitality Northwest to deliver as much as 12 XE-100 (960 MWe) models to Washington state, with the primary module anticipated to be on-line by 2030. Though deployment deadlines could also be pushed again, important help from the U.S. authorities positions the XE-100 as one of many first superior reactors to be absolutely licensed.

X-Vitality’s XE-100 is ready to seize a big market share within the superior co-generation and industrial course of warmth phase, benefiting from aggressive benefits equivalent to the next outlet temperature (750C in comparison with the typical of 500C), enabling versatile course of warmth functions to date unreachable by different applied sciences with decrease outlet temperatures. It has its personal gas cycle provide capacities based mostly on the proprietary progressive TRi-structural ISOtropic (TRISO) know-how supported by the U.S. authorities, which reduces gas safety and provide dangers. The NNWI report estimates the agency might deploy about 100 reactors by 2050, reaching important economies of scale and decreasing prices.

5 First Movers May Account for Half the World SMR Fleet

In keeping with NNWI, taken collectively, all 5 first movers are projected to account for over half of the worldwide SMR fleet in 2025 by put in capability. Evolutionary LWR latecomers, equivalent to NUWARD and Rolls-Royce’s UK-SMR, might doubtlessly safe about 5% of the worldwide market share every, capitalizing on state help. Different designs are at the moment within the early phases of growth however lack substantial backing, equivalent to Holtec’s SMR designs (SMR-160 and SMR-300) and Westinghouse’s AP300, are much less prone to attain the total potential studying curve price discount stage on account of excessive competitors in a comparatively overcrowded phase.

Superior, Technology IV SMRs are prone to encounter substantial delays, with regulators much less accustomed to the applied sciences and fewer mature provide chains. Though some demonstration models would possibly come on-line by 2035, full-fledged first-of-a-kind deployment and collection manufacturing facility manufacturing is extra possible round 2040.

—Tim Yeo is Chairman of the New Nuclear Watch Institute (NNWI) and is a former Minister of State for the Setting with accountability for local weather change coverage within the UK Authorities. As a former Chairman of the UK Parliament Vitality and Local weather Change Choose Committee, he led the work of the Committee on the primary report on SMRs. Veronika Racikova is the Govt Director of the New Nuclear Watch Institute (NNWI).