By Wendell Roelf (Reuters) – Delivery corporations crusing across the Cape of Good Hope to keep away from Houthi assaults on the Crimson Sea face powerful selections over the place to refuel and restock, as African ports wrestle with purple tape, congestion and poor amenities, corporations and analysts say.

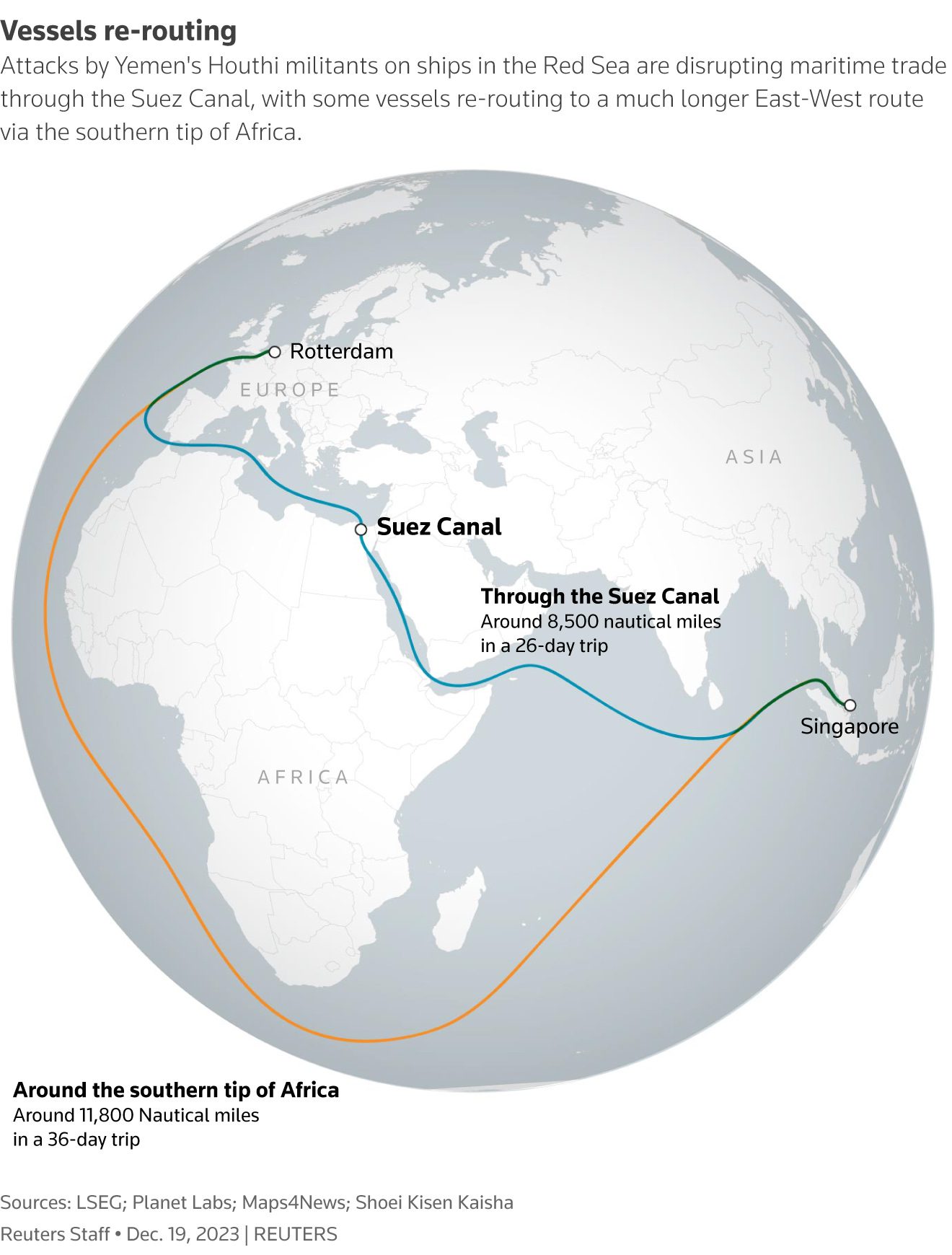

Tons of of enormous vessels are rerouting across the southern tip of Africa, an extended route including 10-14 days of journey, to flee drone and missile assaults by Yemeni Houthis which have pushed up oil costs and freight charges.

The assaults by Iranian-backed militants have disrupted worldwide commerce via the Suez Canal, the shortest delivery route between Europe and Asia, which accounts for a few sixth of world site visitors.

South Africa’s main ports, together with Durban, considered one of Africa’s largest when it comes to container volumes dealt with, in addition to Cape City and Ngqura ports are among the many worst performing globally, a World Financial institution 2022 index launched in Might discovered.

“Even the state that Durban is in now, it’s nonetheless essentially the most superior and largest port in Africa, so ships rerouting across the continent have very restricted selections for berthing for replenishment,” Alessio Lencioni, a logistics and provide chain advisor advised Reuters.

Different giant African deep-water ports alongside the Cape route, akin to Mombasa in Kenya and Dar es Salaam in Tanzania are too ill-equipped to deal with the anticipated site visitors over the subsequent couple of weeks, Lencioni stated.

Maersk stated vessels routed across the Cape will so far as doable attempt to gas at origin or vacation spot.

“In case there’s a want for bunkering en route, it will be selected a case by case foundation with Walvis Bay (Namibia) or Port Louis (Mauritius) being the highest choices,” a spokesperson stated.

CAPE OF STORMS

Tough climate with excessive seas, frequent on the ‘Cape of Storms’ in addition to the cyclone-prone Mozambique Channel, imply ships might burn via their gas faster, making refueling providers essential, shippers stated.

“In Singapore, we’re delivering bigger bunker volumes to vessels that can now be crusing longer voyages,” a spokesperson for TFG Marine, a unit of vitality dealer Trafigura, stated.

Forms is a priority. In September, South Africa’s Nationwide Income Service detained 5 bunkering vessels in Algoa Bay on suspicion of contravening the Customs and Excise Act. BP, Trafigura and Mercuria have all been hit by suspensions pending audits.

Since South Africa’s first ship-to-ship offshore bunkering began in Algoa Bay in 2016, there was a pointy rise in gas volumes and vessels utilizing it.

A spokesperson for Heron Marine, the TFG Marine affiliate working in Algoa Bay, stated the corporate is working with prospects to handle their bunkering necessities. Mercuria and BP BP.L didn’t instantly reply to questions.

In anticipation of extra marine gas being wanted, imports are anticipated to rise to round 230 kilotonnes in December, analysts say.

“South Africa is anticipating a report excessive of gas oil imports for December,” due to demand for refueling linked to the Houthi disaster, Younes Azzouzi, market analyst at information and analytics specialist Kpler stated.

(By Wendell Roelf, further reporting by Jonathan Saul in LondonEditing by Tim Cocks and Barbara Lewis)