Money purchaser GMS studies that the worldwide ship recycling group is ending the yr with combined emotions.

“On the one hand, we have now seen comparatively extra offers concluded in 2023 than we did in 2022, with 2022 being the weakest of years over the past decade (when it comes to the quantity of vessels recycled in a single yr). Alternatively, regardless of the business witnessing a far firmer quantity of vessels recycled this yr, when in comparison with a bloated world newbuilding orderbook (notably within the container sector), the recycling business nonetheless fell wanting the variety of everlasting exits wanted with a view to steadiness out world fleets.”

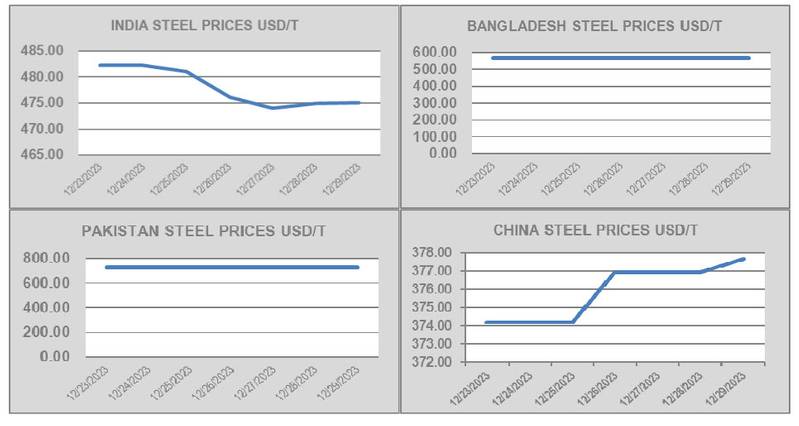

Costs have endured a rocky trip by a lot of 2023, with peaks effectively above and into USD 600/LDT being surpassed within the first half of the yr, adopted by the conventional summer time / monsoon collapse that noticed about USD 150/LDT wiped off in a number of quick months in the course of the rains and even after.

Losses sustained by most ship house owners, money patrons and vessel recyclers have been notably punishing for yet one more yr, says GMS.

“As a cheat sheet on the eve of the New Yr, we want to remind our readers that financing points proceed to persist in each Pakistan and Bangladesh – with a majority of their home banks nonetheless unwilling to sanction recent financing / strains of credit score on new vessel purchases, despite the fact that demand has been firming and home yards are beginning to progressively empty out.”

There’s trigger for cautious optimism as worldwide metal and commodity costs stay agency, with many believing vessel costs to have bottomed out throughout the sub-continent markets.

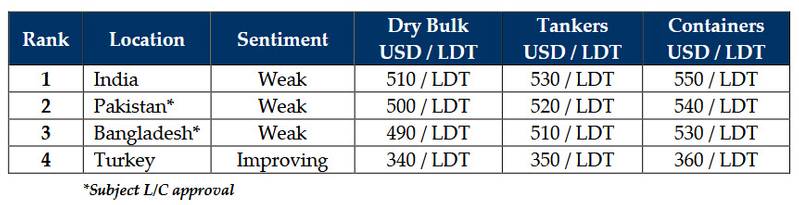

For week 52 of 2023, GMS demo rankings / pricing are: