Bursa Carbon Trade (BCX), Malaysia’s first voluntary carbon market, is gearing as much as supply its first native, nature-based carbon credit throughout the first half of this yr.

The credit might be based mostly on the Kuamut Rainforest Conservation Mission within the state of Sabah, which has been registered with certification scheme Verra. The undertaking is pending validation of its triple gold score based mostly on Verra’s Local weather, Neighborhood and Biodiversity requirements, which it was awarded final yr.

“As quickly because the carbon credit are issued, we can public sale them because the very first Malaysia-based carbon credit,” stated Muhammad Rizal Azmi, assistant vice chairman of enterprise growth and gross sales at BCX.

The Kuamut undertaking, which protects 83,381 hectares of tropical rainforests in Sabah, has already been given the best attainable rating for Improved Forest Administration tasks by carbon undertaking rankings agency BeZero, stated Rizal throughout a BCX webinar final month. It’s anticipated to cut back emissions by 543,049 tonnes of carbon dioxide equal per yr over its 30-year lifespan.

The undertaking is managed through a public-private partnership between the Sabah Forestry Division, Rakyat Berjaya, a subsidiary of state-backed basis Yayasan Sabah, and carbon undertaking financier Permian Malaysia, a neighborhood department of UK-based Permian International which just lately appointed Ivy Wong as its Malaysia CEO. The Kuamut undertaking can also be supported by indigenous neighborhood organisation PACOS Belief and the South East Asia Rainforest Analysis Partnership (SEARRP).

Whereas BCX presently solely accepts Verra-certified carbon credit, it will likely be adopting the Gold Normal, one other certification commonplace for carbon credit, by the tip of this yr, stated Rizal. BCX signed a memorandum of understanding with Gold Normal two months in the past at COP28 with the goal of enhancing its choices and bettering the data of native ecosystem gamers. Gold Normal had agreed to help capability constructing for Malaysian carbon undertaking builders and encourage the event of validation and verification our bodies.

Nature-based credit are anticipated to fetch a premium as a result of their potential co-benefits, in addition to greater operational prices for measurement, reporting and verification (MRV) actions, stated Rizal. Nevertheless, to encourage the itemizing of extra native carbon tasks on BCX, the federal government introduced in its 2024 funds that carbon tasks listed on the alternate are eligible for tax deductions of as much as RM300,000 for prices incurred of their growth, in addition to MRV actions.

BCX additionally plans to start facilitating the commerce of renewable vitality certificates (RECs) by the primary half of this yr through an public sale, with steady buying and selling to start within the third quarter, the alternate informed Eco-Enterprise.

BCX introduced on 17 January that it could collaborate with the Malaysian Photovoltaic Business Affiliation to collectively promote photo voltaic RECs, by which BCX would supply the affiliation’s members the chance to commerce RECs whereas exploring the potential provide of photo voltaic RECs from members.

It’s also exploring the potential provide of RECs from East Malaysian state utilities firm Sarawak Vitality and facilitating cross-border RECs buying and selling through the I-REC platform following an settlement signed with Sarawak Vitality, the I-REC Normal Basis and the Hydropower Sustainability Alliance on the COP28 local weather talks final yr.

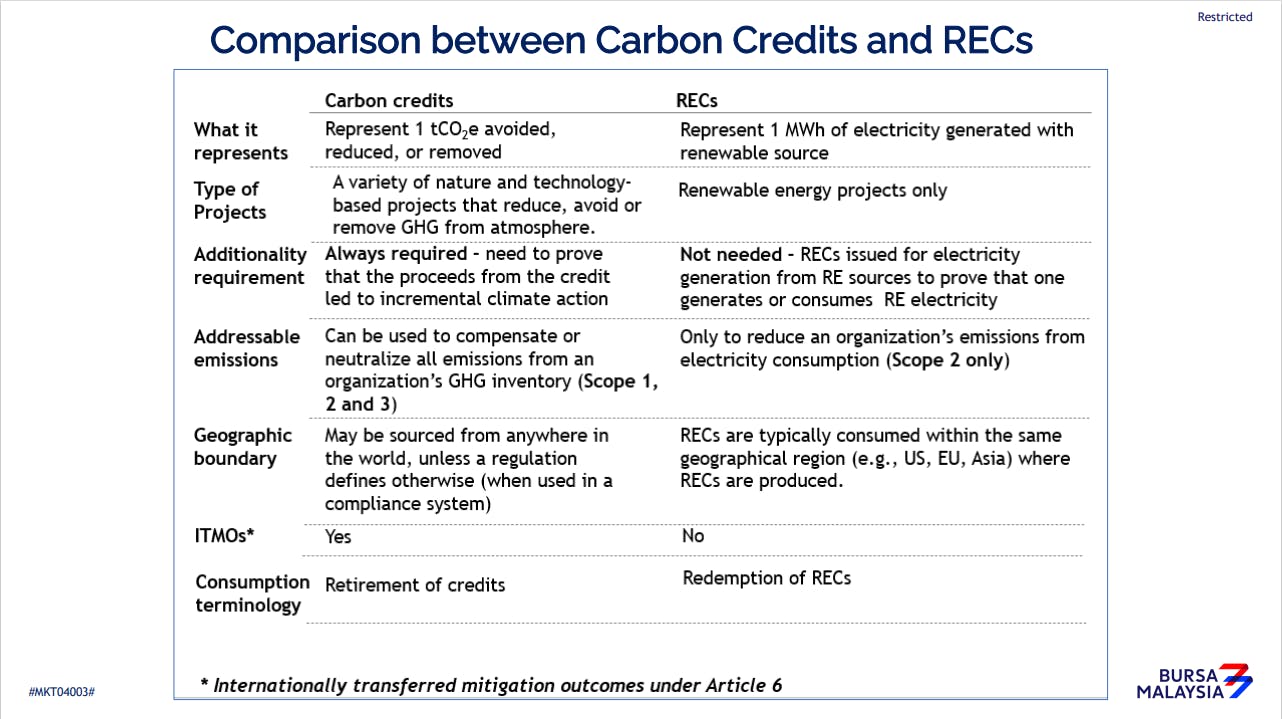

Whereas carbon credit can be utilized to offset an organization’s Scope 1, 2 and three emissions, renewable vitality certificates can solely be used to offset its Scope 2 emissions, which come from electrical energy consumption. Picture: Bursa Carbon Trade

Dr Chen Wei Nee, who leads BCX, stated that the carbon alternate’s choice to develop its product choices is in step with the ambitions of its father or mother firm, inventory alternate operator Bursa Malaysia, which just lately repositioned itself as a multi-asset alternate. “Equally, we want (BCX) to be seen as a grocery store that provides a collection of shariah-compliant environmental (choices),” stated Chen.

Though the alternate enabled steady buying and selling of carbon credit in September final yr, it has skilled weak participation. A verify by Eco-Enterprise of BCX’s market exercise through its web site this week indicated that no carbon credit have been traded throughout market hours.

Nevertheless, the alternate has learnt by conversations with trade contributors and corporations that Malaysian companies are extra conversant in and subsequently extra wanting to commerce RECs, stated Chen. Whereas RECs may also be purchased and traded through worldwide brokers, BCX goals to fulfill the market’s demand for worth discovery and transparency through its public alternate, she stated.

Marketplaces for Malaysian RECs exist already, essentially the most distinguished of which is the Malaysia Inexperienced Attribute Monitoring System (mGATS), a market for Malaysia Renewable Vitality Certificates (mRECs) operated by nationwide utilities agency Tenaga Nasional Berhad. Among the many record of renewable vitality vegetation registered beneath mGATS are a number of photo voltaic farms and hydroelectric energy vegetation.

“Whereas TNB has been doing an excellent job by way of provide RECs, if (demand) isn’t met by TNB, the shortfall is barely capable of be met by (non-public) brokers, by which there’s a scarcity of worth transparency and worth discovery,” defined Chen. “Due to this fact, as an alternate, we now have been requested to increase our merchandise…to supply and promote worth discovery and transparency.”

Chen additionally addressed issues that buying and selling carbon credit and RECs on BCX with the intention of retiring them as offsets could be interpreted as greenwashing as an alternative of encouraging companies to cut back their emissions. She cited a current research by Ecosystem Market which discovered that corporations engaged in voluntary carbon markets reported decrease emissions year-on-year in comparison with corporations that didn’t take part in carbon markets.

Along with it being necessary for companies to reveal their mitigating measures in terms of abating emissions, Chen added that companies ought to guarantee their mitigation measures don’t solely depend on offsets however a broader portfolio of decarbonisation measures.

“There ought to at all times be a mix of precise abatement plus using environmental attributes,” she stated, “(however) over time, you must use fewer environmental attributes and your actual abatement measures ought to improve.”