Whereas the previous yr has marked beautiful triumphs for nuclear vitality, consultants warning that prime prices, regulatory bottlenecks, and the necessity for market alignment stay main hurdles on the trail to a real nuclear renaissance.

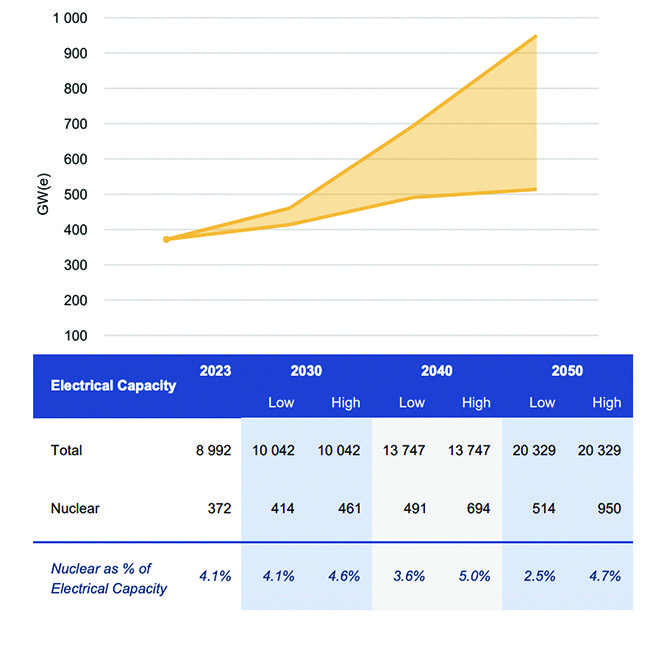

Nuclear vitality is at an inflection level. In 2023, nuclear contributed 9.2% of the world’s whole energy manufacturing with an put in capability of 371.5 GWe from 413 reactors globally. Whereas that determine nonetheless represents a relative waning—particularly if in comparison with nuclear’s share of 18% within the late Nineties—in September 2024, the Worldwide Atomic Vitality Company (IAEA) issued projections that time to a dramatic sectoral revival. Whereas the company’s high-growth situation is formidable—anticipating a fast growth that would attain as much as 890 GW by 2050—even its conservative situation is optimistic, envisioning 458 GWe by 2050 (Determine 1). The company pointed to a number of prevalent drivers. Amongst them are local weather objectives that now acknowledge nuclear as indispensable to realize COP28 pledges and rising worldwide coalitions, together with from 25 nations, that can work to triple nuclear capability by 2050. Nuclear has been championed as a key answer to counter renewable variability and local weather change resilience, and deal with vitality safety amid geopolitical pressure.

|

|

1. The Worldwide Atomic Vitality Company (IAEA) initiatives that whereas whole energy capability may improve by about 12% by 2030 and greater than double by 2050, nuclear capability may improve 2.5 occasions the 2023 capability by 2050 within the excessive case and by about 24% by 2050 within the low case. Courtesy: IAEA |

Continuing with urgency, a number of international locations have already acted to bolster their objectives with a slew of supportive coverage measures designed to handle monetary and operational dangers. In tandem, the nuclear trade’s long-missing market alerts are rising extra pronounced, driving on hovering vitality demand projections from financial development, urbanization, electrification, and currently, the scramble from tech giants to safe energy for his or her energy-intensive information facilities, and for semiconductor and chip fabrication.

Nonetheless, whereas the momentum is beautiful for the trade that has lengthy lagged, trade consultants warning these are nonetheless early alerts of progress. “Total, we nonetheless have greater than half of our technology coming from fossil fuels. To unravel that drawback, primarily based on our modeling, we’re going to wish not less than 150 GWe of nuclear along with all the opposite vitality sources—and by 2050, if that’s our net-zero aim,” stated Adam Stein, director of Nuclear Vitality Innovation at thinktank the Breakthrough Institute. “The query is, is it individuals making an attempt to get issues transferring ahead incrementally, or is it really the beginning of the ramp up? Is it going to be a renaissance, or is it going to be simply some huge cash thrown at a few little initiatives? That’s what we nonetheless need to see.”

Financial Realities, Financing, and Rising Enterprise Fashions

As Stein defined to POWER, a essential imaginative and prescient of the nuclear trade should be centered on reaching large-scale, sustained development that can have an actual influence on decarbonization and vitality safety objectives. To try this, the trade should forge a pathway that may obtain “scale”—an enormous gigawatt-level buildout and orders of magnitude past that. And to try this, it should overcome a prolonged listing of formidable, persistent technical, regulatory, and institutional challenges.

|

|

2. Levelized price of vitality (LCOE) values are proven right here calculated utilizing the Nationwide Renewable Vitality Laboratory (NREL) mannequin, which incorporates things like Inflation Discount Act (IRA) and Mortgage Packages Workplace (LPO) advantages, and manufacturing tax credit score (PTC) and funding tax credit score (ITC) incentives. Even assuming Vogtle 3 and 4 prices inflated to 2024, “the following AP1000s may very well be underneath $100/MWh with IRA advantages and nearer to ~$60/MWh with price reductions,” suggests the U.S. Division of Vitality (DOE). MACRS = modified accelerated price restoration system. Supply: Pathways to Industrial Liftoff: Superior Nuclear (DOE, September 2024) |

Maybe probably the most longstanding is that nuclear crops are exceptionally capital-intensive. In response to the U.S. Division of Vitality (DOE), estimated in a single day capital prices—with out financing prices, as if a plant had been to be constructed actually “in a single day”—differ considerably, relying on area and reactor sort. Vogtle 3 and 4, AP1000 reactors introduced on-line over the previous 18 months (and the primary new U.S. reactors constructed in additional than three many years), introduced an in a single day price of $11,000/MWh. Nevertheless, the price of Vogtle Models 3 and 4 was adversely impacted by “building with an incomplete design, an immature provide chain, and an untrained workforce,” the DOE notes. The AP1000 design is now full, there may be now provide chain infrastructure, and Vogtle educated greater than 30,000 staff, which ought to all assist to carry prices down on future builds (Determine 2).

The World Nuclear Affiliation (WNA) additionally underscores that price escalation has been traditionally stark. In France, building prices elevated from €1,170/kWe within the Nineteen Seventies for Fessenheim to €8,100/kWe in 2022 for the EPR at Flamanville, owing largely to the decline in reactor construct charges and heightened security requirements. On the similar time, nevertheless, sequence builds demonstrated in profitable initiatives in China, South Korea, and the United Arab Emirates have revealed the cost-cutting potential of standardization and regular workflows, it says. “The economics of nuclear energy are a lot improved if a variety of customary fashions will be ordered. The economies of sequence manufacturing then come into impact, and the mounted overhead prices of design and allowing concerned within the provide of nuclear grade parts and programs will be unfold over numerous models,” it notes.

“Probably of equal significance is the discount of building and allowing danger that’s related to constructing quite a few standardized models—which permits better predictability and diminished timelines for the event of further crops.” As well as, capital prices—the entire price to construct a plant and convey it to operation—will be considerably diminished by learning-through-replication, scaling up unit capacities, simplifying designs, sustaining constant licensing, and minimizing building delays to speed up income technology, it says.

Financing prices—usually comprising curiosity accruing throughout building and for challenge debt and fairness remuneration—of a challenge’s prices may also pose a steep (as much as 80%) influence on whole funding price. In deregulated markets, these prices will be exacerbated by income uncertainty, as wholesale costs can fluctuate considerably. However right here, too, new fashions are rising that use frameworks like particular objective autos (SPV) and controlled asset bases (RAB) to share danger and supply extra predictable returns. RAB fashions proposed for the UK’s Sizewell C challenge, for instance, allow income assortment through the building part, offsetting financing prices.

Within the U.S., the DOE’s Mortgage Packages Workplace (LPO) is implementing an “equity-first” strategy that reduces early high-risk publicity by requiring builders to boost personal funding earlier than accessing federal loans. The tactic, as a senior DOE official defined, ensures initiatives are “financially sound and commercially validated” earlier than committing taxpayer {dollars}.

A landmark instance is the $1.52 billion mortgage assure finalized in September 2024 to help Holtec Worldwide’s restart of the 800-MW Palisades nuclear plant in Michigan. The transaction marked the primary mortgage assure by the Vitality Infrastructure Reinvestment (EIR) program, established by the Inflation Discount Act (IRA) Part 1706, which permits initiatives to leverage present infrastructure. The framework notably additionally requires builders to realize important milestones upfront, lowering the chance of price overruns or building delays, he stated.

Managing Substantial New Dangers

Nonetheless, in line with Stephen Greene, senior fellow on the Nuclear Innovation Alliance (NIA), whereas the federal government’s help can be essential in jumpstarting nuclear improvement, over the long term—and to maintain the envisioned buildout—the nuclear trade might want to reconfigure its present improvement mannequin to mitigate monetary dangers that make unbiased improvement of latest nuclear more difficult than different kinds of vitality initiatives. On the crux of the problem is that the nuclear trade has traditionally confirmed to be notoriously sluggish, costly, and risk-averse, and it requires appreciable nuclear challenge improvement skillsets.

Together with massive capital necessities, new nuclear initiatives require longer pre-construction timeframes with better prices. And, because of the “restricted industrial maturity of superior nuclear applied sciences and the dearth of current building expertise, provide chains, and building capabilities are restricted, and it’s tougher to allocate dangers effectively for a nuclear vitality challenge at this time than it’s for initiatives utilizing extra established vitality applied sciences,” Greene defined.

“In our view, danger administration is the important thing challenge hindering the event of nuclear vitality initiatives at this time. A key query is: Which events have the motivation and the sources to tackle that danger for the following few superior nuclear vitality initiatives?” Greene stated. “Built-in electrical utilities have mentioned nuclear vitality as a gorgeous possibility, however thus far, U.S. utilities haven’t proposed particular initiatives regardless of current forecasts of extra fast electrical energy demand development than we’ve skilled in many years. Some customers have expressed curiosity in buying energy from nuclear vitality initiatives, however most have indicated they wish to be prospects of such initiatives, not builders,” he stated.

In the meantime, “The fact is that for early-stage nuclear initiatives, challenge builders will not be ready to soak up the potential price danger of early-stage nuclear vitality,” Greene added. The entities concerned—equivalent to constructors, main gear suppliers, and even some expertise builders—don’t but have the expertise with new nuclear vitality applied sciences to make them comfy taking up these dangers, and lots of don’t have the monetary sources to backstop that danger. Inexperienced instructed extra subsidies, like an funding tax credit score, could also be mandatory to assist offset dangers and allow extra personal funding.

|

|

3. TerraPower celebrated the beginning of building on the Natrium reactor demonstration challenge throughout a groundbreaking ceremony in Wyoming on June 10, 2024. The start of building actions marked the primary superior nuclear reactor challenge underneath building within the Western Hemisphere. Courtesy: TerraPower |

To handle the problem, some superior expertise builders—historically tasked with maturing their applied sciences—have stepped as much as spearhead challenge improvement. TerraPower, for instance, is creating its first Natrium energy plant, Kemmerer 1, in Wyoming (Determine 3), a quick reactor and vitality storage hybrid challenge that’s furnished with as much as $2 billion in approved funding underneath the DOE’s Superior Reactor Demonstration Program (ARDP) and set to start industrial operation within the early 2030s. The corporate, which has thus far secured offtake from PacifiCorp and contracted Bechtel as its engineering, procurement, and building (EPC) contractor, has adopted a method of “equity-only funding for first-of-a-kind (FOAK) initiatives” to keep away from debt burdens and handle monetary publicity, stated Jeff Miller, TerraPower’s director of Enterprise Improvement.

Oklo, in the meantime, is spearheading a “full worth chain” strategy, which entails managing the design, construct, and operation of smaller reactors by energy buy agreements (PPAs)—primarily permitting Oklo to keep up better management over prices and danger administration. “As an alternative of beginning with massive, capital-intensive initiatives, we opted to start with smaller reactors” primarily based on Oklo’s liquid steel sodium quick reactor design, stated Craig Bealmear, Oklo’s Chief Monetary Officer. “Now we have discovered a candy spot on the 15-MW to 50-MW reactor dimension, with the potential for 100 MW as we scale. This strategy is sensible as our reactors are extra accessible to a variety of shoppers and markets, and drastically cut back upfront capital necessities, which helps speed up deployment,” he stated.

The Prospect of Leveraging Present Coal or Nuclear Websites

As one particular doubtlessly impactful strategy to slash dangers, governments all over the world are facilitating the utilization of present vitality infrastructure. Website repurposing initiatives usually exhibit group acceptance and have regulatory background. The power to make the most of things like present transmission connections may help reduce prices and cut back timelines related to new builds. Challenges exist, in fact, which embrace environmental and bodily constraints—for instance, inhabitants density, seismic dangers, water availability, and native insurance policies may pose issues.

In an August 2024 report, the DOE instructed the nation’s 54 present nuclear plant websites (which already host 94 industrial reactors) and 11 retired nuclear websites may backfit 60 GWe or 54 large-scale nuclear crops (sized like AP1000s, at 1,117-MWe), and 95 GWe from 158 smaller reactors, sized at 600 MWe. A bigger array of 145 coal energy websites, in the meantime, may host one other 128 GWe to 174 GWe. The report recognized not less than 27 coal websites retired earlier than 2020 in 16 states that may very well be used as new websites for brand spanking new nuclear crops.

Idaho Nationwide Laboratory (INL) has individually instructed not less than 18 websites are promising for near-term AP1000 deployment, and not less than 9 websites qualify if state coverage is taken into account. These embrace the restarts already introduced at Palisades and Three Mile Island Unit 1, in addition to at Duane Arnold (the place a feasibility examine is underway) and V.C. Summer season (the place an AP1000 challenge was deserted).

For now, nevertheless, the give attention to new builds seems firmly entrenched on small modular reactor (SMR) prospects, Stein has instructed. “First, except there are already AP1000 reactors on the positioning, as is the case on the Vogtle website in Georgia, nobody goes to construct a single massive reactor. Single-unit websites merely price extra than multi-unit websites and gained’t attain the low-cost estimates which have created the current wave of enthusiasm for giant LWRs [light-water reactors],” he stated.

SMRs are additionally extra possible in liberalized markets, given they demand decrease preliminary capital and shorter deployment timelines, aligning with market demand and company wants for pressing, agency energy options. “SMRs provide the potential for reducing absolutely the greenback danger bands for building,” the DOE underscores. “For instance, a $4 billion SMR with a 50% price overrun would end in a accomplished FOAK price of $6 billion; a $10 billion reactor with the identical 50% price overrun will end in a accomplished FOAK price of $15 billion.”

New Market Entrants, Industrial Demand, and Increasing Functions

As a number of nuclear entities have informed POWER, probably the most forceful impetus at present driving nuclear ahead is market sign. Builders are fielding substantial curiosity from tech giants seeking to urgently feed information facilities (see sidebar “Information Facilities—Nuclear Vitality’s New Frontier?”), but in addition from prospects who wish to safe dependable, clear, and inexpensive energy for different industrial and industrial makes use of.

Information Facilities—Nuclear Vitality’s New Frontier?Main offers not too long ago unveiled by tech giants with nuclear builders over the previous few months underscore appreciable market sign from the energy-hungry digital sector. In September 2024, Microsoft and Constellation Vitality dedicated $1.6 billion to restart the Unit 1 reactor of the shuttered Three Mile Island plant in Pennsylvania by 2028, now referred to as the Crane Clear Vitality Heart (Determine 4). Then, in October, Google signed a Grasp Plant Improvement Settlement to facilitate the event of a 500-MW fleet of Kairos Energy molten salt nuclear reactors by 2035 to energy Google’s information facilities. That very same week, Amazon stated it might again the deployment of 5 GW of latest X-energy small modular reactors initiatives, beginning with an preliminary four-unit 320-MWe Xe-100 plant with regional utility Vitality Northwest in central Washington. It additionally signed an settlement with Dominion Vitality to discover a 300-MW SMR close to Virginia’s North Anna Energy Station.

These offers may simply be the start. McKinsey stories that information heart energy demand within the U.S. may rise by 400 TWh by 2030, with a 23% compound annual development fee. The consulting group additionally boldly predicts that whereas information facilities might quickly characterize 30%–40% of all new demand, “hyperscalers” could also be greatest poised to tackle nuclear’s greater preliminary dangers, given the long-term payoff in stability and low-carbon output. Nonetheless, challenges loom massive. Nuclear’s excessive capital prices and decade-long construct timelines make fast scale-up troublesome, McKinsey warns. As well as, nuclear’s price competitiveness with different vitality choices is unsure, and whereas modular reactors promise effectivity features, reaching economies of scale stays elusive. Transmission and interconnection delays pose one other substantial barrier. Even co-located, islanded programs for information facilities might face grid integration complexities. In November, the Federal Vitality Regulatory Fee (FERC) rejected a request to extend the quantity of energy that Talen Vitality’s Susquehanna nuclear plant can dispatch to an Amazon information heart campus. Whereas the order has posed new uncertainties concerning the regulatory panorama for behind-the-meter configurations, particularly for giant co-located information heart hundreds, authorized consultants typically recommend they count on that FERC will use a current co-location technical convention to provoke a generic rulemaking continuing, an motion that would present extra readability on behind-the-meter preparations. For now, key nuclear gamers stay largely optimistic. Constellation CEO Joe Dominguez, throughout an earnings name in November, underscored that the two–1 FERC ruling “isn’t the ultimate phrase” on co-location. “Co-location in aggressive markets stays the most effective methods for the U.S. to rapidly construct the big information facilities which are mandatory to steer on AI [artificial intelligence]. As Chairman Phillips defined, our nation’s complete economic system and nationwide safety is at stake if we don’t lead in AI.” Dominguez stated Constellation, the nation’s largest nuclear generator, remained bullish on information heart prospects. “We’re seeing a wave of curiosity from prospects who’re excited by these alternatives and in our relicensing, and we’re making important progress on contracting. The depth of our negotiations with hyperscalers and others retains going up and up,” he stated. However he additionally famous information heart demand was only one a part of the worth proposition to restart the Crane Clear Vitality Heart (previously Three Mile Island)—which he hailed as a “highly effective image of the rebirth of nuclear vitality,” he stated. “Second, it confirms our thesis that probably the most useful vitality commodity on this planet at this time is clear and dependable electrical energy. And third, it underscores the rising demand for twenty-four/7 clear vitality, pushed by the information economic system, onshoring, and electrification. All of those macro factors profit our house owners.” Given optimism for the market, Constellation can also be exploring not less than 1 GW of further nuclear technology by uprates, Dominguez stated.

|

|

|

5. Oklo Inc. introduced on Nov. 7, 2024, that the DOE and the Idaho Nationwide Laboratory (INL) have accomplished the environmental compliance course of addressing the DOE necessities for website characterization at Oklo’s first industrial superior fission energy plant website at INL. This picture exhibits Oklo’s most well-liked website, with INL’s Supplies and Fuels Advanced, and Transient Reactor Take a look at Facility, seen within the background. Courtesy: Oklo |

Oklo’s Bealmar, for instance, famous his firm’s partnerships (Determine 5) had expanded quickly from 700 MW since Could 2024, when it accomplished a enterprise mixture with AltC Acquisition Corp., to incorporate 1.4-GW in offers throughout a number of sectors—together with with information heart suppliers Equinix and Wyoming Hyperscale, and Texas-based oil and fuel firm Diamondback Vitality. “I feel the largest query all of us get is, ‘Can you progress quicker?’ And I feel we’re all beginning to get questions of ‘What can we do that can assist you transfer quicker,’ which I feel is a good place for the trade to be,” he stated.

To date, 65 operational reactors all over the world already provide warmth for non-electric functions, together with district heating, desalination, and industrial warmth functions. Curiosity is now cropping up, in Finland, for instance, to discover nuclear energy to switch ageing warmth crops. Finnish nuclear startup Regular Vitality’s LDR-50, a 50-MW pressurized water reactor, has garnered substantial curiosity for its design, which produces warmth of as much as 150C for district heating, industrial steam manufacturing, and desalination initiatives.

Cogeneration additionally poses a development alternative. Business is already exploring worth in high-temperature functions, significantly for processes requiring warmth above 500C, equivalent to hydrogen manufacturing, and the oil and fuel sector. In China, nuclear-driven cogeneration initiatives that mix electrical energy and course of warmth for industrial complexes have reportedly yielded “important price financial savings in gasoline and emissions discount,” the IAEA notes. Haiyang nuclear plant, which started offering district warmth in 2020 to switch coal-fired boilers, is now additionally planning a large-scale desalination plant coupled to its AP1000 reactors.

Stein informed POWER that the nuclear trade’s potential to provide industrial course of warmth could also be its largest neglected worth proposition. “If we simply discuss low-grade warmth for industrial processes within the U.S., that’s the thermal output of 70 AP1000s—“an enormous market that’s virtually totally served by fossil fuels proper now,” he underscored. The thermal vitality utility has broader implications for decarbonization objectives past simply electrical energy technology, he famous, and it ought to extra prominently be a part of nuclear’s “larger image,” he stated.

The Threat of Regulatory Bottlenecks

Lastly, and with emphasis, sources informed POWER, probably the most insidious danger dealing with nuclear are outdated and stringent regulatory practices that delay its potential. Regardless of Congressional stress to modernize, the Nuclear Regulatory Fee (NRC) has simply begun to grapple with its new mission that requires licensing and regulation in a fashion that doesn’t “unnecessarily restrict” the usage of nuclear vitality “or the advantages it may present for society.” Though the NRC “appears to have lastly acquired the message from Congress” with the ADVANCE Act, “the problem is precise implementation,” Stein famous (see sidebar “A Compelling Case for the Fast, Excessive-Quantity Deployment of Microreactors”).

A Compelling Case for the Fast, Excessive-Quantity Deployment of MicroreactorsThe Nuclear Vitality Institute (NEI), a North American commerce group that works to form nuclear coverage, is fiercely pushing the Nuclear Regulatory Fee (NRC) to drastically streamline its regulatory course of in order that it will likely be supportive of an rising model of microreactors that may very well be doubtlessly deployed in lower than six months. “Fast high-volume deployable reactors are in contrast to present working nuclear crops or different superior small modular reactors,” wrote Marcus Nichol, govt director, NEI New Nuclear, in a current idea paper. Extra akin to non-power or analysis reactors than industrial reactors, these 2-MWth to 50-MWth applied sciences are “very small in dimension and supply time period,” he defined. They permit modern enterprise fashions by permitting for intensive manufacturing facility building, interesting to prospects who solely wish to use vitality (not promote it). As well as, they cut back prices sufficient in order that distributors can construct reactors pre-emptively with out particular buyer orders, require minimal onsite building, and, in some circumstances, will be transported totally assembled. The reactors are envisioned for distant deployment for a spread of energy and warmth functions, together with oil and fuel manufacturing and improvement, mining and extraction, and chemical processing. At the very least one firm—Shepherd Energy—is actively exploring the idea and has known as for “ample readability by the top of 2024 on a licensing pathway supporting scale microreactor deployment.” In a letter to the NRC, the subsidiary owned by oil and fuel expertise agency NOV stated the crucial is pushed by market demand. “Within the Permian Basin alone, electrical demand is predicted to leap from 4 GWe in 2022 to over 17 GWe in 2032, pushed by electrification of oil and fuel operations to scale back emissions. We led an in-depth analysis, with participation from a number of main oil and fuel firms, that recognized a considerable variety of potential upstream energy and warmth functions that may be served by microreactors, together with water remedy, hydrogen manufacturing, and enhanced carbon seize and storage. These functions had been chosen as a result of microreactors current the perfect technical possibility for reaching their decarbonization, and aggregated collectively, suggest a really massive and instant home market,” it stated. NEI’s 180-day rapid-deployment idea primarily envisions 5 phases after website choice: mobilization and website characterization (1 month); website preparation (1 month); website meeting (2 months); supply and emplacement (1 month); and commissioning and startup (1 month). The idea of deployment, nevertheless, is “dependent upon a number of milestones within the NRC course of for the positioning license,” Nichols famous. “At present, the NRC licensing course of is advanced, together with many steps and options that will not be mandatory for a fast high-volume deployable reactor.” NEI proposes a extra pragmatic and environment friendly regulatory strategy that will align with the ADVANCE Act’s Part 208, which explicitly requires the NRC to ascertain a regulatory framework for microreactors. For one, it advocates for a specialised framework tailor-made to microreactors. NEI stresses that as a result of these smaller reactors function with essentially totally different supply phrases and easier operational fashions than large-scale crops, they would want minimized security considerations and oversight. As well as, NEI urges the NRC to drastically streamline the licensing course of to intention for primarily a four-month assessment course of: a month every for utility preparation and engagement, an acceptance assessment, two months for the NRC’s verification assessment, and one for its closing approval. The NEI report stresses the necessity for NRC regulatory prices to stay beneath 1% of whole challenge prices to maintain microreactor deployment economically viable, supporting fast, high-volume deployment fashions with out compromising security. By minimizing overhead, this strategy ensures nuclear applied sciences can compete in cost-sensitive, distant, and industrial functions, it says.

|

In October, the NRC printed a proposed rule for a Half 53 licensing pathway, a substitute for two present licensing choices (centered closely on LWR-specific necessities), which seeks to ascertain risk-informed, performance-based strategies. Half 53, designed to accommodate a number of applied sciences, should be finalized by 2027.

“It does have lots of issues that doubtlessly may assist expedite the licensing course of for superior reactors and actually simply make the method extra environment friendly with out sacrificing the NRC’s unbiased assessment of security,” stated Patrick White, NIA analysis director. Nevertheless, he stated the larger query stays: “When will this or how can this rule doubtlessly carry advantages to candidates and have or not it’s type of a extra predictable, environment friendly, and efficient course of?” Congress really acknowledged “hesitancy to make use of the brand new rule,” in order a part of the ADVANCE Act, it included a set of licensing prizes that can present a 100% price refund for any applicant that makes it by sure NRC licensing pathways, he famous. “The federal authorities is keen to primarily pay these prices so that you can be that first mover,” he stated.

Stein instructed many extra alternatives exist for effectivity on the regulatory physique, significantly for its “risk-averse regulatory paradigm,” which he stated is stricter than what Congress has stated is “ample margin of security.” Its overly conservative strategy “slows the method down with out offering significant further security to the general public,” he stated.

As only one essential measure, the NRC should transfer away from treating every utility as “totally new” and as a substitute “reference extra simply from previous selections,” Stein stated. In the meantime, additional complicating issues is that the company is shedding skilled senior workers to trade, together with “change makers” in its center ranks. That “hollowing out of the center” is additional hampering the NRC’s skill to streamline its processes because the institutional information is being drained, he stated.

In the end, for all its current successes, alignment throughout the nuclear sector is rising because the trade’s subsequent essential crucial. As White noticed, nuclear deployment depends closely on “lining up all of the totally different stakeholders”—from builders, operators, and finish customers to state and federal officers and, crucially, a powerful regulatory physique, he stated. For years, the trade struggled with a number of of those items lacking, he stated. “We nonetheless have work to do, however I feel we’ve actually acquired that course of began.”

—Sonal Patel is a POWER senior editor (@sonalcpatel, @POWERmagazine).