A current restructure of world not-for-profit CDP was not designed to see energy shift away from Asia Pacific – a area that has been rising in strategic significance – however to make sure that APAC workers are given international purposeful roles that may assist CDP “lean into” the place it must be, defined Nikki Bartlett, its chief affect officer.

“We have now seen a unprecedented shift in Asia, with a giant improve in disclosures in addition to how nicely firms are performing. We’re taking a lockstep method, specializing in how the organisation can work collectively globally, fairly than in pockets,” Bartlett advised Eco-Enterprise.

Information of CDP’s restructure emerged in February, 5 months after the appointment of its new chief government. Regional positions have been scrapped in favour of world purposeful roles, a transfer that prompted quite a few senior sustainability executives in Asia and elsewhere to go away, and a brand new framework is being launched to streamline the disclosure course of. Critics say the restructure has taken energy away from the areas and concentrated it within the West, since a lot of the international roles have now gone to West-based executives.

“Disclosure by itself doesn’t drive motion. You want a system of carrots and sticks to try this,” says CDP’s head of affect Nikki Bartlett. Picture: CDP

Bartlett advised Eco-Enterprise that CDP’s new international focus was by no means meant to maneuver the centre of gravity again to London, CDP’s headquarters, and quite a few international roles may nonetheless go to folks primarily based in different areas. “We’re solely within the first part [of the restructure],” she added. “Are we completed but? No. Is it excellent but? I’ll by no means be the primary to say so. There may be work to be finished.”

CDP, an organisation with about 700 workers, has its disclosure operate partly run out of Beijing, China’s capital metropolis, by co-director Li Fei, Bartlett identified. Sherry Madera, CDP’s chief government officer, who was beforehand an adviser for the Cyberport innovation hub in Hong Kong, additionally has a robust Asia background, she argued. CDP is reworking right into a “globally run machine” with disciplines that could possibly be run out of anyplace, she mentioned.

CDP’s restructure follows its separation from Science Primarily based Targets initiative (SBTi), a requirements physique for validating net-zero targets according to local weather science which CDP co-founded in 2015. Bartlett mentioned rules reminiscent of the US Securities and Alternate Fee’s current mandate for local weather disclosure are affecting firms and their provide chains everywhere in the world, and with CDP turning into extra globally-focused, it may serve regulators and firms higher, “in order that their {dollars} might be spent on motion – and we will observe that motion in a clear method.”

“There’s a lot alternative in what regulators try to do proper now, however these new guidelines have unintended penalties – as a result of regulators usually are not pulling in the identical course,” she mentioned.

CDP is engaged on a brand new framework that it goals to deliver extra standardisation to the plethora of environmental disclosure guidelines all over the world. “It is important that you just get a really structured, constant, comparable dataset. And that dataset can be utilized by firms, traders, and even regulators, to make higher selections,” she mentioned.

The potential that Asia holds to assist bend the curve is thrilling. Is Asia close to a tipping level? Possibly. As a result of there’s a whole lot of enterprise worth to be derived from being a sustainable firm.

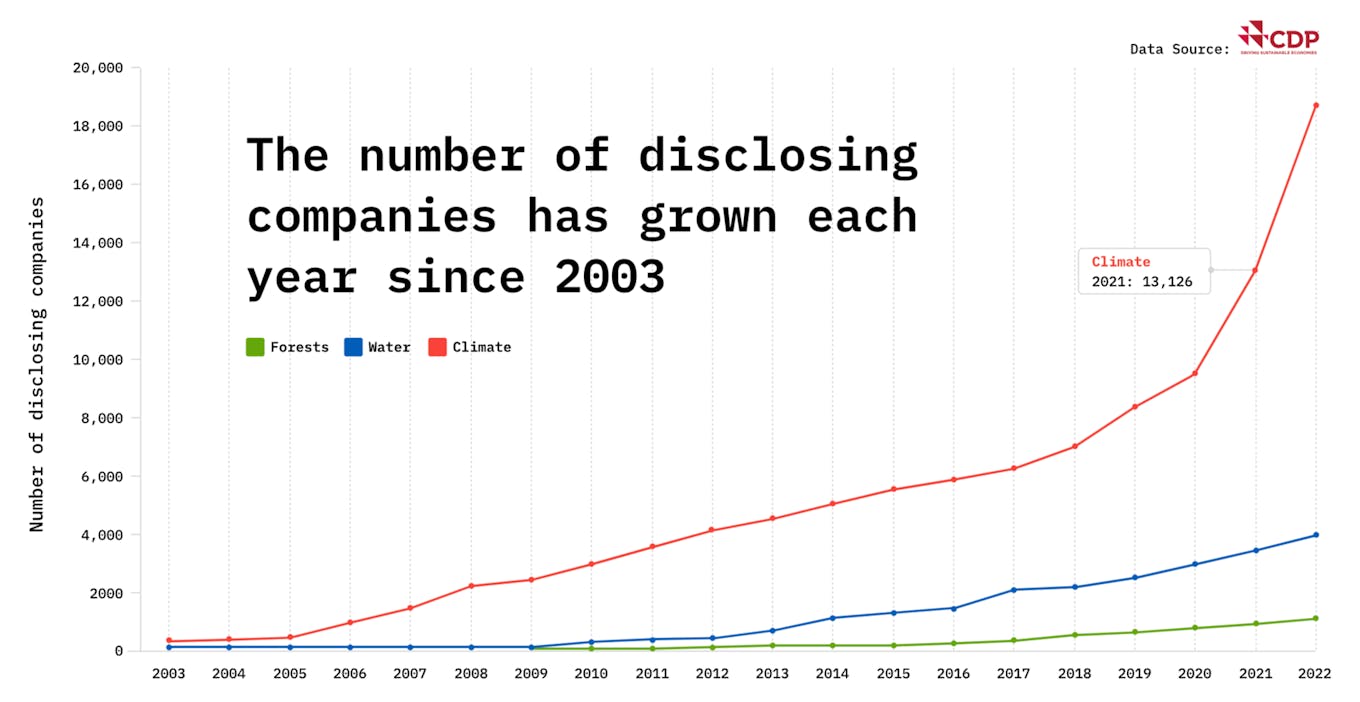

Based in 2000 as Carbon Disclosure Venture, greater than 23,000 corporations reported their environmental affect by means of CDP in 2023, a year-on-year improve of 24 per cent – and a 300 per cent improve for the reason that Paris Settlement of 2015. In Asia, the variety of firms reporting their environmental footprint has grown by 172 per cent since 2020 and it’s second solely to Europe because the quickest rising area for disclosure.

On this interview, Bartlett explains the pondering behind the restructure at CDP, how shifting provide chains are affecting company local weather motion in Asia, and why international emissions usually are not falling regardless of big will increase in environmental reporting.

Why is CDP restructuring?

As rules emerge which aren’t aligned globally, multinational firms are going through a plethora of reporting necessities – and meaning much less cash they will spend on taking motion.

We wish to have the ability to be sure that regulation is driving decision-making in the suitable course. So there was a necessity for our organisation to be globally-focused and double-down on the motion we have to see within the financial system. As a result of we all know that measurement and transparency drives motion.

The extra globally targeted we’re, the extra we will serve regulators and firms by creating a way more environment friendly measurement and reporting world for them, in order that their {dollars} might be spent on motion – and we will observe that motion in a clear method.

Regulators do care that the data within the system is actual, and that it’s getting higher and extra environment friendly. We need to be sure that our system will help determine the gaps as trade strikes in the direction of standardised knowledge.

Beneath all of the totally different rules are the requirements for measurement, just like the Greenhouse Fuel Protocol – and that hasn’t been standardised but. Regulation helps with the standardisation course of. We at the moment are within the place the place we need to take one of the best of regulation and make it bear fruit as quick as attainable.

Now that we’ve got extra knowledge coming into the area, we need to be sure that it’s a comparable and standardised dataset that covers what science wants it to cowl, and that it’s getting used to drive change within the system.

Why does the framework firms use to disclosure their environmental impacts want updating?

Within the earlier method of working, there have been challenges that have been distinctive to, say, Singapore or India. One of many largest challenges was SME [small and medium-sized enterprises] disclosure. What Europe defines as an SME is a listed firm in Singapore, for instance. We have been struggling as an organisation to all pull in a single course and body SME disclosure in a method that labored for SMEs in all places.

With the brand new framework, a reframed questionnaire, and a complete new platform, we’ve got finished that. It’s designed to sort out a few of the distinctive points that Asian firms are grappling with, versus simply what European firms are grappling with.

Take us by means of how CDP is restructuring.

CDP is a worldwide organisation – and is turning into much more international. We pivoted from being a founder-led organisation into an interim construction whereas the brand new CEO was looked for. The CDP trustees have been obsessive about discovering the suitable particular person. We now have Sherry Madera as CEO [formerly of credit card firm MasterCard and data company Refinitiv, who succeeded co-founder Paul Simpson and replaced interim CEO Jamie Neil].

Our new CEO has a robust Asia background [Madera was previously an advisor for the Cyberport innovation hub in Hong Kong] – and that was very deliberate. The restructure was designed in order that we will all pull in a single course and lean in to the place we should be. And proper now, the place we have to lean into is Asia Pacific.

We have now seen a unprecedented shift in Asia, with a giant improve in disclosures in addition to how nicely firms are performing. We’re taking a lockstep method, specializing in how the organisation can work collectively globally, fairly than in pockets. As an example, our disclosure crew is co-led by somebody in Berlin [David Lammers] and in Beijing [Li Fei].

We’ve discovered that it’s a lot smarter to run as a globally arrange machine. A entire bunch of world roles have been opened up for the primary time throughout the system. The intention is to get away from the notion that we’ve got regional places of work. We’re all one machine, with one technique.

Will increase in CDP disclosure over time. Supply: CDP

Regardless of the massive will increase in disclosure from trade, international greenhouse gasoline emissions are nonetheless rising. When are we going to see an increase in company local weather motion correspond with a drop in emissions?

First, take into consideration the place the world would have been on its present progress curve and the place it’s now, due to coverage, decarbonisation and clear power progress. We’d have been in a a lot worse place.

Carbon dioxide within the environment is cumulative and long-lived in nature. Cumulative progress is all that issues to the environment, whereas from an economist’s perspective, the relative change to the financial system [from decarbonising corporates] has been fairly basic.

Current Worldwide Power Company figures [released early March] confirmed that clear progress has gone loopy, however we nonetheless haven’t bent the curve on emissions [the IEA concluded that without clean energy technologies, the global increase in emissions would have been three times larger over the past five years].

It is because economies are nonetheless rising and new clear power is actually including to an power load that didn’t exist earlier than – as a result of there was an power deficit. And the world has not reached ‘peak power’ but.

Disclosure by itself doesn’t drive motion. You want a system of carrots and sticks to try this. And I feel we’re solely simply beginning to scratch the floor of a few of these tipping factors. I feel we’re reached a tipping level for the power sector – however we haven’t obtained there but for heavy trade or transport.

On one stage, the local weather group has finished method higher than I ever thought we might. However on one other stage, we’re not even shut the place we should be.

Wanting throughout the CDP system, it was once a typical chorus from my Asian colleagues to say: “Progress is all nicely and good, however it’s European firms doing this stuff [disclosing and decarbonisation] – you may’t anticipate that from Asian firms.” That simply doesn’t maintain maintain water anymore.

It’s all the time been very irritating for various components of the world that we use the identical benchmarks and methodology for firms in all places. However now, in the latest CDP A-Checklist scores, 40 per cent of firms graded ‘A’ have been from Asia.

It often takes a minimal of three years for an organization in CDP’s system to maneuver up the grade curve. In Asia, that development is way quicker in the intervening time. That’s actually heartening – as a result of Asia is the area with the quickest rising missions, however can also be the area with the quickest charge of change. We even noticed a leap in disclosures from Cambodia and Vietnam this yr – and that’s most likely as a result of provide chains have shifted [away from China towards Southeast Asia].

What else have you ever observed from the CDP scores this yr?

Provide chains have been probably the most highly effective drivers within the CDP system for over 10 years. There are a selection of causes for that.

One is {that a} shopper actually issues to a enterprise. Firms are making procurement selections utilizing sustainability standards. Firms don’t need to lose their provide chains – as we noticed through the Covid-19 pandemic – in order that they’re beginning to incentivise [carbon reductions] at scale. It’s a really direct suggestions loop.

One other is entry to capital, which might be fairly nebulous and oblique, significantly for fairness.

What’s taking place now’s that the entry to capital and the availability chain drivers are coming into the system on the similar time. That basically issues, significantly to SMEs. That’s actually vital in Asia [where the vast majority of firms are SMEs that are part of global supply chains].

There are a couple of tendencies at play right here.

First, it was once the case of what was described in China because the “outdoors in” technique, the place multinationals primarily based in Europe or the US had their provide chains in China. It was a giant driver of change within the area.

Now, we’re beginning to see provide chains that simply cowl Asia, with Chinese language firms utilizing Southeast Asia as their provide chain.

Firms targeted on their provide chains at the moment are Asian multinationals as a lot as they’re European or US multinationals – and that’s inflicting a scale-up [of disclosures] all throughout the area.

Second, we’re seeing a shift in provide chains amongst US and European firms out of China and into Southeast Asia.

These two issues collectively are driving a form of Southeast Asian revolution [in corporate climate action].

The attention-grabbing factor is that it’s inflicting a bunch of firms to recognise that they’ve the identical challenges and might remedy all of these challenges collectively.

So, sure, the emissions curve has not gone down. However the potential that Asia holds to assist bend the curve is thrilling.

Is Asia close to a tipping level? Possibly. As a result of there’s a whole lot of enterprise worth to be derived from being a sustainable firm. From a local weather perspective, the short-term trade-offs in some sectors usually are not wanting as stark as they used to look.

Regulation, significantly from Europe with the EU Deforestation Regulation, is beginning to drive change amongst firms on this area. How do you see this taking part in out?

Local weather motion isn’t a first-mover benefit anymore – it’s a do or die.

I do discover it heartening {that a} regulator has the balls to control like this. The boldness of the EU round a few of these points is having a ripple impact globally, as a result of they’ve targeted on provide chains.

However I do discover it very unhappy that there was such pushback in opposition to the EU’s Company Sustainability Due Diligence Directive [or CSDDD, which was provisionally agreed in December 2023, to curb corporate abuses on human rights and the environment, but was not agreed upon by EU member states].

[The CSDDD] obliges European-headquartered firms to ensure that they don’t have human rights abuses and environmental injury of their provide chains. That’s one hell of an ask, however it’s additionally a hell of a factor to suppose that’s one hell of an ask. That reveals you the way large the battle is that we’ve got to combat.

Are you able to inform us why an organization like tobacco big Philip Morris scores ‘A’ for local weather, water and nature in CDP’s scores? What worth do they actually add to the planet?

We’re an environmental organisation that benchmarks firms on environmental management. We don’t take a social method to that benchmark.

Does that imply we expect tobacco firms are including to society? That’s not for us to say. We’re impartial and we concentrate on the ‘E’ [in environmental, social and governance].

In our scoring methodology, Philip Morris may be very clear and dedicated, and has invested to drive down land use and biodiversity impacts and proven management on water safety. It’s there. It’s all within the knowledge.

We’re very clear about what our scoring methodology is about and what it’s not about. It isn’t an endorsement from CDP of 1 firm or one other firm’s services or products.

This interview has been edited for brevity and readability.