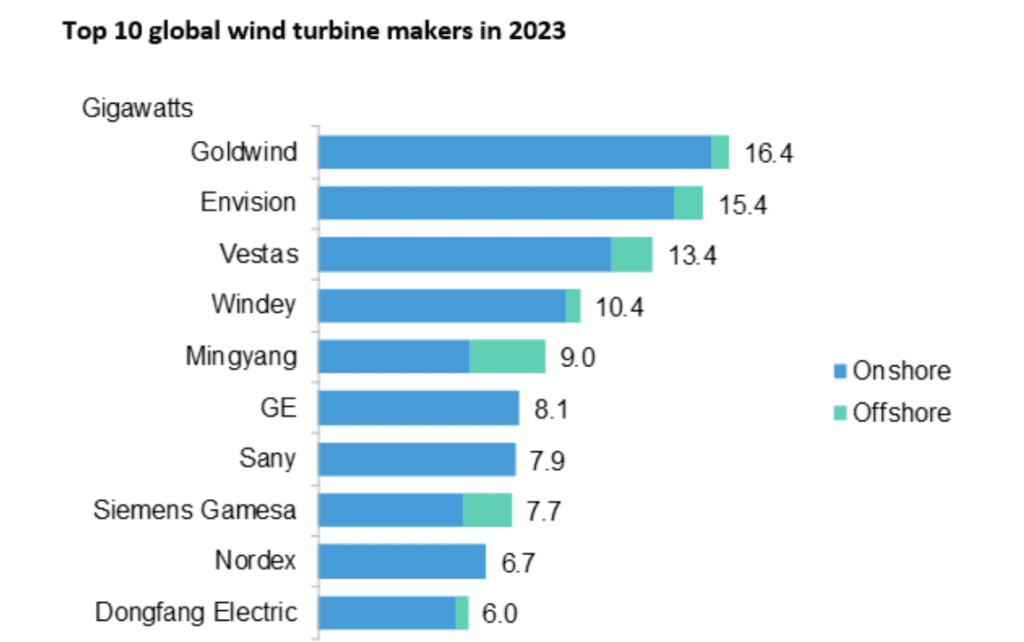

Chinese language wind turbine makers proceed to tempo the worldwide market, taking 4 of the highest 5 spots in a rating of the world’s prime producers of each onshore and offshore wind energy gear.

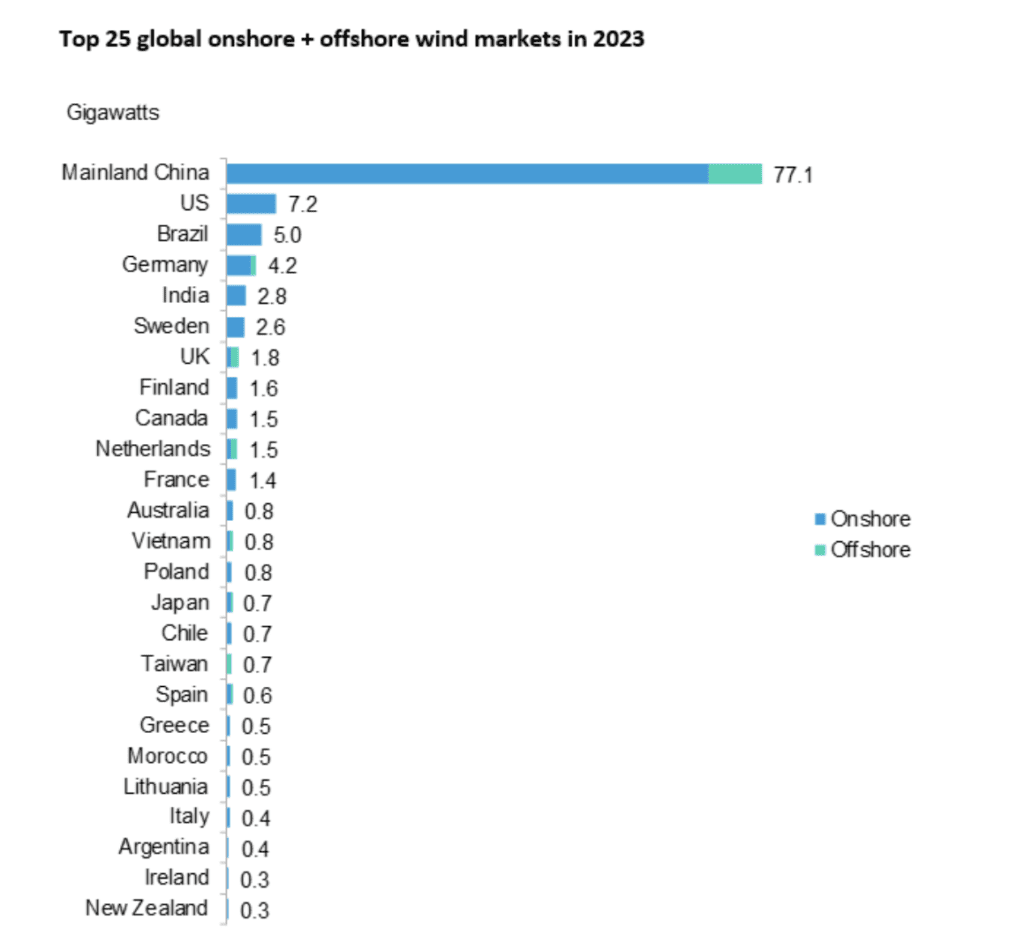

Analysis from BloombergNEF (BNEF) printed March 27 confirmed international wind energy technology capability additions hit a file 118 GW in 2023. BNEF’s “2023 World Wind Turbine Market Shares” report mentioned builders commissioned 36% extra wind energy capability final yr than in 2022, primarily because of China, the world’s largest wind energy market.

The report mentioned 107 GW of onshore wind energy capability was added in 2023, with 11 GW added offshore.

Goldwind Commissions 16.4 GW of New Capability

Beijing-based Goldwind commissioned 16.4 GW of latest wind tasks final yr, with 95% of these installations in China. Envision, headquartered in Shanghai, added 15.4 GW of capability.

Denmark’s Vestas ranked third, with 13.4 GW of latest capability, and was the one Europe-based producer within the prime 5. Windey, one other Beijing producer, was fourth within the rankings, adopted by Mingyang, which is headquartered in Zhongshan.

“It’s no shock that Chinese language turbine makers dominate the highest 5 in our rating, as buildout of gigawatt-scale wind tasks and an finish to pandemic restrictions despatched installations hovering final yr,” mentioned Cristian Dinca, wind analyst at BloombergNEF and lead writer of the report. Dinca famous that though Chinese language producers are exporting their know-how, “these gamers nonetheless rely closely on their house market, with 98% of all their capability additions coming in China itself.”

GE continues as the highest U.S.-based wind turbine maker, although it fell to sixth place within the BNEF rankings for 2023, after inserting third in 2022. The BNEF report mentioned GE’s installations final yr fell 35% from prior-year ranges. The report additionally famous that U.S. additions of wind energy capability final yr totaled 7.2 GW, the bottom stage since 2017.

Mainland China accounted for two-thirds of world wind energy additions. The EU added 15.3 GW, a file for that group and 16% greater than the 13.2 GW put in in 2022. Brazil is the most important Latin American market and added a file 5 GW of latest technology final yr, twice what it added in 2022.

China’s Overseas Attain

The report mentioned Chinese language turbine makers final yr commissioned 1.7 GW of wind tasks in 20 overseas markets, together with in 5 member states of the European Union. Chinese language firms are increasing their presence partly attributable to providing higher costs for generators in comparison with different nations. The flexibility to supply less-expensive gear is also a cause China continues to tempo the marketplace for solar energy gear.

The BNEF report mentioned costs for Chinese language-made wind generators delivered outdoors mainland China are 20% decrease than these of U.S. and European firms.

“The increase in China final yr hides a worrying development, as new additions elsewhere have been simply 8% increased than in 2022,” mentioned Oliver Metcalfe, head of wind analysis at BNEF. “There are indicators that development will speed up, although.” Metcalfe famous orders for brand spanking new generators are rising within the U.S., in addition to in different nations.

“A surge in U.S. turbine orders reveals the early influence of the brand new subsidies within the nation’s Inflation Discount Act,” mentioned Metcalfe, “whereas a increase in challenge approvals in nations like Germany means that Europe’s allowing reform is working.”

Mingyang doubled its installations of offshore wind turbine in 2023, commissioning 3 GW of latest capability and changing into the most important international provider of offshore generators for the primary time. China stays the most important marketplace for new offshore wind capability and, as with onshore, accounts for about two-thirds of latest worldwide technology. The UK and the Netherlands, respectively, have been the second- and third-largest installers of offshore wind capability final yr.

—Darrell Proctor is a senior affiliate editor for POWER (@POWERmagazine).