Business consultants convene at Clarksons HQ to deal with challenges and discover alternatives amid turbulent instances.

Clarksons Securities, Clarksons Offshore & Renewables, and Inexperienced Giraffe Advisory collectively hosted the “Offshore Wind Funding: Thoughts The Hole” seminar at Clarksons’ headquarters in London. The occasion introduced collectively key stakeholders, together with traders, builders, and suppliers, to supply helpful insights into the offshore wind trade’s present panorama.

Amidst a summer season characterised by uncertainty for renewable power traders, this seminar served as a beacon of hope by providing a complete evaluation and discussing methods to navigate the challenges.

The session’s central theme revolved across the concept of embracing “the hole” within the offshore wind sector, with a deal with reaching long-term optimistic outcomes for return on investments, sector innovation, and stabilizing the provision chain. The panel included distinguished trade figures, equivalent to developer BlueFloat Power, PE fund (developer) and North Star Renewables proprietor Companions Group, and basis producer Sif Group.

Panel dialogue together with representatives from Clarksons, Sif, Companions Group, BlueFloat Power and Inexperienced Giraffe

Government Abstract

Regardless of the challenges and adverse headlines which have clouded the offshore wind trade just lately, the seminar supplied an encouraging outlook on how funding can assist unlock provide/demand bottlenecks, promote innovation, and guarantee extra life like electrical energy costs. The prevailing sentiment amongst builders, traders, and provide chain stakeholders is one in all optimism, with the idea that the present setbacks are short-term and surmountable. Business veterans acknowledge that setbacks should not unusual and have been overcome earlier than.

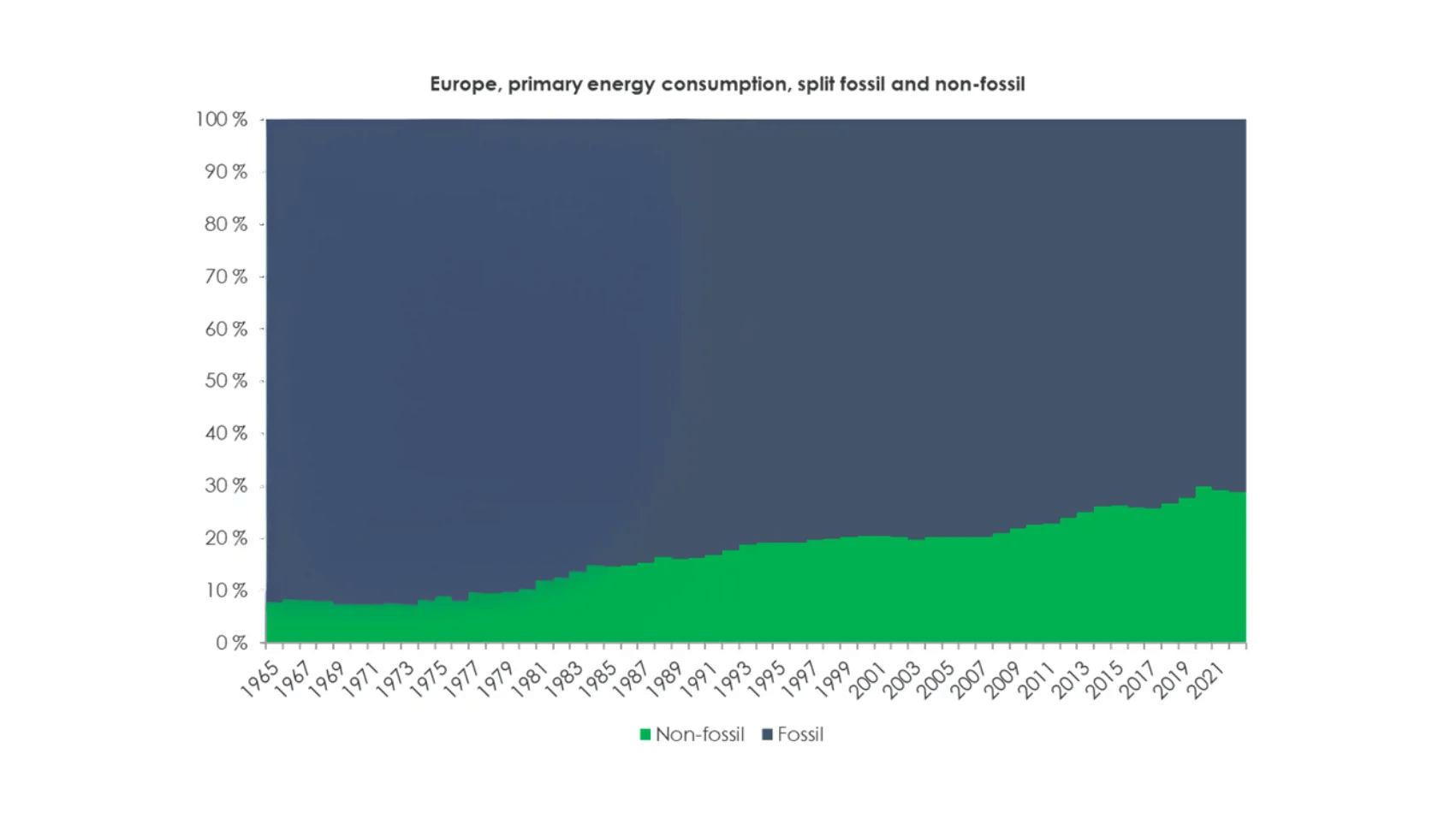

Just lately, the EU revised its Renewable Power Directive (RED), requiring member states to carry the share of Renewable power of their total consumption to 42.5% by 2030. This appears very ambitions, and targets have been raised by the revision of the RED. The EU can nonetheless probably attain this goal. The graph under shows break up between fossil and non-fossil fuels in Europe’s main power consumption. Please notice that the graph is taking a look at all of Europe, whereas RED naturally addresses EU member states solely. In Europe, as of 2022, 29% of main power consumption was non-fossil, whereas 71% was fossil. Be aware that there are additionally some nuances between “non-fossil” and “renewables”, as renewables is outlined by EU’s RED (non-fossil under naturally contains nuclear, hydro and so forth.)

The underside line as Clarksons sees it:

- These targets can really be reached.

- To take action would require large further investments into Renewables by 2030, predominantly photo voltaic and wind.

The seminar supplied a number of key takeaways

Part 1: Offshore Wind is Thriving – A Brilliant Future Forward

Offshore wind power is much from being a mere idea; it isn’t solely viable however poised for substantial progress. Latest developments available in the market, together with Orsted’s endeavors within the US, Vattenfall’s initiatives within the UK, Equinor’s ventures in Norway, and the newest Contracts for Distinction (CfD) spherical 5, have sparked important curiosity and debate concerning the long-term prospects of the sector. It’s important to emphasise that the way forward for offshore wind continues to be promising.

The doubters questioning the sector’s long-term viability want to know that offshore wind should play a pivotal position within the subsequent few many years to reaching the 2050 targets for a sustainable and renewable power panorama. A number of compelling causes help this outlook:

Part 2: Offshore Wind Provide Chain Reshapes Dynamics

The offshore wind provide chain is at present at a singular juncture, and the prevailing dynamics sign a metamorphosis within the trade’s construction. For years, builders held the higher hand, akin to the early days of the Web, the place their focus was on capturing market share, even on the expense of profitability. This intense competitors drove a race to safe mandates simply earlier than Ultimate Funding Selections (FID), resulting in a fast decline in Levelized Price of Power (LCOE) but additionally squeezing revenue margins. This unlucky sample resulted in some corporations going through disappointing monetary outcomes and even chapter. The tide has now turned, and in each aspect of the market, a conspicuous hole has emerged between the appreciable gigawatts (GW) beneath growth – even after factoring in mission cancellations and delays – and the precise capability of the provision chain to ship. This imbalance has significantly strengthened the bargaining energy of contractors and suppliers.

This shift available in the market panorama manifests itself in a number of methods:

- Larger Contract Costs: Contract costs have surged, considerably exceeding short-term inflation charges associated to uncooked supplies and labour prices.

- Contractor-Pleasant Phrases: Contractors now get pleasure from extra beneficial contract phrases, enhancing their place and contributing to a extra equitable and collaborative enterprise setting.

- Prolonged Reservation Occasions: Contractors are securing reservations over extra prolonged intervals, enabling them to align with the very best tasks. This, in flip, offers higher visibility and stability for contractors and the trade as an entire.

Importantly, this transformation doesn’t negate the challenges the provision chain faces. As an alternative, it highlights a shift of those challenges again to the builders, which is able to finally have an effect on shoppers. On this course of, it serves to revive profitability in any respect ranges whereas sustaining competitiveness inside the sector.

“This redirection of dynamics signifies the offshore wind trade’s maturation and its capacity to navigate hurdles and complexities extra successfully, in the end leading to a win-win state of affairs for all stakeholders.”

Part 3: Seizing Funding Alternatives within the Offshore Wind Provide Chain

In gentle of the evolving dynamics inside the offshore wind trade, a outstanding alternative has arisen for investments within the provide chain. This second is important for a number of compelling causes:

Unlocking Bottlenecks: The provision chain at present stands as a bottleneck within the offshore wind trade. By investing on this essential space, we are able to alleviate the pressure on builders, scale back value pressures, and make sure that this pivotal sector for our financial system can thrive.

Promising Returns: Investing within the provide chain, bridging the present hole, and streamlining operations gives the prospect of considerable and sustainable returns. This endeavour encompasses a large number of sub-segments, together with ports, grids, cables, generators, foundations, and extra. Every of those sub-segments has its distinctive set of intricacies and nuances, contributing to the trade’s multifaceted panorama.

Innovation on the Core: Innovation isn’t solely a driving power but additionally on the core of the offshore wind provide chain.

“Buyers, particularly these comfy with greater dangers and anticipating greater returns, will uncover alternatives inside the newer segments of the trade.”

Conclusion: Navigating In direction of a Brilliant Offshore Wind Future

The offshore wind trade finds itself at a pivotal juncture, with a myriad of challenges and alternatives defining its path ahead. As our dialogue has highlighted, a spectrum of options is on the market to safe a vibrant and sustainable future for offshore wind.

- Authorities’s Position: Governments maintain a pivotal position within the offshore wind trade’s future. It’s anticipated that they are going to proactively reassess and realign tenders for offshore wind capability. This adjustment not solely influences pricing but additionally shapes the regulatory framework, fostering an setting conducive to offshore wind growth.

- Environment friendly Public sale Mechanisms: To make sure the trade’s effectivity and vitality, it’s essential to take care of Contracts for Distinction (CfD) and Feed-in Tariff (FIT) auctions. Nonetheless, refining these mechanisms by eliminating pointless value caps, implementing full indexing, and shortening the interval between public sale outcomes and building can improve their effectiveness and the trade’s resilience.

- Lengthy-Time period Planning: Establishing sturdy, long-term plans in each taking part nation is crucial. These plans ought to present a transparent roadmap, outlining targets for 2030, 2035, and 2040, specifying the capability to be auctioned, and defining clear tender guidelines. Readability past 2030 is particularly key, in our view. This strategy ensures long-term visibility and stability for the offshore wind trade.

- Supporting the Provide Chain: The provision chain is a linchpin within the offshore wind sector. To alleviate strain on their margins, appeal to extra funding, stabilize mass manufacturing, and make sure the well timed supply of tasks, supporting the finance and growth of the provision chain is crucial.

- Inflation and Price Stability: Anticipating a decline in inflation, particularly in the price of supplies, is a optimistic signal for the offshore wind trade. The trade has already witnessed important reductions from peak prices, contributing to a extra secure value setting. Furthermore, expectations of lowering rates of interest additional improve the trade’s value stability.

In abstract, the offshore wind trade isn’t solely resilient however poised for important progress. By implementing these options and navigating by the challenges, the trade can fortify its place as a beacon of hope for a sustainable power future. Offshore wind stays an important contributor to the worldwide transition to cleaner power sources, and these methods will pave the way in which for its continued success. With innovation, collaboration, and strategic planning, offshore wind will proceed to thrive within the face of evolving challenges.

Be aware: The opinions, beliefs, and viewpoints expressed on this article don’t essentially replicate the opinions of offshoreWIND.biz