Oversupply is hitting some photo voltaic producers exhausting however grid constraints and labor shortages are unlikely to carry the photo voltaic trade again in 2024.

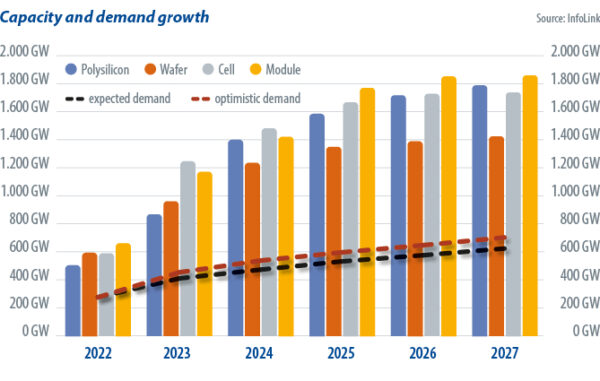

Falling photo voltaic module costs have spurred demand in 2023. Tasks postponed or canceled in 2022 have resumed development and new initiatives have taken form easily. Module demand in 2023 is predicted to hit 412 GW to 455 GW, up 53% yr on yr.

Whereas module shipments elevated, Europe and Brazil have been hit by stock pileups in 2023. Falling costs profit mission inner charges of return however labor shortages, coverage modifications, and mission scheduling drove a mismatch between manufacturing and set up. With extreme stock, some producers are slicing costs or transferring modules elsewhere, inflicting big losses. Set up demand is more likely to develop additional in 2024 however will nonetheless lag manufacturing capability. Oversupply will proceed and can restrict new manufacturing capability. Overstocked producers shall be extra cautious about manufacturing, transport, and gross sales in 2024.

Photo voltaic development can be topic to grid capability. The photo voltaic increase has seen Brazil and a few European nations delay or cancel small-scale initiatives because of grid constraints. Speedy rooftop set up development in China has prompted native governments to handle grid capability however suspending small array connections and mandating power storage is a stopgap measure. Upgrading grids requires funding and regulation.

Though photo voltaic development will sluggish from 2023 onwards, because of the next baseline, grid points, and localization tendencies, the market outlook stays constructive as module costs have plummeted, with module demand projected to see a rise of 15% to twenty% in 2024.

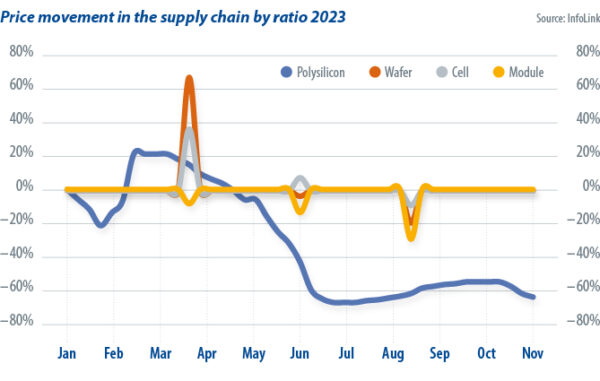

Revenue squeeze

With photo voltaic manufacturing capability growth plans throughout the availability chain materializing in 2023, the polysilicon provide bottleneck eased however quickly expanded photo voltaic manufacturing services led to a critical surplus. Costs throughout the availability chain plunged in 2023. Polysilicon costs retreated from CNY 300 ($41.40)/kg yr’s finish 2022, to round CNY 69/kg at the moment, whereas module costs fell from final yr’s $0.245/W to $0.135/W. Brief-term value actions could happen sooner or later, when provide and demand modifications, however as provide will nonetheless outstrip set up demand, costs will not be more likely to bounce again considerably, leaving extra bargaining energy to finish customers.

Rising photo voltaic manufacturing capability helps trade growth nevertheless it additionally results in more and more fierce competitors between producers. Having noticed speedy market development, higher earnings, and excessive costs throughout the availability chain in 2022, current and new PV gamers introduced growth plans one after one other, escalating competitors and driving down costs.

Now that costs have plummeted, many producers have little room left for earnings, forcing them to regulate utilization charges in accordance with demand. Consequently, some older manufacturing traces have been phased out at a quicker tempo and a few new capability plans have been cancelled as they’re now not worthwhile. Extra growth plans are anticipated to be cancelled in 2024. Corporations with poor value management and inadequate gross sales channels could also be compelled out of the market.

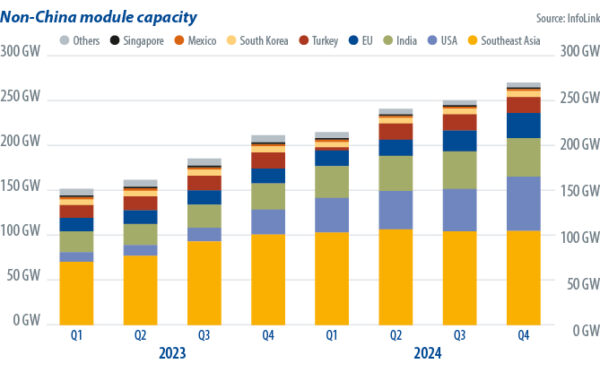

Some nations have just lately launched protectionist measures for photo voltaic merchandise and tried to construct home capability in pursuit of power independence. Current insurance policies embrace the US Inflation Discount Act (IRA) and an anti-circumvention investigation into Southeast Asian photo voltaic merchandise. Different schemes embrace India’s fundamental customs obligation on imported modules, its authorized checklist of fashions and producers, and the production-linked incentive scheme. Europe is evaluating the need of limiting photo voltaic imports because the market grapples with an inflow of low-priced Chinese language modules.

The photo voltaic provide chain stays concentrated in China, with Chinese language polysilicon, wafer, cell, and module manufacturing capability amounting to 93%, 97%, 90%, and 82%, respectively, of the worldwide totals. Capability outdoors China is unable to fulfil demand. If the European Union restricts photo voltaic imports earlier than securing provide, set up volumes will fall. The USA skilled a 16% fall final yr after the Uyghur Compelled Labor Prevention Act restricted the import of modules that includes Xinjiang polysilicon.

Pushed by coverage, 2023 introduced abroad manufacturing capability, particularly in america and India, the place services will come on-line in 2024. InfoLink’s statistics present annual module manufacturing capability outdoors China could have elevated not less than 78%, to 270 GW over the early 2023 to late 2024 interval. Some producers are contemplating increasing capability in Europe and the Center East, which might change an trade panorama dominated by Chinese language modules.

It’s price noting that these abroad growth initiatives are largely for modules, given entry boundaries reminiscent of capital expenditure and technical problem for different hyperlinks within the PV provide chain. There are a couple of cell growth plans and scattered polysilicon and wafer initiatives. New cell and module gamers are unlikely to wean themselves off Chinese language provide fully inside two to 3 years.

General, the photo voltaic trade will proceed to develop in 2024 regardless of the influence of grid capability constraints and labor shortages on installations. Manufacturing capability growth and declining costs will drive demand successfully, offering vivid prospects for photo voltaic builders.

In the meantime, hovering manufacturing capability, an intense value warfare, and technological shifts will problem the availability facet’s functionality to regulate prices and put money into R&D and gross sales. The provision and demand panorama will change into extra advanced and the trade will change extra shortly as manufacturing capacities abroad come on-line.

In regards to the writer: Richard Chen is a photo voltaic analysis assistant at InfoLink. He’s chargeable for gathering the monetary info and customs information of PV producers. He displays utility-scale mission progress and auctions abroad and helps the analyst staff to forecast demand.

The views and opinions expressed on this article are the writer’s personal, and don’t essentially mirror these held by pv journal.

This content material is protected by copyright and might not be reused. If you wish to cooperate with us and want to reuse a few of our content material, please contact: editors@pv-magazine.com.