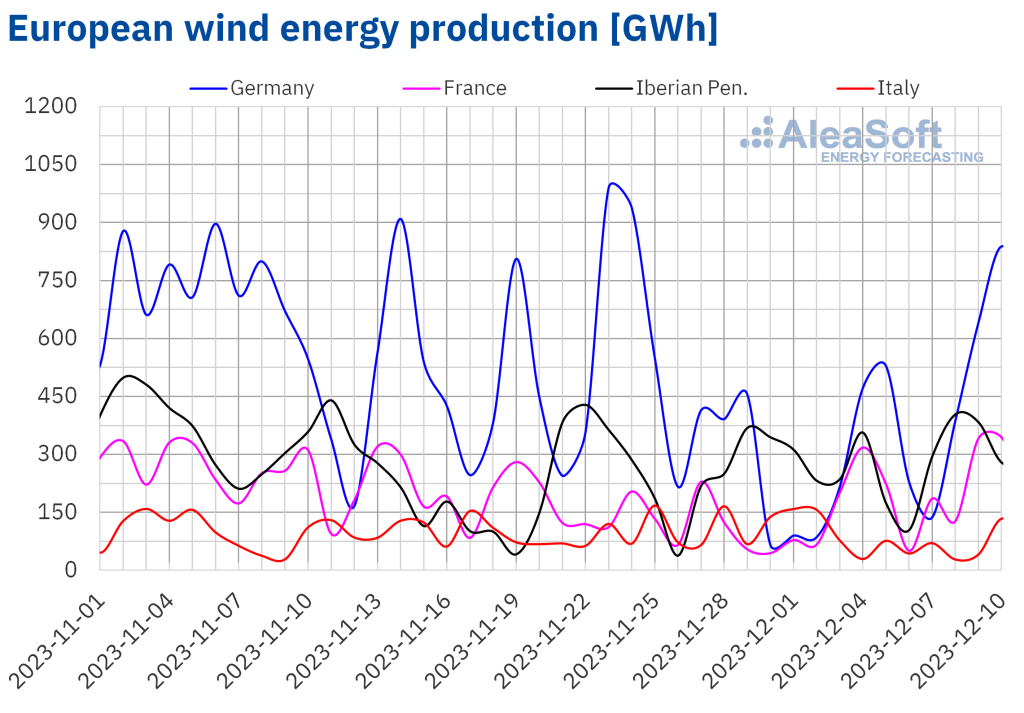

Within the first week of December, fuel costs declined, approaching ranges seen in early October, earlier than the Hamas assault on Israel. CO2 futures additionally declined. On December 8, they registered the bottom settlement value since October 2022. Wind vitality manufacturing elevated in most main European electrical energy markets. On this context, and with electrical energy demand typically decrease, costs in virtually all markets decreased in comparison with the earlier week’s costs.

Photo voltaic thermal, photovoltaic, and wind vitality manufacturing

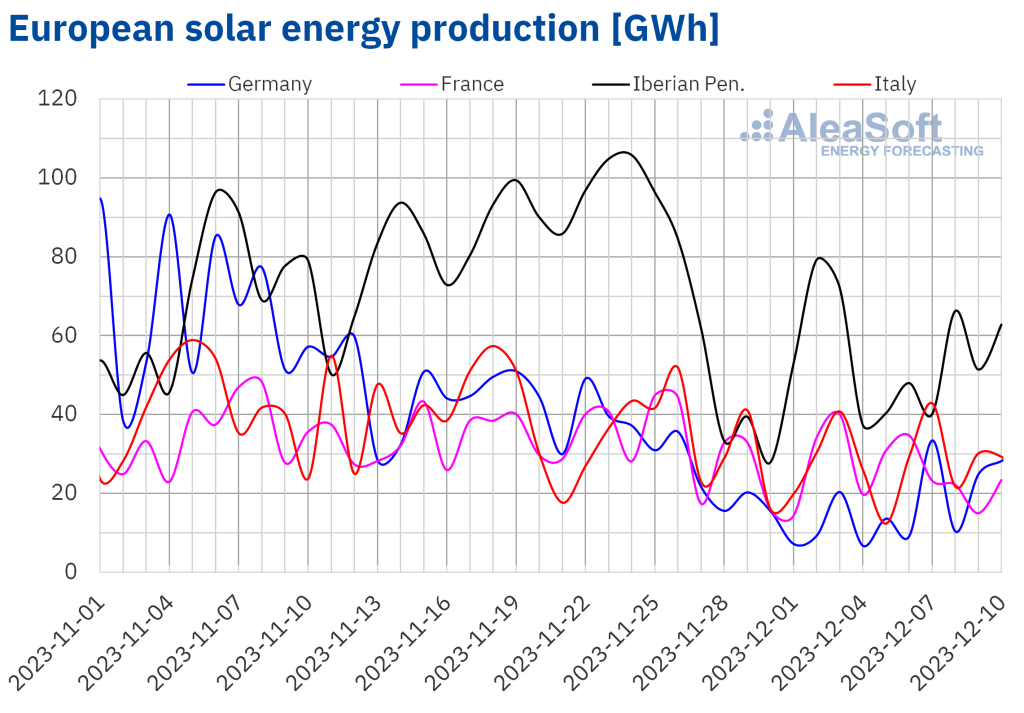

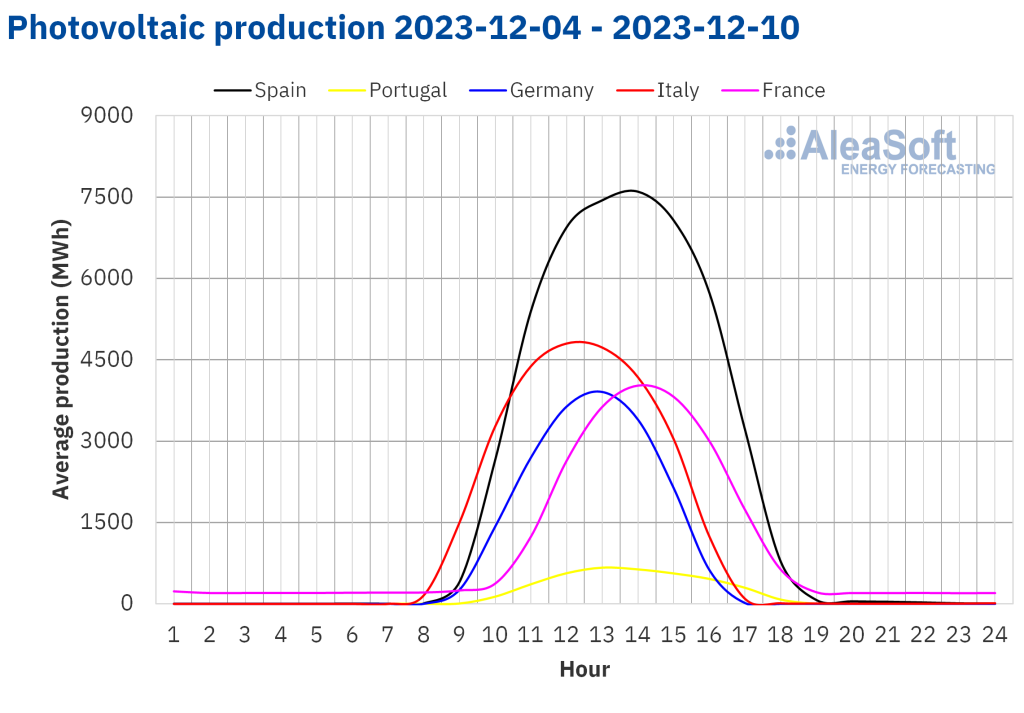

Within the week of December 4, photo voltaic vitality manufacturing confirmed every week?on?week drop in a lot of the primary European electrical energy markets. Declines ranged from 23% in Portugal to three.9% in Spain. Alternatively, within the German market, photo voltaic vitality manufacturing elevated by 15%. In response to AleaSoft Vitality Forecasting’s photo voltaic vitality manufacturing forecasts, it’ll enhance in Germany and Spain, whereas it’ll lower in Italy within the week of December 11.

Within the first week of December, fuel costs declined, approaching ranges seen in early October, earlier than the Hamas assault on Israel. CO2 futures additionally declined. On December 8, they registered the bottom settlement value since October 2022. Wind vitality manufacturing elevated in most main European electrical energy markets. On this context, and with electrical energy demand typically decrease, costs in virtually all markets decreased in comparison with the earlier week’s costs.

Photo voltaic photovoltaic, photo voltaic thermoelectric and wind vitality manufacturing

Within the week of December 4, photo voltaic vitality manufacturing confirmed every week?on?week drop in a lot of the primary European electrical energy markets. Declines ranged from 23% in Portugal to three.9% in Spain. Alternatively, within the German market, photo voltaic vitality manufacturing elevated by 15%. In response to AleaSoft Vitality Forecasting’s photo voltaic vitality manufacturing forecasts, it’ll enhance in Germany and Spain, whereas it’ll lower in Italy within the week of December 11.

Electrical energy demand

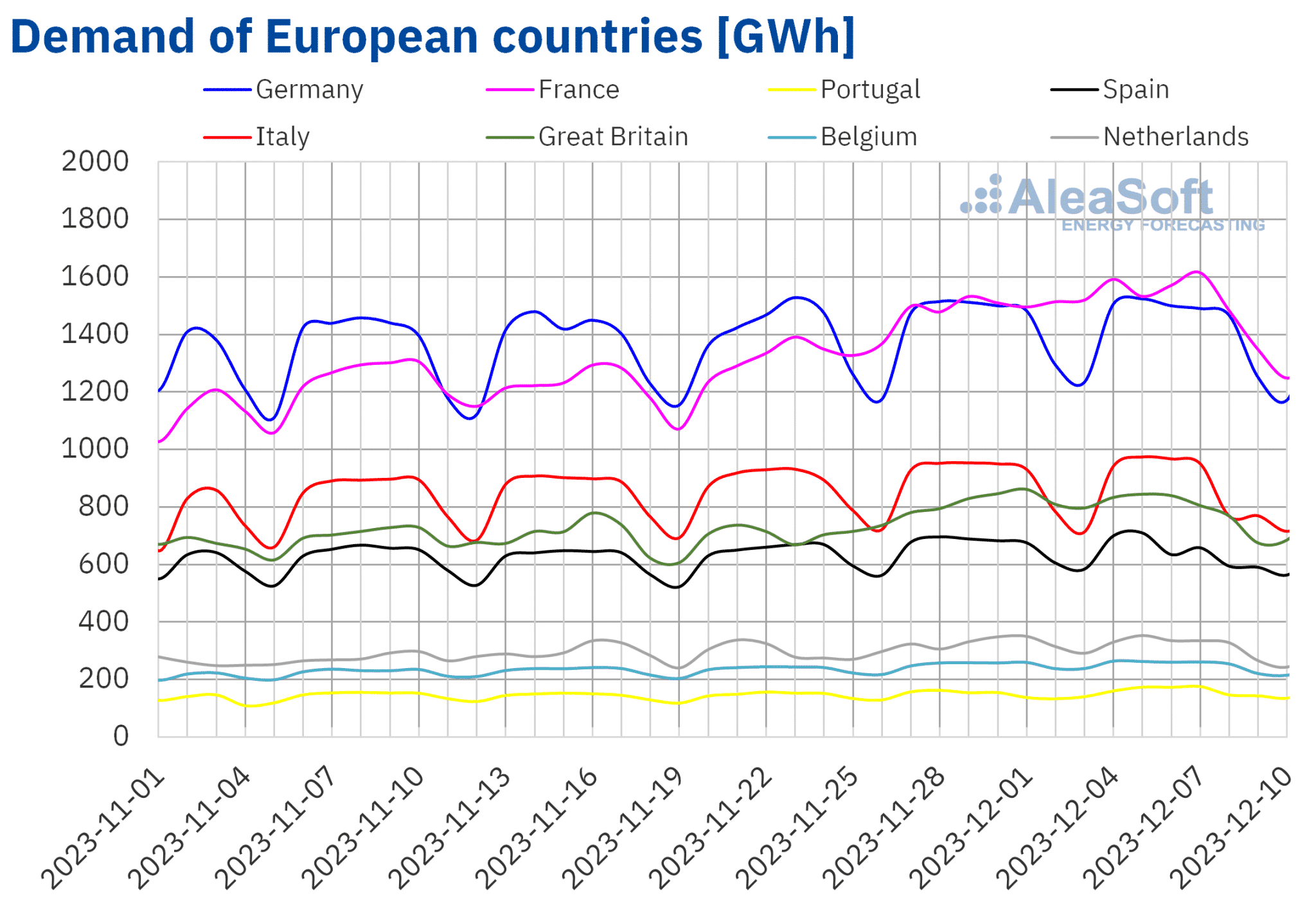

Within the week of December 4, a lot of the main European electrical energy markets registered a lower in electrical energy demand in comparison with the earlier week. Demand declines ranged from 4.7% in Nice Britain to 1.0% in Germany. The Portuguese market was the exception to this development, with a rise in demand of 6.4%.

The drop in demand was associated to much less chilly common temperatures in central and northern Europe in comparison with the earlier week. Common temperature will increase ranged from 1.6 °C in Germany to three.9 °C in Belgium and Nice Britain. In southern Europe, nonetheless, common temperatures have been cooler than the earlier week, with variations starting from ?3.5 °C in Italy to ?0.7 °C in Portugal.

As well as, on December 8, Italy, Portugal and Spain celebrated the Immaculate Conception Day. For Spain, it was the second public vacation of the week, following the Structure Day celebrated on December 6.

In response to AleaSoft Vitality Forecasting’s demand forecasts, electrical energy demand will proceed to say no in a lot of the analyzed markets within the week of December 11. Solely the Iberian Peninsula and Italian markets will register a rise in demand as working hours get better after the vacations of the week of December 4.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ENTSO-E, RTE, REN, REE, TERNA, Nationwide Grid and ELIA.

European electrical energy markets

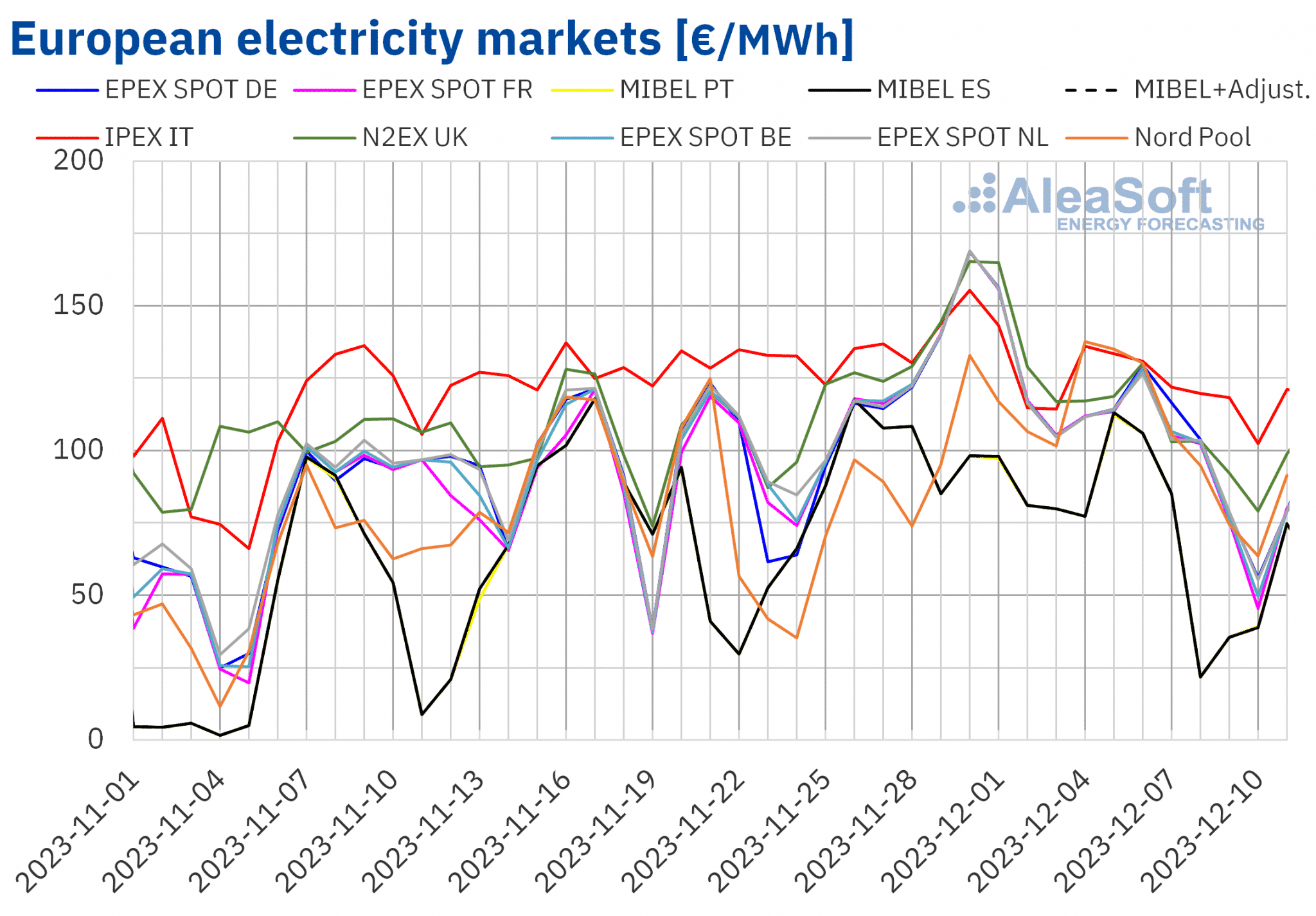

Within the week of December 4, costs in main European electrical energy markets decreased in comparison with the earlier week. The exception was the Nord Pool market of the Nordic international locations, with a rise of three.6%. Alternatively, the MIBEL market of Spain and Portugal registered the biggest value drop, 27%, whereas the IPEX market of Italy had the smallest decline, 8.1%. In the remainder of the markets analyzed at AleaSoft Vitality Forecasting, costs fell between 23% within the EPEX SPOT market of Germany and 26% within the EPEX SPOT market of Belgium and France.

Within the first week of December, weekly averages have been beneath €110/MWh in virtually all analyzed European electrical energy markets. The exception was the Italian market, with a median of €123.21/MWh. In distinction, the Portuguese and Spanish markets registered the bottom weekly averages, €68.15/MWh and €68.21/MWh, respectively. In the remainder of the analyzed markets, costs ranged from €97.53/MWh within the French market to €106.24/MWh within the N2EX market of the UK.

Alternatively, the Spanish and Portuguese markets reached the bottom hourly costs within the first week of December. Actually, since November 29, the MIBEL market has registered each day the bottom each day costs among the many primary European electrical energy markets. This market registered the minimal hourly value of the week of December 4, €4.30/MWh, on December 8 from 3:00 to 7:00 and from 11:00 to 16:00. In distinction, the Nordic market registered the best value, €214.53/MWh, on December 5, from 8:00 to 9:00. This value was the best on this market for the reason that second half of December 2022.

In the course of the week of December 4, the drop within the common value of fuel and CO2 emission rights and the autumn in electrical energy demand in most markets led to decrease costs within the European electrical energy markets. The rise in wind vitality manufacturing in international locations resembling Germany, France and Portugal additionally had a downward affect on costs.

AleaSoft Vitality Forecasting’s value forecasts point out that within the second week of December costs would possibly proceed to fall in most main European electrical energy markets. Declining demand in some markets and elevated photo voltaic vitality manufacturing in markets resembling Germany and Spain, in addition to elevated wind vitality manufacturing in Italy, would possibly contribute to this habits.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from OMIE, EPEX SPOT, Nord Pool and GME.

Brent, fuels and CO2

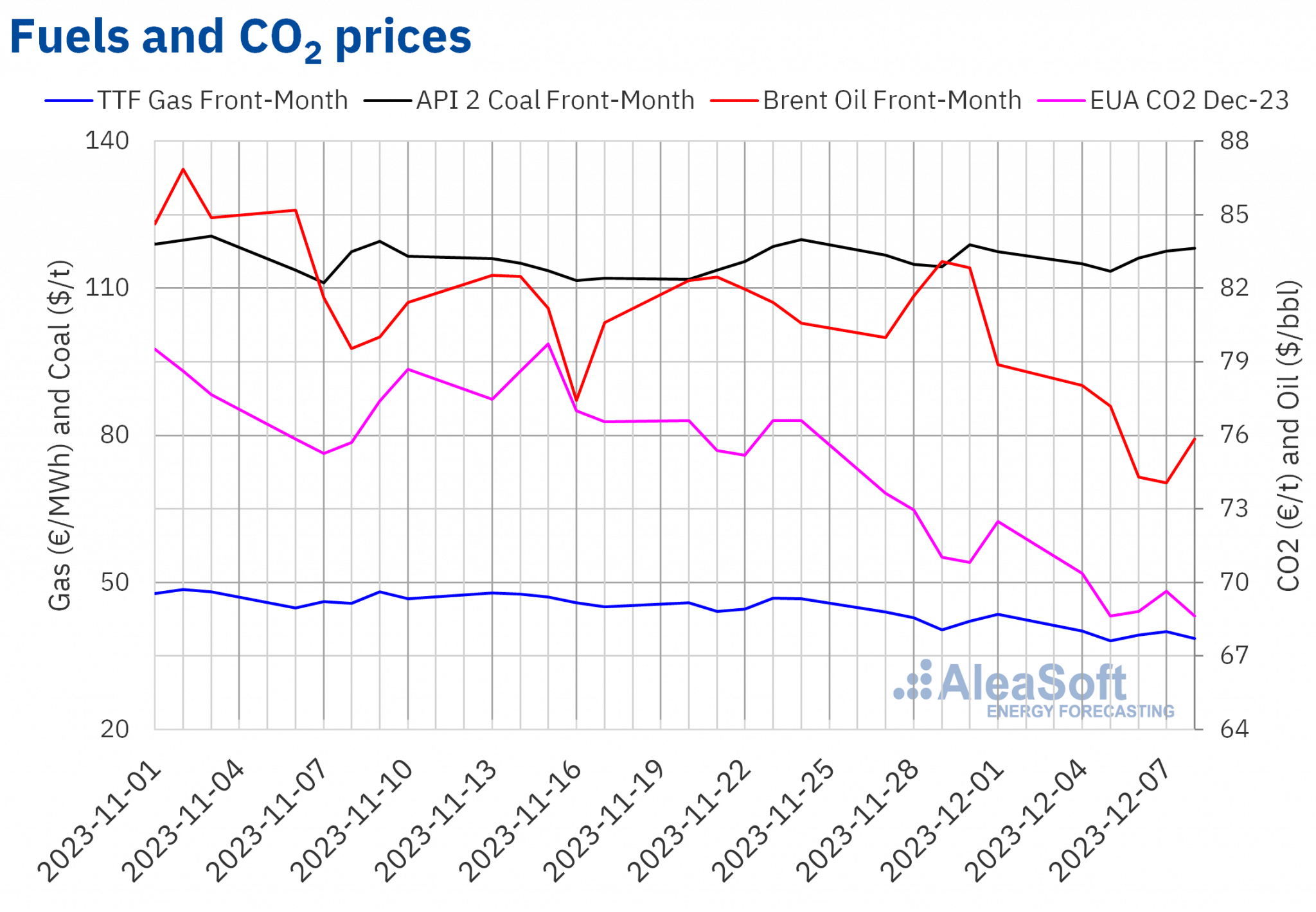

Brent oil futures for the Entrance?Month within the ICE market started the final week of November with a slight value decline from the earlier week. Regardless of this, on Monday, December 4, these futures registered their weekly most settlement value, $78.03/bbl. The downward development continued till reaching the weekly minimal settlement value, $74.05/bbl, on Thursday, December 7. This value was the bottom for the reason that finish of June. In distinction, on Friday, December 8, costs elevated by 2.4% to $75.84/bbl.

Excessive manufacturing ranges in the USA and information on declining crude oil imports in China led to Brent oil futures value declines. Nevertheless, on the finish of the primary week of December, the announcement of the US authorities’s plans to refill its strategic reserves exerted its upward affect on costs. The decision by Saudi Arabia and Russia for extra OPEC+ international locations to make manufacturing cuts additionally contributed to the turnaround.

As for TTF fuel futures within the ICE marketplace for the Entrance?Month, on Monday, December 4, they reached the weekly most settlement value, €40.10/MWh. This value was already 7.8% decrease than the final session of the earlier week. After falling one other 4.9%, these futures registered their weekly minimal settlement value, €38.13/MWh, on Tuesday, December 5. In response to information analyzed at AleaSoft Vitality Forecasting, this value was the bottom since early October. Within the final three classes of the primary week of December, costs have been barely larger, however remained beneath €40/MWh. On Friday, December 8, the settlement value was €38.60/MWh.

Within the first week of December, considerable provide and excessive ranges of European shares led to TTF fuel futures settlement costs beneath €40/MWh. Milder temperatures, following the chilly snap, additionally had a downward affect on costs.

As for CO2 emission rights futures within the EEX market for the reference contract of December 2023, they reached their weekly most settlement value, €70.37/t, on Monday, December 4. This value was 2.9% decrease than that of the final session of the earlier week. In the remainder of the classes of the primary week of December, settlement costs have been beneath €70/t. On Friday, December 8, these futures registered their weekly minimal settlement value, €68.63/t. This value was the bottom since October 2022 for the December 2022 reference contract.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ICE and EEX.

AleaSoft Vitality Forecasting’s evaluation on the prospects for vitality markets in Europe and the vitality transition

Subsequent Thursday, December 14, AleaSoft Vitality Forecasting and AleaGreen will maintain their final webinar of 2023. This version marks the fourth anniversary since these webinars started to be held on a month-to-month foundation. In the course of the webinar, AleaSoft Vitality Forecasting and AleaGreen will current the providers they provide to the vitality sector and the way they are often helpful for the assorted gamers within the sector. As well as, the webinar will analyze the evolution of the vitality markets throughout 2023, in addition to the prospects for 2024.