Within the third week of September, European electrical energy markets costs fell in comparison with the earlier week. The decline was as a result of decrease demand and a major improve in wind vitality manufacturing in a number of markets, which offset the rise in gasoline and CO2 costs. On September 25 TTF gasoline futures reached their highest stage since early April and on September 18 Brent reached its highest settlement worth since November 2022.

Concentrated Photo voltaic Energy, photovoltaic and wind vitality manufacturing

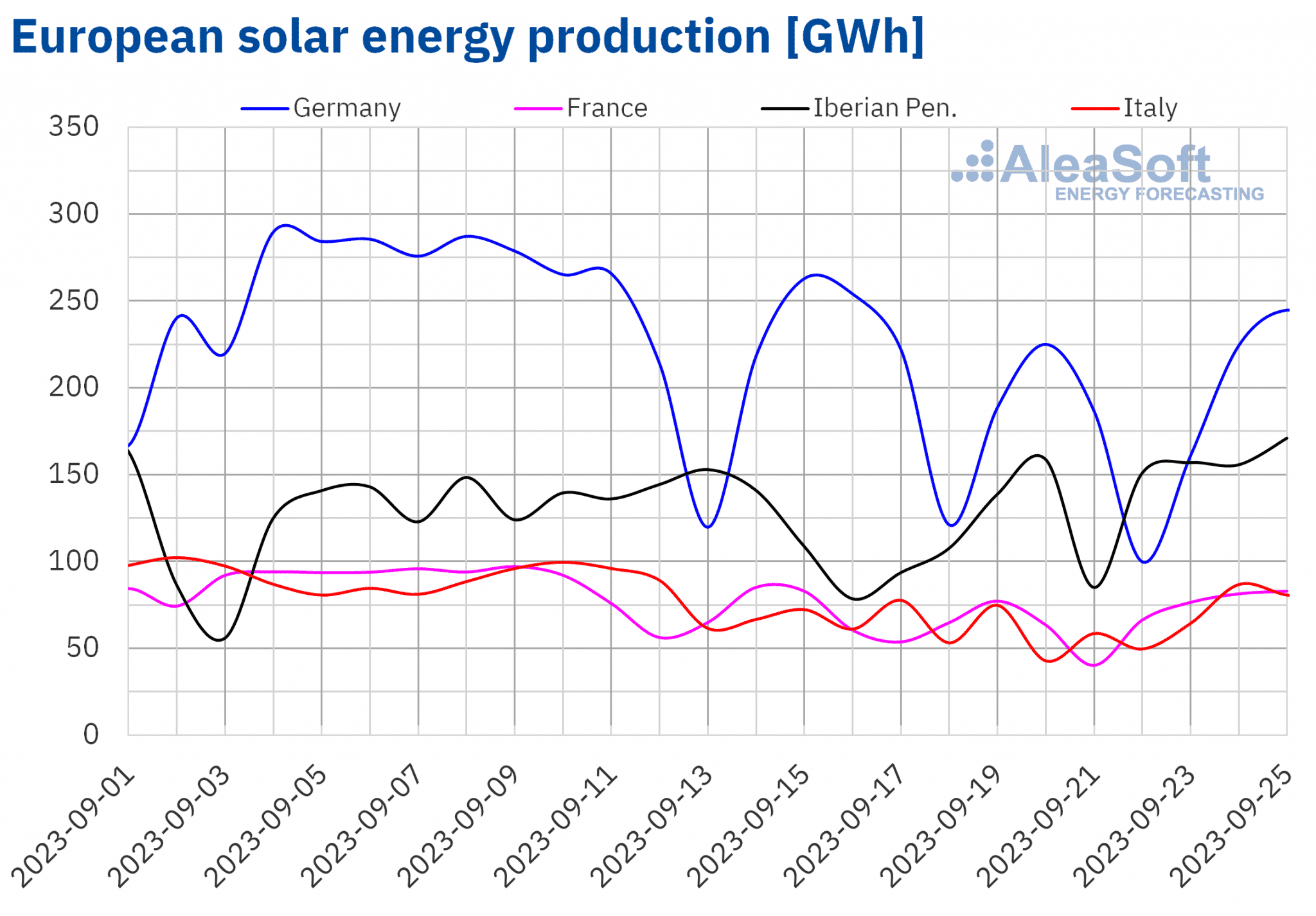

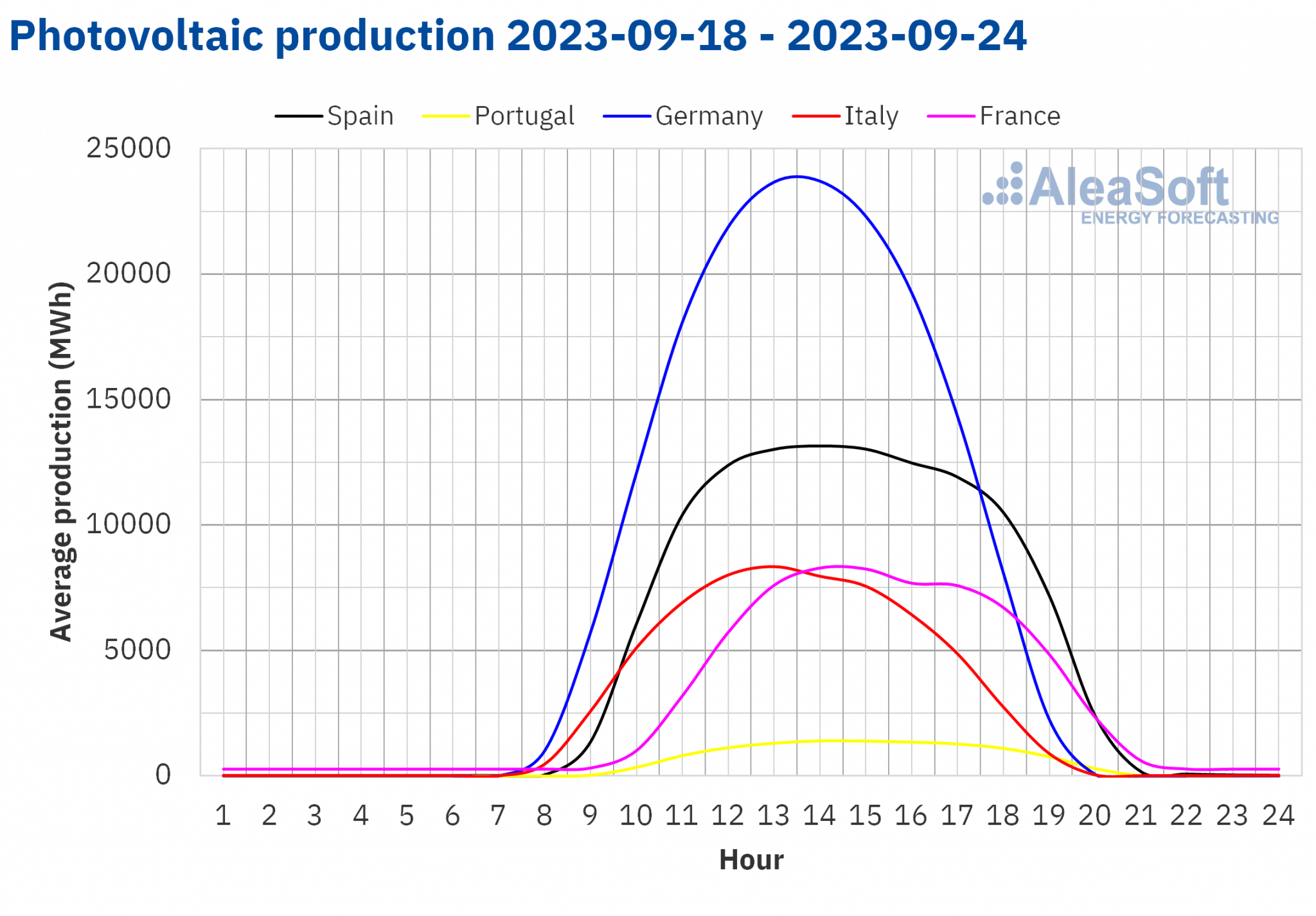

Within the week of September 18, photo voltaic vitality manufacturing decreased in nearly all analyzed markets in comparison with the earlier week. The German market registered the most important lower of twenty-two%. The opposite markets the place photo voltaic vitality manufacturing decreased have been France, down 2.0%, and Italy, down 18%. The exception to this development was the Iberian Peninsula, the place manufacturing elevated by 12% week?on?week. As well as, on Sunday, September 24, the Spanish market reached the very best photo voltaic thermoelectric vitality manufacturing because the starting of September with 22 GWh, and on Wednesday, September 20, the second highest photovoltaic vitality manufacturing in the identical interval with 126 GWh. The Portuguese market additionally generated 13.8 GWh of photovoltaic vitality on September 23, the very best worth because the finish of August.

For the week of September 25, in accordance with AleaSoft Vitality Forecasting’s photo voltaic vitality manufacturing forecasts, a rise is anticipated in all analyzed markets.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

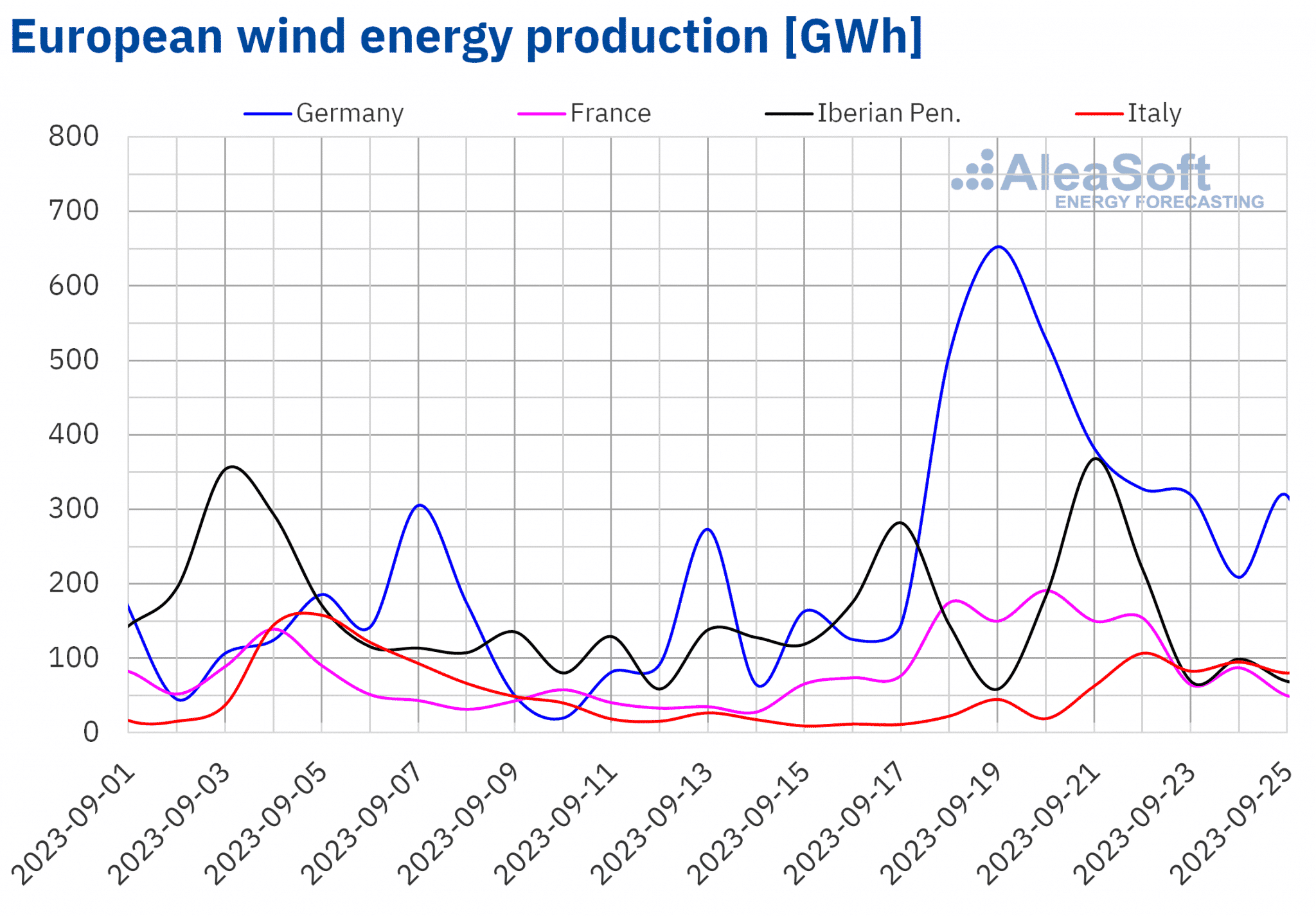

As for wind vitality manufacturing, within the week of September 18, every week?on?week improve was registered in many of the markets analyzed at AleaSoft Vitality Forecasting. The biggest improve, 295%, was registered within the Italian market, adopted by 210% within the German market. The smallest improve, 28%, was registered within the Spanish market. The exception was the Portuguese market with a fall in wind vitality manufacturing of 38%.

Within the third week of September, each day wind vitality manufacturing reached ranges not seen since spring or summer season in a number of markets. In Spain, for instance, 290 GWh have been generated on September 21, the very best worth since Might of this yr. Within the German market, 653 GWh have been generated on September 19, the very best wind vitality manufacturing on this market because the second week of August. In the future later, on September 20, 191 GWh have been generated within the French market, a stage not reached since August 6.

For the week of September 25, AleaSoft Vitality Forecasting’s wind vitality manufacturing forecasts point out that it’ll lower in all analyzed markets.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ENTSO-E, RTE, REN, REE and TERNA.

Electrical energy demand

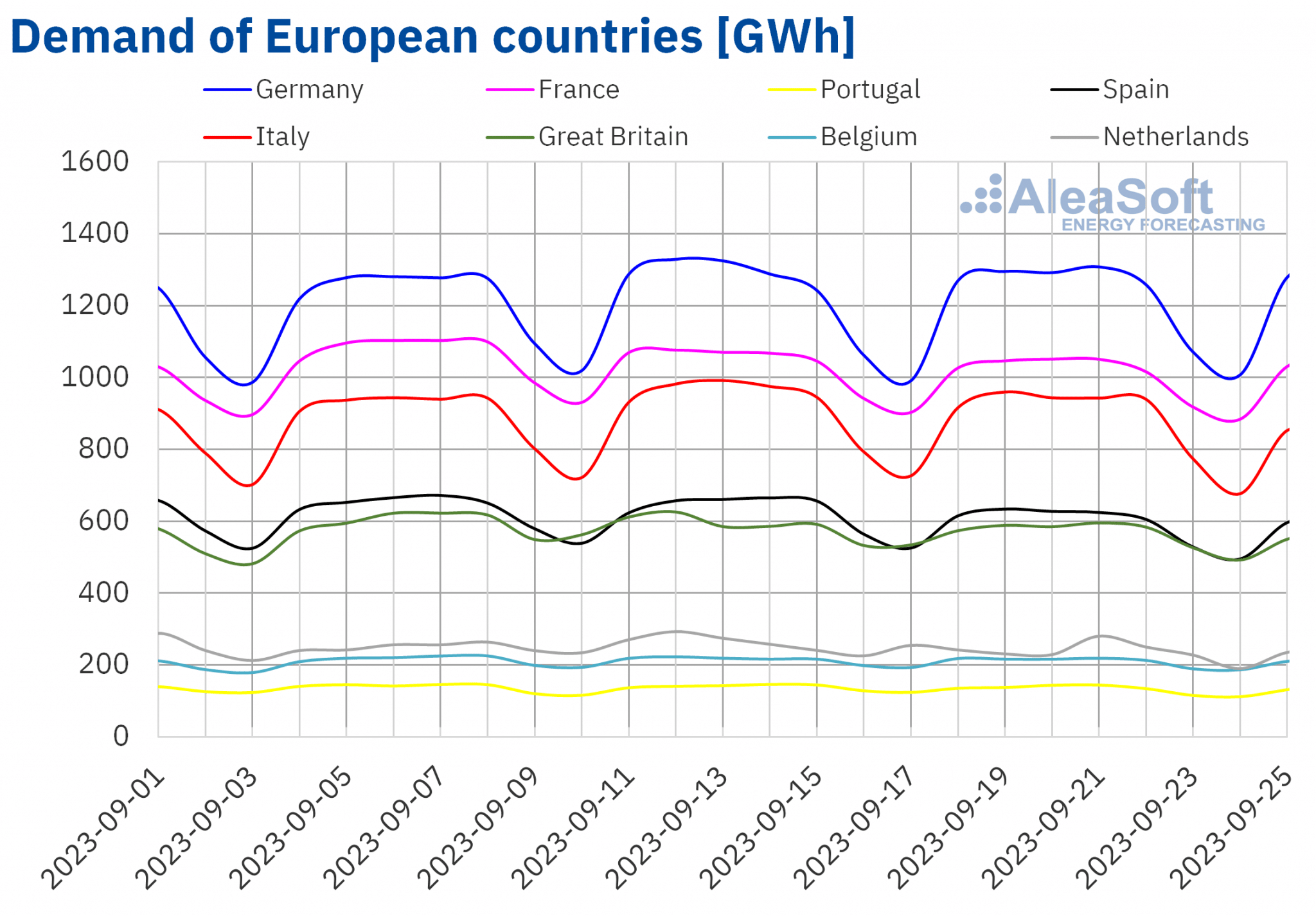

Within the week of September 18, electrical energy demand decreased in all analyzed markets in comparison with the earlier week. The biggest lower of 9.2% was registered within the Dutch market, adopted by the Spanish market with a lower of 5.1%. The smallest lower was registered in Germany, with a decline of 0.3%. Within the different analyzed markets, the decline in demand ranged from 1.8% in Belgium to 4.2% in Portugal.

Throughout the identical interval, common temperatures decreased in all analyzed markets in comparison with the earlier week. The smallest lower was registered in Italy with 0.3 ºC. In the remainder of the analyzed markets, common temperatures decreased from 1.5 ºC in Portugal to three.4 ºC in France.

In keeping with AleaSoft Vitality Forecasting’s demand forecasts, for the week of September 25, electrical energy demand is anticipated to proceed to say no in many of the European markets analyzed, apart from France and the Iberian Peninsula.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ENTSO-E, RTE, REN, REE, TERNA, Nationwide Grid and ELIA.

European electrical energy markets

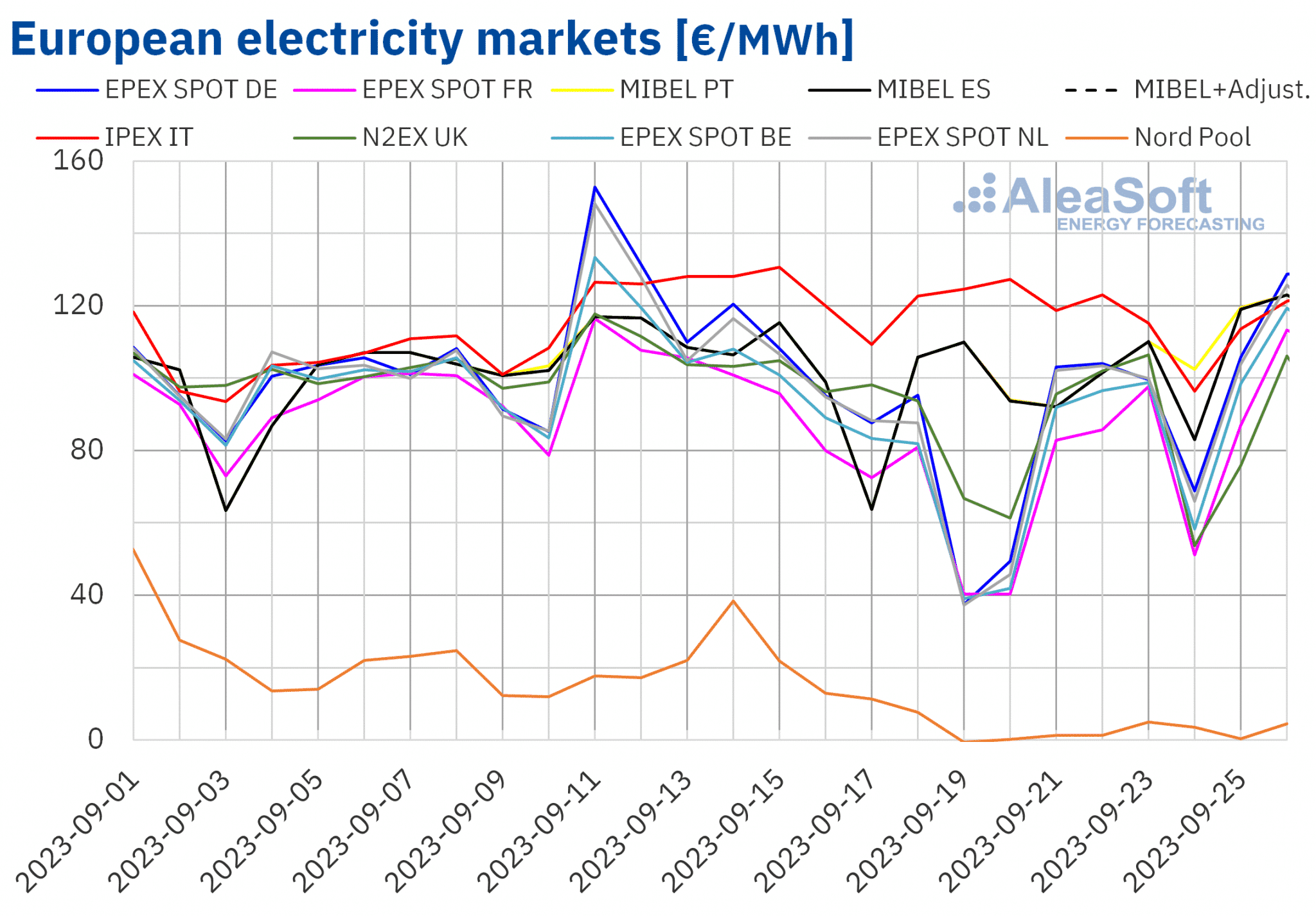

Within the week of September 18, costs in all European electrical energy markets analyzed at AleaSoft Vitality Forecasting fell in comparison with the earlier week. The biggest drop, 87%, was reached within the Nord Pool market of the Nordic nations, whereas the smallest decline, 1.5%, was registered within the MIBEL market of Portugal. Elsewhere, costs fell between 4.2% of the Spanish market and 31% of the EPEX SPOT market of Germany, Belgium and the Netherlands.

Within the third week of September, weekly averages have been beneath €100/MWh in nearly all European electrical energy markets. The exceptions have been the Portuguese market and the IPEX market of Italy, which reached €102.26/MWh and €118.27/MWh, respectively. However, the Nordic market had the bottom common worth at €2.62/MWh. In the remainder of the markets analyzed, costs ranged from €68.42/MWh within the French market to €99.43/MWh within the Spanish market.

Relating to hourly costs, unfavorable costs have been registered on September 19, 20 and 24 within the German, Belgian, French and Dutch markets. Within the Nordic market, along with today, unfavorable hourly costs have been reached on September 21, 25 and 26. Likewise, on the 19th, the Nord Pool market worth was beneath zero, averaging ?€0.60/MWh. Within the case of the British market, unfavorable hourly costs have been registered on September 19, 20 and 25. The bottom hourly worth of ?€5.74/MWh was reached within the German market on September 19, from 14:00 to fifteen:00. This worth was the bottom because the first half of August on this market.

However, within the Spanish market, on Sunday, September 24, from 12:00 to 16:00, the worth was €0/MWh. Within the Italian market, that day, from 13:00 to fifteen:00, a worth of €10.00/MWh was registered, the bottom since Might.

Through the week of September 18, regardless of the rise within the common worth of gasoline and CO2 emission rights, the final decline in electrical energy demand and the numerous improve in wind vitality manufacturing in many of the analyzed markets led to the autumn in European electrical energy markets costs.

AleaSoft Vitality Forecasting’s worth forecasts point out that within the fourth week of September European electrical energy markets costs would possibly improve, influenced by the lower in wind vitality manufacturing, in addition to by will increase in demand in some markets.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from OMIE, EPEX SPOT, Nord Pool and GME.

Brent, fuels and CO2

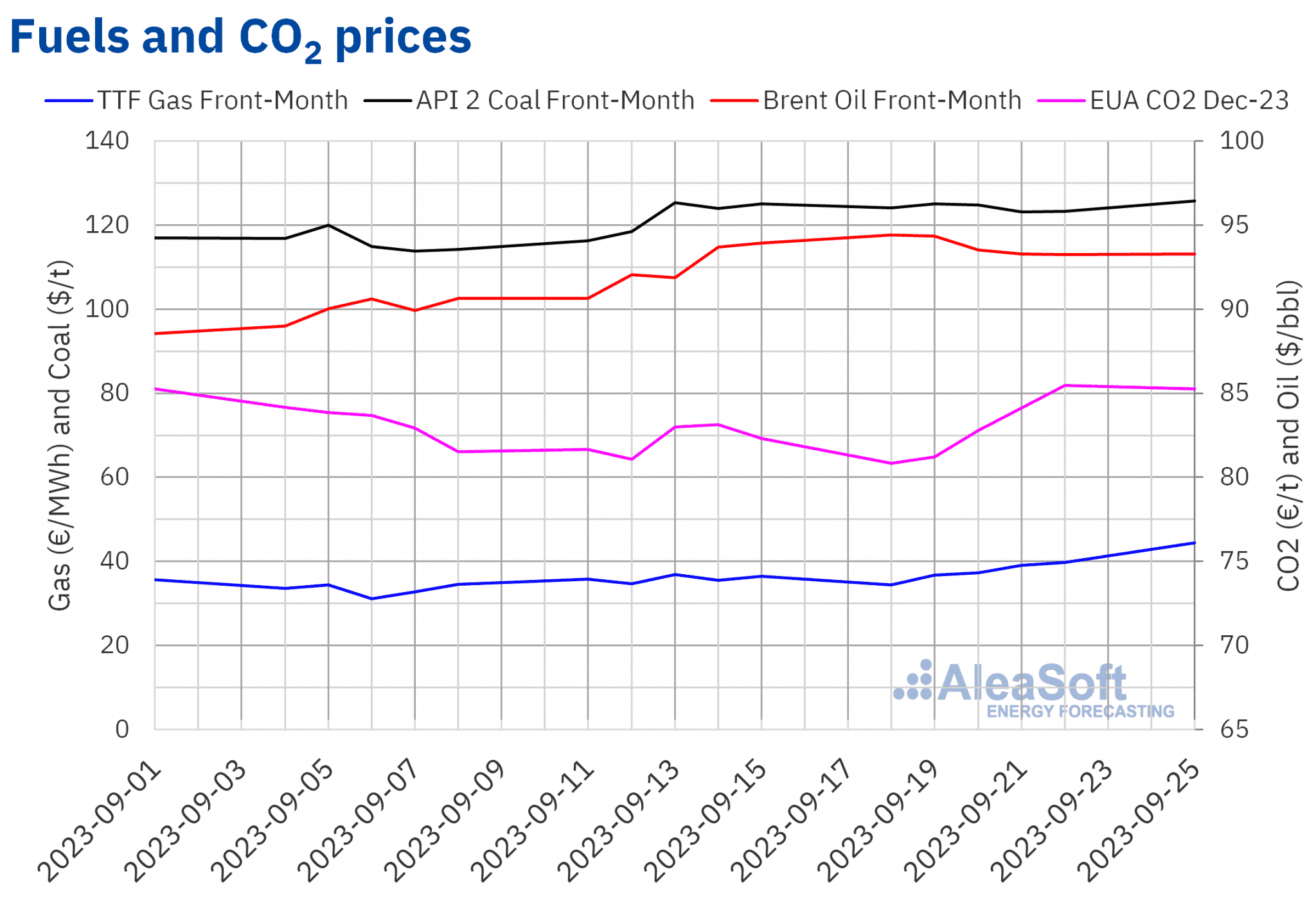

Within the third week of September, settlement costs of Brent oil futures for the Entrance?Month within the ICE market remained above $93/bbl. The weekly minimal settlement worth, $93.27/bbl, was registered on Friday, September 22 and it was 0.7% decrease than the earlier Friday. However, the weekly most settlement worth, $94.43/bbl, was reached on Monday, September 18. This worth was 4.2% increased than the earlier Monday and the very best because the first half of November 2022.

Within the third week of September, manufacturing cuts in Saudi Arabia and Russia triggered settlement costs of Brent oil futures to achieve values above $93/bbl. Nevertheless, issues concerning the evolution of the financial system and expectations of excessive rates of interest for an extended time frame exerted their downward affect on costs, contributing to their decline throughout the week.

As for TTF gasoline futures within the ICE marketplace for the Entrance?Month, on Monday, September 18, they registered a settlement worth of €34.47/MWh, 3.8% decrease than the earlier Monday. However, beginning on Tuesday, September 19, costs started to extend. This rising development continued on Monday, September 25, when a settlement worth of €44.44/MWh was reached. This worth was 29% increased than that of Monday, September 18, and the very best because the starting of April.

Within the third week of September, the proximity of the coldest months led to a rise in TTF gasoline futures costs, regardless of the excessive ranges of European reserves. The alterations within the gasoline stream from Norway, which will probably be prolonged to the month of October, additionally exerted an upward affect on costs. In the meantime, the labor battle at Australian liquefied pure gasoline export vegetation continues.

Relating to CO2 emission rights futures within the EEX market for the reference contract of December 2023, on Monday, September 18, the weekly minimal settlement worth of €80.84/t was registered. This worth was 1.0% decrease than the earlier Monday and the bottom since early June. Nevertheless, throughout the remainder of the classes of the third week of September, costs elevated. As a consequence, the weekly most settlement worth of €85.48/t was reached on Friday, September 22 and it was 3.9% increased than the earlier Friday.

Supply: Ready by AleaSoft Vitality Forecasting utilizing information from ICE and EEX.

AleaSoft Vitality Forecasting’s evaluation on the prospects for vitality markets in Europe and the financing and valuation of renewable vitality initiatives

The following webinar within the month-to-month webinar collection of AleaSoft Vitality Forecasting and AleaGreen will probably be held on Thursday, October 19. Audio system from Deloitte will take part within the webinar for the fourth time. Along with the prospects for European vitality markets for the winter 2023?2024, the financing of renewable vitality initiatives and the significance of forecasting in audits and portfolio valuation will probably be analyzed.