Brookfield Asset Administration introduced the launch of Deriva Vitality, the brand new identify for Duke Vitality’s former unregulated industrial renewables enterprise that Brookfield acquired earlier this yr.

Deriva, which considers itself a number one operator and developer of fresh energy initiatives within the U.S., is headquartered in Charlotte, North Carolina. Brookfield on Oct. 25 stated it had accomplished the acquisition of the renewables enterprise from Duke Vitality. The $2.8 billion deal, which features a portfolio of about 3.4 GW of technology capability, was introduced in June.

“As we speak is a big milestone for our enterprise and opens an thrilling new chapter in our historical past,” stated Chris Fallon, president of Deriva Vitality. “We at the moment are an unbiased developer, proprietor, and operator of fresh power initiatives, with the backing of Brookfield, one of many world’s largest homeowners and operators of renewable energy. As a part of Brookfield, we now have entry to capital for progress and a wealth of working experience, which can allow us to proceed our management in clear power for a few years to return.”

Brookfield, a Canadian firm headquartered in Toronto, Ontario, has $850 billion beneath administration. The corporate stated it has about 90,000 MW of mixed capability both working or beneath improvement throughout and pipeline capability throughout the U.S.

Battery Producer Declares Main Arizona Facility

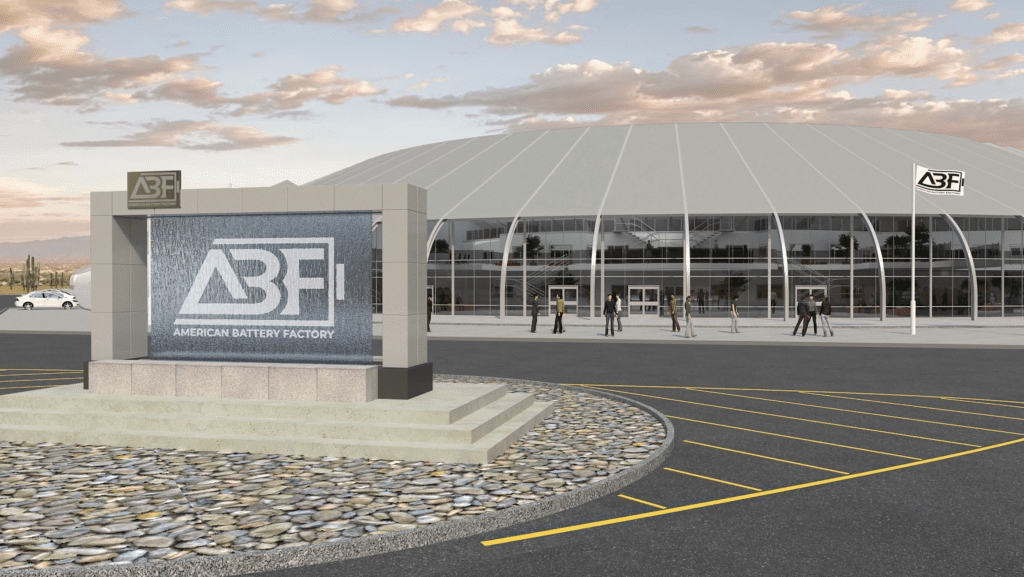

American Battery Manufacturing facility (ABF), an Utah-based battery producer, on Oct. 26 stated it has damaged floor for a 2-million-square-foot manufacturing facility in Tucson, Arizona. The corporate is growing a community of lithium iron phosphate (LFP) battery cell gigafactories within the U.S.

ABF stated the Tucson plant will present about 1,000 jobs, and represents a $1.2 billion funding. The primary section of building, overseen by Utah-based Sprung Immediate Buildings, is predicted to be accomplished by 2025.

“We’re honored to proceed our firm’s mission of worldwide power independence in Arizona, a premier vacation spot for rising applied sciences,” stated John Kem, president of ABF. “We’re happy to hitch this thriving area and name Tucson our residence and sit up for enhancing Pima County’s already rising financial system by fostering innovation in addition to attracting and retaining residents to Tucson.”

“As we speak’s groundbreaking represents a big milestone for Arizona’s battery trade,” stated Arizona Gov. Katie Hobbs. “With this transformational funding, American Battery Manufacturing facility advances Arizona’s clear power trade and bolsters continued financial progress in Tucson and Pima County.”

ABF in a information launch stated the worldwide marketplace for lithium batteries is predicted to succeed in $105 billion by 2025. The brand new plant might be situated on 267 acres in Pima County’s Aerospace Analysis Campus. The corporate stated the power will embody headquarters and a analysis and improvement heart together with the manufacturing plant.

Husk Energy Particulars Plan, Financing for Electrification Challenge

Husk Energy, a mini-grid and microgrid developer primarily based in Fort Collins, Colorado, stated it has secured $103 million in funding from a number of banks to help electrification initiatives in sub-Saharan Africa and South Asia. The corporate stated the cash, a mixture of fairness and debt financing, will assist construct about 2,500 photo voltaic mini-grids on the 2 continents. Husk Energy presently operates about 200 photo voltaic mini-grids in sub-Saharan Africa and South Asia.

The corporate in September of this yr launched its Africa Sunshot initiative, a plan designed to boost $500 million to finance solar-powered mini-grids in a minimum of six African nations by 2030. Manoj Sinha, Husk’s CEO, in an announcement stated, “We’re delighted to place this new fairness and debt on the service of Husk’s progress and to unleash the total financial and social potential of a technology of rural Africans and Asians, notably ladies and younger folks, who would in any other case be left behind.”

Funding for Husk’s initiatives is coming from monetary establishments together with the U.S. Worldwide Growth Finance Corp.; Proparco, a subsidiary of the French Growth Company; and STOA Infra & Vitality, a French funding agency. Cash is also coming from teams within the Netherlands, in addition to from Shell. Sinha stated the European Funding Financial institution, and the Worldwide Finance Corp., a part of the World Financial institution Group, are also supporting Husk’s efforts.

Husk Energy presently operates about 200 photo voltaic mini-grids in sub-Saharan Africa and South Asia.

—Darrell Proctor is a senior affiliate editor for POWER (@POWERmagazine).