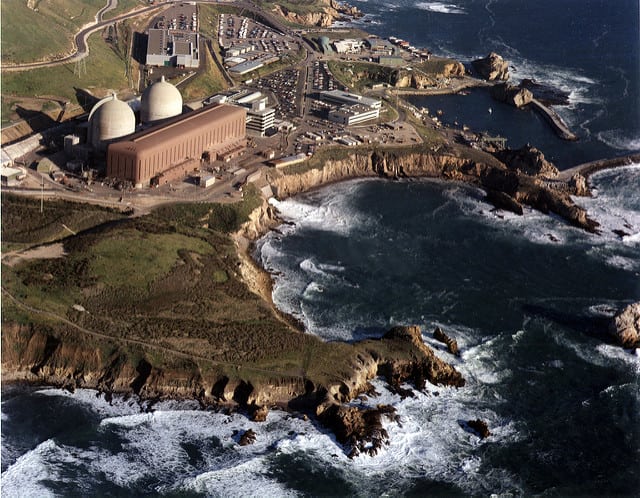

The Division of Power (DOE) will award credit underneath its Civil Nuclear Credit score (CNC) program to bolster the continued operation of Diablo Canyon Energy Plant (DCPP) Models 1 and a pair of, Pacific Fuel and Electrical Co.’s (PG&E’s) 2,240-MW nuclear plant in San Luis Obispo County, California.

A document of resolution printed by the company’s Grid Deployment Workplace on Jan. 2 successfully awards credit to PG&E to assist DCPP proceed operations underneath present Nuclear Regulatory Fee (NRC) licenses and applications. “Funds of credit are anticipated to happen yearly starting in 2025 and will likely be paid retroactively to compensate PG&E for DCPP operations within the prior 12 months(s),” the motion says.

Bolstering Diablo Canyon’s Continued Operation

DCPP, California’s solely operational nuclear energy plant, conditionally gained as much as $1.1 billion in credit from the CNC’s first spherical of funding, which the DOE unveiled in November 2022. The CNC, a $6 billion federal funding mechanism designated by the November 2021–enacted Infrastructure Funding and Jobs Act (IIJA), is designed to maintain open business nuclear reactors which are vulnerable to closure owing to financial causes.

Underneath the CNC program, an proprietor or operator of an authorized nuclear reactor whose bid for credit is chosen by DOE turns into eligible to obtain funds from the federal authorities within the quantity of awarded credit—as long as the nuclear reactor continues operation over the four-year award interval. For DCPP, that timeframe spans January 2023 by December 2026.

PG&E submitted its software for certification and a bid for credit to the DOE in September 2022. In November 2022, the DOE stated the overall credit score award worth designated for DCPP could be contingent on the completion of an environmental overview and negotiation of phrases of a redemption settlement, which basically specifies a megawatt-hour manufacturing dedication for 4 award years (2023–2026). DCPP was set to obtain a most credit score worth of as much as $269 million in 2023, $267 million in 2024, $276 million in 2025, and $289 million in 2026.

PG&E in June 2016 formally introduced it might shutter the 1,138-MW DCPP Unit 1 and the 1,151-MW Unit 2 upon the expiration of the reactors’ working licenses—November 2024 for Unit 1 and August 2025 for Unit 2. The items, each Westinghouse pressurized water reactor items, started operation in 1985 and 1986, respectively.

On the time, PG&E cited challenges of managing “over-generation and intermittency circumstances underneath a useful resource portfolio more and more influenced by photo voltaic and wind manufacturing,” in addition to potential prices for retrofits so the station may adjust to a Could 2010 California Water Sources Management Board coverage limiting once-through cooling (OTC) methods for all of the state’s water consuming energy vegetation. Nuclear consultants at assume tank the Breakthrough Institute, nevertheless, recommend PG&E negotiated an settlement with anti-nuclear environmental teams primarily based on a flawed examine that till just lately was broadly accepted by California’s legislators and regulators.

In September 2022, California’s authorities enacted Senate Invoice 846 (SB 846), enshrining efforts to maintain the plant open as a vital pillar to bolster the state’s vitality safety. The measure successfully approved the $1.4 billion mortgage from the Division of Water Sources to maintain Diablo Canyon open till not less than 2030. As a ultimate step within the extension of DCPP, the California Public Utility Fee (CPUC) on Dec. 14 voted to approve the ratemaking design and new retirement dates for DCPP 1 and a pair of, which are actually 2029 and 2030 respectively.

In October 2022, in the meantime, PG&E filed a letter with the NRC, formally requesting that the company overview the utility’s 2009-submitted license renewal software (LRA)—which PG&E withdrew in 2018—for DCPP 1 and a pair of. In March 2023, the NRC made a “categorical exclusion willpower,” granting DCPP an exemption to the facility plant from the NRC’s well timed renewal necessities, as long as PG&E submitted its license renewal software by Dec. 31, 2023. PG&E submitted its license renewal software for each items on Nov. 7, 2023. The NRC on Dec. 19 decided the LRA is enough for its overview, a vital motion that enables PG&E to proceed working the DCPP items previous their present licenses whereas the LRA is underneath overview.

The NRC has stated an LRA overview sometimes lasts 22 months. “The NRC will proceed its regular inspection and oversight of the power all through the overview to make sure continued secure operation. If granted, the license renewal would authorize continued operation for as much as 20 years,” it famous.

As a result of DCPP has not accomplished a license renewal course of with the NRC, the DOE, in its document of resolution printed Tuesday, acknowledged it accomplished its Nationwide Environmental Coverage Act (NEPA) course of—required for awarding credit—by a overview of present NEPA documentation, together with NRC NEPA paperwork and different experiences.

“DOE’s overview and adoption of the NRC NEPA paperwork covers solely the interval that DCPP’s present working licenses stay in impact,” the company stated. “That’s to say, as long as the DCPP working licenses proceed in impact by operation of regulation, DOE will proceed to pay credit in the course of the four-year award interval.”

The DOE’s overview thought of a number of elements, together with adjustments to the affected setting, which it profiled in a ultimate environmental impression assertion issued in July 2023. The company indicated “that whereas deployment of renewable vitality technology would proceed, partially pushed by present State legal guidelines and insurance policies, pure gasoline technology and the related carbon dioxide and nitrous oxide emissions would enhance if DCPP had been to stop operations.” Three unbiased research the company cited “undertaking {that a} substantial proportion of DCPP’s misplaced technology between 2024 and 2030 could be coated largely by elevated utilization of gas-fired items reasonably than newly constructed renewable electrical sources,” it famous. “DOE discovered nothing to refute that emissions would enhance in the course of the credit score award interval had been DCPP to stop operations.”

Extra Incentives Brewing for the U.S. Nuclear Trade

The DOE is now readying for the second CNC award cycle, for which it launched steering in March 2023. Whereas the primary spherical was restricted to nuclear plant homeowners and operators that had introduced intentions or retirement inside the four-year award interval, the second spherical, which closed on Could 31, 2023, was prolonged to reactors “vulnerable to closure” by the tip of the four-year award interval (Jan. 1, 2024, by Dec. 31, 2027). This contains reactors that stop operations after November 15, 2021, in addition to candidates who’ve publicly introduced intentions to retire.

The CNC additionally extends to reactors that obtain funds from state applications (corresponding to zero-emission credit or clear vitality contracts). The company says it additionally expects that some reactors could also be eligible for the CNC in addition to the manufacturing tax credit score (PTC) underneath Part 45U (the Zero-Emission Nuclear Energy Manufacturing Credit score) of the Inflation Discount Act (IRA).

The Treasury Division is quickly anticipated to problem a ultimate rule on the 45U PTC, a first-of-its-kind PTC that’s anticipated to assist present nuclear vegetation and forestall their untimely closure. The IRA’s Part 45U gives a two-tier credit score (0.3 cents “base”/1.5 cents most, adjusted for inflation) per kWh of electrical energy produced at a professional nuclear facility and offered to an unrelated occasion after 2023 and earlier than 2033.

The Treasury’s just lately issued proposed rules and steering on 45V, a tax credit score for the manufacturing of “clear hydrogen,” notably stirred up disappointment from the facility trade, as POWER has reported. The Nuclear Power Institute (NEI) final week stated that although the principles explicitly enable 45U, the nuclear energy PTC, to be claimed together with 45V, the clear hydrogen PTC, “the authors of the IRA made clear that present nuclear services are eligible for the H2 Credit score.” Nonetheless, NEI was “disillusioned to study the administration plans to undertake a requirement that solely new technology including incremental capability to the electrical grid could possibly be used to provide clear hydrogen for functions of the [hydrogen (H2) credit],” it stated.

—Sonal Patel is a POWER senior affiliate editor (@sonalcpatel, @POWERmagazine).