Join each day information updates from CleanTechnica on e mail. Or comply with us on Google Information!

Many of the heavy electrical vans on the street so far are in China. As of 2022, China bought 36,000 electrical vans, 91% of the overall. No nation apart from China ever bought over 1,000 electrical vans in a yr. In heavy electrical vans, China is by far the biggest person.

This lead continued into 2023, with Europe gaining a bigger share however China nonetheless within the lead.

China’s motivation for heavy-duty electrical vans is that heavy-duty truck emissions exceed light-duty emissions by 50%.

China can be the biggest single marketplace for electrical automobiles, and the electrical automobile battery swapping market is important. There, the federal government helps electrical car battery swapping. The Chinese language authorities has introduced assist for requirements for EV battery swapping.

CleanTechnica writer Michael Barnard has famous that standardization is a key techniques think about battery swapping. The distinction in standardization efforts and authorities assist for swapping is evidenced in China’s higher use of swap techniques in each automobiles and heavy vans in comparison with each Europe and the US.

In Mr. Barnard’s analysis, 5 gadgets had been listed as elements, necessities, situations for achievement, or conditions for swap feasibility. The primary two are conditions, the final three are mixed elements for swap feasibility.

- Handbook swap

- Commonplace transport containers appropriate with transport tools (i.e., cranes, and many others.)

- Fleet — this one has a extra prolonged phrase description.

- The swap market may be very massive and dominated by a number of producers. A comparability instance: cement mixers.

- A authorities initiative to drive battery swapping.

Trying on the outcomes up to now, these situations appear to be largely evidenced empirically. My analysis appears to point that standardization is probably the most vital issue. For automobiles, with quick chargers already established, the necessity for swap will not be that nice, except automobile charging ranges stray far past 150 kW. Already, automobile quick charging prices are higher for quicker charging exceeding that stage. This appears to be tolerable and the necessity for swap will not be nice for automobiles. For probably the most half, a dialogue of sensible swap and quick charging purposes solely includes heavy vans, equipment, and long-haul transport that includes giant quantities of energy in charging, in settlement with the listed situations.

Since most automobile charging is low energy in properties, swap is extra of an extended journey issue than a each day use issue for automobiles usually.

For heavy vans with frequent all-day operation, charging is extra frequent and operational time is at a premium. The issue lies within the elevated ranges of energy required for quick charging. I don’t consider charging heavy vans and different autos will be all the time time shifted to occasions of decrease energy to keep away from extra utility costs or that buffering quick chargers universally solves this drawback. For instance, in California, the premium fee time is a brief interval of about six hours within the early night. With photo voltaic in abundance, there is no such thing as a day–evening arbitration and charges are low at noon. That leaves little alternative for arbitrage in charging.

The evaluation of relative charging prices for battery-buffered quick chargers versus slow-charging swap for heavy vans relies upon totally on the variations in capital tools prices. Buffered quick charging solely provides worth for charging avoiding use throughout premium fee occasions. Solely a restricted quantity of use circumstances require charging throughout these occasions. For a lot of the hours of operation, buffered charging would achieve little or no benefit. The battery packs on electrical autos themselves can function time shift.

Additional, using battery-buffered charging arbitration solely extends to the quantity of buffering obtainable. If extra charging is important, additional buffering is required. For a interval of a number of hours, the battery buffer have to be recharged and isn’t obtainable for totally charging a battery pack. To cost extra battery packs, within the senescent interval, additional battery buffers are wanted to keep away from demand costs or increased TOU charges. That is the case with all excessive energy charging techniques.

Basically, it isn’t attainable to achieve a stage of arbitration solely on the distinction between peak fee occasions and low fee occasions, just because some heavy car pack charging will not be restricted to particular occasions of day. Heavy truck charging based mostly on in a single day sluggish charging doesn’t meet use patterns. For long-haul heavy vans, the recharging cycle durations will be from three to eight hours.

Autos have to cost as routes and conditions require

The heavy car swap cost benefits versus buffered quick charging stay a key distinction inherent in sluggish charging swap. Peak energy calls for in distribution tools have to be met no matter time of day. Pricey grid upgrades have up to now been averted with automobiles as a result of the facility ranges are low relative to current grid capabilities. Utilities will incur heavy capital bills to improve grids to ranges an order of magnitude higher which might be wanted to energy vans. The issue is mainly that heavy vans, significantly semis, have to function at a really excessive use fee, and charging energy may be very excessive in comparison with automobiles with low use charges that may be charged very slowly. Heavy vans should cost extra ceaselessly and at a lot increased ranges. An electrical automobile might totally cost as soon as and drive for days, however an electrical long-haul truck might totally cost twice in a day or extra.

It’s my function to stipulate and present the character of the charging drawback offered to heavy vans, significantly long-haul vans and use circumstances that can’t slow-charge when not in use, and should hold charging prices low to compete with diesel.

Lastly, on the steadiness, it seems that some heavy truck charging choices are based mostly on maximizing car working time. On this case, swap might take priority due to the excessive want.

Electrical automobile battery swapping in China

With over 85% of the world’s battery pack swapping stations, and a big portion of the world’s quick chargers, no dialogue of battery swapping or EVs is full with out a dialogue of China. In China, on holidays, electrical automobile house owners wait as much as an hour to make use of quick chargers, and a median of fifty minutes to cost. The state of affairs has already drastically improved for battery swap automobiles. Whereas folks within the West select electrical automobiles with quicker charging speeds and bigger battery packs, in China, many drivers are choosing the benefit of use of battery pack swap automobiles. In China, house owners have the choice of proudly owning a battery swap succesful automobile or shopping for a swap succesful automobile and renting the battery below the Battery as a Service (BaaS) mannequin. The latter gives a decrease preliminary price to EV patrons. Swapping provides the extra advantage of lowered pack know-how obsolescence and lowered battery pack dangers and car capital prices.

In heavy vans, CATL has began a battery swap initiative with the entry of its QIJI battery pack.

The Ministry of Trade and Data Know-how is the primary EV regulatory physique.

“In June 2023, Xin Guobin, the vice minister of the business, introduced that China goes to push in the direction of a common commonplace of battery measurement, connection factors, and protocols to facilitate the expansion of battery swapping,” based on Nio.

A swap station has many battery packs in it. Nio claims, “it solely wants one third of the house, and one third of the grid connection” (at 2:25). It might use decrease energy tools requiring much less energy from the grid, a price benefit.

An everyday commenter, JP, enumerated the relative charging prices as:

- Price of power in

- Price of land

- Price of non-land capital

- Alternative prices of capital

On 1, the price of power is decrease than quick charging with slow-charged swapping, for the quick charging case with or with out storage buffer. Within the case with out buffer, due to further demand costs, swapping is decrease price. Within the case of quick charging with storage buffer, due to the additional 80% spherical journey power losses of the storage pack, swapping can be decrease price.

On 2, the price of land is much less for the swap station, as a result of the world is smaller.

On 3, the price of capital for the swap station is balanced in opposition to the additional price of storage buffers wanted to shave peak energy. The slow-speed swap station additionally balances price versus quick charging with out storage, as a result of slower-speed swapping station chargers are cheaper than quicker chargers.

On 4, the additional wait time for quick charging provides operational prices, with heavy vans significantly delicate to being out of operation throughout longer charging classes.

On three out of 4 of the issues, swapping batteries has the benefit. On merchandise three, the additional price of swap {hardware} is balanced by the price of both storage wanted to keep away from peak demand costs or the upper price of quick chargers versus sluggish chargers utilized in swapping stations.

For automobiles, satisfactory options for long-distance journey exist already so long as charging speeds and energy are at 150 kW ranges. The place standardization and authorities assist exists, swapping can be utilized together with quick charging for long-distance journey. For heavy vans, there are vital prices related to power storage more likely to push consideration of relative prices of swapping versus quick charging.

To realize some perspective on freeway swapping station use versus quick charging use in China, think about the numbers:

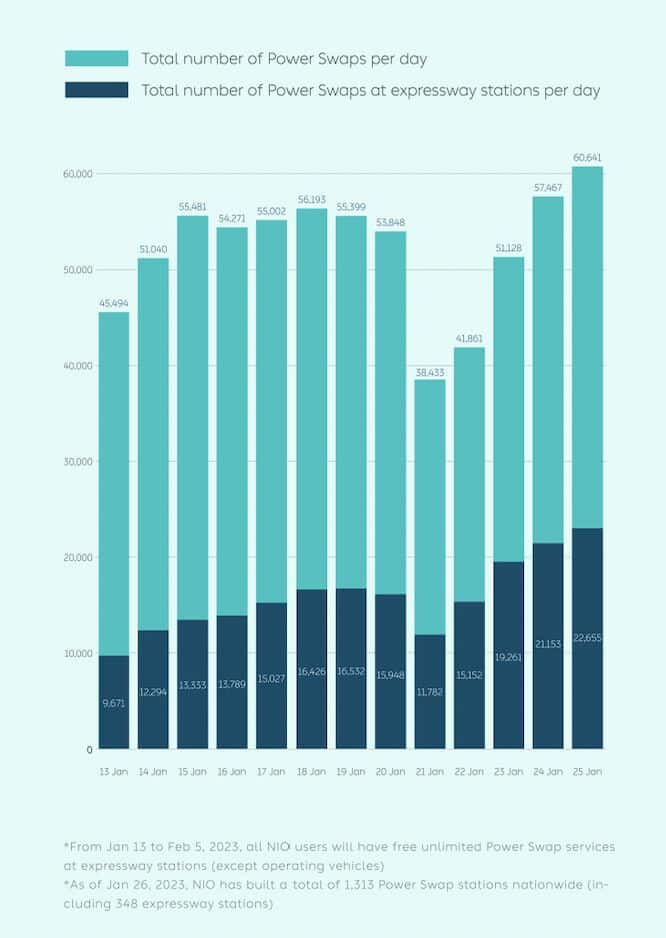

Some 60,000 NIO swaps are completed on a peak day in China.

For reference, Tesla is the biggest DC quick charging supplier in China. Tesla Superchargers common 35 classes per stall per week, or 5 per day. In 2022, there have been about 1,000 Supercharger stations. Now, there are 1,900. The variety of stalls averages about 10× the variety of stations, so 19,000 estimated. With 1,900 Superchargers, the variety of each day classes is about 9,500.

If the NIO numbers from the chart are right, they’ve about 348 expressway stations that did about 22,000 swaps per day initially of this yr. These calculations point out that freeway swaps per day are taking place at a big fee in comparison with Supercharger classes per day in China.

We are going to proceed this dialogue of electrical automobile & truck charging in one other put up or two coming quickly.

Have a tip for CleanTechnica? Need to promote? Need to counsel a visitor for our CleanTech Discuss podcast? Contact us right here.

Newest CleanTechnica.TV Movies

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.

CleanTechnica’s Remark Coverage