European Union (EU) electrical energy markets look like efficiently bucking their reliance on Russian fuel. A number of latest studies level to improved market fundamentals within the area, suggesting the area is on observe to beat the crippling power disaster it suffered final 12 months.

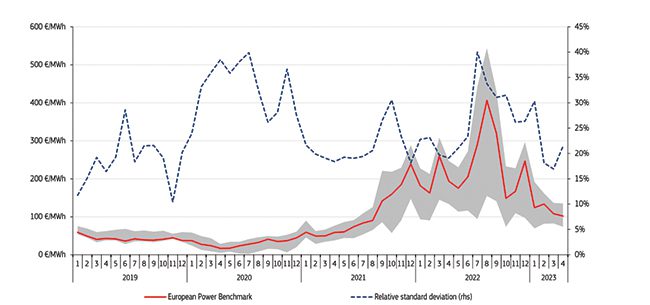

The European Fee (EC) in a report revealed on Oct. 5 mentioned that in comparison with a spike in energy costs in the course of the third and fourth quarters of 2022, the European Energy Benchmark averaged €122/MWh ($130/MWh) over the primary three months of 2023. That’s “40% decrease than in the identical interval twelve months earlier,” it famous (Determine 1). “The best costs in the course of the quarter had been recorded in Italy and Greece (€158/MWh and €157/MWh, respectively) and these had been 37% and 34% decrease than within the first quarter of the earlier 12 months,” it mentioned.

|

On a yearly foundation, 26 member states “skilled a decline in costs of their wholesale electrical energy markets (starting from –57% to –11%),” it added. “The most important year-on-year worth falls in member states had been registered in Spain and Portugal (–57%) and France and Croatia (–43%).”

Downward Pattern in Wholesale Gasoline Costs

The EC mentioned that the worth decreases had been partly pushed by a downward development in wholesale fuel costs. Costs fell from an all-time excessive of €320/MWh recorded on Aug. 26, 2022, to a median spot worth of €53/MWh. Amongst key traits the EC highlighted is that Russia’s share of complete fuel imports within the EU (pipeline fuel and liquefied pure fuel [LNG]) dropped 42% in the identical interval final 12 months.

Representing a potential development, complete EU pipeline imports additionally fell practically 32% year-to-year. Norway remained the EU’s largest pipeline fuel exporter, sending greater than 21.7 billion cubic meters (bcm), or 53% of the EU’s complete, adopted by North Africa (18%, 7.3 bcm), and Russia (12%, 5 bcm). LNG, in the meantime, accounted for 42% of EU fuel imports, a major enhance from 33% a 12 months earlier. The U.S. provided 41.5% of the EU’s LNG imports, nevertheless it was adopted by Russia (19%) and Qatar (12%). “The EU remained the primary LNG importer on the planet with 31.2 bcm or 22% of worldwide LNG import, adopted by Japan and China,” the EC famous.

Knowledge-driven power think-tank Ember in a September report mentioned these traits adopted the same trajectory via the primary half of 2023. It mentioned energy costs averaged €107/MWh from January to June 2023. That represented a drop of greater than 40% in comparison with the identical interval in 2022 (€185/MWh), nevertheless it’s nonetheless “twice the worth within the first half of 2021 (€55/MWh),” it famous.

The suppose tank additionally underscored falling pure fuel costs. “With a median of €44/MWh from January to June 2023, fuel costs have fallen by greater than 50% in contrast with the degrees seen in the identical interval final 12 months (€97/MWh). Nonetheless, they’re nonetheless double the costs within the first half of 2021 (€22/MWh),” it mentioned. Ember warned that fuel is poised to stay pricey for EU markets at the least via the remainder of this 12 months owing to “the specter of curtailed LNG provides from Australia.” It serves as a “reminder that the dangers of fuel worth surges stay, growing as winter and the heating season strategy,” it famous.

Shifting Fundamentals

The EC famous falling electrical energy consumption is a key driver of shifting fundamentals. The EC reported demand within the first quarter fell 6% in contrast with final 12 months’s ranges. “Demand ranges for the primary quarter of 2023 had been additionally effectively beneath the 2017–2021 vary, registering the bottom worth in February 2023,” it famous. Ember advised demand fell 5% total within the first half of 2023.

Ember, nevertheless, highlighted a number of important traits within the EU’s energy combine. “Between January and June, fossil fuels generated 410 TWh within the EU, making up the lowest-ever 33% of demand,” it mentioned. “This collapse was led by coal, which fell by a staggering 23% (–49 TWh) within the EU within the first half of the 12 months, whereas fuel decreased by 13% year-on-year.” In Might, notably, coal energy “set a file” by producing lower than 10% of the EU’s electrical energy era for the primary time ever, it mentioned.

Coal’s decline was partly offset by a 13% (13 TWh) development in solar energy in comparison with the identical interval in 2022. Wind era additionally rose by 5% (10 TWh). “Following the speedy enlargement of renewables ambition lately, each the EU and particular person international locations proceed to interrupt information. Wind and photo voltaic accounted for greater than 30% of electrical energy manufacturing within the EU for the primary time in each Might and July, and surpassed complete fossil era in Might,” it famous.

Hydropower performed a heftier position with an 11% (15 TWh) restoration in comparison with final 12 months. “This was pushed by considerably increased output in Southern Europe and the Baltic States, whereas Nordic international locations’ efficiency has been just like 2022 however decrease than 2021,” Ember mentioned. Hydropower has suffered more and more “poor and risky” output since 2000, laid low with extreme droughts, it famous.

Nuclear era within the EU additionally fell within the first half of 2023 in comparison with the identical interval final 12 months. The drop was precipitated by Germany’s nuclear section out, a closure of Belgium’s Tihange 2, outages in Sweden, and closures of France’s fleet associated to emphasize corrosion points. France, notably, took offline greater than half of its 56-reactor fleet when it found 16 reactors had been affected by stress corrosion points. In October, EDF reported that its nuclear era because the begin of 2023 had jumped 11.4% in comparison with final 12 months, and that it expects to provide 300–330 TWh this 12 months and 315–345 TWh in 2024. The beginning of Finland’s Olkiluoto 3 is anticipated to partially offset closures.

—Sonal Patel is a POWER senior affiliate editor (@sonalcpatel, @POWERmagazine).