Join each day information updates from CleanTechnica on electronic mail. Or observe us on Google Information!

Some 295,000 plugin automobiles have been registered in Europe in September, rising 6% YoY, which represents the EV market’s return to development for the primary time since April. That is much more vital when you think about the general market fell by 4%, to 1.1 million models.

Apparently, BEVs are those pushing the market upwards, rising 14% YoY to 212,000 models. PHEVs stay caught in crimson, falling 9% in September to 83,000 models.

Trying on the remaining powertrains, solely HEVs have been optimistic, rising 12% YoY, whereas petrol was down 19% and diesel continued to free fall, dropping 24%.

As such, September’s automotive market has seen some seismic modifications, with plugin automobile share of the general European auto market rising to 26% (19% full electrics/BEVs). Added to the 34% market share of HEVs, that signifies that 60% of all passenger vehicles offered in Europe final September had some form of electrification.

Much more importantly, for the primary time, gross sales of HEVs (34% share) surpassed gross sales of petrol automobiles (29% share) in September, a pattern that’s absolutely right here to remain. In the meantime, diesel (8%) continues to lose relevance each passing day. At this tempo, I wouldn’t be shocked if diesel was useless in Europe earlier than 2030, with petrol following it a few years later.

These outcomes stored the 2024 plugin automobile share at 22% (15% for BEVs alone) by way of the top of September, which is just one% lower than the place we have been a 12 months in the past, at 23%.

Lastly, trying on the gross sales breakdown between BEVs and PHEVs, regardless of the nice outcome for pure electrics in September, they represented 72% of all plugin gross sales, and they’re at precisely on the similar degree in 2024 as they have been a 12 months in the past (67%). With new or refreshed fashions touchdown quickly for each powertrains — specifically, cheaper BEVs and longer vary PHEVs — and new CO2 ceilings in Europe, it will likely be attention-grabbing to see how the 2 applied sciences behave subsequent 12 months.

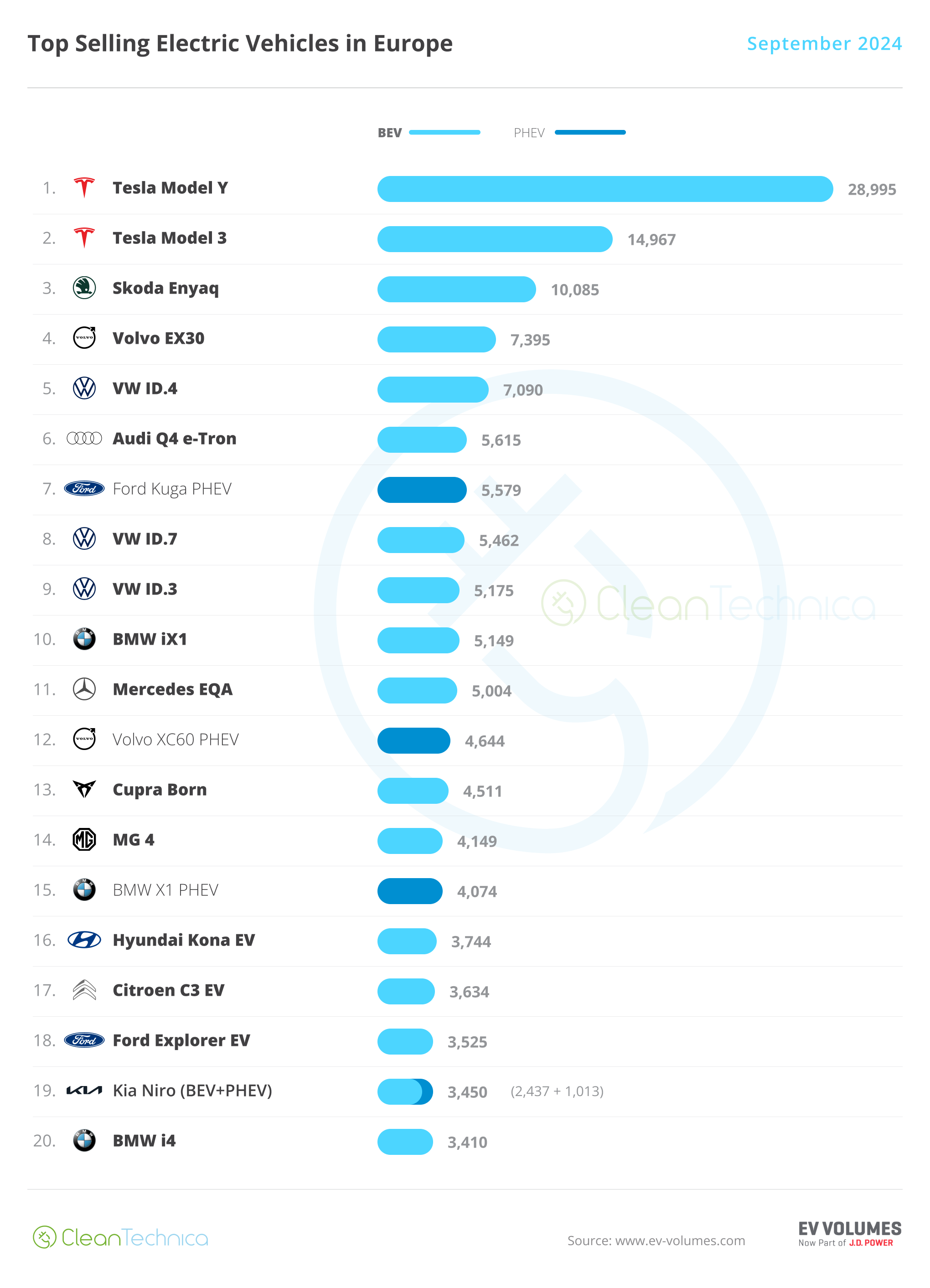

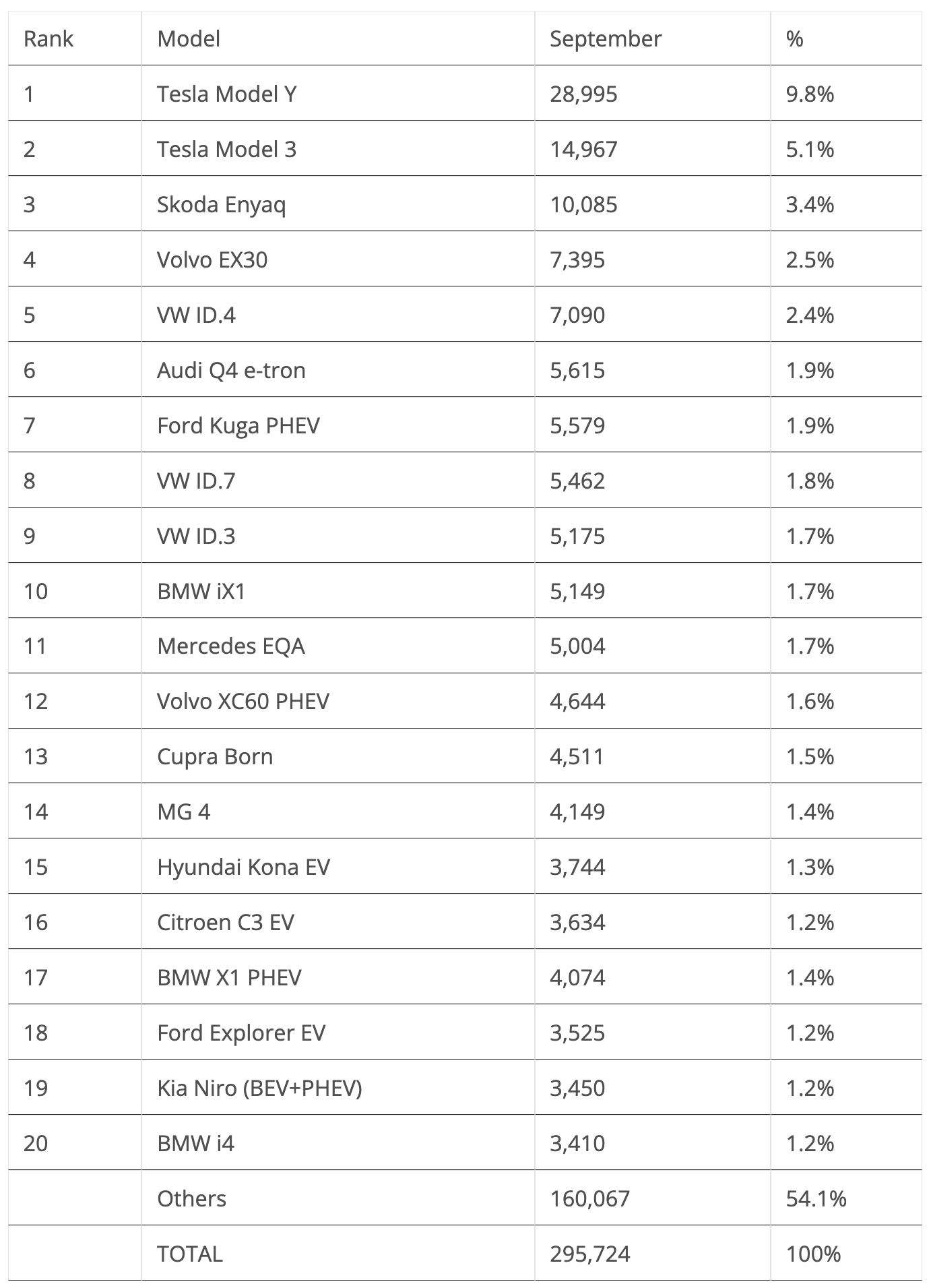

The spotlight of the month was the Skoda Enyaq, nabbing a podium place. However let’s look nearer at September’s plugin high 5:

#1 Tesla Mannequin Y — For the nth month in a row, Tesla’s crossover was the most effective promoting EV in Europe. In September, the midsizer had 28,995 registrations, which was down 1% YoY. Keep in mind after I talked about that 2023/24 could be thought-about the “Peak Mannequin Y” interval in Europe? Tesla’s midsizer has hit the market’s pure limits. Add the refreshed Tesla Mannequin 3 and the rumours of the refreshed Mannequin Y model, mentioned to land early subsequent 12 months, and it is just pure that the Mannequin Y’s efficiency shouldn’t be as wonderful because it as soon as was. particular person international locations, the largest vendor was the UK, with 5,780 models, adopted by France (4,591 models), Sweden (4,125!) Germany (3,067), the Netherlands (2,600), Norway (2,105), and Belgium (1,283).

#2 Tesla Mannequin 3 — Tesla’s sedan delivered 14,967 models, tripling the outcome it had a 12 months in the past. After all, a 12 months in the past, the sedan was in the midst of a transition to the refreshed mannequin, so … anticipate it to proceed taking part in because the operating mate of Tesla’s present star, the Mannequin Y, whereas it protecting the #2 place away from the competitors. As for the markets with probably the most deliveries, there’s an attention-grabbing distinction in comparison with the Mannequin Y. The crossover’s principal markets are all located in Northern Europe, whereas the Mannequin 3 had sedan-loving Spain (2,221 models) as its principal market and in addition had Italy (1,284) amongst its greater markets, together with extra common ones — the UK (1,845 models), Norway (2,067), and the Netherlands (1,258).

#3 Skoda Enyaq — Skoda’s crossover has returned to type, scoring a file 10,085 registrations in September, the primary time the Czech mannequin has hit a five-digit lead to a single month. It thus received a podium presence besides. With demand at a brand new all-time excessive, because of the current refresh, the worth for cash king within the Volkswagen Group galaxy is again within the sport. A high 5 place is feasible for 2024, however that may rely quite a bit on how its youthful (and cheaper) sibling, the Elroq, impacts it. Trying on the Czech’s greatest markets, Germany was by far the most important, with 3,406 models, adopted by Norway (776) and the UK (1,520).

#4 Volvo EX30 — The China-made (however with a Swedish passport) crossover is at cruising velocity, scoring 7,395 registrations in September, however this time it wasn’t in a position to get a podium place. And really … it appears that evidently the China tariffs have considerably harm the crossover’s efficiency, as a result of whereas earlier than the beginning of the tariffs, the EX30 was on a roll, with three consecutive scores above 8,000 models/month, after the beginning of the tariffs, the Volvo EV hasn’t managed to achieve that very same degree of registrations. Coincidence? Again to September, and searching on the EX30’s greatest markets, the UK leads, with 1,620 models, adopted by the Netherlands (904 models) and Norway (803 models).

#5 VW ID.4 — The compact crossover received a high 5 presence in September, with the MEB mannequin scoring 7,090 deliveries. The ID.4 is recovering from a poor first half of the 12 months, because of a current refresh that improved its specs, if not its styling. Trying on the crossover’s greatest markets, its house Germany had 1,371 registrations, which is nearly a 3rd of what its Czech cousin the Skoda Enyaq had in the identical interval. However the information was higher within the UK (1,921 models), making the insular market the largest in September for the Volkswagen EV. Apparently, the UK was the principle marketplace for three of the highest 5 greatest sellers in Europe, highlighting the present significance of the British EV market, which had the very best EV gross sales quantity in Europe final month. With the German EV market nonetheless reeling from the top of incentives, and the French EV market ready for the ramp-up of its new home EVs, the UK is now a essential participant, permitting EV gross sales to soldier on, till the 2025 CO2 guidelines come into play within the EU to offer one other increase. However, again on the ID.4, its third largest market was Belgium (666), which as soon as once more confirmed up among the many greatest promoting markets attributable to its robust BEV firm automotive incentives.

the remainder of the September desk, just a few fashions deserve a point out, like continued good outcomes of Volkswagen’s new ID.7, which hit its third file efficiency in a row(!) by getting 5,462 registrations, permitting it to affix the highest 10 for the primary time, in #8. With the GTX variations now being delivered, and AWD being commonplace in these variations, anticipate its gross sales to develop considerably in Scandinavia.

The #11 Mercedes EQA additionally had a file efficiency, 5,004 registrations, whereas the MG 4 returned to the highest 20 for the primary time because the begin of the brand new tariffs — in #14 because of 4,149 registrations.

Highlighting Volkswagen Group’s good month — it positioned 5 fashions within the high 9 — the Cupra Born was the sixth consultant of the OEM within the high 20 desk, ending the month in thirteenth from 4,511 registrations, a brand new 12 months greatest for the German-born Spaniard.

Lastly, trying on the PHEV class, the Ford Kuga PHEV was the most effective vendor of the class. With 5,579 gross sales, it resulted in seventh, 5 positions forward of the class runner-up, the Volvo XC60 PHEV, whose 4,644 registrations have been its greatest lead to 18 months.

The third PHEV mannequin on the desk was the BMW X1, which scored a file 4,074 registrations, permitting it to finish in seventeenth.

However the really attention-grabbing stuff is nearer to the underside of the desk as we begin seeing the primary strikes from OEMs as they begin getting ready for the 2025 season.

As such, we salute the entry within the high 20 of the brand new Ford Explorer EV, which reached 3,535 models in solely its second month available on the market, permitting it to complete in 18th. Whereas not precisely low-cost, it begins at 47,000€, and though it doesn’t have groundbreaking specs — in any case, it’s a VW ID.4 with a unique costume — the compact crossover has a greater design, inside and outside, in comparison with its Volkswagen Group cousins. It received’t be a future podium candidate, however I wouldn’t be shocked if it secured a high 10 place in 2025.

However maybe much more eventful is the Citroen C3 EV touchdown available on the market in sixteenth with 3,634 registrations. And Citroen wished it may have landed with some 5,500 deliveries….

Nonetheless, this is likely one of the greatest landings ever for a BEV in Europe, and solely France acquired it in vital volumes. If the manufacturing ramp-up goes properly, and that could be a large if, anticipate the French EV to start out 2025 at full velocity. Would 100,000 models by the top of the 12 months be an excessive amount of to ask?…

Beneath the highest 20, extra 2025 fashions are touchdown, or ramping up. The Renault 5 (1,138 models), Porsche Macan EV (1,777), Polestar 4 (1,645), and Tiguan PHEV (3,108) belong to the primary case, whereas the Mini Countryman EV (2,964 models), Audi Q6 e-tron (1,452), Renault Scenic EV (3,225), Peugeot 3008 (3,156), and Toyota C-HR PHEV (2,854) fall to the latter.

A number of notes on all these fashions: first, concerning the hotly anticipated Renault 5, it’s an instance of retro performed proper. Whereas it has among the finest designs on the market, it additionally serves a objective, which is to be Renault’s EV consultant within the B-segment. And whereas 2025 will start with its manufacturing ramp-up nonetheless underway, I imagine the French EV may be capable to attain 100,000 models subsequent 12 months.

As for the Porsche Macan, it had a formidable touchdown, already beating its cousin, the Audi Q6 e-tron, which landed a few months earlier than. It is a good omen for Porsche’s new EV, so I imagine 50,000 models could possibly be attainable in 2025.

The brand new VW Tiguan PHEV has landed with a bang, with the brand new era providing a brand new PHEV powertrain, together with a 20 kWh battery, over 100 km of vary, and even quick charging. The German crossover is a robust candidate for the PHEV title in 2025.

With the Mini Cooper EV affected by the elevated tariffs on EVs produced in China, the Made-in-Germany Mini Countryman EV is now the model’s high vendor, becoming a member of the French Renault Scenic EV and Peugeot 3008 as robust candidates for a high 20 place. The 2 crossovers are their model’s present greatest sellers.

Final, however not the least, the Toyota C-HR PHEV can be ramping up. It was the Japanese make’s greatest vendor in September, so it too could possibly be a candidate for a desk place.

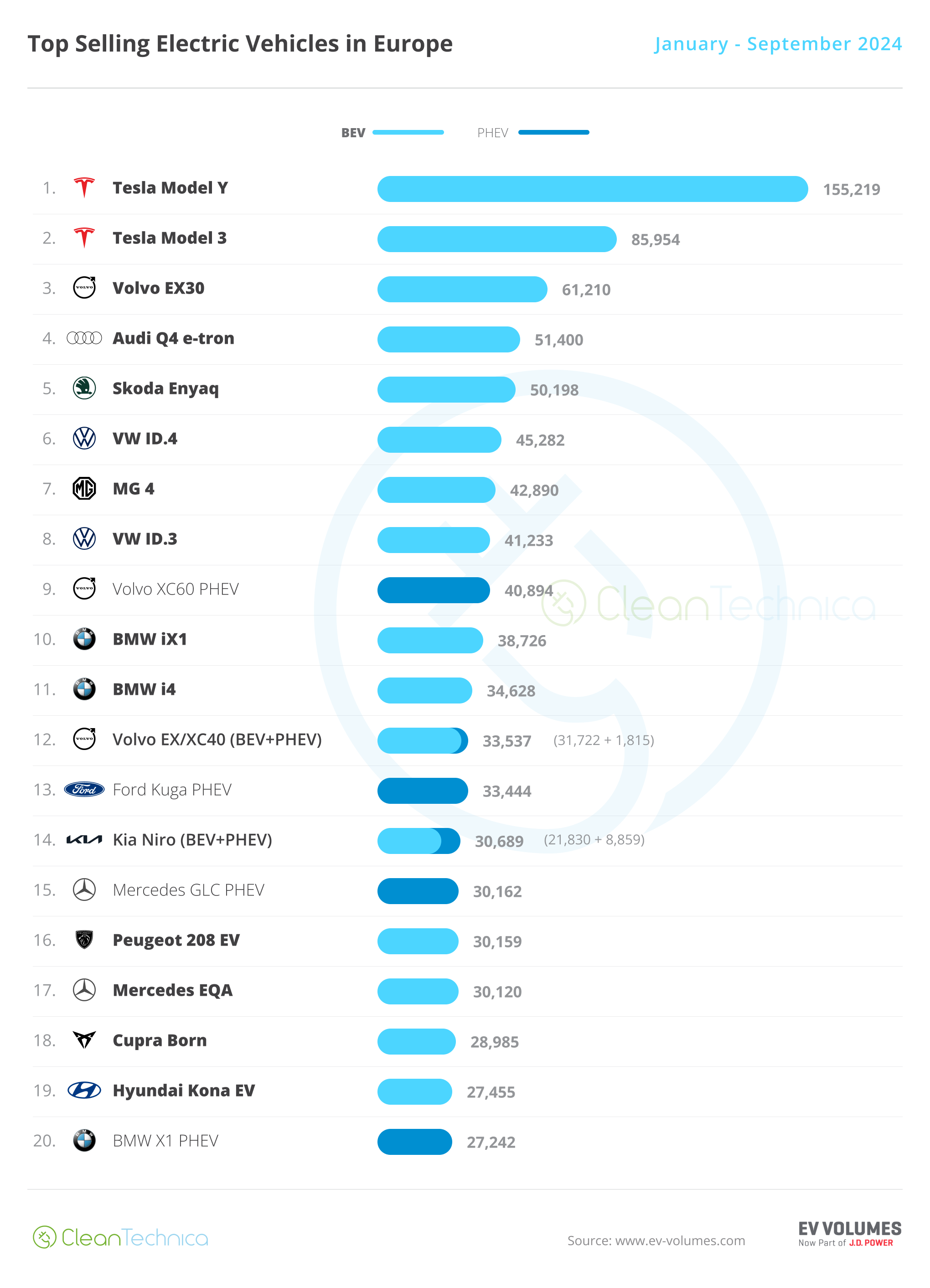

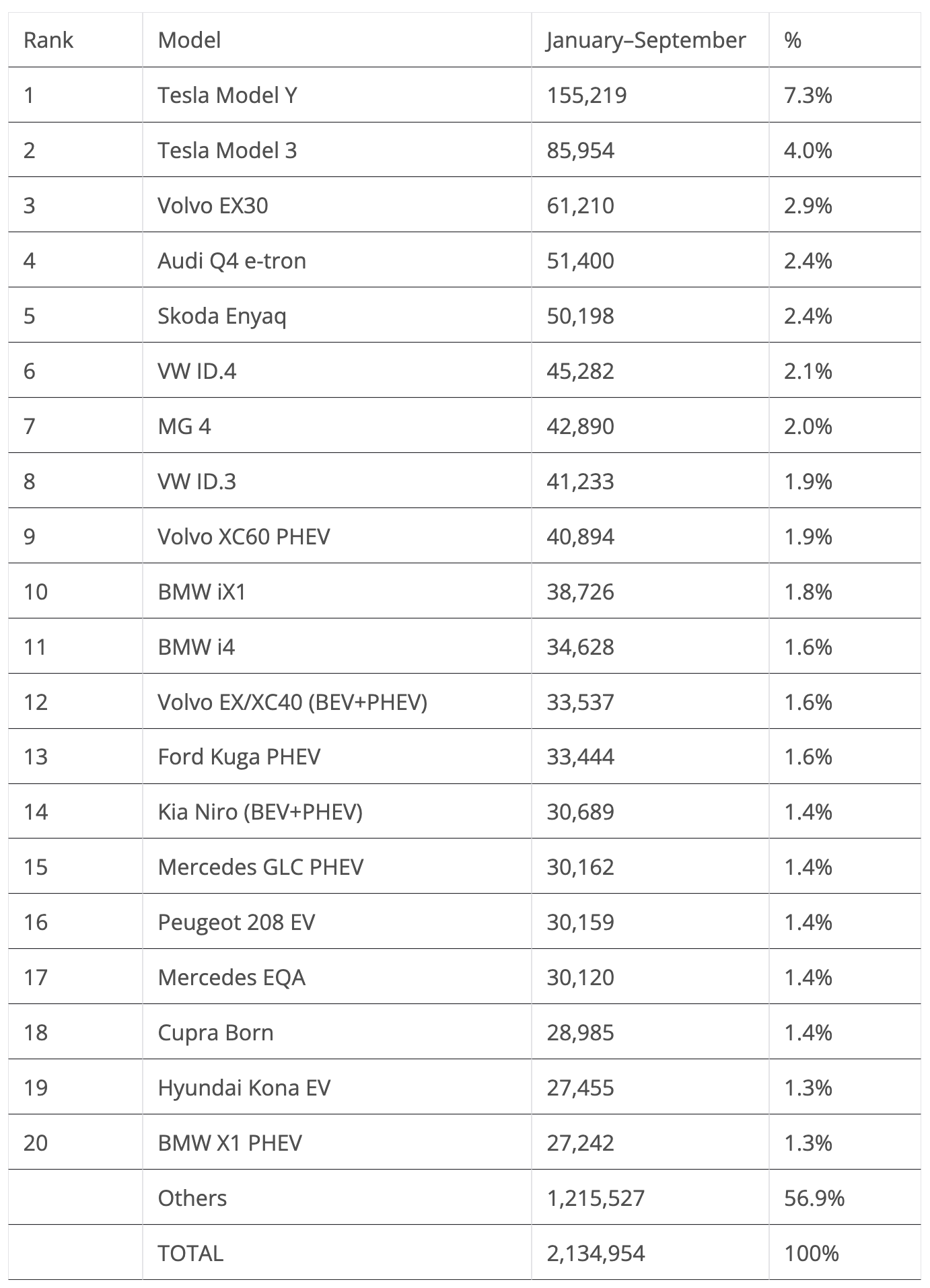

Trying on the 2024 rating, with the chief, the Tesla Mannequin Y, having a 70,000-unit lead over the runner-up Tesla Mannequin 3, the US crossover is about to win its third greatest vendor title in a row.

Beneath it, the Tesla Mannequin 3 has additionally secured the runner-up place, having stored a bonus of some 24,000 models over the #3 Volvo EX30. So, this one must also be secured, and Tesla will almost certainly have a gold plus silver end in Europe this 12 months, repeating the feat of 2022 and 2023.

As for the third spot, the image is much less clear, however with 10,000 models of advance over the #4 Audi This autumn e-tron and 11,000 models over the #5 Skoda Enyaq, the Swede appears to have a big cushion to handle, particularly contemplating there are solely three months till the top of the race.

The primary place modifications occurred within the sixth place, with the VW ID.4 climbing one other place, at the price of the MG 4, nonetheless feeling the burden of the brand new tariffs.

Nonetheless on the highest 10, the opposite VW greatest vendor, the ID.3, surpassed the Volvo XC60 PHEV and climbed to eighth. It’s a good signal that the VW fashions are recovering on misplaced time, however the #3 spot of the ID.4, which it received in 2022 and 2023, appears already out of attain.

Within the second half of the desk, the Kia Niro and Mercedes GLC PHEV benefitted from one other poor month from the Peugeot 208 EV (solely 2,474 models in September), and every climbed one place, to 14th and fifteenth, respectively.

Lastly, we now have two fashions returning to the desk, within the backside positions of the desk. The Hyundai Kona EV jumped to #19, whereas the BMW X1 PHEV was as much as #20.

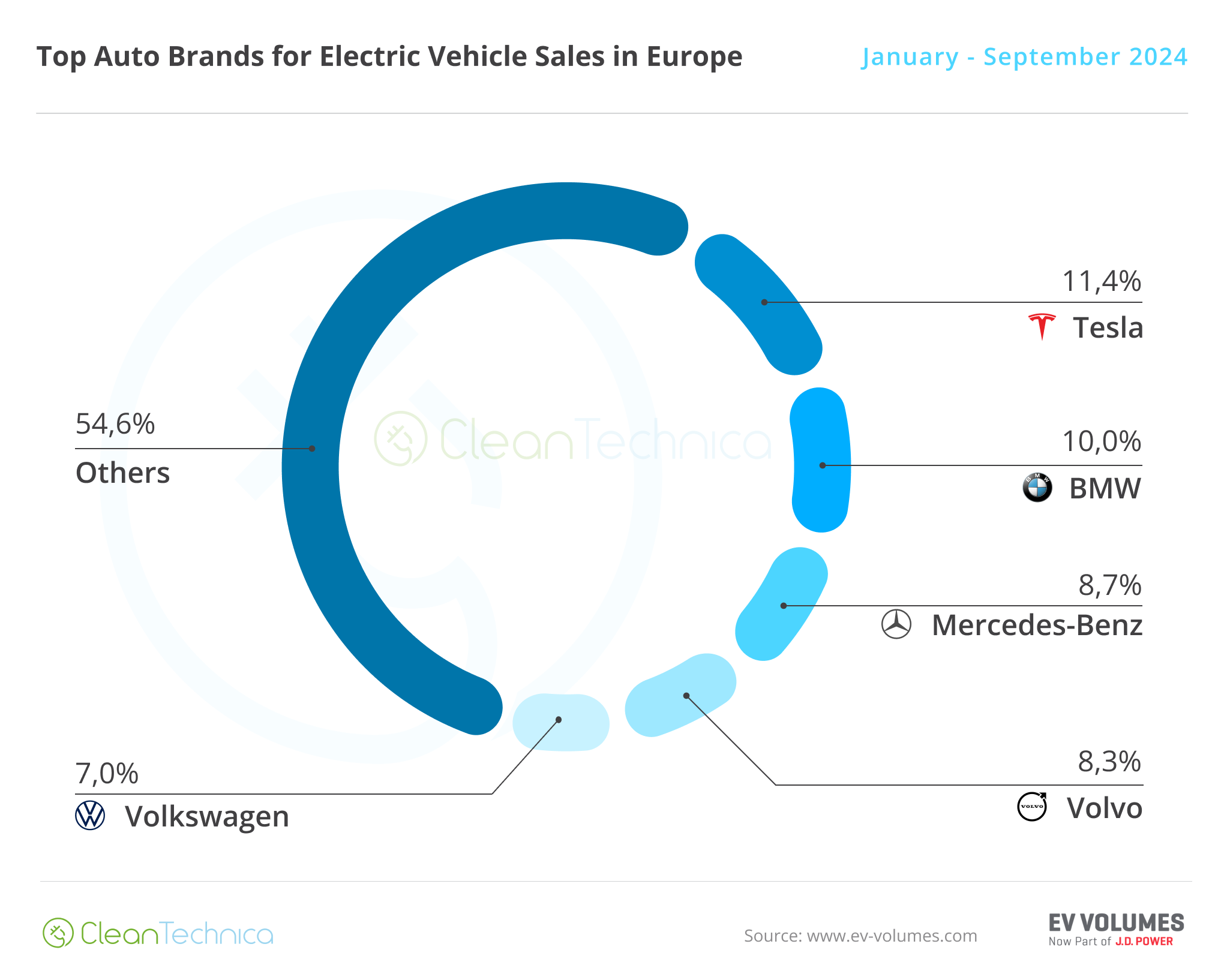

As for the plugin auto model rating, Tesla profited from its end-of-quarter peak (11.4% in September vs. 10.9% in August) and secured sufficient distance to win yet one more title, its third in a row. Nonetheless, in comparison with the earlier 12 months, the space above its competitors has shortened considerably (Tesla had a 4.3% advance over the runner-up twelve months in the past, in opposition to its present 1.4%), so 2025, the US make ought to have a more durable time renewing the title.

Behind the US make, solely Volkswagen gained share, going from 6.7% in August to its present 7%. The Wolfsburg make had a horrible first half of the 12 months and is now recovering, however it’s nonetheless 1.4% share behind its rating a 12 months in the past (7% now vs 8.4% then).

With Volkswagen having been on the European podium virtually yearly since 2015 (with the exception being 2019), anticipate a gross sales push to achieve the third place. However with solely three months left, time is operating out for the Wolfsburg make.

#4 Volvo (8.3%, down from 8.5%) misplaced some floor to #3 Mercedes (8.7%), and it would lose its spot to Volkswagen in the direction of the top of the 12 months.

Lastly, #6 Audi (6.3%, down from 6.4%) misplaced extra floor to the highest 5, however with its most instant followers #7 Kia (4.4%) and #8 Peugeot (4.2%) additionally shedding floor, the Ingolstadt make is secure in its place.

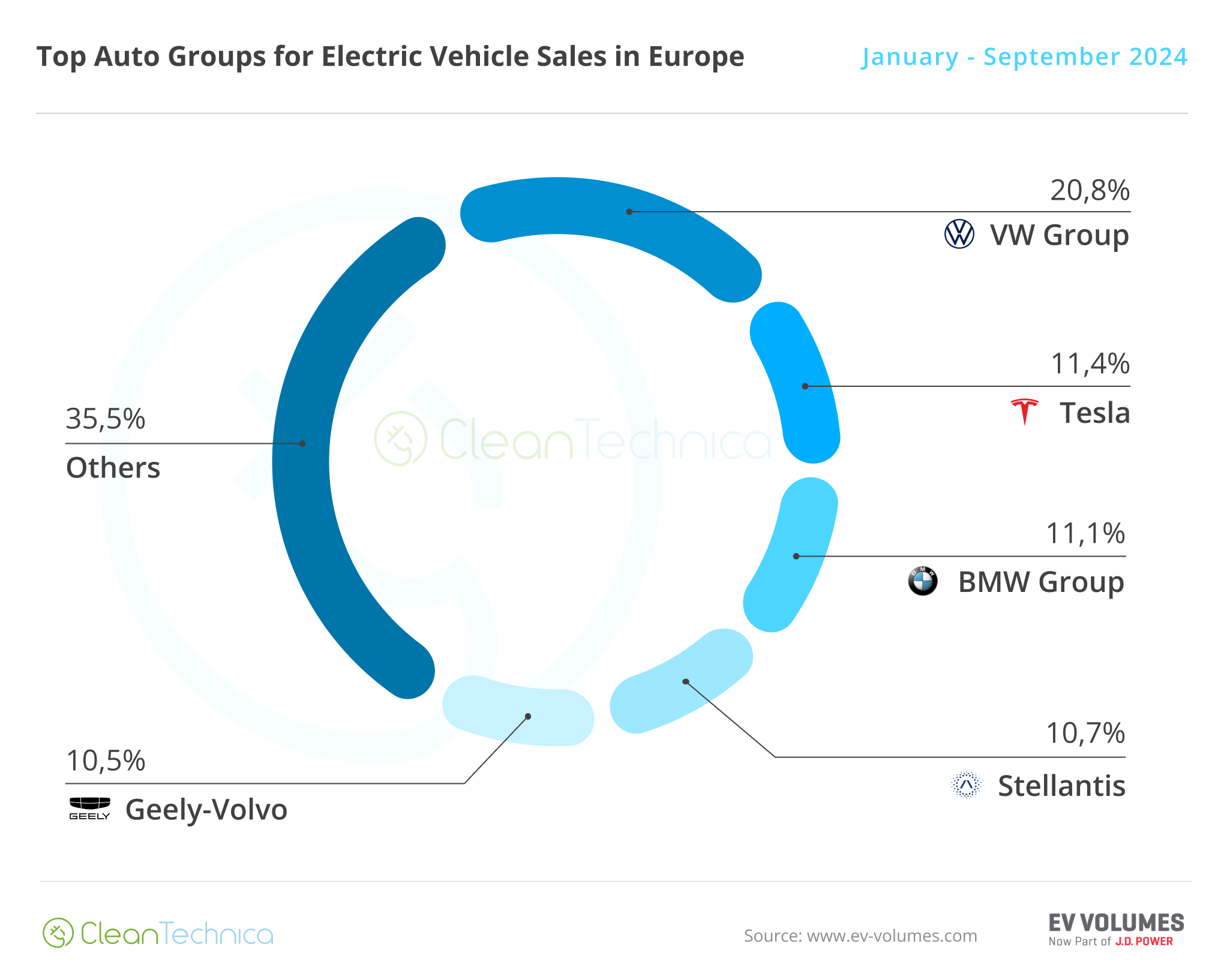

Arranging issues by automotive group, Volkswagen Group is secure within the lead, with 20.8% share (up from 20.4% in August).

Tesla (11.4%) jumped two positions in September, to 2nd, taking advantage of its normal end-of-quarter peak, whereas BMW Group (11.1% in September, up from 11% in August) was additionally on the rise, because of Mini. So, there ought to be an attention-grabbing race taking place right here, particularly contemplating that #4 Stellantis (10.7%) may rebound in This autumn, if the ramp-ups of its new, low-cost EVs go easily.

#5 Geely–Volvo (10.5%) is secure in fifth, and is betting on troubles persevering with at Stellantis to catch it in This autumn. Mercedes-Benz Group (9%) is in a distant sixth place, with the German OEM placing extra floor between it and #7 Hyundai–Kia, which dropped from 7.9% share in August to its present 7.7%.

Chip in just a few {dollars} a month to assist help impartial cleantech protection that helps to speed up the cleantech revolution!

Have a tip for CleanTechnica? Wish to promote? Wish to counsel a visitor for our CleanTech Speak podcast? Contact us right here.

Join our each day publication for 15 new cleantech tales a day. Or join our weekly one if each day is simply too frequent.

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.

CleanTechnica’s Remark Coverage