Join every day information updates from CleanTechnica on e-mail. Or comply with us on Google Information!

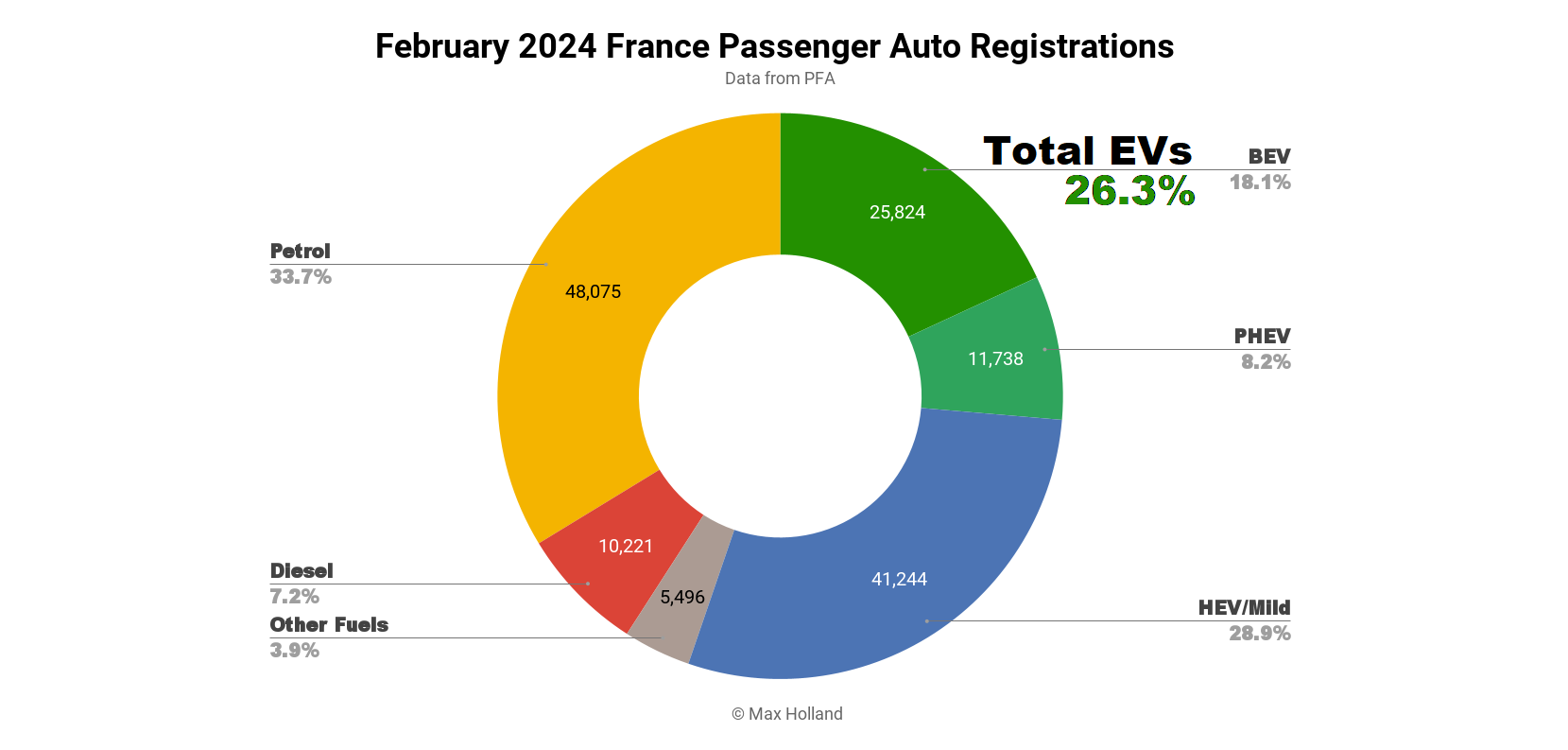

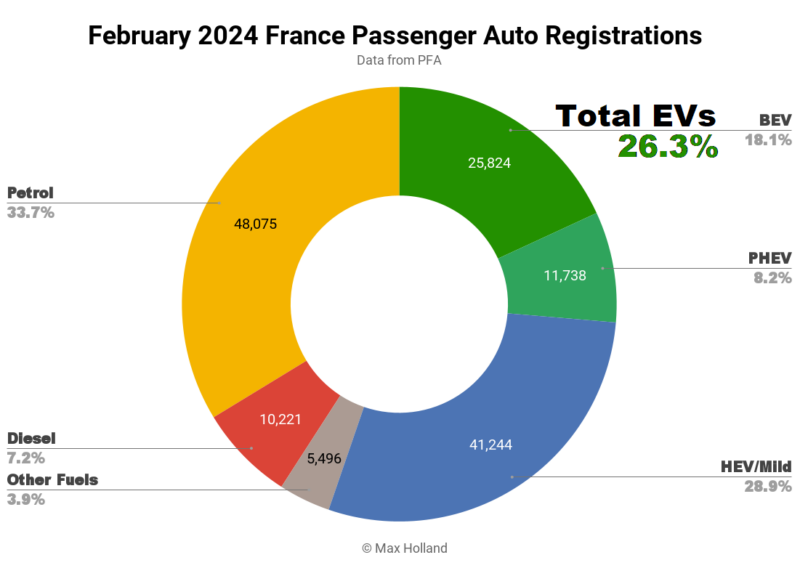

February noticed plugin EVs at 26.3% share in France, up from 23.8% share, 12 months on 12 months. Full electrical quantity grew 32% YoY, and plugin hybrid quantity grew 12%. February’s total auto quantity was 142,598 models, up 13% YoY, although nonetheless nicely under 2017–2019 norms (~190,000). The Peugeot e-208 was as soon as once more the most effective promoting full electrical automobile.

February noticed mixed plugin EVs at 26.3% share in France, consisting of 18.1% full battery electrics (BEVs), and 8.2% plugin hybrids (PHEVs). These evaluate with YoY figures of 23.8% mixed, with 15.5% BEV, and 8.3% PHEV.

PHEVs have been on a plateau for the previous 3 years, hovering near 9% (+/- 1%) of the market. BEVs have continued to develop slowly and steadily for years. 2019 noticed a full 12 months BEV share of 1.9%, adopted by 6.7% in 2020, 9.8% (2021), 13.3% (2022), and 16.8% final 12 months (2023). With some incentives nonetheless in place (albeit thinning), 2024 appears to be one other 12 months of BEV development, with 20% full 12 months BEV share being potential.

That is regular progress, however not quick sufficient to satisfy medium-term targets. At this fee of roughly 3.5% achieve in BEV share annually, it can take till the tip of 2034 for BEVs to seize 50% of the French auto market. Contemplating that the purpose is to get near 100% BEV gross sales by 2035, that is clearly insufficient.

The issue is that BEV pricing remains to be very costly for most individuals. Proper now, in France’s highest quantity auto segments, small and compact, just like the Peugeot 208, Fiat 500, and Opel Corsa, BEVs are priced far above combustion alternate options. The entry combustion Peugeot 208 is listed at 19,350€ whereas the entry e-208 is 34,100€ — that’s 14,750€ (57%) costlier.

Why is a BEV a lot costlier? The widespread expectation was that — as a result of manufacturing prices decline as new applied sciences mature — costs of BEVs ought to by now be not very completely different from combustion counterparts, and shifting in direction of being cheaper than combustion, over time. These anticipated price declines have certainly occurred with the important thing new applied sciences of BEVs — most significantly batteries, and likewise motors and energy electronics.

Automotive LFP cells now price 44€/kWh to make for the massive suppliers in China (CATL, BYD, and so forth), and they’re working at very slim revenue margins, and competing with one another on pricing. Because of this the 50 kWh battery packs of small BEVs like the most effective promoting Peugeot e-208 ought to price not far more than 3,000€. Permitting a beneficiant 2,500€ for motor and energy electronics, and saving at the least 2,000€ from the absent ICE, emissions therapy, ancillaries, and transmission, the BEV price premium ought to solely be 3,500€ at most, on this class of auto. That is conservative. BEV producers in China are already competing head-on with ICE on value, even in segments priced nicely beneath 20,000€, utilizing element provides that are internationally traded.

As I identified in my current Germany report “The [Dacia] Spring’s pack is ~27 kWh, a easy design with modest energy and no energetic cooling, so ought to price beneath 1,600€. The motor and inverters are additionally modest energy (33 kW), so equally cheap. The Renault-Dongfeng badged “Fengshen EX1” model (similar automobile with the very same battery and motor) had a pre-sales-tax value of beneath €6,000 in China.”

What’s the value of the Dacia Spring in France? 18,400€… over 3 times the worth. Even permitting a potential 2,000€ for airbags and security upgrades — after worldwide delivery, 10% import tax, and 20% gross sales tax, that 6.000€ ought to translate to a French sale value of nicely beneath 12,000€, not a value of over 18,000€!

Briefly, it appears like European automobile patrons are being screwed-over on BEV pricing, while the European automakers are making report income. Producers are apparently refusing to compete with one another on providing inexpensive BEVs (which factors to potential value collusion), and are leaning on European politicians to close out international competitors, to allow them to preserve their report income — by overcharging European customers for the BEVs they do supply.

If BEV costs have been retaining tempo with the precise price reductions within the core applied sciences, BEVs would already be near parity with ICE pricing in most segments in France, simply as they’re in China. BEV share would even be maintaining with the velocity of the transition seen in China, which — regardless of scoring behind France in BEV share in 2020 (6.3% vs 6.7%) — ended 2023 far forward (25% vs 16.8%).

Let me know within the feedback what you concentrate on this complete scenario of overpriced BEVs, report income for European producers, even while the velocity of the transition is much under the place it must be.

To complete this part on a optimistic notice, February noticed diesel market share at a report low in France, at simply 7.2%, dropping from 11.7% YoY. Quantity was simply 10,221 models, from 14,717 models YoY.

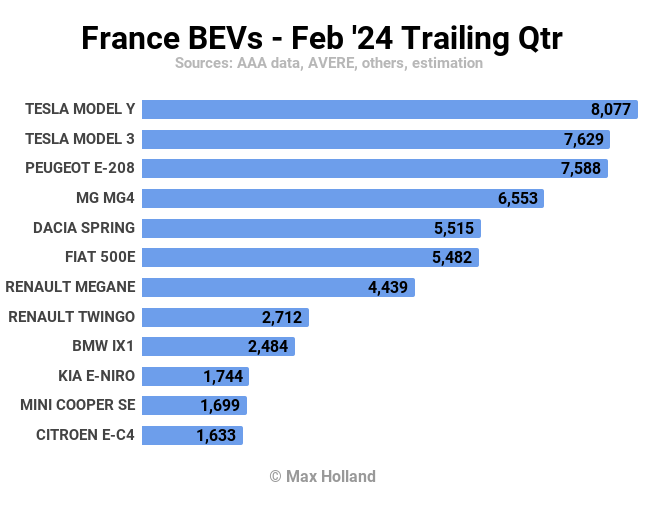

Finest Promoting BEVs

The Peugeot e-208 was as soon as once more the most effective promoting BEV in France, for a second consecutive month, with 4,132 models delivered in February. In runner up place was the Fiat 500e, with 1,990 models, with the Tesla Mannequin Y simply behind, with 1,982 models.

The Citroen e-C4 noticed a very good soar in quantity, to 1,034 models, nicely forward of its current month-to-month common of some 330 models. This was sufficient to see the e-C4 climb to seventh, from fifteenth in January.

One other sturdy climber was the brand new Volvo EX30, which newest information suggests debuted in January, with 307 models, and climbed strongly to 770 models, and tenth spot, in February.

The EX30, which is at present made in China, will probably be excluded from France’s eco-bonus incentive scheme (see current dialogue) after March fifteenth, so is being delivered in a rush earlier than that date. We will anticipate its numbers to fall considerably after March. Volvo is planning to make the EX30 in Europe (in all probability Belgium) from 2025, to beat these obstacles.

Recall that a number of of the most well-liked BEV fashions will fall foul of the brand new eco-bonus guidelines after March fifteenth — basically, any mannequin which is made outdoors of Europe is excluded. Fashions affected embody the Dacia Spring, Tesla Mannequin 3, Kia Niro, Kia EV6, BYD Atto 3, Volvo EX30, MG4 (plus all different MGs), Ford Mustang Mach-e, Fisker Ocean, Nissan Ariya, and Toyota BZ4X (amongst a number of others).

We will anticipate all these fashions to pull-forward deliveries forward of March fifteenth, and see a big drop in quantity from April onwards. Clearly it will imply that these BEVs nonetheless accessing the bonus will achieve in gross sales and rating, because the above common fashions are hamstrung within the competitors. The water is considerably muddied by new pricing methods from a lot of these dropping entry to the bonus. Let’s see how the mud settles in direction of the tip of Q2.

The brand new BMW iX2 made its French debut in February, with 99 models registered. The BYD Seal has additionally just lately debuted, with 38 preliminary models in January, and stepping as much as 202 models in February. For the reason that Seal is at present solely made in China , it received’t see a lot quantity after March fifteenth, until BYD is able to alter its pricing. A BYD European manufacturing facility is being deliberate.

Let’s now investigate cross-check the trailing 3 month rankings:

December information was sparse, so we are able to solely compile a dependable high 12 rating. As standard, the Tesla Mannequin Y is within the high spot, on the power of 4,681 deliveries in December, and first rate volumes since.

Its older sibling, the Tesla Mannequin 3, is in second place, the next rating than standard, which is smart on condition that the European provide is generally made in Shanghai. It is going to thus lose entry to the French eco-bonus after March fifteenth, and has been pulling-forward deliveries forward of time. The Mannequin Y, made within the Berlin-Brandenburg manufacturing facility, stays eligible for the bonus after March.

In third is the Peugeot e-208, following on from its high spot in the newest month-to-month rankings.

The MG4 and Dacia Spring are each making hay while the solar nonetheless shines, in 4th and fifth spots, and can possible fall again from April onwards, after dropping the bonus eligibility.

The remainder of the highest 12 are all acquainted faces, with no huge actions in comparison with the interval 3 months earlier.

Outlook

France’s GDP development stayed above water all through 2023, with consecutive quarterly YoY scores of 0.9%, 1.2%, 0.6%, and 0.7% (newest information). This put France forward of many different European economies. Inflation cooled to 2.9% in February, from 3.1% in January, the bottom in over 2 years. Rates of interest stay flat at 4.5%. Manufacturing PMI improved to 47.1 factors in February, from 43.1 factors in January.

The months forward will see modifications in BEV gross sales because the eco-bonus will get withdrawn for lots of the hottest fashions. We should wait to see what impact this has on the general quantity of the BEV market. Hopefully these producers who’re capable of scale back their costs will accomplish that, as a way to hold their foot within the French market.

Then again, if their BEV fashions are anyway provide constrained (relative to demand throughout Europe), they may presumably favour allocating models to different European markets the place they’ll nonetheless entry incentives, and thus larger margins. We’ll get a fuller image of how the market has modified by the tip of Q2.

What are your ideas on the French EV transition? Please soar in to the dialogue within the feedback part under, and share your perspective.

Have a tip for CleanTechnica? Need to promote? Need to counsel a visitor for our CleanTech Speak podcast? Contact us right here.

Newest CleanTechnica TV Video

CleanTechnica makes use of affiliate hyperlinks. See our coverage right here.